Market participants have often noted that general collateral (GC) repo trades happen very early in the morning, with most activity being completed soon after markets open at 7 a.m. Data on intraday repo volumes timing are not publicly available however, obscuring those dynamics to outside observers. In this post, we use confidential data collected by the Office of Financial Research (OFR) to describe the intraday timing dynamics of GC repo in the interdealer market. We demonstrate that a significant majority of interdealer overnight Treasury repo is completed prior to 8:30 a.m. (all times Eastern time), and explore the various factors that are driving repo traders to secure funding in the early morning.

Intraday Timing in Overnight Treasury Repo

The repo market plays a prominent role in the U.S. financial system as a source of secured funding for broker-dealers, and a crucial piece of the U.S. wholesale and short-term funding markets. As a result, documenting how the market operates, including the intraday trading patterns, is an important input to understanding overall market functioning.

For our analysis, we use confidential data gathered by the OFR from the Fixed Income Clearing Corporation (FICC) on the two cleared interdealer repo markets in the U.S., FICC DVP and GCF. These trade-level data include participant names, volumes, rates, collateral type, and timestamps indicating when trades were submitted and matched. We focus on overnight trades involving Treasury securities as collateral because we want to relate our results to the Secured Overnight Financing Rate (SOFR). We accomplish this by filtering the OFR overnight Treasury FICC DVP data to align as closely as possible with the data currently used to construct SOFR. In particular, we remove all FICC DVP trades occurring at rates below the volume-weighted 25th percentile to reduce the influence of specials activity (trades executed to borrow specific securities). All overnight Treasury GCF trades are included because GCF, by construction, is a general collateral market with no method for obtaining specific securities. Though this post focuses on the first quarter of 2021, our results are largely in line with those for prior periods.

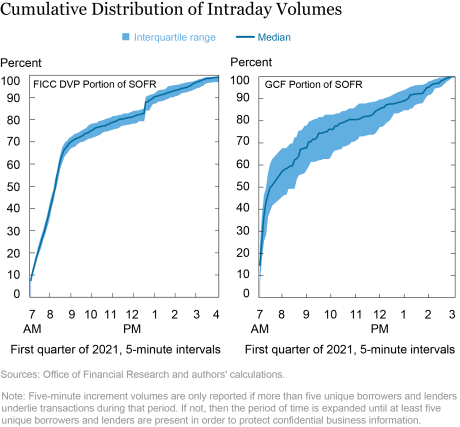

In the first quarter of 2021, we find that the median across days of the share of overnight Treasury FICC DVP repo completed between 7:00 a.m. (when the market opens) and 8:30 a.m. is 64 percent, as seen in the left panel of the above chart. After 8:30 a.m. trading slows significantly, with remaining trades occurring fairly steady until 4:00 p.m. The progression of FICC DVP trading is quite steady day to day, with a very narrow interquartile range (IQR), particularly during the early-morning portion of the session.

Overnight Treasury GCF occurs at roughly the same speed (62 percent is completed by 8:30 a.m.) but with a greater variability in timing, as seen in the right panel of the above chart. That said, GCF is a substantially smaller market; overnight Treasury repo volumes in GCF averaged $28 billion in the first quarter compared to $540 billion in FICC DVP. Note that these distributions are organized by the time submitted to FICC, which can happen some time after the trade has been arranged. That said, it is a market best practice to submit trades quickly after execution.

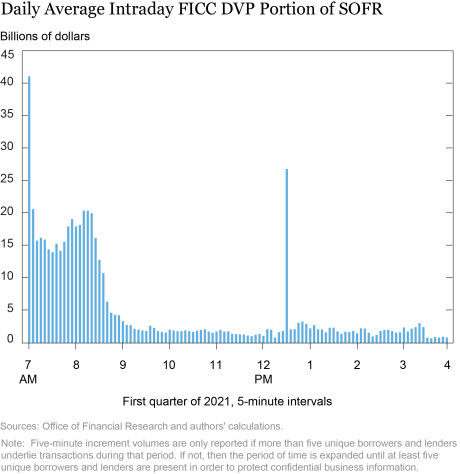

With regard to FICC DVP volumes, the busiest portion of the repo trading session during the first quarter of 2021 is immediately after the market opens: the busiest five-minute increment was the 7:00 a.m. – 7:05 a.m. block, when a daily average of $40 billion (8 percent of total) was completed, as shown in the next chart. An average of $137 billion (25 percent of total) was completed through the first thirty minutes. Other than the brief increase just after 12:30 p.m. (discussed below), the busiest increments are in the early morning. The average five-minute increment prior to 8:30 a.m. is $18 billion, whereas after 8:30 a.m. it is $2 billion.

