Since the financial crisis, banking regulators around the world have been intensely aware of liquidity risk and, in part as a response, have introduced the Basel III liquidity regulation. Today, the world’s largest banks hold substantial liquidity buffers comprising both securities and central bank reserves, to satisfy internal liquidity stress tests and minimum quantitative regulatory requirements. The appropriate level of liquidity buffers depends on the likely outflows in a market stress situation. In this post, we use public data to provide a rough estimate of stressed outflows that the largest banks would face and consider how they could meet these outflows.

Liquidity Buffers and Monetization

Banks hold liquidity buffers to meet unexpected outflows, such as outflows of deposits during times of stress. The size and composition of those liquidity buffers depend on a number of considerations, such as a bank’s internal liquidity stress tests and the need to satisfy liquidity regulation, including the liquidity coverage ratio (LCR). The LCR requires banks to hold sufficient high-quality liquid assets (HQLA) to meet net cash outflows over a thirty-day stress period. In the United States, HQLA include reserve balances held in a Federal Reserve account and Treasury securities, as well as some other assets.

For the financial system to fully reap the benefit of high liquidity buffers, it is essential that banks hold enough reserves in their Fed account or be able to “monetize” the securities in their buffers. By monetize, we mean that banks would have the ability to turn these assets quickly into cash, for example, by engaging in a repurchase agreement (repo) or by selling the assets.

While assets are considered HQLA in part because they should be reasonably easy to monetize at any time of the day, rapidly turning very large quantities of assets—even Treasury securities—into cash could be challenging. One problem is operational, as it might be difficult to find counterparties willing to purchase or repo unusually large quantities of assets on the same day an outflow occurs. Another issue is that potential counterparties may perceive an attempt to monetize a large quantity of assets as a signal of stress and, in response, hold on to their cash in case they need it later. Or they might bargain aggressively if they believe that the bank is desperate to sell, causing banks to accept extremely low prices. In turn, these fire-sale prices could spill over to the broader financial system by causing related security prices to crash as well.

An alternative to monetizing securities is for banks to hold reserves in their central bank accounts. Reserves don’t need to be turned into cash, since they are cash, and are readily available to meet sudden outflows. Moreover, they are not constrained by the closing time of securities settlement systems.

Stressed Outflows

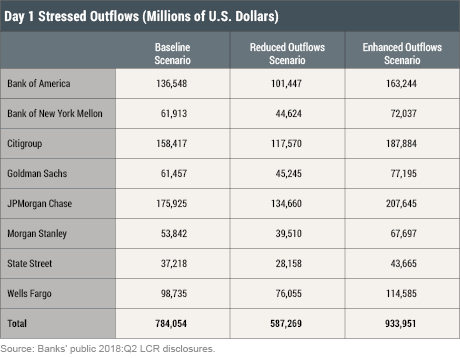

To get a sense of the potential size of bank outflows in a stress event, we examined publicly disclosed LCR data for the largest domestic banks available on their websites. We considered the very largest institutions—the eight domestic banks that are currently in the Large Institution Supervision Coordinating Committee’s (LISCC) portfolio. Based on some assumptions, we then compute the net outflows of these banks for a period of one business day.

We considered a one-day horizon because this is the timeframe over which it might be most difficult to liquidate large amounts of Treasury securities under a stress scenario. Broadly, in our scenario analysis, an exogenous shock spurs an acute market-wide stress and causes liquidity shortages at one bank. The liquidity concerns motivate a run on the bank and liquidity hoarding by its customers who draw down their lines of credit. We assume that, in spite of its liquidity shortfall, the bank will honor these customer requests for credit but, in so doing, it does not have recourse to external funding sources (for example, capital markets).

The data from the banks’ websites show the cumulative thirty-day net outflow but not the contractual maturity of the liabilities. So, to estimate a “day 1” net outflow, we make certain assumptions. For sophisticated creditors, we assume a majority of the projected outflow would occur on the first day of the stress event. For retail depositors and operational accounts, we assume that only a moderate amount is withdrawn on the first day. More details about our methodology for calculating “day 1” outflows can be found here. The table below provides our estimates of day 1 stressed outflows. In addition to the baseline scenario, which we consider to be the most realistic, the table provides outflows under both a more benign and a more acute scenario.

Implications for the Supply of Reserves

Our methodology suggests aggregate potential outflow from domestic LISCC banks in the hundred billions of dollars in any of the three scenarios. Liquidating securities to meet such large outflows would likely be very difficult and could have severe negative consequences for the bank attempting to do it.

As noted in a 2009 article in our Current Issues in Economics and Finance series by two of our former colleagues, the amount of reserves available to the banking sector is a choice of the Fed. Banks can redistribute reserves among themselves, but they have very limited ability to change the total amount of reserves in the system. Thus, only the Fed can ensure that the supply of reserves is sufficient for banks to meet their day 1 outflows. Today, the supply of reserves is approximately $1.8 trillion, more than enough to meet banks’ needs. But before the crisis of 2007-08, the total amount of reserves in the U.S. banking system was quite small, for example, under $50 billion in 2006.

The Policy Normalization Principles and Plans indicate that the Federal Open Market Committee “anticipates reducing the quantity of reserve balances, over time, to a level appreciably below that seen in recent years but larger than before the financial crisis.” How much larger should the supply of reserves be, compared to the pre-crisis level? Our analysis suggests that the amount of reserves needed to meet the largest banks’ net outflows when stressed could be large.

Since our stress scenario applies to one bank, why do we consider the sum of the outflows of all the banks, rather than the largest outflow among banks? Even though all institutions may not experience outflows at the same time, it is important that each bank hold an amount of reserves needed to meet its own stressed outflows. This is because banks would likely not be able to rely on the interbank market to obtain more reserves from other banks, if they are experiencing stress. Indeed, during times of stress, money markets often do not operate smoothly, as institutions have incentives to hoard liquidity.

To Sum Up

Our analysis highlights the trade-off between reserve supply and monetization risk. Low levels of reserves imply a high reliance on banks’ ability to monetize securities in a systemic event, whereas higher levels of reserves could reduce the banking system’s need to monetize securities in a stress event. Having a high supply of reserves, as has been the case since the crisis, may have important financial stability benefits that should not be overlooked.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Ryan Bush is a manager in the Federal Reserve Bank of New York’s Markets Group.

Ryan Bush is a manager in the Federal Reserve Bank of New York’s Markets Group.

Adam Kirk is a senior analyst in the Bank’s Supervision Group.

Adam Kirk is a senior analyst in the Bank’s Supervision Group.

Antoine Martin is a senior vice president in the Bank’s Research and Statistics Group.

Philip Weed is a senior analyst in the Bank’s Supervision Group.

Philip Weed is a senior analyst in the Bank’s Supervision Group.

Patricia Zobel is a vice president in the Bank’s Markets Group.

Patricia Zobel is a vice president in the Bank’s Markets Group.

How to cite this blog post:

Ryan Bush, Adam Kirk, Antoine Martin, Philip Weed, and Patricia Zobel, “Stressed Outflows and the Supply of Central Bank Reserves,” Federal Reserve Bank of New York Liberty Street Economics (blog), February 20, 2019, https://libertystreeteconomics.newyorkfed.org/2019/02/stressed-outflows-and-the-supply-of-central-bank-reserves.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

A good brief analysis and as skeptic of the Financial MKTS and Banks and a Bear on the MKTS, I agree with your analysis, especially the retail investor/depositor, will be the last to panic and withdraw large sums, for they do not understand the Money MKTS and Liquidity.