Even before the start of the new year, businesses in the tri-state region were hampered by supply disruptions, rising input costs, and difficulty finding adequate staff. On top of these challenges, the Omicron wave dealt another setback to the regional economy. With infections running high, many businesses were forced to deal with a combination of reduced demand from customers and renewed absenteeism among workers. Indeed, our regional business surveys indicate that economic growth stalled in early 2022 as firms continued to struggle to find workers. Moreover, employee absenteeism was reported to be nearly three times its normal level. While the path of recovery remains highly uncertain, firms generally expect conditions to improve in the months ahead and many are still adding or planning to add staff.

Regional Growth Stalls

As 2021 came to a close, our regional business surveys were pointing to solid growth in the manufacturing and service sectors. In early 2022, however, conditions changed abruptly as the Omicron wave surged in the region. The manufacturing sector noted that growth stalled in the January survey, for the first time in many months, and the same occurred in the service sector in our February survey. Hampered by the Omicron wave, much of the weakness in the service sector emanated from businesses relying heavily on face-to-face contact in the leisure & hospitality and retail sectors. In the manufacturing sector, however, the weakness appears to be more related to supply disruptions, as many firms were not able to procure the supplies they needed to increase output to desired levels. In fact, far more manufacturers continue to indicate that supply disruptions are worsening than improving, and roughly 85 percent note that such disruptions are impeding their business.

Unprecedented Job Openings and Escalating Wages

Despite the recent slowdown, businesses in the region report unprecedented job openings. When asked in our Supplemental Survey Report, how many unfilled job openings businesses had relative to their total number of employees in February, the median business in both the manufacturing and service sectors reported that openings represented 5 percent of employment. Over the past eight years this question has been asked, this figure had never exceeded 3 percent for manufacturers or 2.5 percent for service firms. Businesses in the transportation & warehousing and information sectors reported particularly numerous unfilled job openings.

Not surprisingly, with businesses struggling to maintain adequate staffing levels, wage increases were widespread due to strong demand for labor and limited supply. Indeed, the wages index in the Business Leaders Survey, covering service firms across the tri-state region, was near a record high. While our surveys are specific to the region, nationwide data paint a similar picture, with workers seeing the strongest wage growth in decades—particularly in lower-wage industries. One potential contributing factor pushing up wages at the start of the year was the increased minimum wage in New Jersey and much of New York State. Indeed, survey results indicate that the latest minimum wage hike had both modest direct effects, by raising the wages of workers who would have otherwise been below the minimum, and, perhaps more significantly, indirect effects as increases cascaded to workers higher in the wage distribution. The biggest impacts were reported by businesses engaged in manufacturing, transportation & warehousing, retail trade, and leisure & hospitality.

High Absenteeism Compounds Staff Shortages

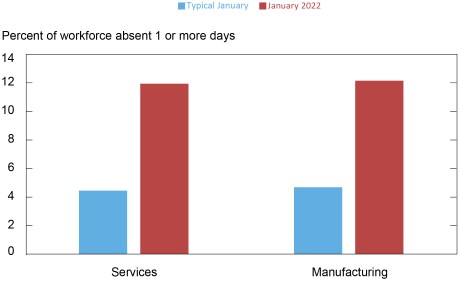

With the Omicron outbreak raging across the region, businesses had major difficulties maintaining adequate staff. Indeed, more than half of service firms and almost two-thirds of manufacturers reported experiencing high absenteeism with the Omicron wave. As the chart below shows, absenteeism among existing staff in January was around 12 percent on average, for both manufacturers and service firms, nearly three times its normal level.

Absenteeism Was Nearly Three Times Higher than Normal during the Omicron Wave

Sources: Empire State Manufacturing Survey; Business Leaders Survey.

Many firms experiencing high absenteeism took actions to compensate. A sizable number of businesses in the education & health and leisure & hospitality sectors cut back on the volume of service they provide. Businesses in manufacturing and distribution, on the other hand, were more inclined to increase the hours of those who were present at work, as well as make more use of outside contractors or temporary workers.

Looking Ahead

While conditions are currently very challenging, a majority of firms do expect activity to increase over the next six months, with service sector firms more optimistic than manufacturers. Those businesses hampered by supply disruptions expect them to last another seven to nine months, on average. How fast the regional economy can recover from this latest round of doldrums largely depends on the evolution of the pandemic, but with the Omicron wave already subsiding, there is reason for optimism.

Jaison R. Abel is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Jason Bram is a research officer in the Bank’s Research and Statistics Group.

Richard Deitz is an assistant vice president in the Bank’s Research and Statistics Group.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics