Asset securitization is an important source of corporate funding in capital markets. Collateralized loan obligations (CLOs) are securitization structures that allow syndicated bank lenders and bond underwriters to repackage business loans and sell them to investors as securities. CLOs are actively overseen by a collateral manager that has the responsibility to trade loans in the portfolio to benefit from gains and mitigate losses from credit exposures. Because CLOs include a diverse portfolio of loans, a single firm that commingles its lending role with the collateral management role can reap information advantages stemming from its “originate-to-distribute” activities.

In this post, we investigate the commingling of the lending and collateral management roles by investigating 230 cash-flow CLOs originated during the 2007-11 period. We are interested in examining whether these relationships that may give CLO managers better access to information compel them to trade differently. To that end, we investigate whether trading around the time of loan default is driven by the extent of the managers’ information relationship, if any, with the firms to whom the original loans were made. At one extreme is the case where the manager has no relationship information because it has never invested in that borrower before. At the other extreme, the manager has a close relationship with the borrower because the manager is affiliated with the bank that arranged the loan. Several possible cases fall between these extremes, such as when the manager or its affiliates has been a participant in the syndicate of the defaulting loan, or when the CLO underwriter has been an arranger or participant in the loan syndicate.

A closer manager-arranger relationship may provide the manager with access to soft information because the arranger monitors and certifies the borrower’s financial performance and compliance with loan covenants. CLO managers that are affiliated with the loan arranger may potentially develop a better profile of the borrower, amassing valuable information that helps in evaluating not only smaller and less transparent firms but also larger, more complex entities.

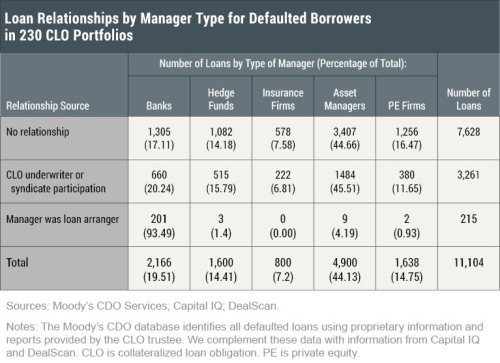

Collateral managers are typically affiliated with banks, insurance companies, hedge funds, private equity firms, and asset managers. The table below summarizes these relationships based on type of manager for all defaulted loans in the 230 CLO portfolios. Most of the loans with manager-arranger affiliations are granted by banks that are subject to prudential regulation and supervision. In comparison, the remaining information relationships are dominated by shadow-banking firms (hedge funds, private equity firms, and asset managers) that typically are not subject to substantial regulatory compliance and investor market discipline.

We investigate whether CLO managers’ trading depends on the manager’s relationship with the arranger by analyzing the investment ratio, defined as the monthly aggregate position held in a defaulted borrower divided by the initial position. This investment ratio starts at 100 percent and then increases or decreases as the manager adds or subtracts from its portfolio holdings. We use a panel regression model to formally control for an array of factors that influence managers’ trading activity (such as a borrower’s credit rating, the size of the CLO portfolio, the size of the position, and the maturity of the loan). The chart below presents the average estimated investment ratio for the three types of relationships over the twelve months before and after default, controlling for other exogenous factors.

The estimates reveal that only managers affiliated with the loan arranger decrease their holdings of distressed borrowers before the default, suggesting an information advantage. While the absence of a selloff by managers without that affiliation before default suggests that those managers might be less informed and thus unable to reduce their exposure before the default, the continued absence of a selloff after default when the bad news is public indicates that the managers are not particularly concerned with divesting portfolio losses. Recall from the table above that more than 70 percent of the CLO managers in these groups are loosely regulated hedge funds, asset managers, and private equity firms that are likely less risk-averse.

In contrast, CLO managers with loan-arranger relationships continue to divest these positions by about 30 percent in the year after default. Their continued divestments of defaulted securities may be compelled by reputational risk concerns stemming from their affiliation with banks. The importance of the organizational structure of CLO managers is further underscored by other evidence we uncover showing that bank managers significantly lowered their credit exposures in comparison to nonbank managers, even in cases where they had no access to private information.

Managers’ Response to Ratings Downgrades

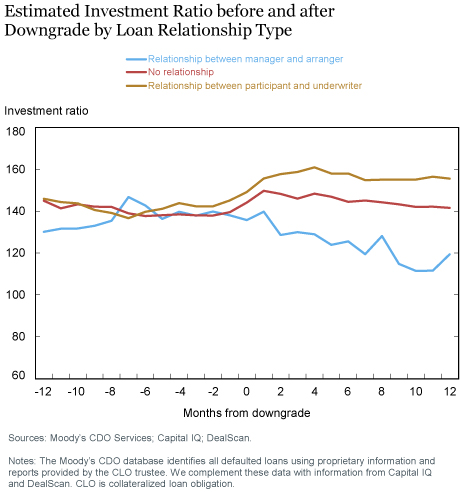

While default often represents a terminal event for a struggling firm, credit rating downgrades offer another, less dramatic signal about a firm’s viability. Are CLO managers with bank-arranger affiliations also sensitive to these lesser credit risk exposures? The chart below summarizes the trading response based on manager relationship type after a rating downgrade. These credit downgrades are not followed by default, so this subset of borrowers is entirely separate from the default sample.

Consistent with the findings above for defaulted borrowers, CLO managers with loan-arranger relationships begin reducing their investment before the downgrade and continue to disinvest over the year that follows the downgrade. Considering the less critical nature of downgrades, the trading reaction is more tepid, with bank-arranger managers typically starting to divest about six months before the rating change. By contrast, managers without access to information from an affiliation with a loan arranger do not lower their exposure to higher credit risks.

Summary

Our analysis shows that all CLOs are not equal; CLOs affiliated with bank loan arrangers appear to preemptively lower their exposures to distressed loan investments. While this behavior may suggest that these CLOs have an informational advantage, the fact that they continue to sell off their investments in distressed loans even after default may instead indicate that they are actively seeking to mitigate reputational risk. Thus, CLOs affiliated with banks appear to be different from the other CLOs in that they adjust their trading strategies and risk appetite in order to be compatible with the generally more conservative goals of their bank organization.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Stavros Peristiani is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Stavros Peristiani is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

João A.C. Santos is a vice president in the Research and Statistics Group.

João A.C. Santos is a vice president in the Research and Statistics Group.

How to cite this blog post:

Stavros Peristiani and João A.C. Santos, “Are All CLOs Equal?” Federal Reserve Bank of New York Liberty Street Economics (blog), December 5, 2016, http://libertystreeteconomics.newyorkfed.org/2016/12/are-all-clos-equal.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Leighton: This is a very good comment. Our work so far has not looked at the performance of these CLOs. Admittedly, it is very difficult to evaluate the performance of CLOs because there are many factors that could influence collateral value. Unfortunately, we also do not have any loan price information from the secondary market that would have facilitated some of these interesting comparisons around the time of default. The Moody’s database provides some useful information on the aggregate estimated market value of the CLO collateral that could shed some light on this issue. Assuming this information is consistently reported by all trustees, we will report any relevant findings in our forthcoming FRBNY working paper.

This whole thing is…misguided. If you are looking at broadly syndicated loans, there is no such thing as a “special relationship”. A borrower might have 50-100 lenders or more, depending on the size of the loan. [Conversely, a middle-market deal might have 1-5 lenders with “special relationships”, but those, as a rule, do not trade, ever.] There are basically three factors affecting trading this should have looked at. One is the difference between public and private information; some CLOs stay public (e.g. typically ones affiliated with hedge funds) and so are no different from any hedge fund involved in the loan. Others go private and take company budgets – this may give them an insight into what is going on below the surface, or it may not, but that is the only real informational difference between lenders, not “relationships”. Two, a firm’s trading approach may or may not have anything to do with what is going on with a given issuer. Some CLOs trade all the time in order to make gains and/or improve metrics (to wit, marketing materials for at least a few funds assume – ! – 1%-2% in trading gains per annum in investor return calculations). Others trade “in concert” with other funds, e.g. buy a loan in the CLO and sell a bond in the affiliated hedge fund. Others still never trade. Etc. Information access has nothing to do with it, rather the firm’s specific goals and trading approach. Three, CLO metrics exist. That means that some trading has absolutely nothing to do with “information” but rather the rating agencies – and not even necessarily the credit ratings themselves, some indentures have recovery rate tests that might mean an otherwise “good” loan is sold to create room under the “average recovery” threshold. Alternatively, an indenture might prohibit any kind of trading in the loan (except for an annual rolling limit) unless there is some credit or price event. CLOs are not hedge funds, and not all trades they make are discretionary, by definition. Bottom line. Umm…ok, nice work that…does not appear to take into account most of the structure of CLO markets and trading?

I’m curious if you followed through with the performance of those CLOs to see if those which did not reduce (the non-agent affiliated) on average outperformed those which did? Did selling in advance of default on average help investors or did the loan price overestimate its likelihood and/or loss severity?