President Trump announced a new tariff of 25 percent on steel imports and 10 percent on aluminum imports on March 8, 2018. One objective of these tariffs is to protect jobs in the U.S. steel industry. They were introduced under a rarely used 1962 Act, which allows the government to impose trade barriers for national security reasons. Although the tariffs were initially to apply to all trading partners, Canada and Mexico are currently exempt subject to NAFTA negotiations, and implementation of the tariffs for the European Union, Argentina, Australia, and Brazil has been paused. South Korea has received a permanent exemption from the steel tariffs and will instead be subject to a quota of 70 percent of its current average steel exports to the United States. In this post, we consider how the steel tariffs could affect U.S. trade and employment. We focus on steel since the steel industry employs about three times as many workers as the aluminum industry, although qualitatively our conclusions apply to both. We argue that the new tariffs are likely to lead to a net loss in U.S. employment, at least in the short to medium run.

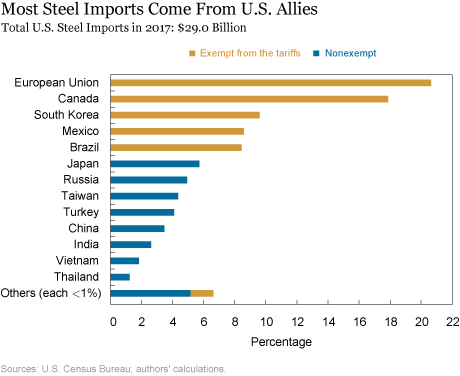

Although the tariffs were introduced under a national security argument, most U.S. imports are actually sourced from U.S. allies. The chart below shows that the largest supplier of steel to the United States is the European Union, accounting for more than 20 percent of its total steel imports. Countries for which the tariff is currently not applied account for 67 percent of U.S. steel imports, although this figure may change as negotiations with the currently exempt countries proceed. What is striking about this chart is the very small share, only 3.5 percent, originating from China. One reason for these trade patterns is that a large portion of imported steel, particularly from China, is already covered by special tariffs.

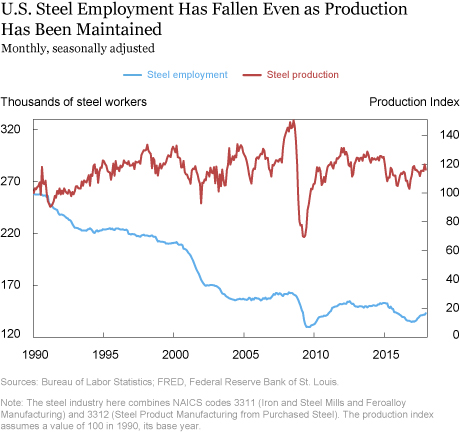

Given the large amount of protection the steel industry has received over the years, it is instructive to look at how employment in the steel sector has fared. As the next chart shows, employment in the steel industry has been on a downward trend for decades. The industry, narrowly defined to only include workers where the steel tariffs apply, just employs 140,000 workers in total. In addition to import competition, rapid technological progress such as the introduction of mini mills has been blamed for displacing workers. As the chart shows, steel output has been fairly stable over the long run, and so output per worker has been on the rise. Since 2000, employment in steel production fell 33 percent while output per worker increased 43 percent (an average of more than 2 percent a year).

How do steel tariffs come into the picture? A tariff increases the price of imported steel, and it enables domestic steel producers to also increase their price. Research on markup adjustments more generally shows that a 10 percent increase in competitor prices leads to a 5 percent increase in domestic prices. With a 25 percent tax on imported steel, local steel producers can increase their markups and prices, and still stay competitive relative to foreign-produced inputs. This is the so-called protection that tariffs confer.

However, firms that are dependent on steel and aluminum inputs—both importers and non-importers—will face higher prices. Downstream domestic producers will have to increase their prices or reduce markups, which makes them uncompetitive relative to competing imports. Similarly, U.S. exporters that need steel or steel-related inputs will face higher input costs and will have to either increase export prices or reduce their profit margins. These effects could lead to lower employment in these steel-intensive industries and possibly plant shut downs. Researchers estimate that the number of jobs in steel-intensive industries, which they define as industries with steel inputs of at least 5 percent of total, is around 2 million—for example, manufacturers of auto parts, motorcycles, and household appliances.

It is in steel-related industries where jobs are likely to be at risk. To get a sense of the magnitude of the employment effects, we can turn to a similar episode in 2002 when President Bush introduced steel tariffs of up to 30 percent, although under different legislation. Studies of these tariffs found evidence of higher steel prices and job losses of 200,000 across the United States. This number is higher than the total number of workers employed by U.S. steel producers (187,500) at the time.

In principle, workers who lose their jobs in steel-related industries should reallocate toward jobs in other industries as the economy rebalances. If this process were frictionless, the impact on unemployment would be short-lived. However, research has estimated that average moving costs between sectors are high and therefore the reallocation process is slow. As firms in steel-related industries become less competitive, average wages in these industries are therefore likely to decline, and workers are likely to remain unemployed for some time.

The negative effects of the steel tariffs could be amplified if there is retaliation by other countries. China has already retaliated against the steel tariff by imposing tariffs on $3 billion in fruit and meat imports from the United States. Similarly, after President Bush imposed the 2002 steel tariffs the EU challenged his decision. The World Trade Organization declared the tariffs illegal and the EU was given authority to impose $2 billion in retaliatory sanctions against U.S. products.

In another case, when President Obama imposed a 35 percent tariff on Chinese tires in 2009, China immediately responded by imposing restrictions on U.S. shipments of chicken parts, which cost American chicken producers $1 billion in sales in 2011. Estimating the cost of a trade war is challenging because historically there have been so few. But one study does estimate the cost to be 3.2 percent of real world income.

Although it is difficult to say exactly how many jobs will be affected, given the history of protecting industries with import tariffs, we can conclude that the 25 percent steel tariff is likely to cost more jobs than it saves.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Mary Amiti is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Sebastian Heise is an economist in the Bank’s Research and Statistics Group.

Noah Kwicklis is a senior research analyst in the Bank’s Research and Statistics Group.

Noah Kwicklis is a senior research analyst in the Bank’s Research and Statistics Group.

How to cite this blog post:

Mary Amiti, Sebastian Heise, and Noah Kwicklis, “Will New Steel Tariffs Protect U.S. Jobs?,” Federal Reserve Bank of New York Liberty Street Economics (blog), April 19, 2018, http://libertystreeteconomics.newyorkfed.org/2018/04/will-new-steel-tariffs-protect-us-jobs.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics