Housing represents the largest asset owned by most households and is a major means of wealth accumulation, particularly for the middle class. Yet there is limited understanding of how households view housing as an investment relative to financial assets, in part because of their differences beyond the usual risk and return trade-off. Housing offers households an accessible source of leverage and a commitment device for saving through an amortization schedule. For an owner-occupied residence, it also provides stability and hedges for rising housing costs. On the other hand, housing is much less liquid than financial assets and it also requires more time to manage. In this post, we use data from our just released SCE Housing Survey to answer several questions about how households view this choice: Do households view housing as a good investment choice in comparison to financial assets, such as stocks? Are there cross-sectional differences in preferences for housing as an investment? What are the factors households consider when making an investment choice between housing and financial assets?

Exploring Survey Data

We study these questions using a novel survey on households’ preferences for housing as an investment relative to investing in the stock market, and rationales behind their choices. In our survey, respondents are prompted to advise a couple in their early 30s from their zip code, after receiving a gift the size of a down payment, whether to invest in housing or the U.S. stock market. The question is framed in two ways, one asks if the young couple should buy a primary residence or invest in the stock market, and a second assumes the couple already has a primary home and asks whether they should consider buying a rental property or investing in stocks. Each respondent randomly receives one of the two framings. After reporting their recommendations, respondents are asked to select reasons behind their answers from a menu of reasons including, for example, stocks having higher returns, housing with lower volatility, commitment device for savings, or they can supply their own reasons. These survey questions were run in February 2020 (largely before the COVID-19 outbreak in the U.S.), October 2020, and February 2021. We report the following results:

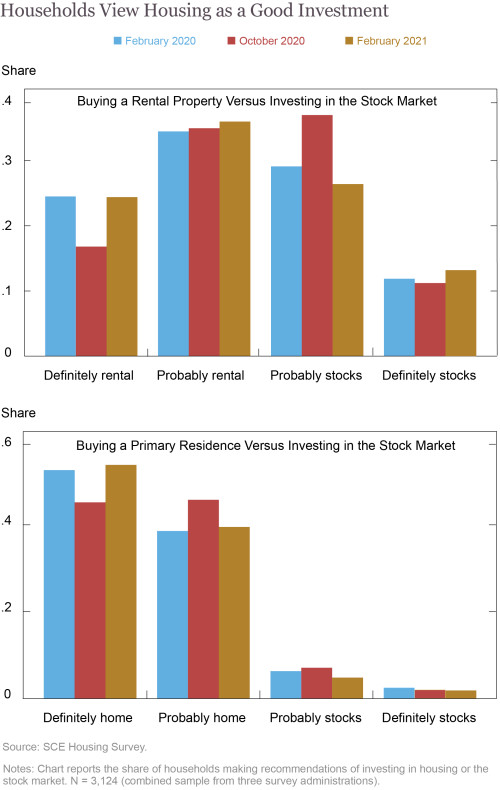

Households View Housing as a Good Investment

The chart below plots the shares of household recommendations over time. We can see that in general, households view housing as a good investment in comparison to the stock market. When asked to choose between investing in a rental property or the overall stock market, more than 50 percent of the households recommended housing in all three administrations of the survey. In the primary residence versus stock market framing, preference for housing is even stronger with more than 90 percent of the survey respondents choosing housing. One interesting pattern is that the preference for housing dipped in October 2020 and returned back to the pre-COVID level by February 2021. Using reasons cited for these choices, we found that this shift away from housing in October 2020 wasn’t driven by lower home price expectations, but reflects other reasons. For example, investors were more worried about the risk of vacant rental units. For buying a primary residence, our survey respondents put less value on the stability provided by an owner-occupied home after the COVID-19 outbreak, potentially because of concerns about making mortgage payments or shortened expected tenure to stay at the current home.

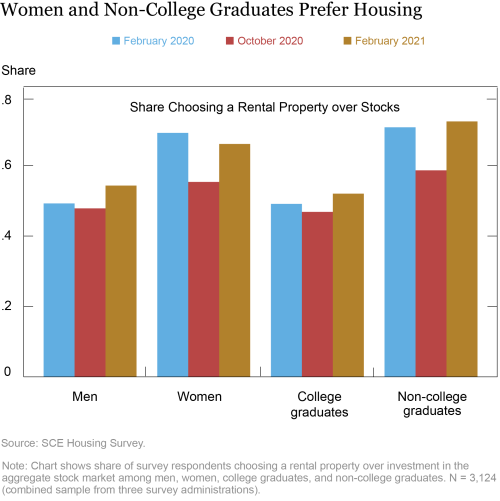

Cross-Sectional Differences in Viewing Housing as an Investment

We next examine important cross-sectional variation in households’ views of housing as an investment. Two strong predictors for investment recommendations are gender and education. For this analysis, we focus on the rental housing versus stocks framing. The next chart shows that women and non-college graduates have a stronger preference for housing than others do. For the gender gap, part of the explanation is that men in our sample are more risk-taking than women and are more willing to invest in the stock market, where returns are perceived as more volatile. For the education gap, college graduates tend to expect higher returns in the stock market than in housing and cite “time to manage a rental property” as one reason for choosing the stock market. We also note that these gender and education gaps were substantially reduced in the October 2020 survey, as women and non-college graduates temporarily shifted away from housing. In future work, we intend to study factors behind the gender and education gaps in preference for housing, and why they were temporarily reduced during the COVID-19 outbreak.

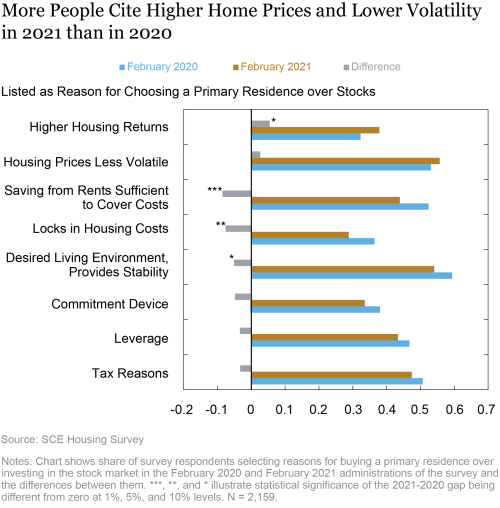

Reasons for Choosing Housing

Turning to reasons cited by the survey respondents for choosing housing, the next chart shows the percentage of respondents selecting each reason for recommending a primary residence over investing in the stock market. Respondents can select multiple reasons. We can see that there is a reasonable share of respondents choosing each of the reasons. “Desired Living Environment and Provides Stability” and “Housing Prices Less Volatile” are among the most commonly selected. Compared to the 2020 responses, in 2021 more survey respondents selected higher house prices and lower volatility, and fewer respondents selected any of the other reasons, including for example, saving from rent, stability, locking in housing costs, and the amortization schedule as a commitment device for saving.

Conclusion

Housing is an important asset class for middle-class households. Using a novel survey fielded before and during the COVID-19 outbreak, we show that investors view housing—both rental properties and primary residences—as a good investment relative to the aggregate stock market. There are important variations in preferences for housing, with women and non-college graduates being more likely to recommend housing. Relative to before the COVID-19 outbreak, more households now cite higher returns and lower volatility as reasons to buy a primary residence.

Andrew Haughwout is a senior vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Andrew Haughwout is a senior vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

![]() Haoyang Liu is an economist in the Bank’s Research and Statistics Group.

Haoyang Liu is an economist in the Bank’s Research and Statistics Group.

Dean Parker is a senior research analyst in the Bank’s Research and Statistics Group.

Xiaohan Zhang is an assistant professor at California State University-Los Angeles.

How to cite this post:

Andrew Haughwout, Haoyang Liu, Dean Parker, and Xiaohan Zhang, “Do People View Housing as a Good Investment and Why?,” Federal Reserve Bank of New York Liberty Street Economics, April 5, 2021, https://libertystreeteconomics.newyorkfed.org/2021/04/do-people-view-housing-as-a-good-investment-and-why.html.

Related Reading

Mapping Home Price Changes – data visualization

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Thanks for the interesting post. It may be interesting to look at age demographics segmentation as well as investigate reasons why renters do not purchase houses. Is it lack of downpayment, lack of adequate financial literacy, need to be mobile for work, assessment of housing pricy as frothy, lack of supply, and so on. Even though we focus so much on homeownership- I wonder if there are negative impacts on job mobility as well as climate change (more resources used as in most cases areas of owned houses are higher than rented units)

Good subject and timely. Many view housing as an Investment rather than a place where you live and enjoy. Many view only the possible upside of home values and not the down side of home values, such as Market Drop/Depression/Deflation and etc. Also, most do not factor in the costs of home ownership/investment, such as repairs, taxes, insurance, mortgage costs, and etc. Home is where you live and enjoy vs investment.