When a household is looking to buy a home, financial considerations are usually very important. In particular, in deciding “how much house to buy,” a household must ponder how large a down payment it can make at the time of purchase, and also how much it can afford to pay each month. The minimum required down payment and the interest rate on available mortgages (which determines the monthly payment) are key elements in the decision. When these variables change, this likely affects the price a household is willing and able to pay for a home, and thus the housing market overall. However, measuring the strength of these effects is notoriously difficult. In this post, which is based on a recent staff report, we describe a novel approach to measure these effects. We find that a change in down payment requirements tends to have a large effect on housing demand—households’ willingness to pay for a given home—especially for current renters, whereas the effects of a change in the mortgage rate are modest.

Methodology

Isolating the effects of financing conditions on housing demand and house prices is hard because these financing conditions don’t evolve in a vacuum. Take mortgage rates: they generally follow yields in the bond market, which in turn depend on economic conditions. So, if you see that mortgage rates have fallen relative to last year and house prices have increased, it is difficult to know how much of this increase was really due to the change in rates rather than other changes in economic conditions. Similarly, consider comparing the housing demand of two households, one of which is allowed by the bank to make a low down payment while the other is asked to make a high down payment. The bank presumably has a reason for asking the second household for a higher down payment—for instance, it may be at higher risk of default. Then, if this household buys a cheaper home, that may be partly due to its economic circumstances rather than the higher down payment requirement.

To circumvent this “identification problem” (in econonerd speak), we do something rather unusual in economic research: we just ask people. Specifically, as part of the 2014 SCE Housing Survey (described in this post), we asked roughly 1,000 household heads to assume they are to move today to a town or city similar to their current one, and ask how much they would be willing and able to pay for a home similar to the one they currently live in. (Thus, everybody is “forced” to buy, even those respondents who are currently renting.) Respondents are shown what different purchase prices would mean for their monthly payments, and are given access to a calculator (see screenshots here). Crucially, we ask them for their “willingness to pay” (WTP) under different scenarios for financing conditions. By comparing our respondents’ WTP for the home across the different scenarios, we can measure how sensitive housing demand is to financing conditions, and how this sensitivity varies with respondent characteristics.

How important are down payment requirements?

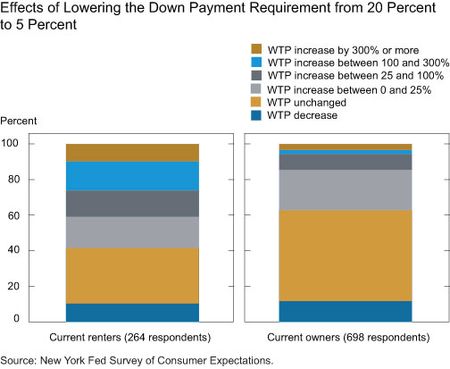

In our first scenario, all households must make a 20 percent down payment. In the second scenario, their down payment can be as low as 5 percent of the purchase price. Based on these scenarios, we find that on average, WTP increases by about 15 percent when households can make a down payment as low as 5 percent of the purchase price instead of having to put down 20 percent. However, this average masks large differences in sensitivity across households. In fact, almost half the respondents do not change their WTP at all when the required down payment is lowered. On the other hand, many respondents increase their WTP very strongly in the second scenario with the lower down payment requirement. This is particularly true for respondents who are current renters (and often relatively less wealthy): their WTP on average increases by more than 40 percent. They also tend to choose lower down payment fractions than current owners; for instance, 59 percent of renters but only 36 percent of owners choose a down payment fraction of 10 percent or lower.

In the chart below, we show the differential reaction between current owners and current renters to the lowered down payment requirement. The chart shows that, upon lowering of the required down payment, the WTP remains unchanged for 51 percent of current owners and 31 percent of current renters. On the other hand, for 14 percent of owners and 41 percent of renters, WTP increases by 25 percent or more.

In more in-depth analysis, we find that the reaction to down payment requirements does not only differ between current owners and renters. Even just looking at owners, the reaction is stronger for those with lower current (housing and nonhousing) wealth, lower income, and lower credit scores. This finding is important since it suggests that liquidity constraints play a substantial role in individuals’ willingness and ability to pay for a home. Furthermore, it implies that any change in required down payments will have differential effects across borrower types and segments of the housing market.

How important are mortgage interest rates?

We also study how our respondents react to changes in the mortgage rate. For this purpose, we randomly assign our respondents to either a 4.5 percent or 6.5 percent mortgage interest rate. This allows us to directly measure the importance of the mortgage rate by comparing across respondents. As another way to measure the effect of the mortgage rate, in a third scenario we “flip” the rate assigned to each respondent, thereby obtaining a direct estimate of how much respondents change their WTP when mortgage rates change. The findings are very similar across the two approaches: when the mortgage rate is 6.5 percent instead of 4.5 percent, WTP is reduced by about 5 percent on average (and there is little systematic variation across different respondent types). While this is a nontrivial effect, we discuss in the staff report that it is quite a bit smaller than theoretical models would predict. In that sense, our results are in line with other research that has also found only modest effects of interest rates on house prices.

Taken together, our findings suggest that the strength of housing demand is strongly affected by fundamentals (household wealth and income) and also the quantity of available financing (especially for first-time home buyers). The price of available financing (that is, the mortgage rate) may play a less important role than commonly thought, although we emphasize that our stylized setting omits certain factors, such as payment-to-income constraints, that may in reality affect households’ ability to qualify for loans.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Andreas Fuster is a senior economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Basit Zafar is a senior economist in the Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

I liked this article, and would enjoy the reading the entire study, or executive summer. I feel the data and chart on down payments are easily understood, and especially useful for those building product in the lower price points. Would it be OK for me to cite the down payment WTP figures in my studies, if applicable? If so, how would you like to be credited in the source box? Secondly, on interest rates, did you consider using two payment scenarios vs two distinct interest rates? On a $200K/30yr loan the payment would increase from about $1,013 to over $1,264, more by $250+ month. Some people may not grasp that a 4.5% vs 6.5% rate equates into a payment 24%+ higher on a $200K/30yr mortgage. (source: Navy Federal Credit Union website mortgage calculator) Thanks again for sharing good quality work on a subject that will become increasingly important to the housing industry in the coming years.