One of the major debates in open economy macroeconomics is the extent to which capital inflows are beneficial for growth. In principle, these flows allow countries to increase their consumption and investment spending beyond their income by enabling them to tap into foreign saving. Periods of such borrowing, however, are associated with large trade deficits, external debt accumulation, and, in some cases, overheating when these economies operate beyond their potential output level for an extended period of time. The relevant question in this context is whether the rate at which a country is taking on external debt has useful predictive information about financial crises.

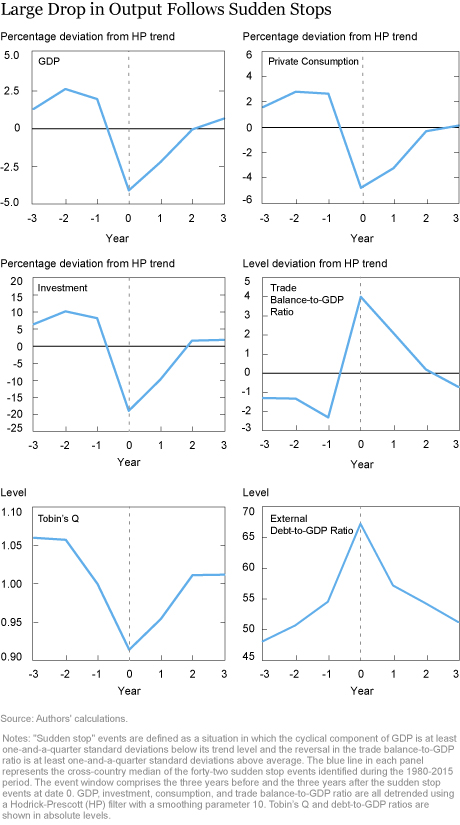

Investigating the dynamics of macroeconomic variables over the last three decades, we find that periods of large net capital inflows have been followed by a financial crisis from a “sudden stop” in these inflows 4 percent of the time. We define a sudden stop as an episode in which there is a large reversal in capital inflows and a severe drop below trend level in GDP. These events are rare, but they have devastating consequences for the economy. During the median sudden stop episode in our data, GDP and private consumption fall about 4 percentage points below trend, private investment falls 20 percentage points below trend, the trade balance-to-GDP ratio experiences a reversal of about 6 percentage points, asset prices fall, and the country’s external debt‑to‑GDP ratio drops by almost 10 percentage points (see the chart below). Significantly, in the run-up to these events, the economy typically experienced a significant trade deficit and rising external debt, while GDP, consumption, and investment spending were all above their respective trends.

Given the dire consequences for the economy, it is of great interest to researchers and policymakers to understand the driving forces behind sudden stop episodes. In a recent paper, “Good News Is Bad News: Leverage Cycles and Sudden Stops,” we tackled this issue by estimating a nonlinear real business cycle model of an open economy with an occasionally binding constraint on debt holdings. In a sudden stop crisis, previously unimaginable outcomes can rapidly become a reality, something not captured by a linear model. Our estimated model can capture long-run business cycle moments and sudden stop dynamics in the data.

The model is buffeted with a variety of shocks, including world interest rate shocks, which proxy for global financial conditions, and permanent total factor productivity shocks. More importantly, we introduced an anticipated component of permanent productivity shocks, which is known as “news.”

Intuitively, one can think of these news shocks as information about important structural reforms to be implemented in the economy that will increase total productivity. Economic agents, for example, learn today of productivity-boosting changes that will be implemented next year. Yet they are also aware of the risk that bad events could counteract these positive changes. Our hypothesis is that the anticipated component in productivity is important for the model to generate realistic sudden stop dynamics. An increase in anticipated productivity leads agents to borrow against their higher future income, increasing their borrowing and bringing them closer to the binding collateral constraint on their debt holdings. In case good news fails to be realized, agents will be more indebted and therefore more vulnerable to an unexpected future adverse shock such as a deterioration in global financial conditions.

We find that a little more than half of the fluctuations in productivity can be attributed to the anticipated component, and that news about future productivity is very positive in the two years prior to the sudden stop. This feature helps the model generate the most well-known characteristics of sudden stop dynamics—that is, a sudden reversal in the trade deficit and capital inflows.

The common view in the literature is that sudden stops are caused by a sustained period of low international borrowing rates, followed by an unexpected large increase in rates. We find that median sudden stop in the model is preceded by only slightly below-average interest rates, indicating that interest rates play only a modest role in driving the increase in the leverage and external debt-to-output ratio before a sudden stop event. Interest rate increases, however, play a somewhat more important role in exacerbating the resulting downturn.

Overall, the patterns around sudden stop periods can be summarized as follows: optimism and borrowing prior to the event and a combination of bad productivity surprises and rising interest rates during the event. The empirical pattern of rising debt and economic optimism followed by financial crisis and below-trend output strongly resembles the patterns identified in a recent influential Quarterly Journal of Economics article by Mian, Sufi, and Verner.

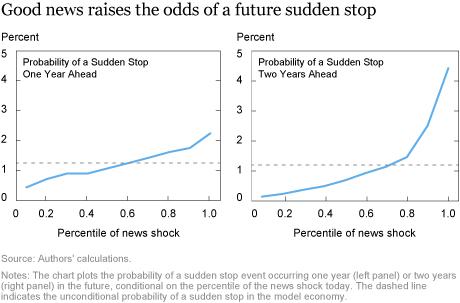

We next calculate to what degree good news today predicts future negative outcomes. We find that the probability of a sudden stop occurring one or two years in the future (see the left and right panel, respectively, of the chart below) is greater after a large good news shock than after a small shock. The strong convexity of the panel on the right reveals that very large good news shocks are especially strong indicators of sudden stop risk, though such events remain unlikely.

In conclusion, we find that good news can be risky for the economy as a whole, because agents are more likely to have borrowed up to their debt limit and thus may be less able to respond to negative shocks. Our findings suggest that in addition to global financial conditions, the evolution of domestic macroeconomic variables such as the trade balance and external debt accumulation is a key determinant of observed sudden stop dynamics and should be monitored closely by policymakers.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Ozge Akinci is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Ryan Chahrour is an assistant professor of economics at Boston College.

How to cite this blog post:

Ozge Akinci and Ryan Chahrour, “Good News, Leverage, and Sudden Stops,” Federal Reserve Bank of New York Liberty Street Economics (blog), May 30, 2018, http://libertystreeteconomics.newyorkfed.org/2018/05/good-news

-leverage-and-sudden-stops.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics