In a previous post, we argued that double liability for bank owners might not limit their risk taking, despite the extra “skin in the game,” if it also weakens depositor discipline of banks. This post, drawing on our recent working paper, looks at the interplay of those opposing forces in the late 1920s when bank liability differed across states. We find that double liability may have reduced the outflow of deposits during the crisis, but wasn’t successful in mitigating bank risk during the boom.

The Opposing Effects of Double Liability

Under double liability, shareholders of failing banks lost their initial investment and had to pay up to the face value of their shares toward depositors’ losses. Advocates for stricter liability argued that forcing bank owners to have more skin in the game would curb their incentive for excessive risk taking. While that direct force is possible, there is also an opposing force since doubling liability essentially gives depositors less skin in the game by providing additional protection in the event of a bank failure. Much like deposit insurance, double liability reduces depositors’ incentive to monitor the risk their bank is taking and to run—withdraw their money—at the arrival of negative news. That opposing force of weakened depositor discipline would tend to encourage risk taking by bank owners. In the model presented in our paper, we show that the net effect of those two forces—owners with more at stake but depositors with less at stake—is unclear: Doubling owners’ liability could reduce bank risk, increase it, or have no net effect. It is, as they say, an empirical question.

Evidence from New Jersey and New York

To investigate, our paper compares bank risk and deposit behavior at banks in New Jersey facing similar regulatory regimes but different liability rules. Around the time of the Great Depression, nationally chartered banks and state chartered banks that were also members of the Federal Reserve (member banks) faced the same reserve requirements, capital regulations, and business restrictions to comply with rules of the Federal Reserve System. However, national banks then operated under double liability, while state banks in New Jersey operated under single liability.

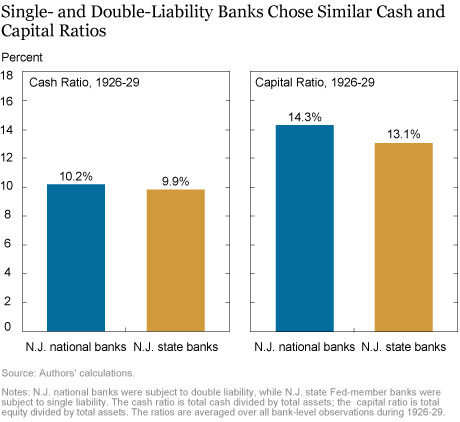

We begin by comparing liquidity (cash-to-assets) and capital (capital-to-assets) ratios at the two sets of banks. The first measures banks’ ability to meet depositor withdrawals and the second measures banks’ capacity to absorb losses. Bank owners choose both ratios, subject to regulatory and supervisory constraints, in accordance with their risk appetites; if double-liability requirements were curbing risk appetites, we would expect higher ratios at the national banks.

The mean of each ratio over 1926-29 for double- and single-liability banks is plotted below. The two measures are quite similar for the two types of banks (in other words, the differences are not “statistically significant”; see our paper for formal statistical analysis). Since insolvency risk decreases when these buffers increase, this finding suggests that double liability did not curb risk taking during the boom before the Great Depression.

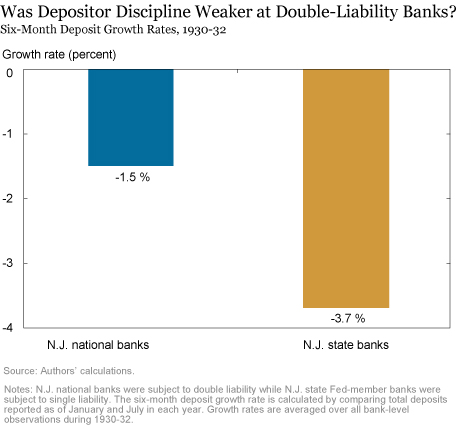

We next examine changes in deposits. By comparing the amount of total deposits reported every January and July, we calculate the six-month deposit outflows for each bank. We then compare deposit outflows at the two sets of banks during the Great Depression (between 1930 and 1932) to determine whether double-liability banks faced weaker discipline via depositor outflows during this period of rampant bank runs. This was indeed the case, as shown below where we plot the average deposit outflows during 1930-32; while both types of banks experienced outflows, the double-liability (national) banks on average lost “only” about 1.5 percent of their deposits every six months, less than half the 3.7 percent loss rate at single-liability banks (state fed-member banks) The finding is in line with our argument that double-liability banks faced weaker depositor discipline (that is, more modest bank runs), an outcome that weakened the effect of double liability on their own risk taking.

Confounding Differences?

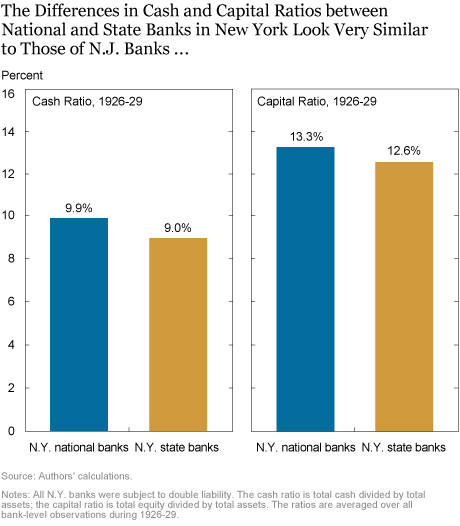

The two groups compared above—N.J. national banks and N.J. state Fed-member banks—differed in other ways (apart from liability) that might account for the differences we’ve noted. Though they faced similar regulations, they were supervised by different agencies (the Office of the Comptroller of the Currency for the former and the Federal Reserve Bank of New York for the latter). More fundamentally, charter choice is endogenous, meaning bankers that choose one charter over the other might have inherently different risk appetites that complicate the effect of liability structure.

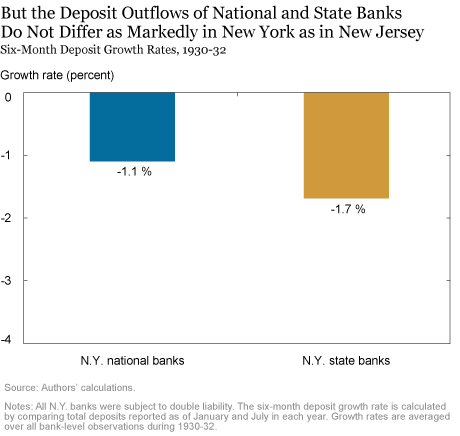

To rule out those complicating factors, we repeat the comparisons above, but use national and state member banks in New York State as our sample. Because state chartered banks in New York were also subject to double liability, this comparison isolates the effect of differences in supervision or charter types. As shown below, we do not see any significant differences for both risk measures and deposit outflows, a finding that suggests that our earlier result of differential outflows is not driven by charter differences. (See our working paper for the formal analysis exploiting the “difference-in-difference” between N.J. and N.Y. banks.)

Lessons Then and Now

The conventional wisdom argues that double liability was largely successful at curbing bank risk. However, our findings here and in our staff report suggest that the banking system remained fragile because of a knock-on effect from double liability that may have been overlooked—that is, requiring shareholders to have more skin in the game provides depositors with downside protection. Thus, doubling liability changed the incentives of both shareholders and depositors, with the result that banks may respond by reducing or increasing bank risk.

Our findings from the Great Depression also bear on current policy discussions. Following the recent financial crisis, regulators introduced various measures, including bail-in-able debt, CoCo bonds, and clawback provisions, that shift losses from some creditors to shareholders. While such policies may reduce shareholder moral hazard, our findings suggest that they may also weaken creditor incentives to monitor and discipline bank risk taking.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Haelim Anderson is a research economist in the U.S. Treasury Department’s Office of Financial Research.

Daniel Barth is a research economist in the U.S. Treasury Department’s Office of Financial Research.

Dong Beom Choi is a financial economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Dong Beom Choi is a financial economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this blog post:

Haelim Anderson, Daniel Barth, and Dong Beom Choi, “‘Skin in the Game,’ Depositor Discipline, and Bank Risk Taking,” Federal Reserve Bank of New York Liberty Street Economics (blog), November 19, 2018, http://libertystreeteconomics.newyorkfed.org/2018/11/skin-in-the-game-depositor-discipline-and-bank-risk-taking.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Response to Dan Bennett: Thank you very much for your comment. Unfortunately we are not aware of other research on your hypothesis. This paper (https://koudijs.people.stanford.edu/sites/g/files/sbiybj3556/f/koudijssalisbury_nebanking.pdf) might be remotely related although they find that “richer” bankers became more risk averse. Response to Joe Sommer: Thank you very much for your comment. We agree with your point that the monitoring incentives of bail-in debt holders should be stronger. In that sentence, we were referring to the monitoring incentives of creditors that are senior to the bail-in debt. As the bail-in debt provides additional buffers, the senior creditors might monitor less.

I can’t see the parallel between double liability and bail-in debt. Double liability is, in essence, a bond stapled to a share of stock. The holder of a double liability bond faces both upside from the stock and downside in a bond. In contrast, a holder of bail-in debt is a pure creditor, only facing downside. It’s monitoring incentives are unmixed. What you’re doing with bail-in debt is concentrating the downside risk onto a smaller number of risk-bearers. This, if anything, should improve monitoring, as it reduces the appropriability problem of public debt monitoring.

In the double liability system was there any research conducted on the shareholders ability to actually facilitate the required deposit should it be necessary? For instance, if the stockholder was wealthy and possessed excess cash when required to make an additional deposit they then would be more risk-tolerant and willing to take a chance on sub-prime loan. Where some investors that were playing the investment close with little cash reserves would be more risk-adverse. Dan Bennett KE2CJ@aol.com