Euro area inflation expectations have been falling at both short- and long-term horizons, with the latter development suggesting the current low inflation environment is perceived as likely to persist. Because long-term inflation expectations play a key role in the decisions of households and firms, economists have stressed the importance of long-term inflation expectations being anchored at a central bank’s target. In this post, we use survey data on inflation forecasts to document evidence of recent “unanchoring” of euro area long-term inflation expectations, and note the difference in comparison to the 2008-09 period, when current inflation and short-term inflation expectations also declined but long-term inflation expectations remained steady.

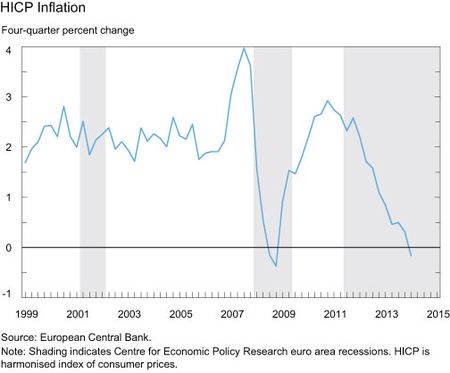

As shown in the chart below, euro area inflation has declined steadily since 2012. The chart also shows a similar decline during the previous recession that extended from first-quarter 2008 to second-quarter 2009 (indicated in gray shading). Because of this parallel, it would be interesting to know individuals’ views of these inflation episodes and how they compare.

One useful source of information on the European inflation outlook is the quarterly European Central Bank (ECB) Survey of Professional Forecasters (ECB-SPF). Like its American counterpart (US-SPF), the ECB-SPF asks participants for both their point forecasts and density (histogram) forecasts for several macroeconomic variables, including inflation, at various horizons. The density forecasts indicate the confidence that participants attach to their point forecasts and also reflect any concerns about tail risks—outcomes that may be far away from their point forecast. The most recent ECB-SPF was collected from January 7 to 13, 2015. An important consideration for our discussion is that while the timing of the survey incorporates much of the recent decline in energy prices, it can only incorporate expectations of the ECB’s bond-purchase stimulus program which was announced on January 22. We return to the latter issue in our closing remarks.

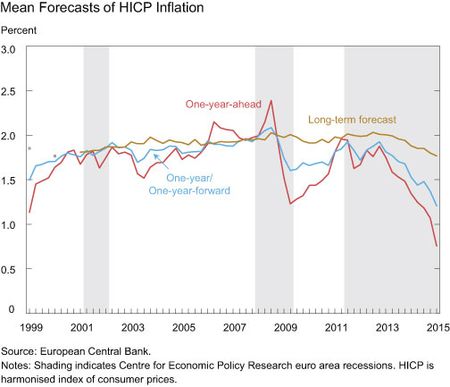

The ECB-SPF asks participants for a one-year-ahead inflation forecast (currently covering December 2014 to December 2015), a one-year/one-year-forward inflation forecast (currently covering December 2015 to December 2016), and a long-term inflation forecast (currently covering the calendar year 2019). An important feature of the two shorter-term horizons is that they don’t overlap, while the longer-term horizon is sufficiently far in the future to exclude current transitory movements in inflation. The next chart plots the mean point forecasts of inflation across participants since 1999 for all three horizons, with the series plotted against the quarterly survey dates.

A comparison of the behavior of the series during the 2008-09 period and post-2012 period suggests very different responses to lower inflation. Specifically, while shorter-term inflation expectations fell during the 2008-09 period, long-term inflation expectations remained quite anchored. This pattern suggests that the decline in inflation associated with the 2008-09 recession was largely viewed as temporary. In contrast, the post-2012 period has witnessed a decline in inflation expectations across all three forecast horizons, suggesting the current decline in inflation is viewed as much more persistent. The ECB’s governing council has indicated that it aims to maintain inflation rates below, but close to, 2 percent over the medium term. The mean long-term inflation forecast has been below 2 percent since fourth-quarter 2013 and is currently reported at 1.8 percent.

While the point forecasts tell us about average predicted values and the perceived persistence of inflation movements, they don’t provide insights into other aspects of the participants’ inflation outlook. For example, we don’t know anything about either the degree of confidence or the extent of any tail risk that participants attached to their point forecasts during the two low inflation episodes. For this purpose, we can turn to the density forecasts which are represented by a histogram in which participants assign probabilities to prespecified bins that provide a range of possible outcomes for the forecasted variable.

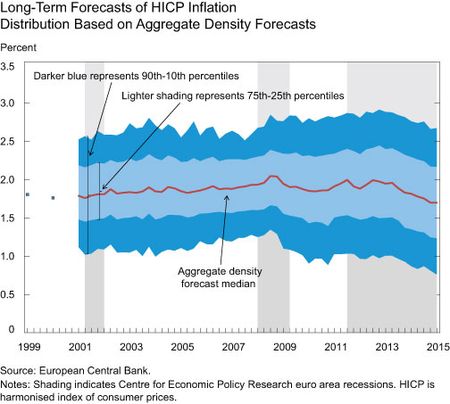

The next chart depicts the aggregate density forecast distribution for inflation at the long-term horizon, constructed by using a simple average of the individual density forecasts. We calculate the 50th percentile (the median) which tracks the long-term inflation outcome where half of the aggregate probability is above and half below this value. The median is similar to the mean but less sensitive to outliers. Two interesting spreads are the difference between the 25th and 75th percentiles (the interquartile range), which provides a measure of variability, and the difference between the 10th and 90th percentiles, which provides information about the tail risk.

The aggregate density forecast reveals several interesting findings. For example, the behavior of the median is qualitatively similar to the mean of the long-term point forecasts. In particular, both show the same stability during the 2008-09 period and the decline during the post-2012 period. However, we now have more details about participants’ long-term outlook for inflation during these episodes. For the 2009-10 episode, the 90th, 75th, and 50th percentiles remain relatively unchanged while the 25th and 10th percentiles declined. This pattern shows that the forecasters perceived greater downside risk associated with their point forecasts. In contrast, the post-2012 period generally shows the 10th through 90th percentiles declining in a roughly parallel fashion—a pattern indicating that the entire density forecast is shifting down, rather than reflecting greater tail risks on the downside. Taken together, inspection of the point forecasts and aggregate density forecasts from the ECB-SPF reinforces the view that that there has been some unanchoring of long-term inflation expectations in the euro area.

On January 22, the ECB announced a bond-purchase program in excess of €1 trillion. While the official announcement occurred after the survey, it is likely that participants had anticipated the introduction of such a program but remained uncertain about the details. This anticipation may account for the stabilization of the point and density forecasts of long-term inflation in the latest survey.

The next ECB-SPF survey, collected in April and released in May, will be especially useful to gauge whether the ECB’s bond-purchase program is having a measurable impact on long-term inflation expectations. If the details of the program are viewed favorably, then we might expect the next survey to show the long-term inflation aggregate forecast density distribution beginning to shift back toward the ECB’s stated inflation objective. The possibility remains, however, that despite this policy intervention the long-term evolution of the ECB-SPF inflation forecasts may continue to follow the post-2012 path if the ECB’s actions are viewed as insufficient.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the pos

ition of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Matthew Ploenzke is a research associate in the Research and Statistics Group.

Robert Rich is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Michael Stewart is a research associate in the Research and Statistics Group.

Joseph Tracy is an executive vice president and senior advisor to the Bank president at the Federal Reserve Bank of New York.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics