The United States has experienced a considerable rise in inflation over the past year. In this post, we examine how consumers’ inflation expectations have responded to inflation during the pandemic period and to what extent this is different from the behavior of consumers’ expectations before the pandemic. We analyze two aspects of the response of consumers’ expectations to changing conditions. First, we examine by how much consumers revise their inflation expectations in response to inflation surprises. Second, we look at the pass-through of revisions in short-term inflation expectations to revisions in longer-term inflation expectations. We use data from the New York Fed’s Survey of Consumer Expectations (SCE) and from the Michigan Survey of Consumers to measure these responses. We find that over the past two years, consumers’ shorter-horizon expectations have been highly attuned to current inflation news: one-year-ahead inflation expectations are very responsive to inflation surprises, in a pattern similar to what we witnessed before the pandemic. In contrast, three-year-ahead inflation expectations are now far less responsive to inflation surprises than they were before the pandemic, indicating that consumers are taking less signal from the recent movements in inflation about inflation at longer horizons than they did before. We also find that the pass-through from revisions in one-year-ahead expectations to revisions in longer-term expectations has declined during the pandemic relative to the pre-pandemic period. Taken together, these findings show that consumers expect inflation to behave very differently than it did before the pandemic, with a smaller share of short-term movements in inflation expected to persist into the future.

How Is Current Inflation Shaping Inflation Expectations?

Inflation expectations are informative about how the current inflation experience has shaped the public’s views regarding future inflation. In particular, by looking at the pattern of expectations at different horizons, we can learn something about how persistent consumers think the current surge in inflation will turn out to be. In addition, inflation expectations may factor into households and businesses’ economic decisions, such as wage bargaining and price setting, feeding into actual inflation outcomes. If high inflation becomes embedded into long-run inflation expectations, such second-round effects could make inflation more persistent, delaying its return to levels consistent with the Federal Reserve’s long-run inflation goal. Similar concerns arise when, conversely, inflation persistently undershoots the Federal Reserve’s long-run target, as was the case over much of the 2010s.

One way to examine this question is to look at how strongly inflation expectations at various horizons respond to economic conditions. Data from the New York Fed’s SCE show that inflation expectations at the one-year and, to a lesser extent, at the three-year horizon increased significantly over the last year, as realized inflation surged. The fact that inflation expectations moved in response to actual inflation is not surprising on its own and is consistent with prior experience. To gauge whether consumers think the current elevated inflation is going to be more or less persistent, we focus first on the sensitivity of inflation expectations at various horizons to “inflation surprises”—that is, the difference between what someone expected future inflation to be and what it turns out to be. Models such as the one analyzed in Orphanides and Williams (2005) suggest that the sensitivity of expectations to inflation surprises is a useful metric to think about how shocks to inflation may get embedded into persistently high inflation and inflation expectations. In particular, the pass-through of inflation surprises to revisions in long-run expectations is informative about the way in which consumers think about the evolution of inflation at longer horizons—specifically, whether they view the current elevated inflation as more or less persistent over time.

A related measure of perceived inflation persistence is the co-movement between revisions in short-term expectations and revisions in longer-term expectations. Intuitively, when inflation is not perceived to be very persistent, we would expect a relatively low pass-through from short-term to long-term revisions—and we would not expect this relationship to be affected by elevated inflation readings. Finally, as an additional metric, we examine the evolution of inflation expectations at various horizons over recent months: here we consider expectations at the one-year-ahead (short-term), three-year-ahead (medium-term) and five-year-ahead (long-term) horizons. As in previous analysis, five-year-ahead expectations also give us a sense of the extent to which long-run inflation expectations have remained well-anchored at levels broadly consistent with the Federal Reserve’s long-run inflation goal.

Measures of the Responsiveness of Expectations to Changing Conditions

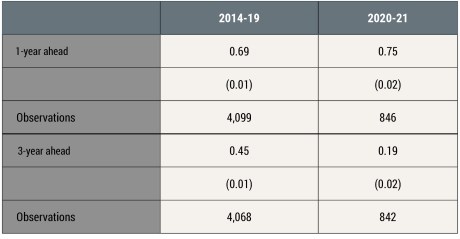

The SCE is uniquely suited to implement these metrics (see here for more details about the survey). Because it is based on a rotating panel that follows individuals over time for up to twelve months, we can measure the extent to which the same person revises their inflation expectations in response to inflation surprises. In a given month, we use the mean of an individual’s density forecast as the measure of that person’s inflation expectation at each horizon under consideration. Individual revisions are defined as the change in the respondent’s forecast of inflation between the start and the end of their tenure in the SCE panel. Similarly, we define the size of the inflation surprise as the difference between annual consumer price index (CPI) inflation recorded in the last month of the respondent’s participation in the survey and their one-year-ahead inflation expectation at the start of their tenure. We then regress individual revisions in inflation expectations on inflation surprises. The table below reports the slope coefficients from regressions using data before and after the start of the pandemic. We can interpret these slope coefficients as the pass-through of inflation surprises to revisions in inflation expectations.

Sensitivity of Revisions in Inflation Expectations to Inflation Surprises

Notes: A respondent’s revision in inflation expectation (dependent variable) is defined as the respondent’s inflation expectation in month 12 minus the respondent’s inflation expectation in month 2. A respondent’s inflation surprise is defined as realized CPI inflation in month 12 minus the respondent’s expected inflation in month 2. Year is defined as the year of the respondent’s second month in the Survey of Consumer Expectations (SCE) panel. Inflation expectations are defined as the respondent’s density forecast mean from the SCE core survey. All slope coefficient estimates are statistically significant at the 0.1 percent level. Standard errors are in parentheses.

We highlight two results. First, the pass-through of inflation surprises to revisions in inflation expectations is considerably larger at the short-term (one-year-ahead) horizon than at the medium-term (three-year-ahead) horizon: for instance, in the pre-pandemic period, the sensitivity of revisions to surprises is about 0.7 at the short-term horizon and 0.45 at the medium-term horizon. This means that a 1 percentage point surprise in inflation on average translates into a 0.7 percentage point revision in one-year-ahead expectations, but only a 0.45 percentage point revision in three-year-ahead expectations. Second, while the estimated pass-through of inflation surprises to revisions in short-term inflation expectations since the beginning of 2020 (0.75 in column 2) is slightly higher than what it was in the period before the pandemic (0.69 in column 1), the pass-through to revisions in medium-term inflation expectations is less than half as large as it was before 2020 (0.19 vs. 0.45). Intuitively, this result suggests that while consumers are highly attuned to current inflation news in updating their short-term inflation expectations, they are taking less signal than before the pandemic from the recent sharp movements in realized inflation when revising their three-year-ahead expectations.

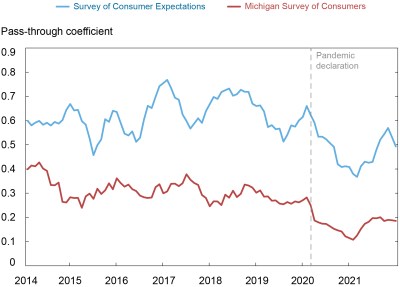

Next, we examine the co-movement between short-term (one-year-ahead) and longer-term (three-year-ahead or longer) inflation expectations revisions. The chart below plots these estimated pass-through coefficients from a series of rolling regressions taken over a six-month window. For instance, the last data point in the illustration represents the rolling regression over the six-month period from August 2021 through January 2022. Here we also use data from the Michigan survey, exploiting its limited panel component whereby a subset of respondents in each month are re-interviewed six months later. As a result of that feature, all revisions in this analysis are defined as the difference in an individual’s response between a given month and six months earlier. Longer-term expectations are measured at the three-year-ahead horizon in the SCE and at the five-to-ten-year-ahead horizon in the Michigan survey.

As seen in the next chart, the estimated pass-through from short-term to longer-term inflation expectations has been lower, on average, during the pandemic than it was before. On average, the estimates of pass-through to longer-term inflation expectations declined from 0.62 to 0.48 in the SCE, and from 0.31 to 0.17 in the Michigan survey. This finding is consistent with that reported above on the decline in the sensitivity of longer-run inflation expectations to inflation surprises during the pandemic period.

Co-movement between Short-Term and Longer-Term Inflation Expectations Revisions

Sources: Federal Reserve Bank of New York Survey of Consumer Expectations (2013-22); Michigan Survey of Consumers (2013-22).

Notes: The chart shows estimated slope coefficients from six-month rolling regressions of revisions in longer-term inflation expectations on revisions in short-term inflation expectations. A respondent’s revision in inflation expectations (dependent variable) is defined as the respondent’s inflation expectation in month t minus the respondent’s inflation expectation in month t-6. In the Survey of Consumer Expectations (SCE), longer-term expectations are three-year-ahead density means and short-term expectations are one-year-ahead density means. In the Michigan survey, longer-term expectations are five-to-ten-year-ahead point forecasts and short-term expectations are one-year-ahead point forecasts. For each survey, the last data point in the plot represents rolling regressions over the six-month period between August 2021 and January 2022, included.

Long-Run Inflation Expectations Remain Stable

Finally, to complement this analysis, we consider the evolution of inflation expectations at the long-term horizon. The data are based on a new survey question that we have fielded in the SCE a number of times since last summer, including most recently in January 2022. The table below shows that, as mentioned earlier, one-year-ahead and, to a lesser extent, three-year-ahead inflation expectations increased over the last year—although they show signs of moderation in January. In contrast, long-term (five-year-ahead) inflation expectations have remained remarkably stable since last summer. This finding is again suggestive of a low perceived persistence of inflation over longer horizons, and is consistent with the earlier evidence of well-anchored expectations from the analysis that was carried out last summer.

Median Inflation Expectations at Different Horizons

Notes: Data for July 2019 are based on 986 responses from a special SCE survey. Data for August 2021 are based on SCE core survey responses at the one- and three-year horizons and 2,183 responses from a special survey at the five-year horizon. All other data are based on SCE core survey responses. Median expectations are computed over individual respondents’ density means. The core survey includes about 1,250 household heads per month.

Besides its tragic human toll, the pandemic has brought about extraordinary economic dislocation, including unprecedented supply and demand imbalances that have resulted in a sharp rise in inflation. Our measures indicate that consumers seem to recognize the unusual nature of the current inflation experience. While short-term inflation expectations have been highly responsive to inflation news, medium-term expectations have exhibited lower sensitivity to inflation surprises during the pandemic than before it. The pass-through from short-term to longer-term inflation expectations revisions has also declined, on average, since the start of the pandemic. Finally, while one-year-ahead and three-year-ahead expectations rose significantly during the pandemic, five-year-ahead inflation expectations have remained remarkably stable. Taken together, these findings indicate that consumers are taking less signal than before the pandemic from inflation news in updating their longer-term expectations, and that they do not view the current elevated inflation as very long-lasting.

Oliver Armantier is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Leo Goldman is a senior research analyst in the Bank’s Research and Statistics Group.

Gizem Koşar is a senior economist in the Bank’s Research and Statistics Group.

Giorgio Topa is a vice president in the Bank’s Research and Statistics Group.

Wilbert van der Klaauw is a senior vice president in the Bank’s Research and Statistics Group.

John C. Williams is president and CEO of the Bank.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York, the Federal Open Market Committee, or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics