Samuel Kapon and Joseph Tracy

The unemployment rate is a popular measure of the condition of the labor market. With the Great Recession, the unemployment rate increased from a low of 4.4 percent in March 2007 to a peak of 10.0 percent in October 2009. As the economy recovered and growth resumed, the unemployment rate has fallen to 6.7 percent. What other measures are useful to supplement our understanding of the degree of the labor market recovery?

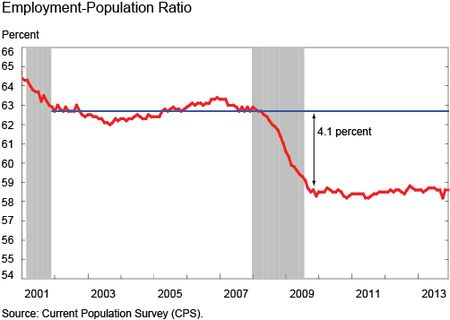

The employment-population (E/P) ratio frequently is used as an additional labor market measure. The E/P ratio is defined as the number of employed divided by the size of the working-age, noninstitutionalized population. An advantage of the E/P ratio over the unemployment rate is that it is not impacted by discouraged workers who stop looking for employment. The E/P ratio also dominates a measure focusing just on total employment in the economy, since it adjusts for changes in the size of the working-age population. The chart below shows the E/P ratio since 2001. The gray shading represents time periods when the economy was in a recession. Over the Great Recession, the E/P ratio (red line) declined by 4.1 percentage points relative to the average of the E/P ratio over the prior expansion (blue line). Since the end of the recession, the E/P ratio has largely remained constant—that is, virtually none of the decline in the E/P ratio from the Great Recession has been recovered to date. An implication is that the 7.6 million jobs added since the trough of employment in February 2010 has essentially just kept pace with growth in the working-age population.

In its failure to recover, the E/P ratio would seem to depict a much weaker labor market than indicated by the unemployment rate. An important question is whether this is a correct or a misleading characterization of the degree of the labor market recovery. While the E/P ratio is not affected by discouraged workers, it still is impacted by changing demographics in the economy. The employment rate profile over a worker’s career has an inverted U-shape, with rising employment rates until a worker reaches her mid-30s to mid-40s, then leveling off and declining in her 50s with sharp drops at 62 and 65. The effect of population aging on the E/P ratio depends on the distribution of individuals in the economy across the rising and falling sections of their career employment rate profiles. The earlier observation that no progress has been made in closing the E/P gap opened up by the Great Recession assumes that, in the absence of the recession, the E/P ratio would have remained relatively constant at the level indicated by the blue line in the chart. However, it is important to check this assumption by estimating the impact of changing demographics on the E/P ratio.

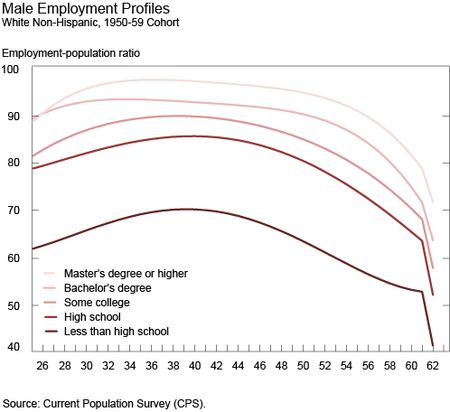

To explore this question, we take all individuals age sixteen or older from the Current Population Survey Outgoing Rotation Group samples from January 1982 to November 2013. This gives us monthly data with 10.2 million observations on individuals and their employment status. We divide these individuals into 280 different cohorts defined by each individual’s decade of birth, sex, race/ethnicity, and educational attainment. We assume that individuals within a specific cohort have similar career employment rate profiles. We use the 10.2 million observations to estimate these 280 career employment rate profiles. The next chart shows five of these estimated profiles for white non-Hispanic men born between 1950 and 1959 by five levels of education.

This depiction shows both the inverted U-shape for employment rate profiles and that individuals with more education tend to have higher employment rates at each age. We would expect that when the labor market is tight (slack) that average employment rates would be higher (lower) than indicated by our estimated profiles. When we estimate these 280 career employment rate profiles, we remove any of these business-cycle effects by including in the estimation a full set of year effects. We allow these business-cycle effects on employment rates to differ between men and women.

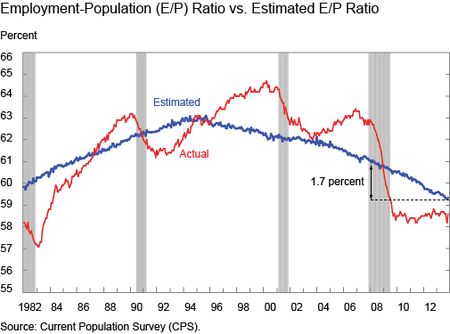

We now can assess the implications of changing population demographics on the E/P ratio. We use the 280 estimated career employment rate profiles to create a demographically adjusted E/P ratio in the following manner. For each of the 10.2 million individuals in our sample, based on their decade of birth, sex, race/ethnicity, and education, we select one of our 280 estimated career employment rate profiles. Using the worker’s age, we calculate the predicted employment rate for that individual based on their selected employment rate profile. We then calculate the weighted average of these predicted employment rates across all individuals in a given time period to generate an estimated E/P ratio for that time period. We repeat this exercise for each time period covered by our data. Finally, we seasonally adjust this estimated E/P ratio. The result is our demographically adjusted E/P ratio since it controls for changes over time both in the composition of individuals between the 280 cohorts, as well as aging of individuals within each cohort.

To overlay our demographically adjusted E/P ratio with the actual E/P ratio, we need to adopt a normalization. Recall that we eliminated business-cycle effects in the estimation by including a full set of year effects. A consequence is that there is no overall intercept for our demographically adjusted E/P ratio—only variations over time. To determine an intercept, we adopt the normalization that over the thirty-one years in our data sample any business-cycle deviations between the actual and the adjusted E/P ratios will average to zero. The next chart shows the overlay of the actual E/P ratio (in red) and our normalized, demographically adjusted E/P ratio (in blue). The demographically adjusted E/P ratio peaked in the mid-1990s and has been slowly declining since then. Importantly, from the beginning of the Great Recession to November 2013, the demographically adjusted E/P ratio has declined by 1.7 percentage points. This result indicates that although the actual E/P ratio has not changed since the end of the recession, the E/P gap defined as the difference between the two lines is actually closing due to this decline in the demographically adjusted E/P ratio. That is, a relatively constant E/P ratio since the end of the recession represents improvement in the labor market relative to an underlying demographically adjusted E/P ratio that is declining. In addition, based on our normalization, the E/P ratio was 1.6 percentage points above the demographically adjusted E/P ratio just prior to the onset of the recession. This suggests that the labor market was relatively tight prior to the recession. The same pattern shows up prior to the 1990 and 2001 recessions as well.

Adjusting for changing demographics has an important impact on the picture that emerges about the degree of the labor market recovery. The actual E/P ratio suggests that the labor market has made relatively no progress since the end of the recession in recovering from the 4.1 percentage point decline in this measure. In contrast, the gap between the demographically adjusted E/P ratio using our normalization and the actual E/P ratio is a much smaller 0.7 percentage points. Different normalizations would affect the size of this remaining gap. For example, if we assume that business-cycle effects averaged to zero just prior to the last recession (as opposed to over our full sample), then the actual E/P ratio would have been 1.4 (as opposed to 1.6) percentage points above the demographically adjusted E/P ratio at the outset of the Great Recession. In this case, the remaining gap increases from 0.7 to 0.9 percentage points. With either normalization, the basic conclusion is that the E/P gap is much smaller than it would appear making no adjustments (that is, using the horizontal blue line in our first chart as the reference point).

We have argued that the E/P ratio is a misleading indicator for the degree of the labor market recovery. However, the normalized, demographically adjusted E/P ratio is a useful additional gauge of labor market conditions. It is important to control for changing demographic factors when looking at the behavior of the E/P ratio over time. This step is particularly important today when these demographic factors are exerting downward pressure on the actual E/P rate, suggesting that the recent lack of improvement in the E/P ratio does not imply a lack of progress in the labor market. The adjusted E/P rate corroborates the basic picture from the unemployment rate that the labor market has been recovering over the past few years, but that it still has a ways to go to reach a full recovery.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Samuel Kapon is a senior research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Joseph Tracy is an executive vice president and senior advisor to the Bank president at the Federal Reserve Bank of New York.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

I was very interested in your analysis of the demographically adjusted E/P ratio. However, looking at working age population to 62 or 65 may be misleading. That is because there is a growing percentage of those over 65 at work. Data from the OECD, for example, show that about 35 per cent of men 65-69 are working. Is there a way to adjust to take account of shifting working patterns? > > Is it possible that these shifts are not statistically significant if the question one is trying to answer is whether the labour market itself is in recovery? There was some interesting research fro the Boston College Center for Retirement Research suggesting that about half of those dropping out of the labour market are “retiring”, taking advantage of some pension benefits available before age 65. I’m trying to get a better understanding of the falling US workforce participation rate at a time when the UK is going in the opposite direction. >

Maybe if you keep saying things like this, enough people will believe the emperor is wearing clothes? First, as pointed out by other posters, the older demographic isn’t following the usual retirement trends. Further, incomes are down in most families. So for us to believe there is no real employment slack, we’d have to believe that people are satisfied with a lower family income. Secondly, even if you were right about the employment slack, the employed percentage represents decreased productivity, decreased tax revenue, and increased dependency on that theoretical tax revenue. With the extra spending coming from debt, the outlook continues to decline.

The ten to fifteen year housing boom led many to enter construction trades as virtually unskilled contractors instead of pursuing technical or academic education and acquiring skills for life. What we’re seeing is the result – chronic long term unemployment. It’s much like what happened during the “Rust Belt” era in the Midwest. Those affected will either get skills or subsist on a myriad of liberal welfare programs – disability, food stamps, housing assistance, extended unemployment, Medicaid. Unfortunately for them, the middle class will tire of the tax burden and vote for a cut back. It would be better if the regional Federal Reserve Banks warned of the need to get skills before it is too late for the comfortably poor.

I would like to propose that either the Fed or the Labor Department begin calculating a “support ratio,” which would just be this E/P percentage with the non-workers divided by the workers. In other words, we are calculating how many workers it takes to support the non-workers. Based on this graph, in 2007 the ratio was .579, and in 2013 it was .706. At 1, it takes one worker to support one non-worker. The share of work required to support non-workers has gone up by 12.7%, meaning that the support ratio has gone up by 22% in 5 years. This in my opinion looks at the big picture by including our whole population in the mix. Demographics and our aging population are a factor in our economy and must be accounted for when we talk about employment.

The article says the E/P ratio its using is the ratio of the “employed to the working age, non-institutionalized population.” The BLS appears to define E/P ratio differently–i.e.,it uses “over 16” rather than “working age” as the age restriction on the relevant population. The current E/P ratio in the first graph–between 58% and 59%–appears to correspond to the BLS’s “over 16” population. So is the “P” in the article “over 16” or “working age.” If it’s “working age,” what is the working age range used and what is the source of that data.

Thanks for an interesting paper. I would like to see the ‘estimated’ line extended into the future so we can see where & when the E/P ratio bottoms out. My understanding of spending patterns suggests that, due to the reduction of spending by those 50+ we will continue to see very slow total spending growth & GDP growth until about 2023 when the next generation’s spending growth overtakes the decline in Boomers’ spending. We’re mostly pushing on a string until then.

Thank you, everybody, for the responses. To Jerry Hodge: While this analysis does imply less slack in the labor market than implied just by looking at the unadjusted employment-to-population ratio, other measures (such as the share of long-term unemployed as you indicate) are still important in any labor market evaluation. To PM: Excluding from the normalization the recession and post-recession periods does shift up the demographically adjusted employment-to-population ratio, although not by a great deal (as we explain in the text). The decline in the demographically adjusted employment-to-population ratio since the recession, however, is independent of our choice of normalization. With regard to the age buckets, our analysis focuses on the demographic adjustment, rather than on the within-group behavioral movements.

I agree, for all those that chart the participation rate of 24-54 year olds then 55+ year olds: If i have a participation rate of 20% for over 55s and they are 10% of the population, what happens when that participation rises to 25% and they are 30% of the population? The overall participation rate of 65% (say thats what it is) will have to fall despite the rise in the 55+ participation rate. eg 60/100 people work … participation of 55+ is 10% and they are 25% of population (25) so only 2.5 65+ workers … then participation rises to 20% and ratio rises to 40% (40), then there would be 8 workers … either participation of the remainder would have to rocket higher or overall participation would fall.

Can’t you simply perform a shift-share analysis rather than this very complicated and fancy calculation which is completely ignoring the within-group labour force participation rate dynamics, as pointed out by many comments? It seems to me this is a rather useless statistical artifact

This analysis ignores the fact that the population segment 55+ has increased its employment more than any other group since 2008. Moreover, this segment has been increasing its employment since 1992. According, ironically, to the Federal Reserve. In other words, the drop in employment after 2008 cannot be due to the 55+ age segment. So other than being completely wrong, this is an interesting article. http://research.stlouisfed.org/fred2/graph/?g=rG2

An interesting analysis. A key demographic statistic driving this declining estimated e/p ratio is the population in the prime working age of 25-54 years old. This population has actually DECLINED by 1.6 million people since November 2007. A failure to account for this demographic is why most people who use BLS ratios are providing misleading or inaccurate information. http://data.bls.gov/timeseries/LNU00000060 When I analyze how many jobs we need to get back to where we were before the Great Recession, I look at 1.2 million fewer people are working (http://data.bls.gov/timeseries/CES0000000001) and then add the 1.1 million person growth in the labor force (http://data.bls.gov/timeseries/LNS11000000) to determine that we are currently short about 2.3 million jobs.

What happens when you exclude the poor economy of 2008 forward from your blue line average? By including it, you are pushing down the reference point. Also, is it not easier to track the E/P ratio by age bucket? My bet is that analysis would show an unmitigated catastrophe for all age ranges for 2008 forward. My concern with this analysis is that it gives ammunition to those who wish to do nothing for the unemployed, allowing them to say, “the NY Fed thinks it is just demographics.”

This analysis ignores the following issues and economic red flags in the job market: – Real Disposable Income continues to fall – Long Term Unemployment is still near historical highs relative to total unemployment How much of a factor are “golden handshakes” in weeding out job market participants? Can we really trust Fed Officials to deal with these issues objectively? Have we forgotten about the phrase regarding how the “sub-prime crisis appears to be contained” and the term “soft-landing”?

I suggested that the UR is misleading over 2 years ago at a Philly fed working paper group. The rationalization was, it is a convenient and public measure for use in evaluating household spending potential . (Kind of like saying I’ll predict if it will rain by the rheumatism in my big toe rather than looking on the internet because it is convenient.) Thank you for an excellent topic to begin discussing. It would be important to know what percentage of the population is no longer looking for work because of taking either individual or spousal unemployment draws, or working under the table. This would create the double jeporday of no contributions and some increased program expense, and add a new dimension to the “discouraged” population. Likewise we need to adjust for the increased number of people on disability either because of work injuries or other complications. .

Civilian participation rate 25-54 (‘meat’ of the workforce): http://research.stlouisfed.org/fredgraph.png?g=rEo Civilian Participation rate 55+ (boomers +): http://research.stlouisfed.org/fredgraph.png?g=rEq The long term trends are blatantly obvious. Not sure how you can try to apply 1950s to now. The relationship is not even close. I excluded the 16-24yr old since they are at series lows. ex. 16-19yr old. http://research.stlouisfed.org/fred2/series/LNU01300012

Employment to population ratio includes government workers does it not? Civilian Labor Force Participation Rate would be better if the focus is on the private sector. Regardless the old trends do not follow the new. 16-64 Men no disability: http://research.stlouisfed.org/fred2/series/LNU02376940 16-64 Women no disability: http://research.stlouisfed.org/fred2/series/LNU02376945 65 and over: http://research.stlouisfed.org/fred2/series/LNU02375379 Clearly the 16-64 shows a decline coming out of the recession and flatline. 65+ shows a solid growth trend in retiree age employment. If anything, the exact opposite of what you propose is occurring.

Very interesting. Those who focus on employment-to-population are aware of slow-moving, predicatable demographic trends. The lack of cyclical upturn in employment-to-population is highly unusual in the context of previous cycles, and deserves the attention it receives for that reason. The answer to the puzzle more likely resides at micro, industry-level data than in broader macro figures. An important conclusion from the analysis – FOMC projections imply too high a potential growth rate for the US economy. A faster decline in unemployment could require a faster normalization of interest rate policy.

Except that boomers actually aren’t retiring as forecasted but staying in the labor market.