Michael J. Fleming and John Sporn

Inflation swaps are used to transfer inflation risk and make inferences about

the future course of inflation. Despite the importance of this market to

inflation hedgers, inflation speculators, and policymakers, there is little

evidence on its liquidity. Based on an analysis

of new and detailed data in this post we show that the market appears

reasonably liquid and transparent despite low trading activity, likely

reflecting the high liquidity of related markets for inflation risk. In a previous

post, we examined similar issues for the broader interest rate derivatives

market.

Inflation Swaps Defined

An inflation swap is a derivatives transaction in which one party agrees to

swap fixed payments for floating payments tied to an inflation rate for a given

notional amount and period of time. For example, an investor might agree to pay

a fixed per annum rate of 2.5 percent on a $25 million notional amount for ten

years in order to receive the rate of inflation for that same time period and

amount. The inflation gauge for U.S. dollar inflation swaps is the

nonseasonally adjusted consumer price index for urban consumers.

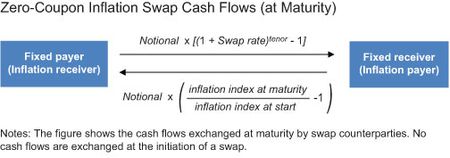

The figure below illustrates the

cash flows for a zero-coupon inflation swap—the most common inflation swap in the U.S.

market. As the name “zero-coupon” swap implies, cash flows are exchanged at

maturity of the contract only. The fixed rate (the swap rate) is negotiated in

the market so that the initial value of a trade is zero. As a result, no cash

flows are exchanged at the inception of a swap.

Market Is Modest in Size, but Growing

Quickly

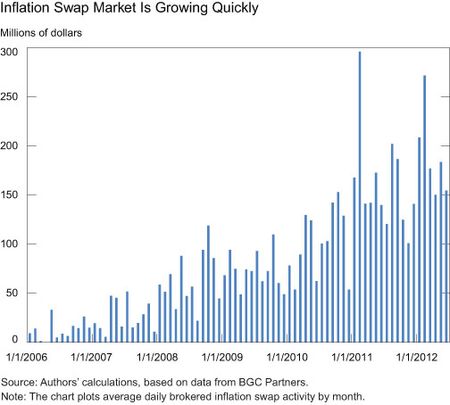

Evidence suggests that the U.S. inflation swap market is modest in size,

but growing quickly. As shown in the chart below, data from BGC Partners, a

leading broker, indicates that interdealer trading of zero-coupon swaps

averaged roughly $100 million per day in 2010, $160 million per day in 2011,

and $190 million per day in the first half of 2012. Data from an informal survey of dealers—accounting

for activity with customers as well as activity brokered among dealers—peg

the overall market size in April 2012 at roughly $350 million per day.

Transaction Data Point to Low Trade

Frequency

The bulk of our analysis is based on inflation swap transactions between

June 1 and August 31, 2010, in which a major derivatives dealer was on at least

one side of the resulting position. The data come from MarkitSERV, the

predominant trade-matching and processing platform for interest rate derivatives.

The data set contains just 144 U.S. inflation swap trades, or an average of

just 2.2 per day. The data set doesn’t cover every transaction in this

over-the-counter market, but is reasonably thorough, covering an estimated 44 percent of interdealer activity.

Trading Concentrates in Certain Tenors

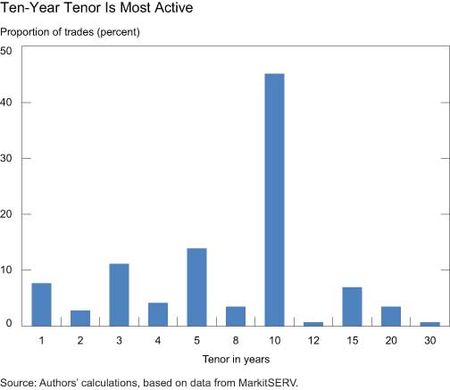

We identify concentrations of inflation swap activity in certain tenors, as

shown in the chart below. The ten-year tenor alone accounts for 45 percent of

activity, followed by tenors of five years (14 percent), three years (11 percent), one year (8 percent), and fifteen years (7 percent).

Trade

Sizes Are Large and Fairly Standardized

Despite the low trade frequency in the inflation

swap market, we identify a mean trade size of $29.5 million and a median of $25 million. Trades are concentrated in certain sizes, so that 36 percent of all

trades are $25 million, 8 percent are $50 million, and 3 percent each are $15 million and $100 million. Tenor is one factor explaining trade size variation,

with one-year trades in particular being larger than longer-tenor trades.

Bid-Ask Spreads Are Modest

The spreads between bid and offer prices are modest in this market, indicating

a low cost of trading despite the low trade frequency. Bid-ask spreads faced by

institutional customers, as estimated from transaction data, average just under

3 basis points. Results from a survey of

dealers are consistent with this estimate, pointing to average bid-ask spreads

of 2 to 3 basis points in both the interdealer and customer-dealer markets.

Prices Seem to Be Transparent

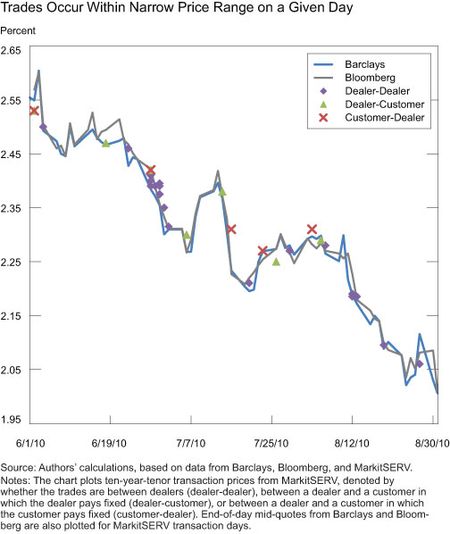

Lastly, the inflation swap market appears reasonably transparent despite

the low frequency of trades. The chart below shows that transactions in the ten-year

tenor occur at prices close to end-of-day mid-quotes from Barclays and

Bloomberg. Moreover, trades involving customers occur at prices that deviate

from mid-quotes only slightly more than trades between dealers. This evidence

suggests that there’s a general consensus among transacting customers as well

as dealers as to what prices should be for a given contract.

Why Is the Market So Liquid Despite the

Low Trading Frequency?

How can we reconcile the low frequency of trades in this market with the

large trade sizes, modest bid-ask spreads, and seemingly high transparency? The

inflation swap market is part of a much larger market for transferring

inflation risk. This larger market includes other derivatives products as well

as more actively traded Treasury Inflation-Protected Securities and nominal

Treasury securities. The broader market provides a vehicle for pricing

inflation swaps and for hedging positions taken in the market. As a result, the

low frequency of inflation swap trades isn’t a good gauge of the market’s

liquidity or transparency.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Michael J. Fleming is a vice president in the Research and Statistics Group of the Federal Reserve Bank of New York.

John Sporn is a senior analyst in the Markets Group of the Federal Reserve Bank of New York.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Excellent work. Regarding the relative pricing of inflation swaps versus TIPS, see “Why does the Treasury Issue TIPS? The TIPS-Treasury Bond Puzzle.” (Matthias Fleckenstein, Francis Longstaff, and Hanno Lustig), forthcoming in Journal of Finance. The authors claim that TIPS are cheap relative to inflation swaps. In any case, there is some more research to do here, given that both the TIPS market and the inflation swaps market seem to be relatively efficiently priced, internally.