In yesterday’s post, we studied the expected debt relief from the CARES Act on mortgagors and student debt borrowers. We now turn our attention to the 63 percent of American borrowers who do not have a mortgage or student loan. These borrowers will not directly benefit from the loan forbearance provisions of the CARES Act, although they may be able to receive some types of leniency that many lenders have voluntarily provided. We ask who these borrowers are, by age, geography, race and income, and how does their financial health compare with other borrowers.

Who is Without Mortgage and Student Debt?

To understand the distribution of borrowers who will be ineligible for the debt relief provisions of the CARES Act, we draw on the New York Fed’s Consumer Credit Panel—a nationally representative sample of Equifax credit report data. Our data set for this post includes a representative 1 percent sample of the nation’s adults with credit records in anonymized form.

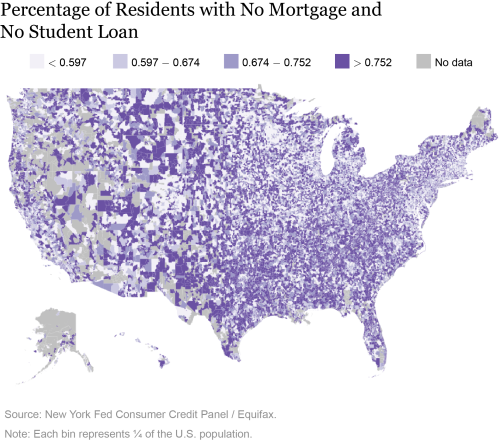

The map below shows the (adult) population-weighted geographic (zip code) distribution of the share of the population with neither mortgages nor student debt. Each bin represents 1/4 of the U.S. adult population, so one quarter of adults live in zip codes where less than 60 percent have a student loan or mortgage, while another quarter lives in zip codes in which more than 75 percent have neither type of debt. The darkest-colored bin, where more than 75 percent of people are borrowers with neither a student loan nor mortgage, dominates by land area: 40 percent of all zip codes fall in the top quartile, indicating that these zip codes are less populated than those with higher rates of mortgage and student debt. Spatially, the borrowers without mortgages and student debt largely live in rural areas and they constitute a higher share of the borrowers in rural areas: 74 percent of Americans living in rural areas are in this category, versus 68 percent of people living in MSAs (urban areas).

Borrowers with neither mortgages nor student debt skew older than those who have either form of debt more generally. These older borrowers have either paid off their mortgages or never owned a home to begin with. Also they are less likely to have originated a student loan when they were younger. The median age of these borrowers is 56, while the median age of mortgage holders is 51 and that of student debt borrowers is 34. Although the median age of borrowers without any mortgage and student debt, and the median age of mortgage holders are not very different, the age distributions are different.

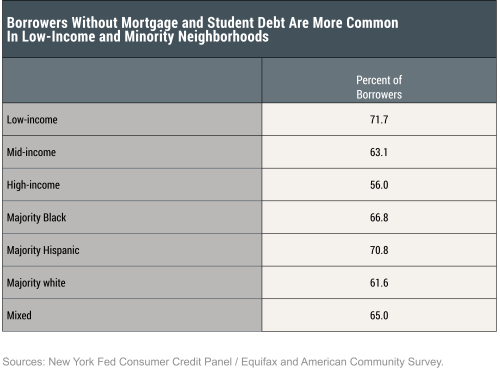

Partitioning zip codes by income (low-income, mid-income, high-income) and by race (majority-Black, majority-Hispanic, majority-white and mixed) as defined in our previous post, we investigate where these borrowers are concentrated (See the table below). First, distinguishing neighborhoods by income, we find that these borrowers are more concentrated in low-income neighborhoods: 72 percent of the borrowers in low-income neighborhoods have neither mortgage nor student debt whereas in mid-income and high-income neighborhoods these numbers are, respectively, 63 percent and 56 percent.

Distinguishing neighborhoods by race, we find that these borrowers are more concentrated in majority Hispanic and majority Black neighborhoods with 71 percent of borrowers in majority-Hispanic neighborhoods and 67 percent of borrowers in the majority Black neighborhoods. This compares to 62 percent in majority white neighborhoods. This analysis reveals that a large share of borrowers in low income, majority Hispanic, and majority Black neighborhoods will not receive direct relief from the debt moratorium provisions of the CARES Act.

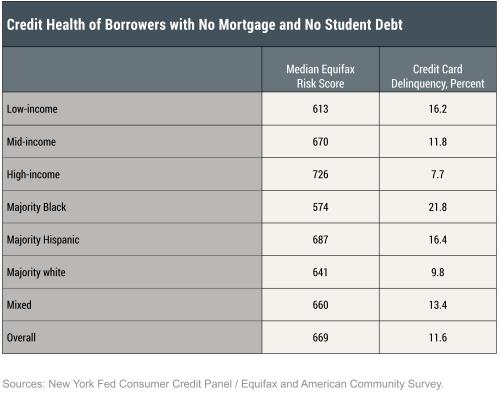

Borrowers who carry loans other than mortgages or student debt have lower credit scores (as captured by Equifax risk scores) than other borrowers, as we see in the table below. The median Equifax risk score for this group is 669 while the median risk score of all individuals with any debt is 700. To further understand the state of financial health of this group of borrowers, below we present the proportions of borrowers in this category who are delinquent on credit card payments by at least 90 days or in collection, conditional on having credit card debt. We find that 11.6 percent of this group of borrowers are more than 90 days delinquent on their credit card debt (last row). This compares with an overall delinquency rate, of 9.9 percent in our sample for credit card debt.

We find that older borrowers with loans other than mortgages and student debt are in better financial health than working-age borrowers. This reflects the fact that older people have often paid off their mortgages and student debt, while younger people without mortgages or student loans often had never owned a home. Regardless, these borrowers will not receive debt relief under the CARES Act forbearance provisions, although they can receive relief from its other provisions, such as direct stimulus checks.

Differentiating by neighborhood income, borrowers without any mortgage or student debt who live in low-income neighborhoods are considerably more likely to be in financial distress than those from high- or mid-income neighborhoods—as captured by both risk score and credit card delinquency. Differentiating by race, we find that borrowers without mortgage and student debt from Black neighborhoods are in markedly worse financial health than those coming from other neighborhoods. The risk score of these borrowers who reside in Black neighborhoods is 574 and their credit card delinquency and collection rate is at 21.8 percent. These contrast with delinquency rates of 16.4 percent and 9.8 percent for the group residing in majority Hispanic and majority white neighborhoods, respectively.

In this post, we have focused on borrowers who carry debt other than mortgages and student loans, and therefore, will not directly benefit from the debt payment moratorium provisions under the CARES Act. We find that these borrowers are likely to be older than those holding mortgage and student debt, and more likely to be concentrated in low income, majority Black and majority Hispanic neighborhoods. They are more likely to be in financial distress than other borrowers, as captured by credit card delinquency rates. Further, as revolving debts are important for smoothing gaps in income, borrowers with already-delinquent credit card accounts are unlikely to be able to lean on these accounts to smooth consumption. Given this, relief from other parts of the Act, such as unemployment insurance and stimulus checks, will therefore be particularly important in mitigating the crisis’ impact on the financial health of these borrowers.

Rajashri Chakrabarti is a senior economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Andrew F. Haughwout is a senior vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Donghoon Lee is an officer in the Bank’s Research and Statistics Group.

Joelle Scally is a senior data strategist in the Bank’s Research and Statistics Group.

Wilbert van der Klaauw is a senior vice president in the Bank’s Research and Statistics Group.

How to cite this post:

Rajashri Chakrabarti, Andrew Haughwout, Donghoon Lee, William Nober, Joelle Scally, and Wilbert van der Klaauw. “Debt Relief and the CARES Act: Which Borrowers Face the Most Financial Strain?” August 19, 2020, https://libertystreeteconomics.newyorkfed.org/2020/08/debt-relief-and-the-cares-act-which-borrowers-face-the-most-financial-strain.html.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics