Leading up to the COVID-19 outbreak, there were growing concerns about corporate sector indebtedness. High levels of borrowing may give rise to a “debt overhang” problem, particularly during downturns, whereby firms forego good investment opportunities because of an inability to raise additional funding. In this post, we show that firms with high levels of borrowing at the onset of the Great Recession underperformed in the following years, compared to similar—but less indebted—firms. These findings, together with early data on the revenue contractions following the COVID-19 outbreak, suggest that debt overhang during the COVID-recession could lead to an up to 10 percent decrease in growth for firms in industries most affected by the economic repercussions of the battle against the outbreak.

Debt Overhang Defined

Economists argue that firms may experience a debt overhang problem and be unable to finance new worthwhile projects when the face value of a firm’s debt exceeds its payoff. This could be because potential debtors cannot accurately evaluate a company’s investment opportunities, while equity holders are averse to financing projects whose benefits accrue only to existing debt holders. This problem tends to be amplified in downturns because existing projects become less profitable and the cash flows of firms decline.

Debt Overhang and the Great Recession

We analyze the impact of debt overhang on firm growth during the Great Recession in a new paper. We focus on total liabilities relative to cash flow as a measure of debt overhang because liabilities are a broad indicator of “indebtedness.” Further, we consider a cash flow-based measure, rather than a pure balance sheet-based measure, because cash flow (and revenue) can be more volatile than a firm’s balance sheet structure and may depend on macroeconomic conditions unrelated to the firm’s business model.

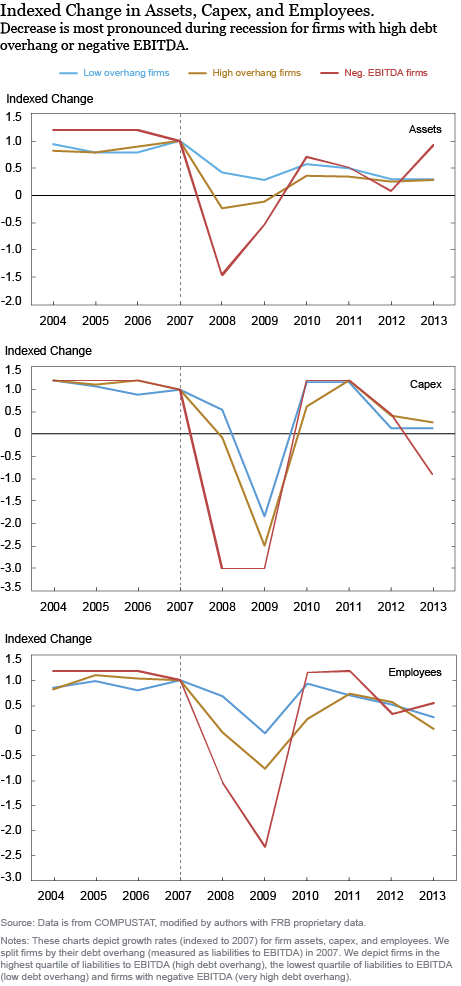

Consistent with the insight discussed above, we find that firms that entered the Great Recession with high levels of debt to cash flow, experience poorer performance in subsequent years. This is evident in the charts below that compare firms’ performance as measured by indexed (a) asset growth, (b) growth of employees, and (c) capital expenditures, in the years after the Great Recession. We split firms based on the ratio of their liabilities to EBITDA (a cash flow proxy) in 2007. In each chart it is clear that firms with high liabilities to cash flow (or even high liabilities and negative cash flow) experience slower growth during the recession. According to our aggregated average estimates, firms with debt overhang experience an asset growth that is 2 percent lower during ordinary times and up to 3 percent lower during the Great Recession than comparable firms without debt overhang.

We additionally show that the effects of debt overhang during the Great Recession are significantly more pronounced for firms with more significant needs for external funding. We assess firms’ need for external funding through several different measures, including (i) the maturity left in their debt at the onset of the crisis, (ii) whether they refinanced their debt in the year leading up to the crisis, (iii) the amount left unused in their credit lines, and (iv) reductions in the size of the credit lines available to them.

Debt Overhang and COVID-19

The COVID-19 outbreak has the potential to have an even bigger effect on the economy through the channel of debt overhang than what we identified in the Great Recession. Corporate sector indebtedness stood at record-high levels at the time of the outbreak in early 2020. Based on data available for the first two quarters of 2020, we see that firms that entered the COVID-19 crisis with high levels of overhang experienced slower or even negative growth during the first half of 2020. Moreover, the economic shutdown that followed the spread of COVID-19 had a significantly negative effect on firms’ cash flows. This is likely to have mechanically raised the debt overhang of firms in affected industries during the crisis. For example, firms operating in tourism, restaurant, hospitality, and related industries entered the crisis with an average debt overhang that was twice as high as the average overhang of firms in other industries. Additionally, the revenue contractions were most severe in these industries (following the economic shutdown), meaning debt overhang likely have increased much further. Based on the analysis in our paper, we estimate that the combination of high prior debt overhang and revenue contractions in 2020 could lead firms in these most affected industries to grow 10 percent more slowly in a Great Recession-type crisis than they would in ordinary times.

There is at least one additional factor that is likely to increase the costs of debt overhang in the current crisis: the ownership structure of debt. Debt forgiveness is usually an important mechanism to resolve problems of debt overhang but it may be hampered when debt ownership is diffuse. Forgiveness by any one party presents a free rider problem if any other debtholder does not follow suit. This problem is compounded when loan ownership is dominated by many investors owning small loan shares as in the leveraged loan market. For example, at the end of 2019, there were on average 203 collateralized loan obligations (CLOs) in Ba rated loans, and their average loan share was just 0.24 percent.

Of course, in instances when voluntary debt forgiveness is not feasible, the Chapter 11 bankruptcy process may be a viable option. Bankruptcy courts can help encourage a debt renegotiation and debtor-in-possession (DIP) loans can help a firm circumvent some of the challenges of out-of-court reorganizations. This may be an option for large firms provided that the bankruptcy courts are not overburdened and DIP financing is still available. As for small firms, notwithstanding the restructuring opportunities provided by the Small Business Reorganization Act, their more limited access to DIP financing may make reorganization more difficult. The liquidation or simply reduced long-term growth prospects of small firms with debt overhang represents a sizable risk for the economy because this segment of the corporate sector collectively accounts for a large portion of employment and economic growth.

Kristian S. Blickle is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

João A. C. Santos is a senior vice president in the Bank’s Research and Statistics Group.

How to cite this post:

Kristian S. Blickle and João A. C. Santos, “The Costs of Corporate Debt Overhang Following the COVID-19 Outbreak,” Federal Reserve Bank of New York Liberty Street Economics, December 1, 2020, https://libertystreeteconomics.newyorkfed.org/2020/12/the-costs-of-corporate-debt-overhang-following-the-covid-19-outbreak.html.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Debt overhang lack of ability to service existing Debts. It will take more and more financial resource to service the Large/Overhand Debt to the point Corporations will be unable to service their Debt. Debt Investors will not continue to lend money when corporations cannot service their existing Debt. In the current situation we are at or nearing this point of inability to service the existing Debt by many. We will then see Debt Deflation take hold. Actually we are seeing Debt Deflation take hold in Europe and China. China’s SOE’s are now unable, in some cases and growing to be able to service their Bonds and Gov’t not coming to their rescue. Debt Deflation shall spread over the next 24 months across the Globe.