Today, the majority of retail payments in the United States are digital. Practically all digital payments are tracked, collected, and aggregated by financial institutions, payment providers, and vendors. This trend has accelerated during the COVID-19 pandemic as payments that require physical contact, such as cash, have been discouraged. As cash gradually becomes obsolete, consumers are left with fewer alternatives for making private transactions. In this post, we outline some evidence on the impact of COVID-19 on consumer payment behavior and follow up in the second post in this Liberty Street Economics series with a look at the implications of cash obsolescence for privacy.

Why Cash Was King

Cash is unique as a means of payment by virtue of being a physical object that itself conveys value. This means that it can be exchanged anonymously without the need to retain any memory of the history of transactions. Therefore, cash transactions between any two parties can occur without requiring them to know each other’s identities, or even pseudoidentities.

The physical nature of cash becomes problematic during the outbreak of a highly contagious virus. Viruses can live on surfaces and people, rightly or wrongly, may perceive that there is a risk to handling cash. If done incorrectly, attempts to sterilize cash may backfire, and correct methods are likely impractical for individuals or small businesses.

The Acceleration of Digital Payments during COVID-19

How popular is cash as a means of payment? As cash is inherently difficult to track, most of what we know about its use comes from surveys. The Federal Reserve Bank of San Francisco’s Diary of Consumer Payment Choice provides an annual report of consumers’ payment behavior based on a demographically representative sample. In the 2019 report, cash was listed as the second most commonly used payment tool after debit cards, being used predominantly for small-value purchases.

A drawback of surveys is that they do not provide real-time data. Fortunately, there are alternative data sources that can shed light on high-frequency trends in the utilization of various payment methods. In particular, using search frequency data from Google Trends, we can examine key words associated with various payment choices.

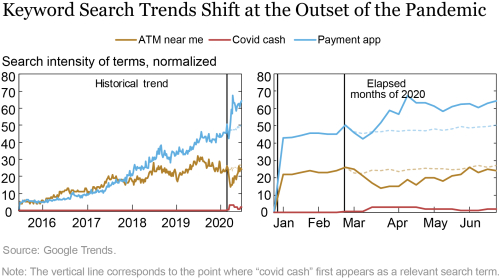

The following chart compares searches related to cash and digital payment options over two time frames. To measure cash-related searches, we exploit the fact that the primary method for obtaining cash is through ATMs. To measure searches related to digital payment options, we construct a composite score across several key mobile payment applications: Venmo, Cash App, and Zelle. Finally, to approximate the timing at which consumers became concerned with COVID-19 spread through cash, we use the search term “covid cash.”

The left panel shows the historical trend, and the right panel shows search results for the elapsed months of 2020. As expected, searches including “covid cash” first appear in the second week of February (represented by the black vertical line), but only jump significantly in the second week of March around the time that the United States breached the mark of 1,000 confirmed COVID-19 cases. The peak in searches for “covid cash” occurred at the end of March.

To estimate the impact of COVID-19 on search volumes, we examine what the search frequency might have been without the pandemic. We do so by extrapolating from the trend in the historical search volume. Historical search volume exhibits both persistence and seasonalities, driven by various factors, including weather and holidays. We use a statistical model to account for these dynamics and quarterly seasonalities. Based on the results of this model, we then forecast the search volume from the last week of February until the week of June 21.

Since our model does not include the effects of COVID-19, the difference between our forecasts and the actual data provide information on the effects of the pandemic. We find that, at the maximum difference, searches regarding payment apps were 42 percent higher, and searches with the keywords “ATM near me” were 42 percent lower, than projected using our model.

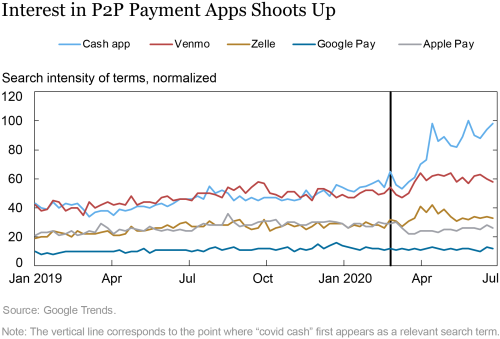

A closer look across different digital payment applications also reveals an interesting pattern. The chart below shows search intensity by various mobile payment applications. Search growth is driven by applications such as Cash App, Venmo, and Zelle, which offer a convenient P2P payment solution. In contrast, Google Pay and Apple Pay, which offer service for retail and in-device purchases, do not show a meaningful uptick. One possible explanation is that consumers may be seeking an alternative to cash to facilitate transactions in the informal economy.

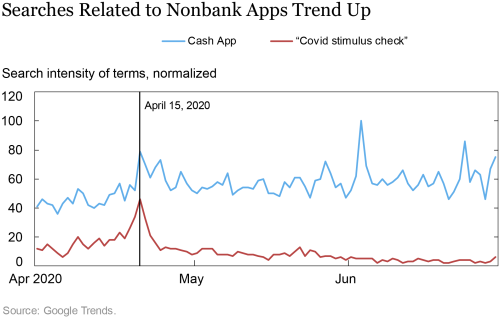

Policy responses to COVID-19 may also have induced consumers to open accounts provided by nontraditional payment providers. On April 15, initial coronavirus stimulus checks, mandated by the CARES Act, were automatically deposited to bank accounts of eligible tax filers in 2018 and 2019.

Evidence suggests that consumers may have sought nonbank payment apps for direct deposits. On April 15, we find a sharp spike in Cash App searches. On the same day, Cash App published a detailed guide for setting up a direct deposit in a Cash App account. The chart below illustrates the sharp spike in searches for the terms “Cash App” and “Covid stimulus check” on April 15.

One potential explanation is that consumers may have sought nonbank payment apps to receive stimulus checks outside the reach of relationship banks. While these checks were intended to provide direct short-term relief to households, it became apparent that banks and debt collectors could seize funds deposited into certain accounts. Alternatively, the uptick in search may reflect unbanked individuals seeking to remedy delays associated with the delivery of physical checks.

These events could ultimately lead to a further reduction in cash use for transactions. Once consumers familiarize themselves with Cash App and other payment apps, these options may become their preferred choice for both P2P and P2B transactions.

Summing Up

Our analysis of Google searches during the pandemic demonstrates a shift in public interest from cash-related terms to digital payment options. Given evidence that even transient shocks can have long-term effects on technological adoption, the need to address the issues associated with a reduction in privacy that follow from the shift toward digital payments is even more apparent, a subject of our forthcoming piece in this series.

Rod Garratt holds the Maxwell C. and Mary Pellish Chair in Economics at the University of California Santa Barbara.

Michael Lee is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Michael Lee is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Aaron Plesset is a former senior research analyst in the Bank’s Research and Statistics Group.

How to cite this post:

Rod Garratt, Michael Lee, and Aaron Plesset, “COVID-19 and the Search for Digital Alternatives to Cash,” Federal Reserve Bank of New York Liberty Street Economics, September 28, 2020, ttps://libertystreeteconomics.newyorkfed.org/2020/09/covid-19-and-the-search-for-digital-alternatives-to-cash.html.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics