Puerto Rico’s economic and fiscal challenges have been an important focus of work done here at the New York Fed, resulting in two reports (2012 and 2014), several blog posts and one paper in our Current Issues series in just the last few years. As the Commonwealth’s problems have deepened, the Obama administration and Congress have begun discussing potential approaches to addressing them. In this post, we update our previous estimates of Puerto Rico’s outstanding debt and discuss the effect that various forms of bankruptcy protection might have on the Commonwealth.

Puerto Rico’s Public Sector Debt

As we discussed in detail in our 2014 report (using data from 2012), Puerto Rico’s debt burden is very heavy both in comparison to mainland states, and to advanced and emerging market economies. The latest available data do not change those conclusions. In fact, the Island’s fiscal situation has become even more challenging since we wrote the previous report because the territory has lost normal access to capital markets, even for very short-term funding. Here we update our figures using data contained in a report published by Anne Krueger and two other former International Monetary Fund officials (the Krueger Report) and in Puerto Rico’s Fiscal and Economic Growth Plan (FEGP).

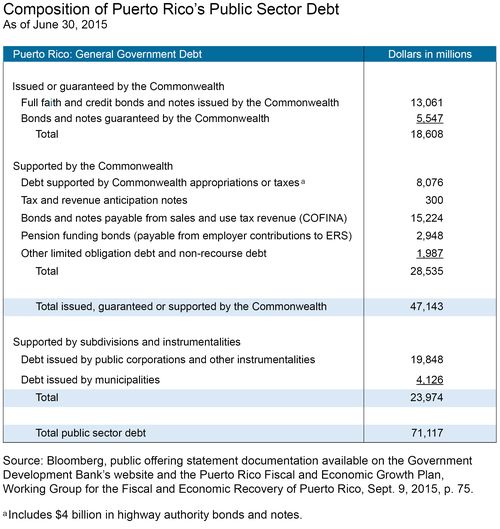

As illustrated in the table below, Puerto Rico’s total public sector debt amounted to about $71 billion as of mid-2015, equivalent to about 103 percent of its Gross National Product (GNP). This figure includes all debt owed by the public sector, including the central government, municipalities, and a wide array of public corporations. (The interested reader should see the 2014 report for additional detail.) Not shown in this table is the estimated present value of net unfunded pension liabilities, estimated at $44 billion, or 64 percent of GNP.

The $71 billion public sector debt stock figure mentioned above actually hasn’t changed much since the 2014 report. Partly this is because of significant tax increases and expenditure cuts that have been enacted at the central government level. But it also masks the fact that the Puerto Rican government has been forced to finance itself by running down assets and by delaying payments owed to suppliers and taxpayers (see page 13 of the FEGP). This is not sustainable.

In thinking about the scale of Puerto Rico’s debt burden, one might focus primarily on the full faith and credit and guaranteed debt of the Commonwealth ($18.6 billion), but this is too narrow and gives an inaccurate representation of the government’s debt burden. A better guiding principal is to think in terms of debt issued by public entities whose debt service capacity derives primarily from taxes on incomes and economic activity generated in Puerto Rico or whose primary purpose is to service as financing vehicles for governmental entities. This debt totals roughly $47 billion, and includes debt payable from the General Fund, debt payable from sales and use taxes (COFINA), pension funding bonds, the highway authority, and certain other debt, but excludes the municipalities and the other large service-providing public corporations. We will refer to this as debt of the “broad central government.” The highway authority is included in the broad central government because it is reliant on gasoline taxes collected by the Commonwealth.

While there is some uncertainty about the exact state of the Commonwealth’s finances, the general state of Puerto Rico’s finances is clear from the Krueger Report, the FEGP as well as our reports.

Total debt service payments over the next five years for the broad central government average about $3.6 billion per year. This amounts to about 5.2 percent of GNP, or a third of broad central government revenues as forecast under current law. Debt service this large is clearly a very difficult burden for the Commonwealth to manage. Data contained in both the Krueger report and in the FEGP suggest that the broad central government primary balance (defined as the excess of revenues minus noninterest expenditures excluding the highway authority) available to service this debt is likely to be roughly $0.5 billion this year. The future path of primary balances is uncertain and dependent on a range of economic and policy factors, notably including expiration of one-time funds from the Affordable Care Act. However, the situation is clearly very challenging, as the FEGP suggests that the primary balance would average a surplus of roughly $1.5 billion per year over the next five years even under the most favorable fiscal and economic reform scenario—still well below the level needed to service these debt payments. The baseline under current policies and economic conditions would be much worse: deficits averaging a bit over $1 billion per year.

The largest and most important component of the remainder of the Commonwealth’s public sector debt ($20 billion) is owed by the Island’s major service-providing public corporations, the largest being the electric and water authorities. Even if we treat this debt as separate from the broad central government, it is important to keep in mind that it also represents a substantial burden on the Island’s economy and government.

What can be done?

Puerto Rico is currently in a vicious cycle: poor fiscal outcomes lead to higher interest rates and debt service costs, requiring higher taxes and service cuts, which in turn create incentives for citizens to locate elsewhere, like Florida, further worsening the fiscal situation. In our earlier reports, we suggested several mechanisms for breaking this cycle, and restoring fiscal stability and growth to the Island’s economy.

Some recent discussions have focused on restructuring debt to achieve the same end. How exactly that might be done is unclear. Absent a legal framework to manage a restructuring, the process could quickly become very costly to all the parties involved. A default would lead to potentially hundreds of creditor lawsuits and attempts to attach assets. Currently, Puerto Rico has no legal framework under which it can resolve its public debt burden so restructuring would likely exacerbate the vicious cycle, with ever-increasing levels of social and economic costs.

In the fifty states, Chapter 9 of the U.S. Bankruptcy Code provides a mechanism for the orderly resolution of debts of municipalities, avoiding the high costs associated with prolonged legal battles and the potential for disruption of public services. But Chapter 9 doesn’t currently apply to Puerto Rico. To fill this gap, the Commonwealth passed the Corporations Debt Enforcement and Recovery Act (aka the “Recovery Act”) in 2014. But a July 2015 federal Appeals Court decision held that by excluding Puerto Rico from Chapter 9, Congress “preserved to itself that power to authorize Puerto Rican municipalities to seek Chapter 9 relief,” and that the Recovery Act thus violates the Supremacy Clause (Article VI) of the U.S. Constitution.

Providing a framework for an orderly restructuring process will most likely involve some kind of bankruptcy regime for the Commonwealth and its municipalities. In the language of Chapter 9, “municipalities” are political subdivisions or instrumentalities of states; states themselves are not eligible to file for bankruptcy protection under Chapter 9. Thus, a direct application of Chapter 9 to Puerto Rico (that is, treating Puerto Rico as if it were a state) would allow for the possibility that the debts of the public corporations and agencies, along with municipality debt, would be subject to protection from creditors. As shown in the table above, these debts totaled $24-28 billion as of June 2015, representing less than 40 percent of total Commonwealth debt. Reducing or rescheduling these debts would offer some relief to the Commonwealth. (It’s less clear how some special kinds of debt like COFINA and the Commonwealth’s pension bonds would be treated under this version of Chapter 9. Deciding this would likely be a costly and time-consuming process.)

Of course, Puerto Rico is not a state, and an alternative approach would be to devise a mechanism that would also apply to the obligations of the Commonwealth itself, rather than just to those of its subdivisions. Such a mechanism could include all $71 billion shown in the table, an amount roughly equal to Puerto Rico’s GNP, and would render irrelevant any ambiguity about exactly what is an obligation of the Commonwealth versus a subdivision. Including a more comprehensive set of obligations would offer significant debt relief and the potential to share the burden of restructuring over a broader set of creditors.

Conclusion

There is little clarity at this time about how Puerto Rico’s high public debt will be brought down to more sustainable levels. And Puerto Rico’s situation is further complicated by the high debt of its public-sector corporations and the ongoing loss of population. The reduction in the Island’s debt, and the burden of servicing that debt, should lessen the need for tax increases and other fiscal austerity measures that have been a drag on the economy. At the same time, an articulated framework to restructure the Island’s debt must be accompanied by a strong and credible fiscal program to ensure that the Commonwealth remains on a sustainable path, as our earlier report argued. Both components are vital parts of the complete package of structural reforms needed to make the Island a more competitive environment for investment and economic growth.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Hunter L. Clark is an assistant vice president in the Federal Reserve Bank of New York’s Integrated Policy Analysis Group.

Andrew F. Haughwout is a senior vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Andrew F. Haughwout is a senior vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Thanks, Cate, for the comments. As you point out, PREPA was very close to an agreement with its creditors when you wrote the comment and a restructuring deal was reached last Thursday with some of them. That deal, however, doesn’t include everyone – the bond insurers are excluded – and it’s not clear what the economic impact will be for PREPA and its ratepayers. So we would argue that the jury is still out on how that deal will proceed. In any event, PREPA has been negotiating with its creditors since at least July 2014 so this hasn’t been a quick or easy process. A couple of other brief responses: While it’s true that public sector employment in Puerto Rico in the month of September was up very slightly – about 1,000 jobs – since the same month a year ago, it is down almost 25 percent (about 76,000 jobs) since 2008. It’s also true that up-to-date audited financial statements for some of the Commonwealth’s entities aren’t available, but in our view there is more than enough reliable information to conclude that Puerto Rico’s fiscal situation is quite serious.

The authors miss some important points: 1) The Krueger report assumes full amortization of debt which is a nice goal but something very difficult to achieve without substantial fiscal reductions. 2) Puerto Rico’s electric utility, Prepa, is near agreement with bond insurers, bondholders and fuel line lenders to restructure approx $9 billion in debt outside of federal bankruptcy. It is possible that other classes of PR debt could also be consensually restructured. 3) Puerto Rico’s central government has increased the number of employees in the last year although the island has lost population. 4) More precisely PR schools lost 8% of their enrollment this year but the PR Dept of Ed is moving 800 central admin employees into schools instead of downsizing. It is very difficult for Congress to create a structure to haircut bondholders when the island has done little to reach a balanced budget. Also 4 units of the central government cannot get KPMG to sign off their 2014 financials so no one really knows what their financial condition is.