This series examines the Federal Reserve Bank of New York’s dynamic stochastic general equilibrium (FRBNY DSGE) model—a structural model used by Bank researchers to understand the workings of the U.S. economy and provide economic forecasts.

Dynamic stochastic general equilibrium (DSGE) models provide a stylized representation of reality. As such, they do not attempt to model all the myriad relationships that characterize economies, focusing instead on the key interactions among critical economic actors. In this post, we discuss which of these interactions are captured by the FRBNY model and describe how we quantify them using macroeconomic data. For more curious readers, this New York Fed working paper provides much greater detail on these and other aspects of the model.

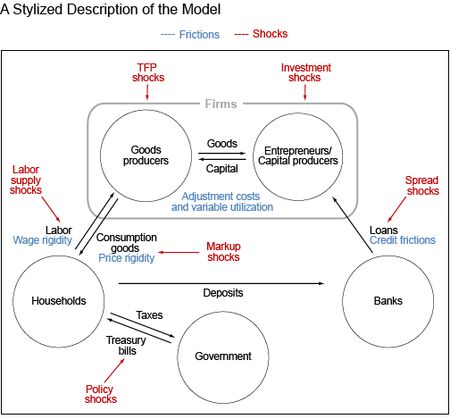

In DSGE models, economic agents make decisions to achieve their objectives, given the circumstances they face. In the FRBNY model, these agents include: households, which work and consume; firms, which employ capital and labor to produce goods and services; banks, which intermediate credit between savers and borrowers; and the government, which sets fiscal and monetary policy. The model incorporates key aspects of the economy: banks face borrowers’ default risk, which leads them to charge a spread over the deposit rate to protect against this risk; households can only adjust their wages infrequently; and firms cannot always set prices optimally and face costs when adjusting investment or capital utilization. In economic jargon, we say that the model features credit frictions, as well as wage and price rigidities, and that there are investment adjustment costs and variable capital utilization. The following figure provides a schematic representation of the model’s structure.

Agents’ choices in the model are dynamic (hence the “D” in DSGE) in the sense that they take into account both current and future expected conditions. Technically, agents solve intertemporal optimization problems, subject to constraints. For example, households choose their consumption profile over time, given their preferences and their budget constraints, while firms choose their prices by maximizing profits, given the production technology they operate. The outcome of each agent’s optimization problem is a decision rule that describes how they react to changes in their circumstances. The intensity of this reaction depends upon the parameters that characterize their preferences as well as their environment. For instance, workers supply labor based on the wage they would earn by working more and the value they place on the extra income. How much more they will work for any extra dollar depends on the so-called elasticity of labor supply, a parameter of the model that is related to each worker’s preference for leisure. People who like leisure more will need a higher wage increase to be convinced to work an extra hour. Firms, in turn, demand labor based on the wage and the productivity of workers. The slope of their labor demand curve (that is, how much more they are willing to pay to convince a worker to stay one more hour on the job) also depends on parameters, in this case, having to do with the technology they operate. The interaction of workers and firms in the labor market balances their conflicting interests (workers prefer higher wages, while firms would rather pay less) and determines an equilibrium wage. The process of simultaneous determination of wages and all other prices in the economy is what makes the model one of “general equilibrium,” which accounts for the “GE” in DSGE.

Finally, the “S” is for stochastic, illustrating the fact that agents face uncertain circumstances when making decisions. The environment faced by agents is subject to random disturbances, called “shocks.” Our model features several such shocks, including: shocks to productivity, which affect the amount of output that can be produced with a given amount of inputs; mark-up shocks, which capture exogenous inflationary pressures, such as those coming from movements in oil prices; and labor supply shocks, which capture changes in demographics or labor market imperfections. In addition, there are financial shocks, which affect the riskiness of borrowers, and shocks to investment demand, which capture changes in uncertainty about future demand, among other factors affecting firms’ desire to invest. Finally, two types of policy shocks capture changes in monetary and fiscal policy.

Agents in the model react to shocks according to the decision rules described above. For instance, when workers’ productivity increases, firms respond by demanding more labor. Similarly, a positive labor supply shock—such as the one associated with the increased participation of women in the labor market starting in the 1960s—implies that households are willing to work more hours at any given wage offered by firms. In our model, these shifts in labor supply and all the other shocks are treated as “exogenous,” in the sense that they are not triggered by changes in the choices described in the model. They are instead a “primitive” driving force, whose movements elicit reactions in all the variables in the model without being affected by them.

To use a DSGE model for forecasting and policy analysis, we must choose values for the parameters that characterize agents’ behavior. There are many ways of performing this task. Following the pioneering work of Schorfheide and Smets and Wouters, we estimate the FRBNY DSGE model using Bayesian methods. This econometric approach makes it possible to combine prior information on the parameters, which might come, for example, from microeconomic studies of agents’ behavior, with information about the time series properties of the variables in the model. These variables are output growth and hours worked (per capita), inflation (as measured by the core component of the Personal Consumption Expenditure deflator), the labor share as a measure of workers’ compensation, the federal funds rate, and the spread between the BAA corporate rate and the ten-year Treasury yield as a measure of borrowing costs (see our New York Fed working paper for details).

Once the model parameters are estimated, the DSGE model can be used to identify the fundamental shocks that might be behind any given event. This type of exercise relies on the fact that the estimated model gives us a mapping from shocks into outcomes for the economy. By “inverting” this mapping (using a popular statistics tools, the Kalman filter, as explained in detail in this paper by Del Negro and Schorfheide), we can obtain an estimate of the disturbances that were behind any given observed economic developments. The next post in this series is an example of this exercise, as it attempts to identify the sources of the Great Recession.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Bianca De Paoli is a senior economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Argia M. Sbordone is a vice president in the Bank’s Research and Statistics Group.

Andrea Tambalotti is an officer in the Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Justin, Thank you for the comment. We’ve corrected the arrows between “Households” and “Goods producers” in the figure. We regret the error.

I think the arrows are pointing the wrong way between households and goods producers. Cool stuff!