The brief increase in FICC DVP activity shortly after 12:30 p.m. is associated with the close of the SOMA securities lending operation. Although securities borrowed by primary dealers from SOMA are largely used to complete specials rather than GC transactions, this activity has been seen as driving a notable amount of “follow-on” GC activity as dealers reposition and balance their funding once SOMA allocations are known.

Though timestamped data is not yet publicly available for Bank of New York Mellon tri-party repo, a dealer-to-client market, repo traders have universally noted that tri-party trading is also conducted in the early part of the session. A forthcoming OFR Brief will more thoroughly detail daily tri-party repo timing.

Why So Early?

A variety of factors have been cited to explain the early day GC repo activity. The factor that market participants most consistently cite is the start of daylight overdraft fees assessed by clearing banks at 8:30 a.m. to dealers that have not funded their clearing accounts. These fees are particularly meaningful for smaller, independent broker-dealers, that raise a substantial portion of their funding in interdealer repo. Thus, smaller dealers make every effort to fund as early as possible. Larger dealers must also operate early to address client demands from both smaller dealers and prime brokerage clients such as hedge funds.

Repo market participants also look to trade during the most liquid and active portion of the session, driving further activity to the early portion of the day. This is particularly true in the FICC DVP and GCF markets, for which there is the greatest opportunity to achieve balance-sheet savings by netting through FICC when there is the most amount of activity occurring.

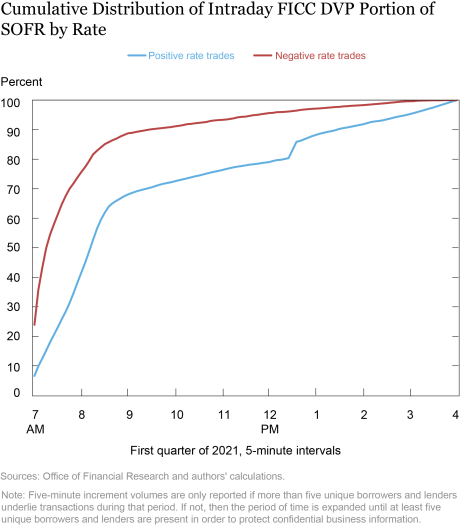

More recently, repo market participants have highlighted an early morning “scramble for collateral” due to an overabundance of cash. This imbalance has several drivers, including less interest in cash borrowing (and thus providing collateral) by levered accounts, the continued increase in cash availability amid money-market fund inflows and rising aggregate reserve balances, and Treasury bill paydowns. This has resulted in an increase in more early morning and negative-rate trading as dealers are willing to incur negative cash lending rates to obtain collateral. Indeed, negative-rate GC trades throughout the first quarter occurred earlier in the daily session than zero- or positive-rate trading as shown in the next chart.

Additionally, repo market contacts have highlighted an increase in the amount of repo trades being arranged prior to the market formally opening at 7:00 a.m., with many cash lenders queuing to buy collateral as early as possible at a rate of zero rather than face rates quickly turning negative during early trading. This is broadly consistent with the data available, which shows that the average of FICC DVP trades with submission times prior to 7:00 a.m. has increased from $2 billion in the first quarter to $5 billion in the second quarter.

To Sum Up

Our post provides new information about an opaque characteristic of the repo market. We show that repo trades in the interdealer market occur very early in the morning and explain the drivers behind this decision. The fact that trading occurs early is important to understand, because it limits the amount of time market participants have to react to stress events, such as the mid-September 2019 rate spikes, as well as constrains the ability of market participants to respond. Looking ahead, a number of factors could affect the timing of this market, such as changes to the supply of reserves, developments in the structure of the Treasury market, or modifications to new services like the FICC’s sponsored service. We will continue to monitor this market as it evolves.

Kevin Clark is a senior associate in the Federal Reserve Bank of New York’s Markets Group.

Adam Copeland is an assistant vice president in the Bank’s Research and Statistics Group.

R. Jay Kahn is an economist at the Office of Financial Research, U.S. Department of the Treasury.

Antoine Martin is a senior vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Mark Paddrik is a senior researcher at the Office of Financial Research, U.S. Department of the Treasury.

Benjamin Taylor is a senior associate in the Federal Reserve Bank of New York’s Markets Group.

How to cite this post:

Kevin Clark, Adam Copeland, R. Jay Kahn, Antoine Martin, Mark Paddrik, and Benjamin Taylor, “Intraday Timing of General Collateral Repo Markets,” Federal Reserve Bank of New York Liberty Street Economics, July 14, 2021, https://libertystreeteconomics.newyorkfed.org/2021/07/intraday-timing-of-general-collateral-repo-markets.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics