Editor’s note: This post has been corrected to reflect that the limit on itemized deductions of state and local taxes for individuals is now $10,000 (not $5,000, as originally stated) and the limit on the mortgage interest deduction for individuals is now $750,000 (not $375,000). These errors did not affect the authors’ conclusions since their analysis concerns the impact of the new tax code with respect to a married couple.

The Tax Cuts and Jobs Act of 2017 (TCJA) introduces significant changes to the federal income tax code for individuals and businesses. Several provisions of the new tax law are particularly significant for the owner‑occupied housing market. In this blog post, we compare the federal tax liability and the marginal after-tax cost of mortgage interest and property taxes under the old and new tax codes for a wide range of hypothetical recent home buyers in a high tax state. We find that impacts vary substantially along the income/home price distribution.

Key Changes for Homeowners

The TCJA has altered the tax treatment of homeownership in a number of ways.

- The standard deduction for 2018 has nearly doubled for both individuals and married couples filing jointly.

- Itemized deductions of state and local taxes, previously uncapped, are now limited to $10,000 for individuals and married couples filing jointly.

- The limit on the mortgage interest deduction for a married couple filing jointly has been reduced to the interest on a maximum of $750,000 of acquisition indebtedness, down from $1,000,000 under the old law. For individuals, the limit has also been lowered to $750,000. Spouses filing separately each face a $375,000 limit.

- The parameters of the Alternative Minimum Tax (AMT) have been altered such that it will impact far fewer taxpayers going forward.

- Finally, marginal tax rates have declined for a large proportion of taxpayers, which potentially reduces the tax savings from housing-related itemized deductions.

These changes affect the after-tax cost of mortgage interest and property taxes. This in turn impacts the marginal attractiveness of an additional dollar of owner-occupied housing and of owning one’s home rather than renting. Some analysts have argued that these changes may depress both home prices and the homeownership rate going forward, particularly in metropolitan areas, where home prices and property taxes are often high.

In this post, we examine these issues by computing, under the old tax code and the new tax code, the overall federal tax liability and the marginal after-tax cost of mortgage interest and property taxes for a range of hypothetical recent home buyers in a high tax state. We find that the impact of the TCJA varies substantially, depending on four main factors:

- whether a recent home buyer who would take the standard deduction under the new tax code would have done so under the old tax code

- whether a recent home buyer’s state and local taxes exceed the new limit on such itemized deductions

- whether a recent home buyer would have been affected by the AMT, which disallows deductions of state and local taxes, under the old code (the new tax code makes a much smaller share of taxpayers subject to the AMT)

- whether a recent home buyer’s mortgage interest deduction would be limited under the new tax code but would not have been limited under the old tax code (this provision impacts buyers of relatively expensive homes)

Comparing the Old and New Tax Codes

We compute the federal tax liability for a married couple at various income levels who purchase a home in 2018. We compare the couple’s federal tax liabilities and after-tax mortgage interest and property tax costs under the new tax law with the figures that would obtain under the old tax law with 2018 parameters. We assume that the price of the home purchased is equal to 3.25 times the couple’s adjusted gross income (AGI), with a mortgage equal to 80 percent of the price of the home. We also assume a thirty-year, fully amortizing mortgage with an interest rate of 4.5 percent. Since we are focusing on a high tax state, we assume that property taxes are 3 percent of the home value. Finally, we assume that the annual cost of property insurance is equivalent to 0.4 percent of the home value.

Under this set of assumptions, monthly payments for principle, interest, property taxes, and insurance (PITI) equal 27 percent of the couple’s AGI, which is in line with typical mortgage underwriting standards. In our analysis, we take into account the phase-out of both personal exemptions and itemized deductions under the old tax law. To calculate state and local income taxes, we use the State of New York tax code. Note that we are only focusing on issues pertaining to homeownership, so we do not factor in other features of the new tax law, such as the expanded child tax credit or the treatment of pass-through income.

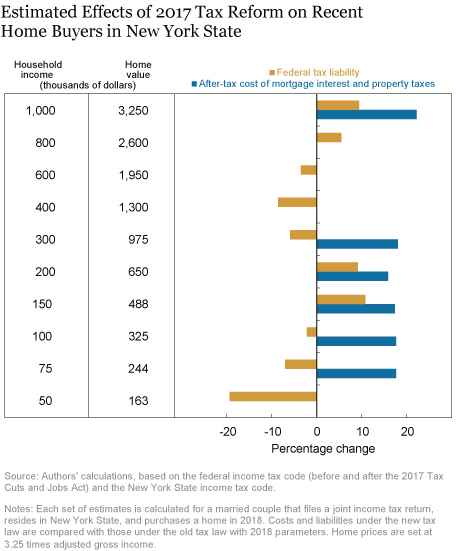

The chart below shows the percentage changes in the total federal tax liability and the marginal after-tax cost of mortgage interest and property taxes under the new tax code relative to the old tax code for a wide range of incomes and home values.

As noted above, there is substantial variation in impacts. The first issue, which pertains to taxpayers with relatively low AGI/home price levels (such as the $50,000 AGI/$162,500 home price example shown at the bottom of the chart), is whether a recent homebuyer would have taken the standard deduction under the old law, in which case they almost certainly would take the standard deduction under the new law. Under those circumstances, overall tax liability would decline significantly but there would be no change in the marginal after-tax cost of mortgage interest and property taxes.

Households with AGI in the $75,000-$100,000 range are more likely to have itemized deductions under the old law but would probably not do so under the new law, owing to the large increase in the standard deduction. In such cases, a household’s marginal after-tax cost of mortgage interest and property taxes increases while its total tax liability is likely to decline.

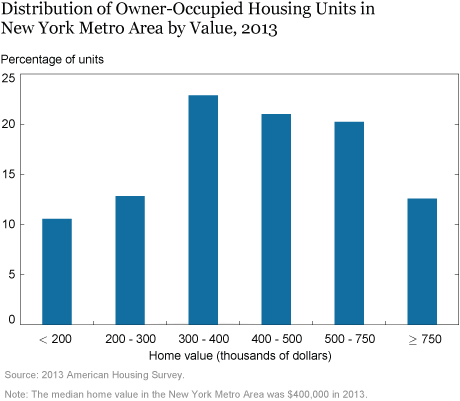

The next AGI threshold falls in the $150,000-$200,000 range (with home values ranging from $325,000 to $650,000). Here, the taxpayer would itemize deductions in both cases but now faces a significant impact from the $10,000 limit on state and local tax deductions. The resulting increase in the marginal after-tax cost of mortgage interest and property taxes is 15 percent or more. As shown in the chart below, which plots the distribution of values of owner-occupied properties in the New York Metro Area as of 2013, property values associated with this income range likely make up roughly half of the total.

Taxpayers with AGI in the $300,000-$800,000 range (with property values of $1 million to $2.5 million) would likely have paid the AMT under the old tax law. Under the new law, they would not be impacted by the AMT, but their deductions of state and local taxes would be limited to $10,000. The after-tax cost of an additional $1 of property taxes would be the same in both cases—$1. In addition, taxpayers at the lower end of this range would be affected by the limit on mortgage interest deductions under the new law, but not under the old one. This results in an increase in the marginal after-tax cost of mortgage interest. But in the middle and upper portions of this AGI range, homebuyers would have been affected by the old law’s limitation on mortgage interest deductions, so there would be no change in the marginal after-tax cost of mortgage interest.

Finally, a taxpayer with $1,000,000 in AGI would experience both an increase in federal tax liability and an increase in the after-tax cost of mortgage interest and property taxes. Under the old law, such individuals already faced a high marginal tax rate and limits on deductions and so were not impacted by the AMT. The new law’s limitation on state and local tax deductions has an important impact on high-income taxpayers, whose mortgage interest deduction has also been scaled back.

Conclusion

The effects of the TCJA on tax liabilities and the marginal after-tax costs of homeownership in a high tax state vary substantially across the income/home price spectrum. However, for a large portion of the distribution of property values, those marginal after-tax costs would rise—in some cases, quite substantially.

Theory suggests that such increases will affect the behavior of prospective home buyers, potentially weighing on both home prices and the homeownership rate. The exact magnitudes of such impacts are uncertain, however, because the marginal after-tax cost is only one of many factors influencing home buyer behavior.

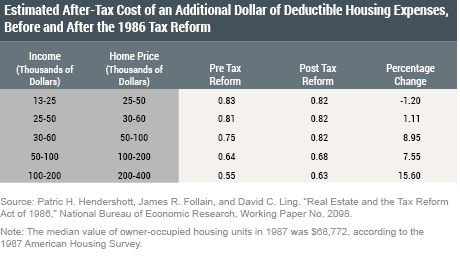

For example, the table below presents estimates of the change in the marginal after-tax cost of mortgage interest and property taxes resulting from the Tax Reform Act of 1986. The percentage increases were more modest than those estimated for the 2017 tax reform, except at the highest part of the distribution. In the aggregate, neither a decline in real home prices nor a decline in the homeownership rate occurred in the years immediately after the 1986 legislation, despite the fact that nominal interest rates over the period from 1987 through 1991 were higher than they were in 1986. Of course, it is possible that both home prices and the homeownership rate would have been even higher absent the 1986 tax legislation.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Richard Peach is a senior vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Gizem Kosar is an economist in the Bank’s Research and Statistics Group.

Nicole Gorton is a senior research analyst in the Bank’s Research and Statistics Group.

How to cite this blog post:

Richard Peach, Gizem Kosar, and Nicole Gorton, “How Will the New Tax Law Affect Homeowners in High Tax States? It Depends,” Federal Reserve Bank of New York Liberty Street Economics (blog), April 11, 2018, http://libertystreeteconomics.newyorkfed.org/2018/04/ how-will-the-new-tax-law-affect-homeowners-in-high-tax-states-it-depends.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Yaw and Eric: Thank you for bringing these points to our attention. The post has been corrected.

Following up on Yaw’s comment, I believe the same error was made with respect to the mortgage deduction cap (i.e. Single and married filers get $750,000, married separate gets $375,000).

“Itemized deductions of state and local taxes, previously uncapped, are now limited to $5,000 for individuals and $10,000 for married couples filing jointly.” I believe the $10,000 capped deduction is for single filers too. However, it is $5000 for married filing separately.