The Federal Housing Administration (FHA) played a significant role in maintaining mortgage credit availability following the onset of the subprime mortgage crisis and through the Great Recession. Not surprisingly, the FHA’s expansion during a period of falling home prices and deteriorating economic conditions resulted in material losses to its mortgage insurance fund arising from mortgage defaults and foreclosures. These losses, in turn, have generated increased policy interest in the design of the FHA mortgage insurance program. In this post we analyze how the cost of FHA insurance is shared between mortgage defaulters and non-defaulters and find that non-defaulters pay a disproportionate share. Although the ten-year cumulative default rate for our sample of FHA mortgages is 26 percent, defaulters only pay 17 percent of total mortgage insurance premiums. We discuss changes to the FHA mortgage insurance pricing that would shift more of the premium cost to defaulters.

A principle of mortgage insurance pricing is to target premium payments toward borrowers who are at a higher risk of default. A standard way to implement this principle is to use risk-based mortgage insurance premiums—that is, to vary premiums with key risk indicators such as the loan-to-value (LTV) ratio and the borrower’s credit score. As the housing crisis was unfolding, the FHA was planning on implementing risk-based pricing. However, this was prevented by a provision (section 2133) in the Housing and Economic Recovery Act of 2008.

How could the FHA shift the burden of mortgage insurance to defaulters without using risk-based mortgage insurance pricing and still keep mortgages affordable? A key feature of mortgage defaults is that they tend to occur earlier in the life of a mortgage than do prepayments. Consequently, if the FHA charged just a common annual premium for its mortgage insurance, then defaulters would pay less than their proportionate share of the premiums.

In terms of affordability, this approach does not increase the borrower’s required cash at closing, but does increase the monthly cost of the mortgage. If, instead, the FHA charged just a common up-front premium that is paid in cash by all borrowers, then defaulters would pay their proportionate share of mortgage premiums. However, this approach increases the borrower’s required cash at closing which may limit affordability, while leaving the monthly cost unaffected.

A pricing design can also involve both an up-front and an annual premium—which is referred to as a two-part pricing structure. The choice of a specific combination of up-front and annual premium involves a trade-off between the degree to which that choice shifts the burden of premiums to defaulters and the degree to which it affects the affordability of the mortgage in terms of the required cash at closing and the monthly payment. But this trade-off only applies if borrowers have to pay the up-front premium at closing. The FHA currently charges an up-front premium of 1.75 percent of the principal balance at origination and an ongoing annual premium of 0.85 percent paid as part of the borrower’s monthly payment. However, the FHA allows borrowers to finance the up-front premium by rolling it into the mortgage balance—this negates the ability of the up-front premium to shift the cost of mortgage insurance to defaulters.

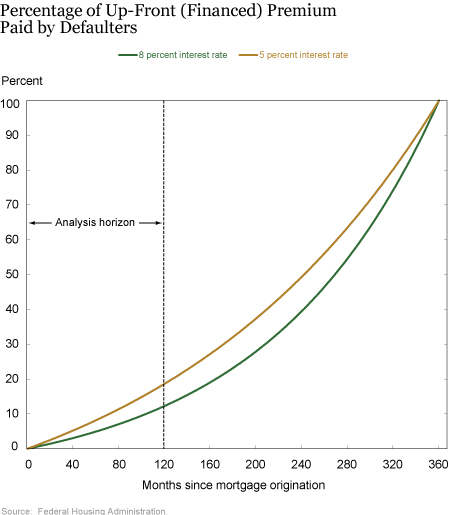

Allowing up-front mortgage insurance premiums to be financed means that, instead of being collected up-front as the name implies, the premium is effectively collected over the life of a mortgage according to the amortization schedule with any remaining balance paid when the house is sold. However, if the borrower defaults, the remaining balance on the up-front premium is not paid. That’s because the full remaining balance of the mortgage at the time of the default—including the unpaid portion of the up-front premium—is insured by the FHA. Consequently, borrowers who prepay their mortgage pay in full the up-front premium, while borrowers who default pay only a portion of the up-front premium depending on when the default occurs. Below we quantify the importance of the FHA’s policy of allowing up-front mortgage insurance premiums to be financed for the incidence of program costs between defaulters and non-defaulters.

