Buyout activity by financial investors fluctuates substantially over time. In the United States, peak years result in close to one hundred public-to-private buyout transactions and trough years in as few as ten. The typical buyout is primarily funded by debt, hence the term “leveraged buyout” (or LBO). As a result, analysis of buyout fluctuations has focused on the availability and cost of debt financing. However, in a recent staff report, we find that the overall cost of capital, rather than debt alone, is the primary driver of buyout activity. We argue that it is the common changes in both the cost of debt and the cost of equity—the aggregate risk premium—that are the source of booms and busts in buyout activity.

Why should the risk premium matter?

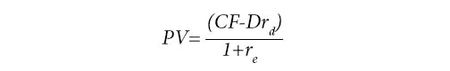

Prior research suggests buyouts are an investment in improved management of a firm. These management improvements in turn increase cash-flow growth. If we examine a simple one-period present value calculation, we can see the value of an investment equals the incremental cash flows, CF, less the cost of servicing incremental debt, D, at an interest rate of rd, discounted by a discount rate, re:

The greater the present value, PV, the more profitable the deal and the more likely it is to be undertaken. We argue that changes in the overall cost of capital, both re and rd, rather than the cost of debt alone are the primary determinants of deal activity. When the cost of capital is low, not only is debt financing cheap (low rd), but the discount rate for buyout investors, re, is also low, resulting in higher present values and more deals. Therefore, we contend booms commonly attributed solely to lower cost of debt are a result of lower costs of financing more generally.

In addition to increasing the cash-flow of a firm, a buyout transaction creates a relatively illiquid investment. Buyout investments typically last three to five years and are not as easily sold as investments in similar public firms. In our paper, we demonstrate that the cost of being illiquid is also greater when the risk premium is high. Hence, a high risk premium not only decreases the present value of cash-flow improvements, but it also increases the costs of making illiquid investments like buyouts.

What is the evidence?

To demonstrate the importance of the overall risk premium rather than debt-related factors we use a measure of the equity risk premium. The details on measuring that premium are in our paper, but the intuition is that we are essentially estimating expected stock market returns. When expected returns are high, market participants demand more return to take on risk. Whereas when expected returns are low, they demand less compensation for holding risk, meaning their risk premium is lower.

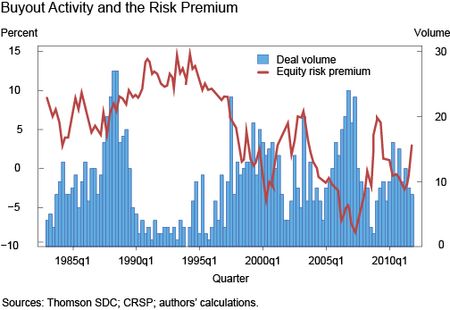

The chart below plots the quarterly number of U.S. public-to-private deals along with our measure of the equity risk premium. There are several sustained booms in the number of buyout deals: the late 1980s, the turn of the millennium, the mid 2000s, and a modest rebound after the recent financial crisis. Three of these booms are accompanied by a decline in the risk premium, consistent with our story. Likewise, the sustained drought of buyout activity in the early 1990s corresponds to a persistent and high risk premium.

Going a step further, we test the risk premium’s ability to explain time variation in buyout activity versus commonly used credit market factors. In these tests we not only want to know whether the risk premium is negatively correlated with activity (it is), but whether it explains the variation in activity more so than several credit factors. The chart below compares how much (in percent) of the variation is explained by our risk premium versus three credit market factors that others have argued characterize the level of credit risk (the spread on a high-yield bond index, a measure of credit risk constructed by Gilchrist and Zakrajsek [2012], and the spread of firm cash flows relative to high-yield rates). Whether we consider the volume or value of buyout activity, we find the risk premium explains two to three times more of the time series variation.

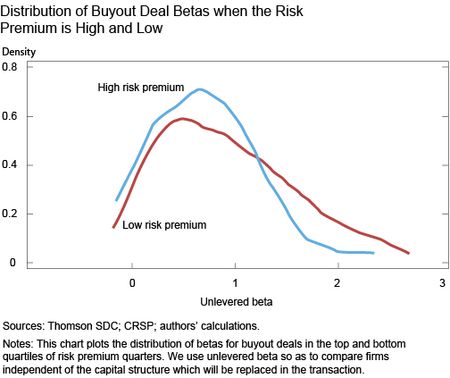

Another implication of the investment framework is that deals for high

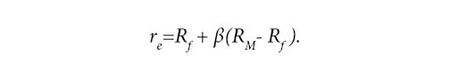

beta firms will be more sensitive to changes in the risk premium. This finding follows directly from a classic cost-of-capital calculation where the cost of capital equals the risk-free rate, Rf, plus the firm’s beta times the risk premium on market assets relative to the risk-free rate, RM -Rf:

Recall the cost of capital is used as the discount rate for investments. When the risk premium increases, the discount rate for high beta firms increases more quickly than for low beta firms. By extension, the present value of the buyout declines more for high beta firms than low beta firms. Therefore, high beta firms should be less attractive buyouts when the risk premium is low. In fact, the chart below demonstrates that buyouts of higher beta firms are less common when the risk premium is high compared with when it is low.

Final Thoughts

The dialogue around buyouts has traditionally centered on the role of credit markets. However, in the big picture, the aggregate risk premium—the overall demand for risk by all types of investors—is the primary determinant of buyout activity. Given that many investment decisions are a function of the risk premium, we expect initial public offerings, mergers and acquisitions, and other types of corporate financial activity to also be closely related to time variation in the risk premium.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Valentin Haddad is an assistant professor of economics at Princeton University.

Erik Loualiche is an assistant professor of finance at the MIT Sloan School of Management.

Matthew Plosser is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics