Victoria Gregory, Christina Patterson, Ayşegül Şahin, and Giorgio Topa

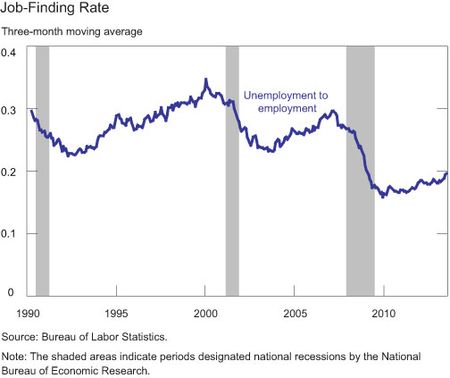

Fluctuations in unemployment are mostly driven by fluctuations in the job-finding prospects of unemployed workers—except at the onset of recessions, according to various research papers (see, for example, Shimer [2005, 2012] and Elsby, Hobijn, and Sahin [2010]). With job losses back to their pre-recession levels, the job-finding rate is arguably one of the most important indicators to watch. This rate—defined as the fraction of unemployed workers in a given month who find jobs in the consecutive month—provides a good measure of how easy it is to find jobs in the economy. The chart below presents the job-finding rate starting from 1990. Clearly, the job-finding rate is still substantially below its pre-recession levels, suggesting that it is still difficult for the unemployed to find work. In this post, we explore the underlying reasons behind the low job-finding rate.

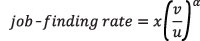

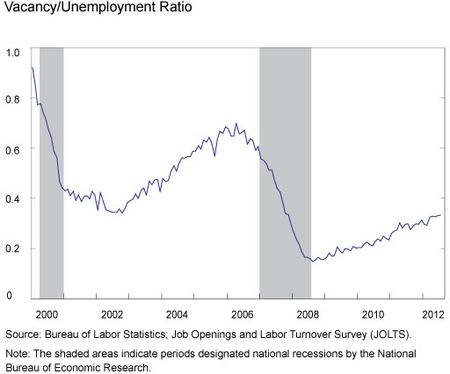

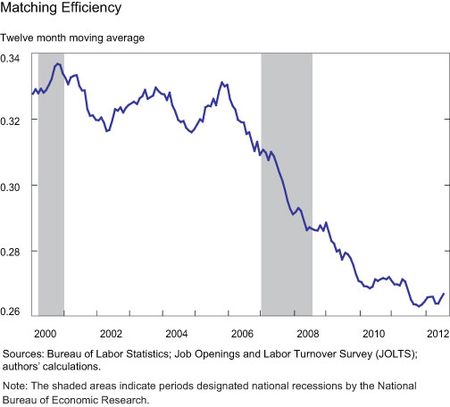

According to the search and matching theory developed by Diamond, Mortensen, and Pissarides (see, for example, Pissarides [2000], Mortensen and Pissarides [1994], and Diamond [1982]), it is costly for workers and firms to form suitable matches because of the uncoordinated nature of the labor market. Workers must devote considerable time to sending out resumes, contacting job agencies, and interviewing for jobs, and firms must consume resources posting vacancies and recruiting candidates with suitable skills and talents. The process that matches workers to firms is typically summarized by a matching function, which determines the number of jobs formed given the number of vacancies and unemployed workers. According to the matching function, the main determinants of the job-finding rate are the ratio of job openings to the number of unemployed, (v/u), elasticity, α, and the matching efficiency, x:

The vacancy-unemployment ratio summarizes demand and supply conditions in the labor market. When there are many job openings per unemployed individual, it is naturally easier to find jobs; conversely, it becomes harder to find jobs when there are many unemployed individuals competing for a small number of job openings. The parameter matching efficiency captures various factors that affect the efficiency of the matching process. An increase in skill or geographic mismatch, a decline in search effort of workers, or a decline in recruiting effort of employers would all lower the matching efficiency in the labor market. The elasticity, α, captures the responsiveness of the job-finding rate to the availability of jobs.

As seen in the charts above, both the vacancy-to-unemployment ratio and matching efficiency declined during the Great Recession and have not recovered since. The matching efficiency is constructed under the assumption that the elasticity, α, was unchanged over this period. It is important to understand the contribution of each factor to the recent behavior of the job-finding rate, since the vacancy-to-unemployment ratio reflects labor market conditions, while matching efficiency is a measure of how well the labor market forms new matches.

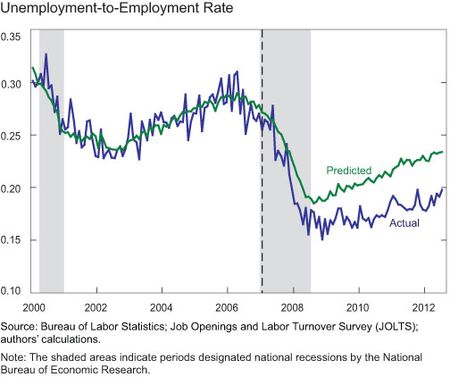

To isolate the contribution of these two factors, we regress the job-finding rate (unemployment-to-employment transition rate) on the vacancy-unemployment ratio using data until November 2007. The chart below shows that this regression captures the pre-recession behavior of the job-finding rate very well. We then use the relationship estimated using pre-recession data to generate predicted values for the job-finding rate starting in December 2007, as indicated by the bar. The predicted job-finding rate is an estimate of what the job-finding rate would be if matching efficiency had remained at its pre-recession level, but vacancies and unemployment had evolved as they did through the recession. As seen below, the actual job-finding rate currently lies below the predicted job-finding rate.

However, one can also see that even the predicted job-finding rate still sits at 23.4 percent, significantly below its 2007 average of 27.8 percent. This implies that even if matching efficiency had returned to its pre-recession level and the economy had moved to the predicted line, the job-finding rate would still be significantly below its pre-recession levels. Our calculations suggest that while the efficiency of the U.S. labor market has not yet recovered, the most important factor is still the low vacancy-to-unemployment ratio.

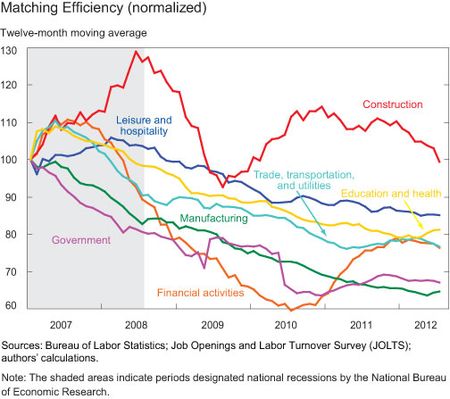

Finally, one can ask whether the observed decline in matching efficiency has been more or less pronounced in different sectors of the economy. The charts below examine this question for several representative industries, both in levels and using December 2007 normalized levels as the starting point. The plots show that matching efficiency has experienced declines across the board, with the possible exception of construction, where matching efficiency has returned to something close to December 2007 levels.

We conclude that while matching efficiency has declined and remained low in virtually all industries, the most important factor in the low job-finding rate is the persistently low level of vacancies per unemployed.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Victoria Gregory is a senior research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Christina Patterson is a former senior research analyst in the Research and Statistics Group.

Ayşegül Şahin is an assistant vice president in the Research and Statistics Group.

Giorgio Topa is a vice president in the Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Good report on the basics. What is necessary next is an analysis of the structural matchmaking issues. That is, how is match-making done? Is it working, or is it failing? How does this contribute to the problem? To talk about vacancies and number of unemployed and matchmaking – without discussing how the matchmaking is done – is just an academic exercise. It’s like discussing how people are starving and there’s a food shortage without mentioning agriculture and food production and distribution. I suggest the authors take a look at the success rates of the dominant “matching tools” being used by employers today. Hint: They don’t work well at all, yet employers rely on them. Cf., “Unemployment — Made in America by Employers,” PBS NewsHour.org, http://www.pbs.org/newshour/making-sense/ask-the-headhunter-unemploymentmade-in-america-by-employers/