There’s an ongoing debate about whether policymakers should respond to financial conditions when setting monetary policy. An argument is often made that financial stability concerns are more appropriately dealt with by using regulatory and macroprudential tools. This post offers a theoretical justification for policymakers to monitor and possibly respond to financial conditions not because this would lessen concerns about financial stability but because this information helps reveal the state of the economy and the appropriate stance of monetary policy.

In particular, financial market risk measures offer insight into the natural interest rate, broadly defined as the rate that is in line with achieving full employment and stable inflation. More specifically, as my collegues have stated in their post “Why Are Interest Rates So Low?,” the natural rate is “the rate of interest that would obtain if all prices and wages had adjusted so as to bring the level of economic activity to its full-employment level.”

In a recent paper, “Cyclical Risk Aversion, Precautionary Saving, and Monetary Policy,” and a related Liberty Street Economics blog post, my coauthor and I examine the channels through which risk and uncertainty affect the natural interest rate. To understand these channels, think of the risk-free interest rate as the price of postponing consumption and saving the extra cash. Hence, a change in the demand for savings will affect the level of interest rates. In our work we stress that an important part of the demand for savings comes from a desire to put money aside for precautionary reasons based on an individual’s perception of risk and attitude toward it. In fact, the paper finds that higher economic volatility, lower risk tolerance, and higher risk of a recession critically increase demand for precautionary savings and put downward pressure on the natural interest rate.

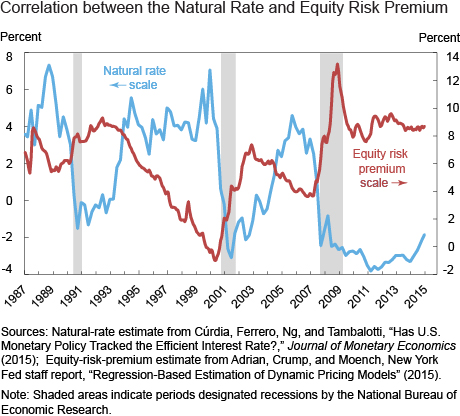

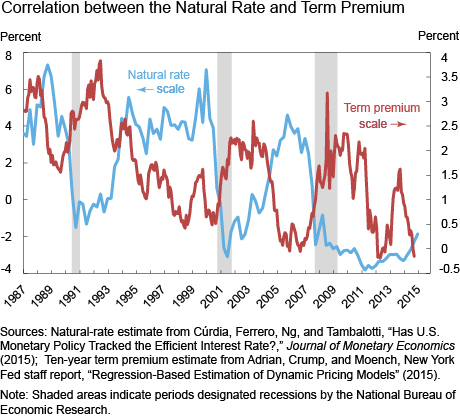

But these risk factors are precisely the ones determining how much return investors require to hold risky assets, as our previous research shows. In other words, higher economic uncertainty, lower risk tolerance, and higher risk of a recession increase risk premiums. So theory suggests that these risk factors should create a negative correlation between the natural interest rate and risk premiums. The data in the charts below support this theoretical prediction.

The above chart plots the natural interest rate derived from a counterfactual exercise using a structural model of the economy. The correlation is indeed negative. That is, periods of compressed risk premiums tend to coincide with periods of high levels of the natural rate, and vice-versa.

The first chart below shows a negative correlation between estimates of the term premium – or the excess return that investors require in order to hold a long-term bond instead of a series of shorter-term bonds – and the natural rate, while the subsequent chart plots the estimates of the natural rate against the spread between BAA-rated corporate bonds and ten-year Treasury bonds. Both charts illustrate a negative correlation between a financial market risk measure and the natural interest rate.

Theory suggests that there’s a link between the natural interest rate and people’s attitude toward risk and the data appear to support this link. So a case can be made for adjusting monetary policy according to the level of risk taking in markets to the extent that this affects the natural rate. Failing to do so can lead to a non-neutral policy. There could be an environment in which a given policy move changes the degree of risk taking in financial markets, affects market volatility, and influences financial conditions more broadly. Under such circumstances, the policy move should be calibrated to take into account that changes in uncertainty and risk taking critically influence the path of interest rates that is consistent with the central bank’s employment and inflation objectives.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Bianca De Paoli is a senior economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Bianca De Paoli is a senior economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics