Editor’s note: When this post was first published, the placement of the shaded confidence intervals in the charts was incorrect; the charts have been corrected. (December 3, 2018, 3:20 p.m.)

We had previously documented large excess returns on equities ahead of scheduled announcements of the Federal Open Market Committee (FOMC)—the Federal Reserve’s monetary policy-making body—between 1994 and 2011. This post updates our original analysis with more recent data. We find evidence of continued large excess returns during FOMC meetings, but only for those featuring a press conference by the Chair of the FOMC.

Prior Findings

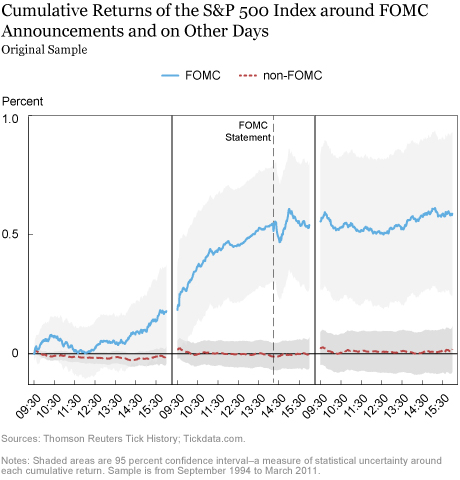

Our New York Fed staff report and past Liberty Street Economics post found that U.S. and international equity markets have seen large and statistically significant excess returns in the twenty-four hours prior to scheduled FOMC announcements. The chart below illustrates this result in our original sample that starts in 1994, when the Federal Reserve began announcing its target for the federal funds rate, and ends in March 2011, which is the last meeting before the Chair of the FOMC began holding press conferences.

As shown by the blue line, equities on average appreciated in the afternoon of the day before, and then more sharply on the morning of FOMC announcement days. Following the 2:15 p.m. announcement (denoted by the vertical line; all times are Eastern time), equity prices may have fluctuated depending on the content of the announcement, but on balance they ended the day at about their pre-announcement level, almost 50 basis points higher than when the market opened on the day prior. Interestingly, we found no similar pre-announcement returns for monetary-policy sensitive assets, such as Treasury securities, but found similar pre-FOMC announcement drifts for equities in many other developed countries.

A Puzzle

A central tenet of financial economic theory is that excess returns on financial assets are earned as compensation for risk. Absence of risk would otherwise lead to increased investor demand for those assets, pushing up their prices and eliminating any positive (riskless) return. Since FOMC announcements provide investors with information about monetary policy or the macro-economy, investors should require compensation for holding financial assets right before the announcements. Risky assets, such as equities, should trade at a discount ahead of the announcements and, on average, increase in value as uncertainty is resolved when the announcements are made. Empirically, however, equity returns were earned ahead of, rather than at, the announcements.

What could explain these puzzling pre-announcement returns? In our staff report we showed that while equities on average appreciate ahead of the announcements, these pre-announcement returns are unrelated to the direction of the actual return when the announcement is made. That is, while equities may over- or under-perform in response to the FOMC announcement, returns prior to the announcement do not contain information about what is about to be announced. The absence of pre-announcement returns in the Treasury market also suggests that no material information is revealed ahead of the announcement. Indeed, the hours and days before an FOMC meeting fall into the FOMC “blackout period,” a time when policymakers and Fed staff refrain from expressing their views in public.

One could posit that investors reallocate their attention to monetary policy as a policy announcement approaches. For example, investors may finely tune their views about monetary policy only before a policy announcement when other investors are expected to do so as well (for example because of rational or irrational attention theories). This could be because pricing monetary policy information for equities is a complex task that requires assessing both a cash flow, a discount rate effect (see for example, Law, Song, and Yaron), and then using prices to infer what other investors expect the Fed to do.

Finally, one could posit that this “catch-up” process creates news and risk to investors and thus a positive return ahead of the FOMC announcement. But even under such a risk-based explanation, why would investors not require a larger premium at the time of the 2:15 p.m. announcement when a much more significant flow of news is released?

More Recent Evidence

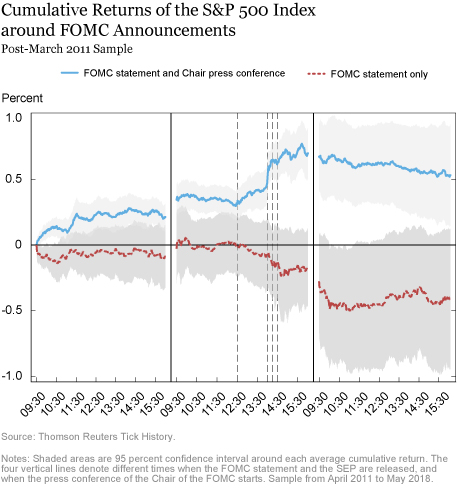

The chart below updates our original analysis through the period starting in April 2011 and ending in June 2018. Since April 2011, the Chair of the FOMC has been giving a press conference at every other FOMC meeting. At these meetings the FOMC also releases the summary of its members’ economic projections (SEP), so that three forms of communication take place: the FOMC statement, the SEP, and the press conference with the Chair.

In 2011 and 2012, FOMC statements (including the SEP) that were scheduled with a press conference were released at 12:30 p.m., and the press conference started at 2:15 p.m. FOMC statements without a press conference (and hence without SEP) were released at 2:15 p.m. as in the pre-2011 sample. Starting in 2013, FOMC statements are always released at 2:00 p.m., while press conferences start at 2:30 p.m. (and SEP material is released at the start of the conference). The chart below shows four vertical lines that mark each of these times.

As shown in the chart above there are two distinctive patterns to equity returns on days with an FOMC announcement in the more recent sample (note that these results are consistent with findings in Boguth et al). On days without a press conference, there is no longer any evidence of excess returns ahead of the release of the FOMC statement. While we see negative returns following the release of the statement, this effect is not statistically significant, as the gray shaded area encompasses the zero line. Instead we see large returns ahead of announcements for meetings with press conferences. Interestingly, these returns accrue a bit earlier than in the pre-2011 sample, and more specifically, in the morning of the day before the announcement.

In addition, there is some further appreciation at, and after, the announcement(s). On net, the pre-FOMC announcement drift on press conference days is about 40 basis points when computed from the open of the day before to about lunchtime of the day of the announcement day—in line with the pre-FOMC drift in the original sample. One can also see an additional 30 basis points return by the end of the press conference, which could reflect news released either in the statement, press conference, or SEP, or a risk premium as predicted by financial theory (see, for example, Ai and Bansal or Wachter and Zhu). What remains puzzling in the post-2011 period is the pre-FOMC announcement drift.

In addition to the timing of the return, we are now also confronted with the fact that the pre-announcement returns are only present at meetings with press conferences. Since the SEP are only released at meetings with press conferences and policy rate changes have only taken place at these meetings since 2011, some investors have reportedly discounted the amount of information that could be released at meetings without press conference. Consistent with the attention reallocation hypothesis, this may have reduced the amount of re-pricing ahead of the meetings absent press conferences.

But an attention reallocation hypothesis still begs the question as to why some sophisticated investors would not attempt to profit from the positive returns. In fact, the timing of the post-2011 returns suggests that such activities may have occurred. Pre-FOMC returns were positive in the post-2011 sample on press conference days from the open of the day before the FOMC, while cumulative returns were positive starting only in the afternoon of the day before the announcement in the pre-2011 sample. This suggests that some investors could be attempting to profit from the pre-FOMC returns, pushing prices up earlier than before. If this were the reason for the shift in the timing of the returns, such a process would imply that the pre-FOMC returns should eventually disappear.

As announced in June, starting next year all FOMC meetings will include a press conference. It remains to be seen if the pre-FOMC announcement drift is to again become a more regular phenomenon or the extent to which any future arbitrage activity could make the pre-FOMC drift disappear.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

David O. Lucca is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

David O. Lucca is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Emanuel Moench is the head of research of Deutsche Bundesbank in Frankfurt.

How to cite this blog post:

David O. Lucca and Emanuel Moench, “The Pre-FOMC Announcement Drift: More Recent Evidence,” Federal Reserve Bank of New York Liberty Street Economics (blog), November 26, 2018, http://libertystreeteconomics.newyorkfed.org/2018/11/the-pre-fomc-announcement-drift-more-recent-evidence.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics