In September 2016, the Bank of Japan (BoJ) changed its policy framework to target the yield on ten-year government bonds at “around zero percent,” close to the prevailing rate at the time. The new framework was announced as a modification of the Bank’s earlier policy of rapid monetary base expansion via large-scale asset purchases—a policy that market participants increasingly regarded as unsustainable. While the BoJ announced that the rapid pace of government bond purchases would not change, it turned out that the yield target approach allowed for a dramatic scaling back in purchases. In Japan’s case, the commitment to purchase whatever was needed to keep the ten-year rate near zero has meant that very little in the way of asset purchases have been required.

Easy Monetary Policy but Stubbornly Low Inflation

Inflation began falling in Japan after the collapse of the so-called “Bubble Economy” in the early 1990s. By 1994, core inflation (a measure that excludes fresh food and energy prices) was running below 1 percent. The BoJ responded with aggressive rate cuts. By 1995, its main policy rate had been slashed to 0.5 percent, a then-unheard-of level. In late 1999, the policy rate was pushed down to zero, but outright deflation had already set in, with the core consumer price index falling by almost 1 percent annually from 1999 to 2002.

A central bank’s ability to moderate the business cycle depends on controlling the real rate of interest—that is, the nominal rate adjusted for inflation. If inflation is stuck at too low a level, even a policy rate of zero may not be enough to revive the economy. As a consequence, pushing inflation into positive territory is important because it provides room for countercyclical monetary policy.

In March 2001, the BoJ stepped up its fight against deflation by adopting a program of quantitative easing. Under the new policy, the Bank stepped up its purchases of Japanese government bonds (JGBs) and other assets in order to expand the monetary base, which consists of banks’ reserve balances plus currency in circulation. (Since central banks purchase assets by crediting banks’ reserve accounts, an expansion of the monetary base follows automatically.) Compared with what other central banks would undertake in the wake of the global financial crisis, the BoJ’s asset-purchase program was fairly small.

By March 2006, when the program was halted, the BoJ’s asset holdings had increased from ¥110 trillion to more than ¥150 trillion (equivalent to about 30 percent of Japanese GDP at the time). While the BoJ’s policy board stated that inflation was now “consolidating a positive trend,” core inflation stood at -0.6 percent, and even the BoJ’s then-preferred measure of inflation (excluding only fresh food) was just 0.1 percent. A series of smaller quantitative easing measures were implemented from 2010 through early 2013.

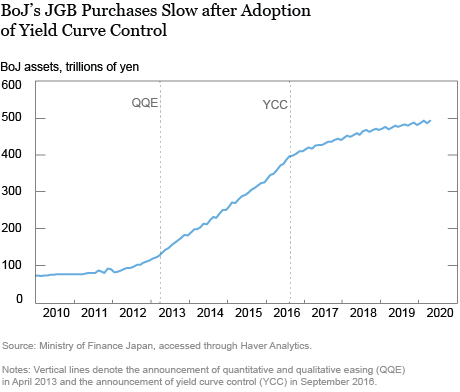

In April 2013, the BoJ adopted a “shock and awe” strategy called Quantitative and Qualitative Easing (QQE). The new policy had several elements: first, a commitment to massive asset purchases, largely of JGBs, that would increase the monetary base by ¥60-70 trillion per year; second, a commitment to lengthen the maturity of its JGB holdings, in an explicit attempt to lower long-term rates and flatten the yield curve; finally, a pledge to stick with the new policy until inflation was firmly at or above the BoJ’s 2 percent target. A little over a year later, the asset purchase commitment was raised to ¥80 trillion.

The BoJ’s balance sheet grew rapidly. Holdings of JGBs rose from ¥140 trillion in April 2013 to ¥380 trillion by August 2016. The monetary base rose by a similar amount. The scale of this monetary expansion is hard to overstate. By August 2018, the monetary base stood at roughly 90 percent of GDP, three times the initial ratio. Asset purchase programs in the United States and the euro area, themselves unprecedented, never pushed the monetary base as high as 30 percent of GDP.

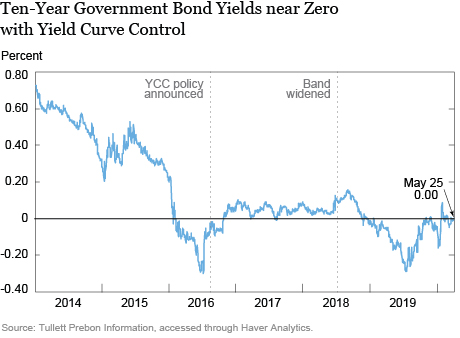

There were early signs that QQE was working in Japan. Yields on ten-year government bonds fell significantly, from about 0.75 percent prior to the program to about 0.25 percent by late 2015. Unemployment fell steadily, signaling that the economy was growing above its potential pace. Core inflation rose from -0.6 percent when the policy was adopted to 1.2 percent by late 2015.

But the good news did not last. Core inflation fell back to just 0.5 percent by mid-2016. Market measures of long-term inflation expectations also declined. Moreover, the BoJ now held almost 40 percent of the JGB market. With this share steadily rising, dealer surveys pointed to a deterioration in JGB market functioning. Finally, the ten-year yield on JGBs fell into clear negative territory in early 2016, soon after the BoJ cut its main policy rate (the deposit rate on marginal excess reserves) from 0.1 percent to -0.1 percent. Many market analysts worried that long-term rates might stay well below zero for some time, compressing lending margins and undermining the financial strength of banks and insurance companies.

A New Framework

In September 2016, the BoJ introduced a framework it labeled Quantitative and Qualitative Easing with Yield Curve Control (QQE with YCC). The BoJ reaffirmed that the rapid pace of asset purchases would continue until inflation had moved above its 2 percent target “in a stable manner.” But now, the BoJ would also set a target for ten-year JGB yields of “around zero percent,” near the prevailing rate at the time. While it was not part of the announcement, markets soon inferred that this involved a fluctuation band of ±10 basis points.

The effects of YCC were quickly evident in financial markets. As seen in the chart below, ten-year JGB yields settled close to the target and remained remarkably stable over the next two years. Yield volatility, already much lower than in the U.S. or German markets, declined even further, with the standard deviation of monthly changes falling by about half relative to the QQE period. Volatility did pick up after the BoJ widened the ten-year yield fluctuation band to ±20 basis points in July 2018, but remained low relative to the volatility seen in Japan during the QQE period and contemporaneously in other countries.

BoJ Credibility Allowed for a Substantial Reduction in JGB Purchases

Yield curve stability has come with a marked decline in the pace of BoJ asset purchases, despite the Bank’s statements that it was leaving its earlier purchase target unchanged. As seen below, the Bank’s JGB holdings have risen by just ¥100 trillion in the nearly four years since YCC was introduced, and by roughly ¥20 trillion over the past twelve months. In essence, maintaining the rate target has become delinked from the pace of balance sheet expansion. Consistent with the reduced pace of BoJ purchases, dealer surveys of JGB market functioning have turned notably less negative.

The reduced pace of asset purchases reflects the credibility of the BoJ’s commitment to the ten-year yield target. After all, the Bank has essentially unlimited buying power, and can thus always purchase the quantity of JGBs needed to keep yields near zero.

Success?

Has YCC been a success? Seemingly not on the inflation front, at least thus far. Core inflation has been running near 0.5 percent in recent months, barely higher than when the policy was adopted. The challenge for the BoJ is that expectations for persistently low inflation are entrenched. Banks were awash with liquidity when YCC started and long-term yields were already near zero. If monetary stimulus alone had the power to push Japanese inflation up to 2 percent, it likely would have happened already under QQE. Of course, we don’t know what inflation would have been without YCC. It should also be noted that the unemployment rate before the COVID-19 outbreak was near historic lows, so there was the possibility that continued labor market tightness would have eventually pushed inflation higher.

Any central bank considering a move to implement its own version of YCC —as the Reserve Bank of Australia did recently—has many questions to ponder. What rate is targeted? How much should rates be allowed to vary around the target? What guidance should be offered about the conditions under which the target rate and range might change? And, ultimately, does YCC help a central bank achieve its policy goals?

For Japan, the jury is still out on this last question. Still, YCC has had one clear benefit. Under the new policy, the BoJ has been able to exert fairly close control over the term structure of interest rates without resorting to large-scale interventions in the JGB market. Investors accept that the Bank can buy whatever quantity of JGBs is needed to keep yields from rising and, as a result, it has not had to buy many at all.

Matthew Higgins is a vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Thomas Klitgaard is a vice president in the Bank’s Research and Statistics Group.

How to cite this post:

Matthew Higgins and Thomas Klitgaard, “Japan’s Experience with Yield Curve Control,” Federal Reserve Bank of New York Liberty Street Economics, June 22, 2020, https://libertystreeteconomics.newyorkfed.org/2020/06/japans-experience-with-yield-curve-control.html.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Julia: The role of the portfolio balance channel is a complicated debate in monetary theory, and our blog post was an effort to add some context by reviewing Japan’s experience with YCC. As we noted, it is not clear how effective YCC will be, relative to asset purchases, in allowing the BoJ to reach its inflation target. In addition, one could argue that Japan’s experience does not help settle the portfolio balance debate since YCC followed purchases on a scale not undertaken by other major central banks.

This is a curious conclusion: “Still, YCC has had one clear benefit. Under the new policy, the BoJ has been able to exert fairly close control over the term structure of interest rates without resorting to large-scale interventions in the JGB market.” Do you assume that that the portfolio balance channel is irrelevant? That there is no role for quantity, only price?