Marco Cipriani, Antoine Martin, Patrick E. McCabe, and Bruno Parigi

In the academic literature on banks, “suspension of convertibility”—that is, preventing the exchange of deposits at par for cash—has traditionally been seen as a potential means of preventing economically damaging bank runs. In this post, however, we show that giving a financial intermediary (FI) the option to suspend convertibility may ultimately increase the risk of runs by causing preemptive runs. That is, investors who face potential restrictions on their future access to cash may run when they anticipate that such restrictions may be imposed.

This insight is relevant for policymaking in today’s financial system. For example, in July 2014, the Securities and Exchange Commission adopted rules that are intended to reduce the likelihood of runs on money market funds (MMFs) by giving the funds’ boards the option to halt (or “gate”) redemptions or to charge fees for redemptions when liquidity runs short, actions analogous to suspending the convertibility of deposits into cash at par. Our results show that the option to suspend convertibility has important drawbacks: A bank, MMF, or other FI with the option to suspend convertibility may become more fragile and vulnerable to runs. In other words, we show that instead of offering a solution, policies relying on gates and fees can be part of the problem.

Preemptive Runs

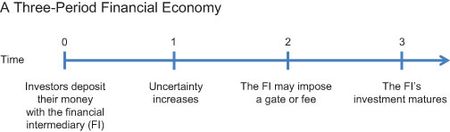

To formalize the intuition for why gates or fees may trigger runs, we consider a four-period model of the economy, as outlined in the exhibit below. Investors deposit money with the FI at date 0, for example, in the form of demand deposits that can be withdrawn at par or MMF shares redeemable at $1 each. The FI invests part of this money in a relatively illiquid asset—a bank might make a loan, while an MMF might purchase commercial paper—that matures at date 3. The FI’s investment offers a positive rate of return that the FI can pass along to investors who withdraw at date 3. However, if investors withdraw before date 3, the FI incurs a substantial cost in liquidating the investment.

Consider what happens if uncertainty suddenly develops about the return on the FI’s investment. In particular, suppose that, at date 1, a portion of the FI’s investors—call them “informed”— learn that the FI’s investment returns are more volatile than originally thought. Let’s also assume that both the FI and the informed investors will learn at date 2 whether the FI’s investment has actually soured.

At date 1, the informed investors have a choice. They can immediately redeem to obtain their cash, which would force the FI into a costly liquidation of the investment. Alternatively, they can wait for the uncertainty to be resolved, since a favorable outcome for the FI’s investment will allow them to obtain a positive return at date 3.

For the FI and the economy as a whole, having investors wait is clearly better. This would avoid costly liquidation and allow for the possibility that the investment might turn out to be profitable, in which case everyone will be (ex post) better off waiting until date 3.

In fact, we show that under fairly general conditions, if the FI cannot suspend convertibility by imposing gates or fees on redemptions, informed investors will optimally decide not to run at date 1. Instead, they will wait until uncertainty is resolved at date 2, because waiting may allow them to partake of the positive return on the FI’s investment if it turns out to be profitable. After all, these investors would still have the option of redeeming at date 2 if they learn that the FI’s investment has turned out to be bad.

But what happens if the FI can impose a gate or fee at date 2? We show that if the FI’s investment turns out to be bad, the FI will exercise its option to impose gates or fees on investors at date 2. In this case, informed investors may obtain less than what they originally deposited with the FI, because they must share the loss with the FI’s other investors. This risk causes informed investors to run preemptively from the FI at date 1 in anticipation of the possibility that convertibility may be restricted at date 2.

Conclusions

We prove these points more formally in a recent Federal Reserve Bank of New York staff report. There, we use a traditional model of financial intermediation to demonstrate the basic proposition discussed in this post: Giving an FI the option to impose gates or fees may be destabilizing because the option itself can trigger damaging runs that otherwise would not have occurred. This result is likely to hold for a variety of adjustments to the assumptions in our model, because the intuition is stark: The possibility of a fee or any other measure that is costly enough to counter investors’ strong incentives to run amid a crisis will give investors a strong incentive to run preemptively to avoid such measures.

Even though our model does not address how runs on FIs can create large negative externalities for the financial system and the real economy, one important policy implication is clear: Giving FIs, such as MMFs, the option to restrict redemptions when liquidity falls short may threaten financial stability by setting up the possibility of preemptive runs.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Marco Cipriani is a research officer in the Federal Reserve Bank of New York’s Research and Statistics Group.

Antoine Martin is a vice president in the Bank’s Research and Statistics Group.

Patrick E. McCabe is a senior economist in the Division of Research and Statistics at the Board of Governors of the Federal Reserve System.

Bruno Parigi is a professor of economics at the University of Padua.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Bail-ins. Negative interest rates. Now gates and fees. These transfer risk to the investor, and transfer trust away from the institution and the regulator. Seems only logical the dynamic, intelligent investor must re-price that new risk and trust. If gated, a money market becomes a time fixed bond, requiring compensation for the time. If price is allowed to float, the account becomes a risk asset, requiring compensation for the risk.

Although the post above provides an interesting theoretical insight, the discussion brings to mind the quote by Yogi Berra that, “In theory, there is no difference between theory and practice. But in practice, there is.” In practice, fees and gates are just one aspect of the nuanced package of money market fund reforms that the SEC adopted in July 2014 after long study. It is curious that the blog post fails to mention that the SEC’s new rule also requires institutional money market funds to float their net asset values (NAVs), a reform that the 12 Federal Reserve bank presidents—including William Dudley, the president of the New York Federal Reserve—said would address run risk. If this is true, then it is unclear that a floating-NAV fund would ever need to impose fees and gates. For other reasons why fees and gates are unlikely to cause runs, please see this blog post by ICI economists Sean Collins and Chris Plantier: http://www.ici.org/viewpoints/view_14_theory_practice_gates