Authors’ Update: Murray Rothbard’s The Panic of 1819: Reactions and Policies was an additional source for this post and should have been cited. We regret the omission.

As we noted in our last post on the British crisis of 1816, while Britain emerged from nearly a quarter century of war with France ready to supply the world with manufactured goods, it needed cotton to supply the mills, and all of Europe needed wheat to supplement a series of poor harvests. The United States met that demand for cotton and wheat by expanding agricultural production, facilitated by the loose credit policies of a growing number of lightly regulated state banks. Meanwhile, the Treasury needed revenue to pay off debts from the Louisiana Purchase and the War of 1812, so the government turned to selling land acquired in the Louisiana Purchase. But the increased agricultural demand and easy credit policies led to a speculative real estate boom, particularly in Alabama. So when the Treasury started to pay off its debts, the specie drain caused a painful but necessary contraction and the boom went bust. In this edition of Crisis Chronicles, we describe America’s first great economic crisis.

Loose Credit and Lax Standards

In the mid-1810s, the nation was still sparsely populated at just 7 million inhabitants, the economy was agriculture-based, specie was scarce, and barter was extensive on the frontier. While some cotton and wool was used for domestic mills in the Northeast, the majority was produced for export, with Boston, New York, and Philadelphia serving largely in an export/trade capacity.

The nation was also in debt. The government had borrowed heavily to finance the War of 1812, and the debt payments for the Louisiana Purchase were looming. State banks issued their own paper money and specie payments were suspended in 1814. Without a requirement to convert notes into specie, expansionist Western banks issued notes far beyond their ability to eventually redeem them in gold or silver. But banks in the Northeast remained more conservative and were even reticent to lend to the government.

The Second Bank of the United States

The expansionist note issuance led to a chaotic money situation, with different notes from different banks trading at different discounts. As a result, many argued for creation of a second national bank (the first one had ceased operation when its twenty-year charter expired in 1811). The Second Bank of the United States was chartered with a primary goal to create a uniform national currency by printing paper money convertible into specie. But the Bank undermined its own credibility by accepting IOUs for capital, and it did little to rein in the expansionist money policies of the state banks. It even contributed to the monetary expansion, particularly in its western branches.

But the loose monetary and credit policies spurred investment in transportation infrastructure, such as turnpike construction and shipbuilding, and in agriculture-based real estate. And while investors, merchants, and farmers took on debt, those investments were initially profitable, driven by the demand for cotton in the British mills, the demand for wheat across Europe, and the need for transport to deliver the goods to market. Specie payments resumed by 1817, if only on a nominal basis, from the state banks.

An Unlikely Epicenter of the Boom

By 1818, the economy was growing fast. As Glaeser notes in his recent work on real estate speculation in American history, “The epicenter of the boom, Huntsville, combined excellent cotton-growing soil with access to the Tennessee River, which brings access to the Ohio River, the Mississippi River and ultimately, the Gulf of Mexico. Transportation was the key to making frontier land valuable, and water was the key to transportation.” Farmers and speculators competed for land, driving up prices. The country boomed.

Then U.S. cotton prices plummeted in January 1819 after British investors substituted to Indian cotton, a development that coincided with a general fall in demand for agricultural imports to Europe as European harvests improved. As Glaeser notes, “. . . the boom busted, the country went into recession and Alabama land values plummeted.”

As Coffey explains, after the Bank attempted to resume a tight monetary policy through deflation, prices fell, housing and real estate values collapsed, and over-indebted banks and homeowners went bankrupt. Those maladies in turn spread to farming and manufacturing, which increased unemployment. The panic and recession were on.

A Likely Target for the Bust

The nation was leery of a national bank with seemingly endless power to manipulate the money supply and the Second National Bank of the United States was attacked by both the expansionists and the sound money opponents. It was during this period that future President Andrew Jackson shaped his anti-Bank views in Tennessee while his future hard-money arm in the Senate, Thomas Hart Benton (Old Bullion), shaped his views in Missouri, two of the hardest-hit states. The debate over central banking, and the concern over deflation and inflation, continue two hundred years later.

Inflationary and Deflationary Concerns

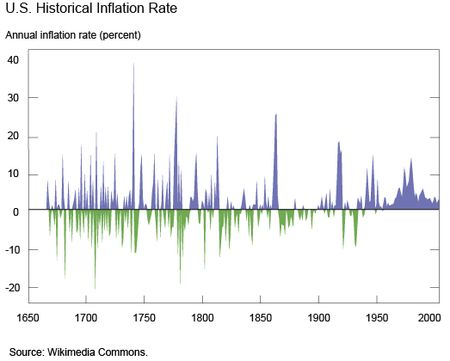

Great concern, debate, and often a change of course have typically followed tumultuous periods of heavy deflation or inflation over the past century. The graph below shows a nearly 350-year history of U.S.—or perhaps better termed “American”—inflationary and deflationary episodes, with inflationary periods in blue and deflationary periods in green. While the inflationary years leading up to the Panic of 1819 and the deflationary years that followed stand out during the first half of the nineteenth century, they appear to be in line with episodes over the century leading up to the panic and depression.

Perhaps the most anomalous pattern in this history is the near complete lack of deflation—or green areas in the graph below—after the 1930s deflationary period of the Great Depression. The destructive ruin amid the downward deflationary spiral of the economy from those years led to the Keynesian fight against being stuck back in such a “liquidity trap” again. While concern over the risk of deflation was paramount, such concern was not as strongly levied against the risk of inflation. After the typical bout of inflation that accompanies war—and the graph illustrates that inflation was, incidentally, much milder in the case of World War II than in the previous cases of World War I and the Civil War—a lax attitude about inflation (and for some, an ill-advised advocacy of the belief that inflation would reduce unemployment) led to the most cumulatively inflationary episode (the mid-1960s through the 1970s) in the nation’s history and pre-history. Federal Reserve Chairman Paul Volcker’s defeat of inflation in the early 1980s ushered in the longest period of low and stable inflation rates in American history.

During the recent Great Recession, concern again arose about the risk of deflation, as inflation edged at times below 1 percent. And whenever the slow recovery hits rough patches, concerns about deflation jump back into the headlines. Others continue to speak of inflationary risks because of the unprecedented growth of the monetary base that was a byproduct of the Federal Reserve’s quantitative easing programs. Will deflation or inflation concerns always persist for the economy? Or after two hundred years, has U.S. central banking finally won the war against deflationary and inflationary fears? Tell us what you think.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

James Narron is a senior vice president in the Federal Reserve Bank of San Francisco’s Cash Product Office.

David R. Skeie is an assistant professor of finance at Mays Business School, Texas A&M University.

Donald P. Morgan is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Inflation has had different definitions and baskets-of-goods over the decades and few reflect the real economy. As an example, Australia’s inflation has been roughly equivalent to that of Britain over the last few decades. When I went to London in the 1970’s, wages were low and food was expensive compared to Australia’s. Nowadays British wages are relatively high and food is cheap when compared to Australia’s. The second example of inflation being poorly defined is provided by the price of oil as prices skyrocketed recently without affecting inflation and the corollary may hold as prices decline. Informal colonial taxes may also affect inflation calculations. As an example the Scientific American about two decades ago stated that America had spent over one trillion dollars on their water systems and that their rivers functioned better before the first dime was spent. Australia’s ‘benefit’ from the 2014 G20 meeting is the establishment of an infrastructure hub. My pre-emptive G20 approach has been successful and US-media recently reported two cases of a European Government seeking to revoke diplomatic immunity in order to collect fines that relate to tax avoidance. Additionally the NY Times carried an extensive report about processes surrounding the construction of the 4 billion dollar subway in New York. Maths may be inaccurate and international taxes may increase. Are other countries producing G20 financial services reviews? Sincerely David

best to practice avoidance of gross policy mistakes, or failure to recognize disruptive influences and their long-term effect. not to be flippant, but it’s always something.

Clearly Fed policy is geared against “not making that mistake again” ie. deflation. However, the US has had a very successful history that looks to be full of deflationary periods. Could the fear of deflation be a massive policy error in the making?

Very interesting article, but is it accurate to call the Panic of 1819 America’s First Great Economic Crisis? Wasn’t the situation in the decade following the War of Independence the first and dramatically worse? At that time the newly independent country was essentially insolvent and defaulted on its foreign debts, and prior to Hamilton’s First Bank of the United States there was even less (only two banks I think, including Hamilton’s Bank of New York) of a financial system in place than in the 1810’s. The fact that Hamilton so skillfully extracted the new federal government from the mess shouldn’t blind us to the fact that this was, indeed, and existential threat.

“Others continue to speak of inflationary risks because of the unprecedented growth of the monetary base that was a byproduct of the Federal Reserve’s quantitative easing programs.” My question is how does the Fed gradually work off the larger base. Another question is how does one determine the ‘right’ size of the monetary base.

This is again an opportune time (there have been others in recent years) for central banks across the world to drop their two percent target rates to one percent or even zero. We used to believe that at least six percent or more was necessary to maintain high employment. That was disproved many times in the past decades. It is now time to move closer to zero.