Adam Copeland

As noted in the introduction to this series, over the past two decades financial intermediation has evolved from a traditional, bank-centered system to one where nonbanks play an increasing role. For my contribution to the series, I document how the sources of bank holding companies’ (BHC) income have evolved. I find that the largest BHCs have changed the most; they’ve shifted their mix of income toward providing new financial services and are earning an increasing share of income outside of their commercial bank subsidiaries. In this post, I summarize my study’s key findings.

Meet the Data

I use BHC data from Federal Reserve Y-9C regulatory filings covering the period 1994 to 2010. I use these data to analyze how a BHC’s sources of income have changed over time, controlling for mergers. To create a data set to set up this type of analysis, I first pick the top fifty BHCs in 2006 (as measured by assets). I then add to this sample of data by identifying all bank holding companies that are linked to these fifty BHCs through mergers. Consequently, in 2006 I have data on exactly fifty BHCs. In any previous year, more than fifty BHCs are in my sample because I include all the bank holding companies that merged into and became part of the top fifty in 2006. Similarly, in 2007 and later, there are fewer than fifty BHCs in the data because of continued mergers among them, in addition to exits.

For this sample, I use the detailed Y-9C data to measure how much BHCs have taken advantage of industry and regulatory changes to earn income by providing new types of financial services. To do this, I group sources of income into three categories: traditional, securitization, and nontraditional. The traditional income group contains the classic sources of income that most banks have relied upon historically (for example, interest and fee income on loans, and fees for payments services). The securitization category captures income generated from banking activities related to the securitization of assets. Finally, the nontraditional group contains income from, loosely speaking, capital market activities (such as trading revenue, investment banking, and insurance commissions and fees).

The Importance of Nontraditional Income … for Large Banks

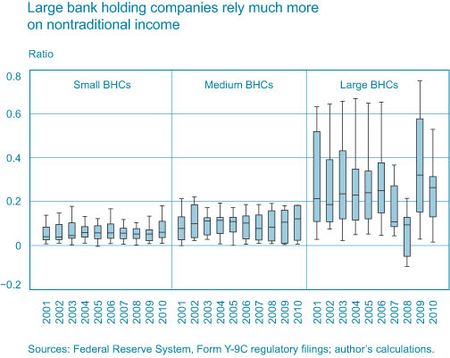

A striking difference across BHCs is the relative importance of nontraditional income. From 2001 to 2010 for the BHCs in the sample, I compute the fraction of nontraditional to total income. I then plot this distribution for three groups of BHCs in the chart below. Large BHCs are those linked to the top ten BHCs in 2006, medium are those linked to the top eleven to twenty, and small are the remaining BHCs. The “box-and-whisker” format characterizes a distribution, where the length of the box provides a measure of the dispersion across observations. Technically, the box portion comprises the 25th, 50th, and 75th percentiles of the distribution.

The chart illustrates the positive relationship between size and reliance on nontraditional income sources. For large BHCs, nontraditional income accounts for 21 percent of total income on average, a significantly larger portion of total revenues compared with those of small and medium BHCs. In contrast, all BHCs in the sample rely on securitization income (chart not shown) to roughly the same extent (less than 10 percent of total income, on average). Based on these results, I argue that the significant heterogeneity between large BHCs and the remaining BHCs suggests that changes in the financial industry have had a substantial and uneven impact. BHCs of all sizes are all earning income from asset securitization. Only the largest BHCs, however, have aggressively built up new sources of income in the nontraditional group.

The Diminishing Importance of the Commercial Bank Subsidiary

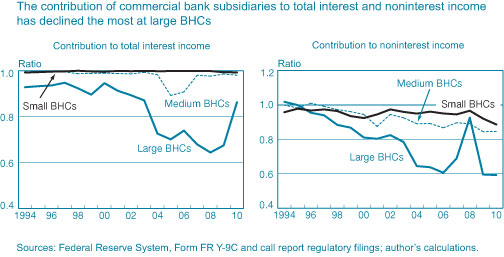

Historically, the commercial bank subsidiary has earned the vast majority of a BHC’s income. But a well-known feature of the current evolution in banking and financial intermediation is the rising importance of noncommercial bank entities. Indeed, the post by Avraham, Selvaggi, and Vickery documents a substantial increase in the share of the banking industry’s assets held in noncommercial bank subsidiaries. To measure how much BHCs rely on their commercial bank subsidiaries for income, I compute the fraction of a BHC’s total interest and noninterest income earned by the commercial bank subsidiaries. The chart panels below plot the average fraction of interest and noninterest income generated by a BHC’s commercial subsidiaries for the three size groups.

Once again, we see that the largest BHCs differ markedly from their smaller counterparts. The commercial bank subsidiaries of large BHCs have significantly decreased their contribution to interest income, while small and medium BHCs continue to rely almost entirely on their commercial bank subsidiaries for interest income. For noninterest income, commercial bank subsidiaries have become less important income sources for small and medium BHCs, but not nearly to the extent seen in large BHCs.

These differences highlight how the evolution in financial intermediation that this series covers has had an uneven impact on BHCs. The largest BHCs have evolved the most in response to events over the past two decades, by shifting their mix of income toward nontraditional sources and relying much more on noncommercial bank subsidiaries.

Disclaimer

The views expressed in this post are those of the author and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author.

Adam Copeland is a senior economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

I think we see that commercial bank subsidiaries have become less important income sources for small and medium BHCs….