Kenechukwu Anadu, Pablo D. Azar, Marco Cipriani, Thomas Eisenbach, Catherine Huang, Mattia Landoni, Gabriele La Spada, Marco Macchiavelli, Antoine Malfroy-Camine, and J. Christina Wang

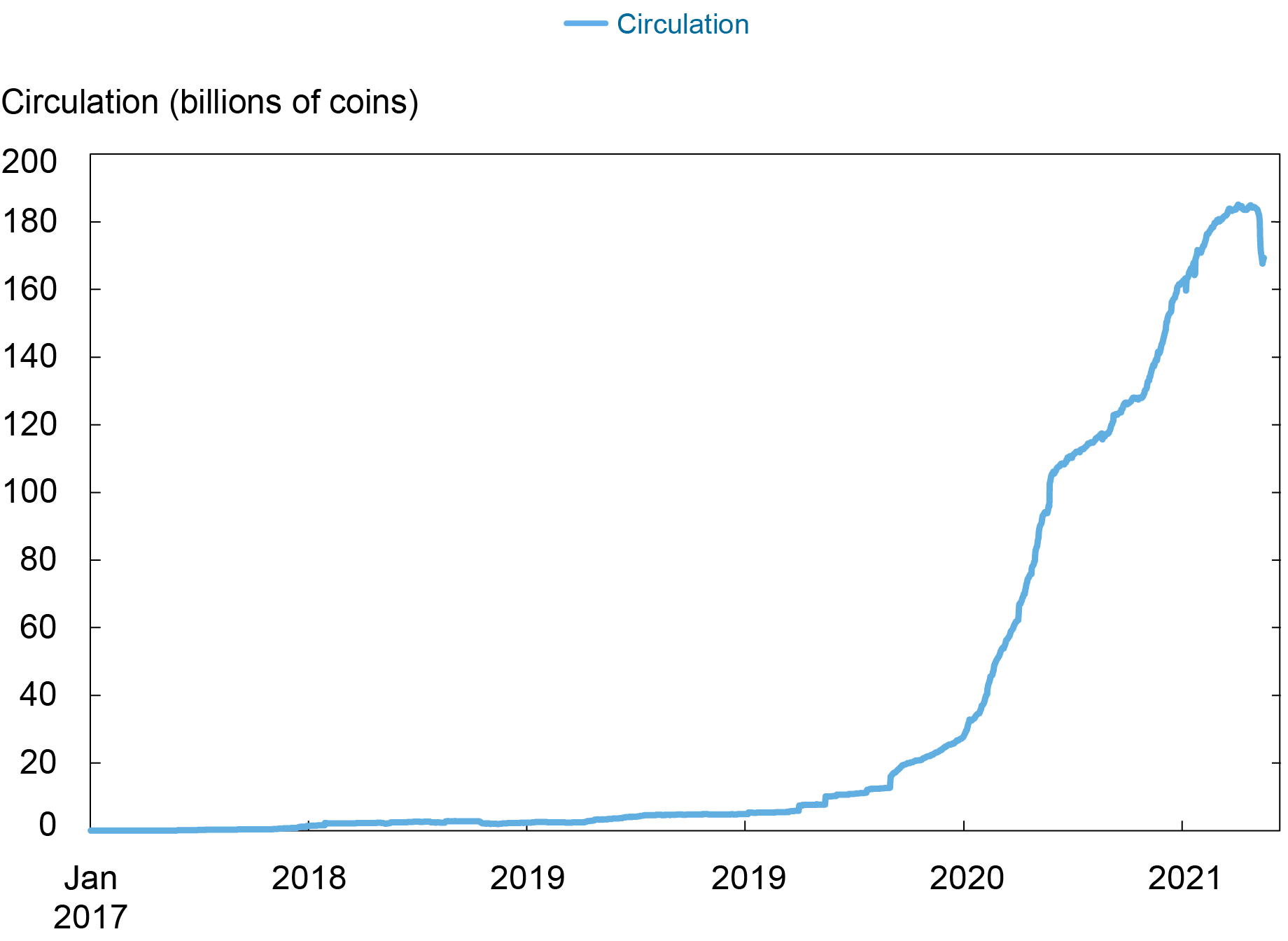

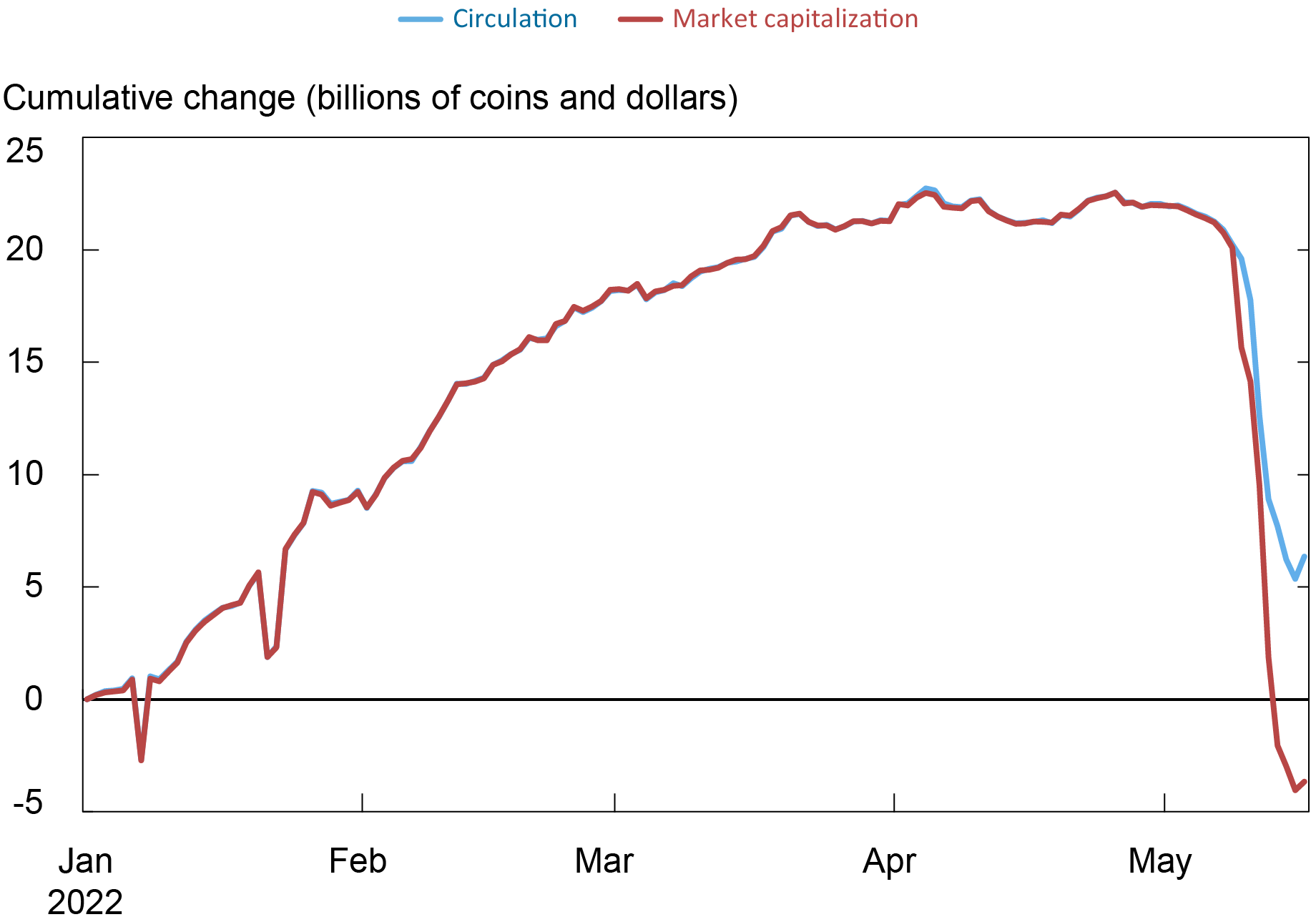

Stablecoins are digital assets whose value is pegged to that of fiat currencies, usually the U.S. dollar, with a typical exchange rate of one dollar per unit. Their market capitalization has grown exponentially over the last couple of years, from $5 billion in 2019 to around $180 billion in 2022. Notwithstanding their name, however, stablecoins can be very unstable: between May 1 and May 16, 2022, there was a run on stablecoins, with their circulation decreasing by 15.58 billion and their market capitalization dropping by $25.63 billion (see charts below.) In this post, we describe the different types of stablecoins and how they keep their peg, compare them with money market funds—a similar but much older and more regulated financial product, and discuss the stablecoin run of May 2022.

Stablecoin Circulation Has Been Increasing since 2019, but Dropped Sharply in May 2022

Stablecoin Circulation and Market Capitalization in 2022

The Different Types of Stablecoins

Stablecoins use different mechanisms to peg their value. The top four stablecoins by market capitalization are Tether (USDT), USD Coin (USDC), Dai (DAI), and Binance USD (BUSD). Among these, USDT, USDC, and BUSD are ostensibly backed by traditional financial assets. Part of the backing of USDT is comprised of U.S. Treasury bills and corporate bonds, but also consists of relatively risky assets such as precious metals. In contrast, USDC and BUSD are backed by cash deposited in U.S. banks, short-term U.S. Treasury bills, and other relatively low-risk assets such as reverse repo contracts collateralized by U.S. treasuries. Moreover, the issuers of USDC and BUSD are based in the United States and regulated by U.S. authorities, unlike the issuer of USDT, which is not based in the United States.

Stablecoins backed by traditional financial assets resemble the structure of money market mutual funds (MMFs). Users can mint new coins by depositing dollars with the issuer. When users want to withdraw their dollars, they send their stablecoins back to the issuer, who returns dollars to users’ bank accounts. To be sure, there are important differences. First, MMFs are regulated by the Securities and Exchange Commission under Rule 2a-7, which sets minimum portfolio liquidity and maturity standards, among other things, while stablecoins are not. Second, stablecoins are traded on multiple exchanges, whereas MMF shares are not traded on exchanges. Finally, stablecoin units can be used as collateral in decentralized finance protocols, increasing the interconnection between different blockchain applications, whereas tokenization of MMF shares is nascent.

Other stablecoins, in contrast, are backed by volatile cryptoassets; DAI, for instance, can be backed by Ether, the native cryptocurrency of the decentralized, open-source blockchain Ethereum. In order for the peg to be credible, every dollar of DAI is backed by more than one dollar worth of Ether; that is, DAI is overcollateralized. Another important feature of DAI is that it is decentralized: DAI can be created by depositing collateral in smart contracts, which are programs executed by miners on a blockchain (Ethereum in the case of DAI) that run when predetermined conditions are met. In order to mint DAI, an investor deposits the collateral in the smart contract; in order to redeem DAI, the investor deposits the DAI in the smart contract and receives back the collateral. Importantly, if the value of the collateral drops below the minimum collateralization level required by the contract, any user can call a function on the contract to liquidate the collateral through an auction and receive a percentage of the collateral as a reward. This feature makes DAI very different from the stablecoins described above and also from MMFs. In addition to Ether, DAI can be backed by other cryptoassets including Bitcoin, USDC, and, more recently, tokenized mortgages, with MakerDAO—the decentralized autonomous organization regulating and maintaining DAI—setting the required level of collateralization for each asset.

A third type of stablecoin, algorithmic stablecoins, are backed by an algorithmic mechanism that is supposed to maintain the peg. The most prominent algorithmic stablecoin used to be Terra, which at its peak had a market capitalization of over $18 billion. The developers of Terra created two cryptoassets: TerraUSD (UST)—designed to be stable—and Luna—designed to fluctuate over time, similarly to Bitcoin. Any investor in Terra had access to a smart contract that allowed them to create or redeem one unit of UST for one dollar worth of Luna. For instance, if the price of Luna was $10, the smart contract would exchange one Terra for 0.1 units of Luna. Therefore, irrespective of the price of Luna—as long as it was greater than zero—the value of UST should have been $1 due to an arbitrage opportunity. For instance, if the price of UST dropped to 99 cents, traders could profit by buying UST and exchanging it for Luna—profiting 1 cent per token. Such arbitrage trading would drive the price of UST up due to an increase in demand and, at the same time, reduce the supply due to the exchange of Terra tokens for Luna tokens. Conversely, if the price of UST was at $1.01, arbitrageurs could profit by buying $1 worth of Luna, transforming into UST and obtaining $1.01, yielding a profit of 1 cent.

This algorithmic mechanism, however, relied on investors being willing to buy Terra whenever its price dropped below one; this was not always the case. In particular, Terra redemptions increased the supply of Luna. As the price of Luna dropped due to the increase in its supply, each dollar redeemed out of Terra triggered an even greater increase of the supply of Luna. For instance, if Luna traded at $0.1, redeeming one unit of Terra would create ten units of Luna; but if Luna dropped to $0.01, redeeming one unit of Terra would create 100 units of Luna. At some point, investors would be unwilling to buy Terra even if its price dropped below $1 because it would be backed by an asset, Luna, whose price was rapidly declining.

The Run on Terra

Indeed, that’s exactly what happened in May 2022. Terra, the fourth largest stablecoin at the time, suffered a run and a subsequent collapse, with its circulation dropping by almost 8 billion and its market capitalization dropping by $18.47 billion by the end of the month. As Terra suffered heavy redemptions, the supply of Luna increased from 365 million units on May 9, to more than 6 trillion units by May 13. Between May 7 and May 8, the algorithmic mechanism broke, and Terra broke the peg, with its price dropping from $0.9964 to $0.7934.

In about a week, between May 7 and May 16, the crash wiped out $17.17 billion in Terra’s market value and $20.77 billion in Luna’s market value. The run quickly propagated to other stablecoins, including USDT and DAI. U.S.-based stablecoins backed by traditional safe financial assets, however, such as USDC and BUSD, received significant inflows during the same period as investors moved from riskier stablecoins to less risky ones. In particular, circulation dropped by 8.70 billion units for algorithmic stablecoins and by 2.25 billion units for crypto-collateralized stablecoins; in contrast, the circulation of U.S.-based stablecoins increased by 3.88 billion units. This dynamic is similar to what we have observed in recent runs on the MMF industry, when investments flowed from riskier prime funds to less risky government funds. And as with MMF runs, stablecoin runs can propagate to broader asset classes; the May 2022 stablecoin run, for instance, affected the broader crypto market, with approximately $200 billion in crypto market value (beyond stablecoins) being wiped out over eight days.

Summing Up

In May 2022, there was a run on Terra, an algorithmic stablecoin whose price broke its peg of $1 and crashed to zero. The run spilled over to the entire stablecoin sector, with stablecoins backed by riskier assets heavily affected and investors fleeing to less risky U.S.-based stablecoins regulated by U.S. authorities. As the digital asset ecosystem continues to grow, its potential to affect traditional financial markets and a broader section of households and firms could grow accordingly.

Kenechukwu Anadu is vice president at the Federal Reserve Bank of Boston.

Pablo Azar is a financial research economist in Money and Payments Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Marco Cipriani is head of Money and Payments Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Thomas M. Eisenbach is a financial research advisor in Money and Payments Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Catherine Huang is a research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Mattia Landoni is a senior financial economist at the Federal Reserve Bank of Boston.

Gabriele La Spada is a financial research economist in Money and Payments Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Marco Macchiavelli is an assistant professor of finance at University of Massachusetts Amherst.

Antoine Malfroy-Camine is a senior risk analyst at the Federal Reserve Bank of Boston.

J. Christina Wang is a senior economist and policy advisor at the Federal Reserve Bank of Boston.

How to cite this post:

Kenechukwu Anadu, Pablo D. Azar, Marco Cipriani, Thomas Eisenbach, Catherine Huang, Mattia Landoni, Gabriele La Spada, Marco Macchiavelli, Antoine Malfroy-Camine, and J. Christina Wang, “Runs on Stablecoins,” Federal Reserve Bank of New York Liberty Street Economics, July 12, 2023, https://libertystreeteconomics.newyorkfed.org/2023/07/runs-on-stablecoins/

BibTeX: View |

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics