There has been unusually high activity on central banks’ balance sheets in recent years. This activity, which has expanded beyond the core operations and collateral of the central bank, has been called “unconventional,” “nonstandard,” “nontraditional,” and “active.” But what constitutes a normal central bank balance sheet? How does central bank asset and liability composition vary across countries and how did the crisis change this composition? In this post, we focus on the main characteristics of central bank balance sheets before the crisis. In our next piece, we describe how this composition has changed in response to the crisis.

Central Bank Liabilities in Normal Times

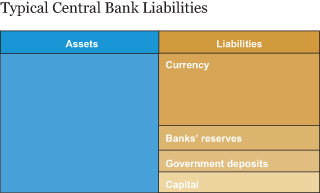

The main liabilities of central banks are typically currency (banknotes) and reserves, a form of money that can only be held by banks at the central bank (see the figure below). Banks use reserves to make payments among themselves and to the central bank. In addition, some central banks issue deposits to the government. These accounts function as the government’s “checking account” at the central bank.

The Federal Reserve was a central bank that, before the crisis, held mostly currency as its main balance sheet liability. Currency represented 93 percent of the Fed’s liabilities in December 2006, with reserves only 1.5 percent and the Treasury’s general account half a percent. Currency is a sizable liability on most central bank balance sheets in normal times.

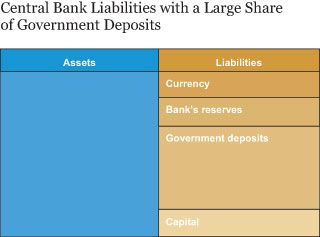

Other central banks had a much larger share of their liabilities as reserves before the crisis. One reason to issue a lot of reserves in normal times is to help interbank payments run smoothly; if the supply of reserves is small, banks concerned about running out of reserves at the end of the day may choose to delay payments to other banks, which can create “gridlock.”

As an example, the Norges Bank issued a relatively large amount of reserves before the crisis—7 percent of its liabilities. Almost 50 percent of the liability side of the Norges Bank balance sheet at the end of 2006 was made up of treasury deposits, and currency represented only 16 percent of liabilities, so its balance sheet looked more like the figure below.

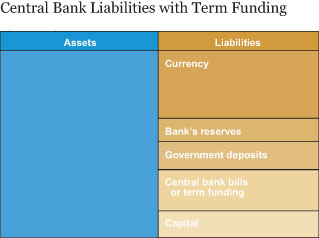

Currency and reserves are “immediate” maturity liabilities, since they can be instantly transferred to other parties for payment. Some central banks also issue term maturity liabilities, either term deposits, which are only available to counterparties that hold a central bank account, or term repos, which are collateralized and available to counterparties beyond depositing institutions. Some central banks have the authority to issue bills. Like Treasury bills, central bank bills are available to nonaccount holders in the secondary market, although some central banks restrict primary issue to account holders. Term liabilities can be issued both to reduce the amount of reserves in the system and to control the central bank’s target interest rate. (This composition is depicted in the figure below.)

For instance, the Bank of England (BoE), the European Central Bank (ECB), the Fed, and the Reserve Bank of Australia (RBA) have been fine-tuning term deposit facilities and repo instruments that have longer maturities than overnight. The BoE, the ECB, the Swiss National Bank, and the RBA are among the central banks that have the ability to issue bills, the Fed does not currently have this authority.

Central Bank Assets in Normal Times

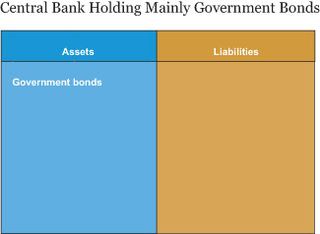

Central banks acquire assets by purchasing them or by making loans. When a central bank purchases an asset, say a bond, it pays by creating reserves or currency, thus increasing its assets and liabilities by equal amounts. Similarly, when a central bank extends a loan, it creates the new reserves that are lent. Central banks’ counterparties are usually banks, although some accept nonbank counterparties as described in yesterday’s post. In normal times, central banks hold mainly government bonds, foreign exchange reserves, and loans to banks as assets. However, the relative importance of these assets varies a lot across central banks. Prior to the crisis, changes to a central bank’s asset holdings were typically passive and did not have a monetary policy purpose.

The Fed’s balance sheet before the crisis was relatively simple; at the end of 2006, nearly 90 percent of its assets were U.S. Treasuries, broadly matching the amount of outstanding currency, as in the figure below.

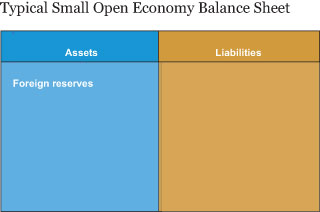

In contrast, central banks in small open economies tend to have a large share of foreign reserves on their balance sheets, as in the figure below. This is partly due to history: When exchange rates were fixed and capital flows regulated, large holdings of foreign reserves ensured that imports could be funded, and made fixed exchange rates credible. With free capital flows and floating exchange rates, these aims are less important, but central banks still sometimes intervene in foreign exchange markets and need foreign reserves for this purpose. Furthermore, during financial stress, reserves may be used to serve central bank customers such as the government, and to reduce the risk of instability in financial systems heavily dependent on foreign currency funding. The importance of these objectives will depend on each country’s need for interventions and the unhedged exposure of its financial system to exchange rate risk. While reserve holdings are valuable in those stress scenarios, the exchange rate risk to which it exposes the central bank could be higher than the interest rate risk associated with holding government bonds. See this paper for further discussion of the role of foreign reserves on central bank balance sheets.

The Norges Bank is an example of a central bank with a large share of foreign reserve holdings, with 86 percent of its assets (excluding the sovereign wealth fund) in this form at the end of 2006. In comparison, the Fed held negligible foreign exchange reserves of about 4 percent.

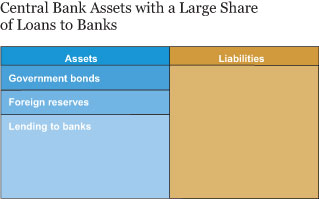

Loans to banks can also be a sizable asset of central banks. This often happens when the central bank holds few securities as assets, relative to the amount of its liabilities, notably currency. However, sizable lending to the banking sector may occur even from central banks that hold a substantial amount of securities against the currency. The loans may be useful to create reserves, as discussed above, which can facilitate interbank payments. If the supply of reserves is low, central bank lending to banks can make reserves available to support payments among banks. More than half the assets of the BoE in December 2006 were loans to banks in the form of repos, and at the ECB, it was close to 40 percent of assets, as in the figure below. In comparison, only about 4 percent of Fed assets were loans and repos at that time.

In some cases, a large share of bank loans on the central bank’s balance sheet may be an indication of undeveloped money markets. This scenario requires the central bank to provide liquidity directly to its banks, rather than let them redistribute the liquidity among themselves through the money market.

To sum up, even in normal times the composition of central bank balances sheets can vary considerably across countries. While all central banks issue two key forms of money, currency and reserves, as liabilities, the relative size of these items can vary a lot. Some central banks also issue deposits to the government and offer term liabilities, while others don’t. Assets typically consist of government bonds, foreign reserves, and loans to banks, in varying proportions, but again, with considerable variation across central banks.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Emily Eisner is a senior research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Antoine Martin is a senior vice president in the Bank’s Research and Statistics Group.

Ylva Søvik is a deputy director at Norges Bank, the central bank of Norway.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

In reply to Jared: Thank you for your question. We don’t know exactly how each central bank may choose to display its assets and liabilities but, generally, currency in circulation is a liability of a central bank and will be shown as such on its balance sheet.

Thanks for the post, I found this very helpful and informative and I look forward to your analysis of post-crisis balance sheets. Does all currency in circulation show up in the liabilities of that currency’s central bank?