Who Pays for Insurance under the FHA’s Current Pricing?

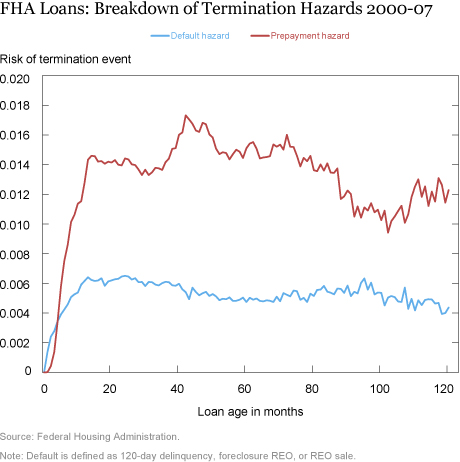

The first step in the analysis is to estimate the timing of defaults and prepayments for FHA-insured mortgages. We use data for all FHA-insured, thirty-year fixed-rate mortgages originated between 2000 and 2007 in the Lender Processing Services (LPS) data. We define default as being when a loan reaches 120 days or more past due. Since our data only run through 2016, we calculate the timing of default and prepayment over a ten-year horizon after a mortgage is originated. The chart below shows the probability that a borrower either defaults or prepays at each duration given that the mortgage is still active the month before—what are known as the default and prepayment hazards.

We use the estimated ten-year hazards to conduct a set of calibration exercises to study the FHA’s mortgage insurance pricing structure. For simplicity, we begin with a $1 million pool of newly originated, thirty-year, fixed-rate mortgages all with LTV ratios of 96.5 percent and note rates of 5 percent. As a baseline, we use the FHA’s current practice of charging a 1.75 percent up-front mortgage insurance premium that the borrower rolls into the balance of the loan and a 0.85 percent ongoing annual mortgage insurance premium. We then create a standard amortization schedule, which, when coupled with the default and prepayment rates shown above, enables us to compute monthly totals for mortgage insurance receipts (up-front and ongoing). For simplicity, we ignore discounting in these calculations.

For our data, the ten-year cumulative default and prepayment rates are 26 percent and 63 percent, respectively. Put differently, after ten years, only 11 percent of the original FHA mortgage pool was still active. Hence, an analysis based on a ten-year horizon should provide a good approximation to what the overall distribution of premium payments would be over the full thirty-year period.

The results of our exercise indicate that under the FHA’s current pricing scheme a disproportionate amount of the premiums are paid by non-defaulters. Most of the FHA’s premium income comes from the ongoing fee, 72 percent. While we estimate a cumulative default rate of 26 percent, defaulters only pay 21 percent of these annual premiums. Although the up-front fees account for a smaller portion of the overall premium income, 28 percent, the share of the financed up-front fees paid by defaulting borrowers is only 7 percent.

This small share is due to the fact that the percentage of the up-front premium that is paid by defaulters grows very slowly with the mortgage age as shown in the chart below. For example, even after ten years (120 months) a borrower who defaults on a mortgage with a 5 percent coupon rate has still paid less than 20 percent of the up-front premium (gold line ). At the higher interest rate of 8 percent, defaulters would only have paid 12 percent of the up-front premium after ten years. Overall, we find that defaulters end up paying only 17 percent of total premiums—well below their cumulative default rate.

Alternative Designs

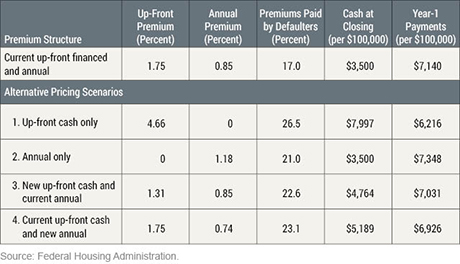

We now explore the implications of changes to the design of the FHA mortgage insurance premium pricing for affordability and the share of premiums paid for by defaulters. For each pricing choice considered, we impose the constraint that it generates the same expected total premiums as the FHA’s current pricing scheme. To evaluate the effects on affordability, we consider a $100,000 home purchase financed with a 3.5 percent down payment plus a thirty-year fixed-rate mortgage with a 5 percent coupon rate. We also assume that default and prepayment behavior is not affected by the pricing changes.

We examine four alternative pricing scenarios and compare each to the current FHA schedule, which is displayed in the first row of the table below. The first scenario involves eliminating the annual premium and imposing only an up-front, cash payment that is revenue neutral. This equalizes the burden of premium payments borne by defaulters and non-defaulters. However, it does so at the cost of more than doubling the required cash at closing (from $3,500 to $7,997) for our example house purchase, although annual payments would decline by $924 (13 percent). The second scenario involves eliminating the up-front payment and increasing the annual premium to maintain revenue neutrality. In this scenario, defaulters would bear a larger fraction of payments than under the current pricing, but non-defaulters would still bear a disproportionate burden. Although cash at closing would remain constant at $3,500, the initial annual payment—including both mortgage and premium—would increase only modestly by $208 (3 percent).

The final two scenarios are two-part pricing schemes with up-front cash premium payments plus annual premiums. Demanding up-front cash payments increases revenue relative to the current financed pricing scheme, so it is necessary to lower either the annual premium or up-front premium (or both) to maintain the same revenue stream. Thus, in the third scenario, we maintain the current FHA annual premium (0.85 percent) while decreasing the up-front payment to 1.31 percent but requiring that it is paid in cash. In the final scenario, we maintain the current level of the FHA-financed premium (1.75 percent) but paid in cash and lower the annual premium. Both scenarios increase the payment burden borne by defaulters, but do not quite achieve proportionality. In addition, both scenarios also increase up-front costs by similar magnitudes.

The FHA’s policy of allowing borrowers to finance their up-front mortgage insurance premiums acts to reduce the total cost of borrowing during the first year (required cash at closing plus first-year payments), but results in non-defaulters paying a disproportionate share of program costs. Requiring up-front cash premiums improves the balance of program costs between defaulters and non-defaulters, but will reduce affordability on the margin. Based on our simulations, an FHA pricing structure with only annual premiums would better target premiums toward defaulters with almost no effect on affordability. Looking ahead, we will study whether program costs could be better balanced between defaulters and non-defaulters through risk-based annual premiums.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

W. Scott Frame is a financial economist and senior advisor in the Research Department of the Federal Reserve Bank of Atlanta.

Kristoper Gerardi is a financial economist and adviser in the Research Department of the Federal Reserve Bank of Atlanta.

Joseph Tracy is an executive vice president and senior advisor to the president of the Federal Reserve Bank of New York.

How to cite this blog post:

W. Scott Frame, Kristopher Gerardi, and Joseph Tracy, “Being Up Front about FHA’s Up-Front Mortgage Insurance Premiums,” Federal Reserve Bank of New York Liberty Street Economics (blog), March 27, 2017, http://libertystreeteconomics.newyorkfed.org/2017/03/being-up-front-about-the-fhas-up-front-mortgage-insurance-premiums.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

What about the idea of either a “step down” or gradually diminishing annual premium? If risks of default tend to be concentrated in a mortgage’s early years, it might make more sense to start premiums from a “high” rate and lower costs as risks decline. With the FHA program as important is it is in today’s tight lending climate, perhaps a stepped premium structure might be changed to 1.5 percent (or less) up front, then 1.25 percent for years 1-3, 1 percent for years 4-6, 0.6 for years 7-9, 0.25 percent for years 10-12 then automatically canceling (or similar structure, stepped over time)? Alternately, a more fluid diminishment could be considered where the percentage amount of each premium is fractionally reduced with each payment (i.e. in the first payment, an annualized fee of 1.25 percent (0.10416), a annualized fee of 1.24 percent (.10333) used for payment 2, etc. and structured so as to terminate at a point where the incidence or severity of loss to the MIF is minimal. Either way could be structured so that the percentage of possible lifetime premiums paid (versus today’s structure) could be advanced into a period earlier in the term of the underlying mortgage when losses are more likely to occur. Borrowers would be rewarded for staying in the program for longer, as costs would diminish over time, then terminate.