Editors Note: The title of this post has been changed from the original. August 17, 2023, 10:35 a.m.

Inflation in the U.S. has experienced unusually large movements in the last few years, starting with a steep rise between the spring of 2021 and June 2022, followed by a relatively rapid decline over the past twelve months. This marks a stark departure from an extended period of low and stable inflation. Economists and policymakers have expressed differing views about which factors contributed to these large movements (as reported in the media here, here, here, and here), leading to fierce debates in policy circles, academic journals, and the press. We know little, however, about the consumer’s perspective on what caused these sudden movements in inflation. In this post, we explore this question using a special module of the Federal Reserve Bank of New York’s Survey of Consumer Expectations (SCE) in which consumers were asked what they think contributed to the recent movements in inflation. We find that consumers think supply-side issues were the most important factor behind the 2021-22 inflation surge, while they regard Federal Reserve policies as the most important factor behind the recent and expected future decline in inflation.

The SCE is a monthly, nationally representative, internet-based survey of a rotating panel of roughly 1,300 household heads that has been conducted by the New York Fed since June 2013. In addition to its regular monthly survey containing a fixed core set of questions, the SCE conducts occasional “special surveys” of a subset of former SCE panelists fielded on an ad hoc basis to address timely policy-relevant questions. Here, we focus on a special survey fielded from June 7 to June 20, 2023, with 2,155 respondents. In the survey, we asked respondents what they think the twelve-month rate of inflation was at three distinct points in time: (1) before the COVID-19 pandemic (in 2019), (2) over the twelve-month period between June 2021 and June 2022, and (3) over the past twelve months (between June 2022 and June 2023). In addition, we elicited respondents’ expectations for the rate of inflation over the next twelve months (between June 2023 and June 2024).

We used the responses for inflation perceptions and future expectations to ask tailored questions about which factors respondents think contributed to the changes in inflation over three separate periods: between 2019 and June 2022 (when actual inflation surged), between June 2022 and today (when inflation started declining), and between today and one year from now. We presented a list of possible factors and asked respondents to rate the extent to which they believe each contributed (or will contribute) to the perceived (or expected) change in the rate of inflation over a given period using a Likert scale between 1 (not at all important) and 5 (very important).

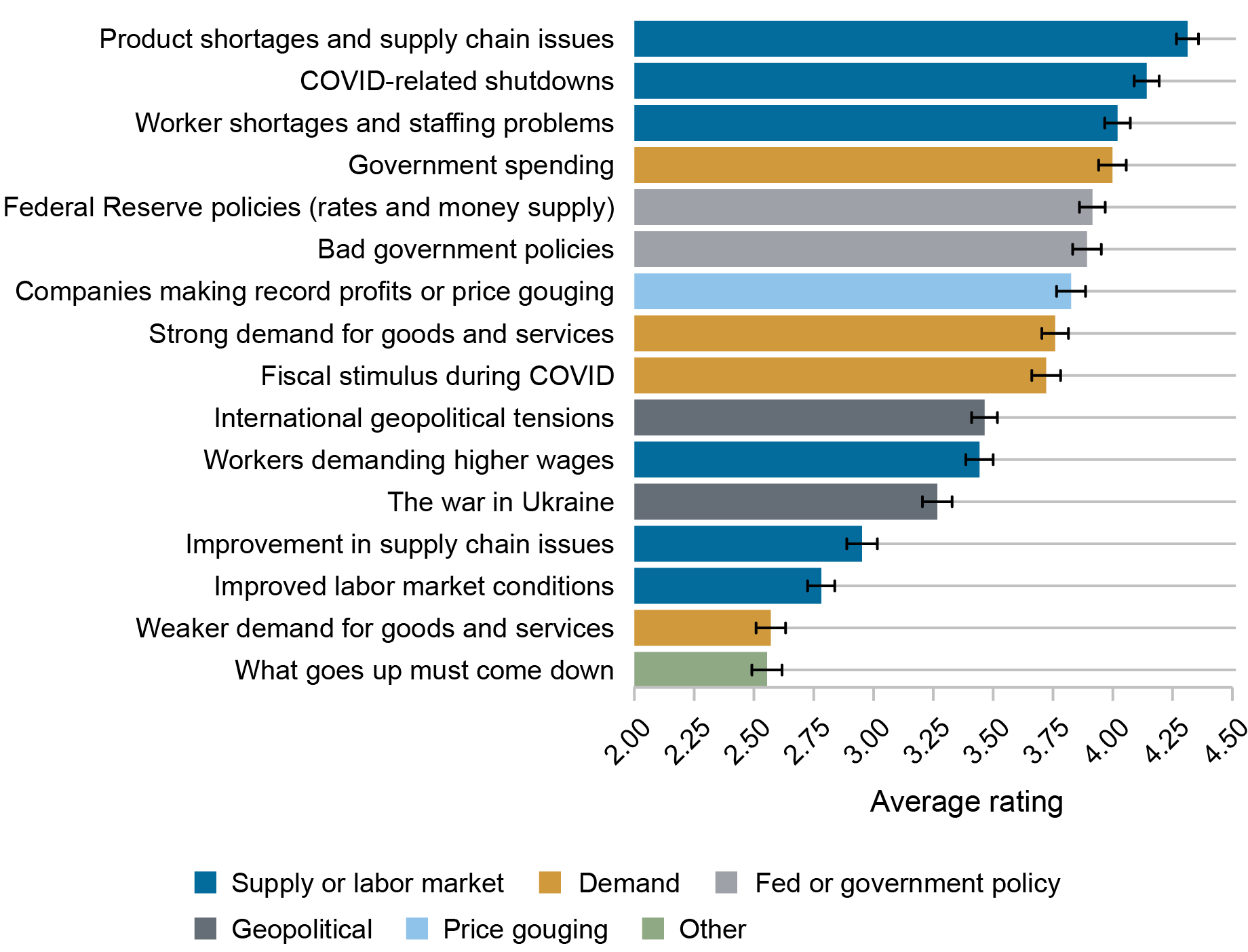

Starting with the earliest period, we find that most respondents (80 percent) think that inflation rose between 2019 and June 2022. As shown in the chart below, the top three factors respondents rated as the most important contributors to the increase are all supply-related: “Product shortages and supply chain issues,” “COVID-related shutdowns,” and “Worker shortages and staffing problems.” In particular, 86 percent of these respondents rated “Product shortages and supply chain issues” as the highest of the sixteen factors they were asked to rate. This result is consistent with the view that the surge in inflation over this period was due to binding capacity constraints (see for instance here). The relative consensus among consumers that supply-side factors were the highest-rated contributors to the 2021-22 surge in inflation is quite striking compared to the divergence of views that still appears to persist among economists and practitioners, mentioned in the first paragraph above.

Importance of Factors in Contributing to the Inflation Increase between 2019 and June 2022

Source: New York Fed Survey of Consumer Expectations.

Notes: The chart shows the average importance rating assigned to each factor as a contributor to the change in inflation among the 1,698 respondents who perceived an increase in inflation between 2019 and June 2022. A rating of 1 means “not at all important” while a rating of 5 means “very important.”

The next three factors ranked highest by consumers in the chart above are a combination of demand-side and Federal Reserve or government policies, indicating that consumers recognize that fiscal and monetary policy may have played a role in the rise of inflation. The next factor, “Companies making record profits or price gouging,” is ranked somewhat lower, perhaps surprisingly in light of recent discussions of possible “greedflation” and price gouging (see for instance here and here). Similarly, strong demand for goods and services and fiscal stimulus, which were initially predicted to have large impacts on inflation (see here), were not ranked among the most important contributors to the rise in inflation—consistent with recent findings. Finally, despite its impact on oil and food prices, consumers rated the war in Ukraine as only a modestly important contributor to inflation over this period. Some of the effect, however, may have been captured by other factors such as “Product shortages and supply chain issues.”

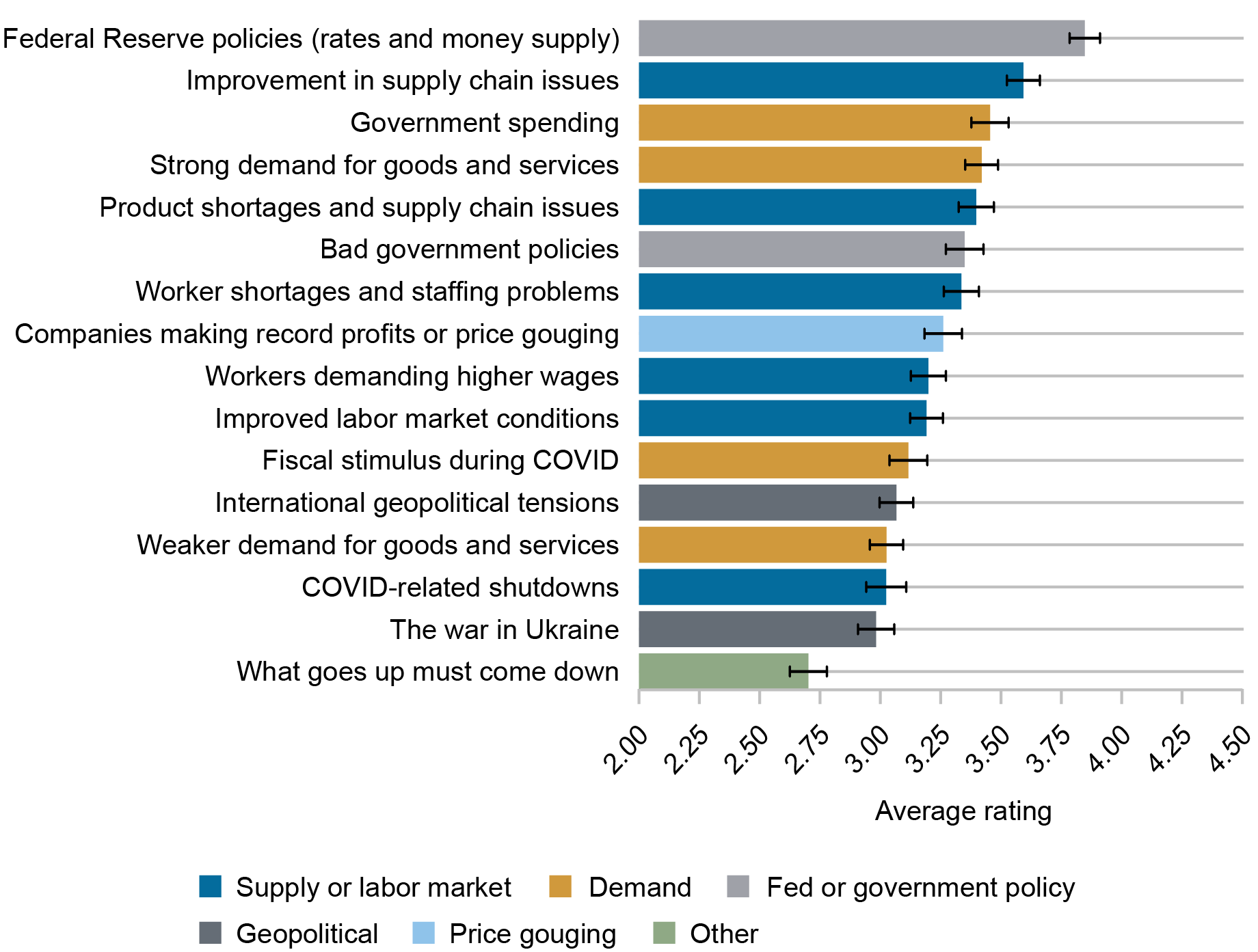

Turning now to the most recent period between June 2022 and June 2023, the chart below shows that respondents who perceived a decrease or a stabilization in inflation over the past year attributed this change first and foremost to “Federal Reserve policies (rates and money supply),” followed by “Improvement in supply chain issues.”

Importance of Factors in Contributing to the Inflation Decrease between June 2022 and June 2023

Source: New York Fed Survey of Consumer Expectations.

Notes: The chart shows the average importance rating assigned to each factor as a contributor to the change in inflation among the 1,171 respondents who perceived a decrease or no change in inflation from June 2022 to June 2023. A rating of 1 means “not at all important” while a rating of 5 means “very important.”

The next chart shows that the same two factors were also ranked highest by the 82 percent of respondents who expect a decline or a stabilization in inflation over the coming year.

Importance of Factors in Contributing to the Expected Inflation Decrease between June 2023 and June 2024

Source: New York Fed Survey of Consumer Expectations.

Notes: The chart shows the average importance rating assigned to each factor as a contributor to the change in inflation among the 1,744 respondents who expect a decrease or no change in inflation between June 2023 and June 2024. A rating of 1 means “not at all important” while a rating of 5 means “very important.”

Our results suggest that consumers believe supply chain issues—a deterioration first followed by improvements—was among the main reasons behind the sharp inflation movements the U.S. economy has experienced since 2020. That consumers cite Federal Reserve policies as the most important factor behind the recent and expected future decrease in inflation may seem at odds with recent academic research at first. Several studies (see for instance here and here) suggest that American consumers tend to be imperfectly informed about the policies of the Federal Reserve (for example, they know little about the Federal Reserve’s inflation target or forward guidance), which could limit the effectiveness of monetary policy. However, these studies were conducted before the surge in inflation of 2021, at a time when inflation was low and stable. The authors of these studies acknowledge that in such an environment, consumers may be more inattentive to inflation and monetary policy. In contrast, in periods of high or changing inflation, consumers may pay more attention to inflation and the actions of the Federal Reserve (for a recent study showing evidence on this, see here). Our results provide support to this hypothesis. Indeed, we find that consumers today know enough about the Federal Reserve to recognize its policies as the most important factor behind the recent and expected future decline in inflation.

Chart data ![]()

Felix Aidala is a research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Olivier Armantier is the head of Consumer Behavior Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Fatima Boumahdi is a senior research analyst in the Bank’s Research and Statistics Group.

Gizem Kosar is a research economist in Consumer Behavior Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Devon Lall is a research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Jason Somerville is a research economist in Consumer Behavior Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Giorgio Topa is an economic research advisor in Labor and Product Market Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Wilbert van der Klaauw is an economic research advisor on Household and Public Policy Research in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Felix Aidala, Olivier Armantier, Fatima Boumahdi, Gizem Kosar, Devon Lall, Jason Somerville, Giorgio Topa, and Wilbert van der Klaauw, “Consumers’ Perspectives on the Recent Movements in Inflation,” Federal Reserve Bank of New York Liberty Street Economics, August 17, 2023, https://libertystreeteconomics.newyorkfed.org/2023/08/consumers-perspectives-on-the-recent-movements-in-inflation-expectations/

BibTeX: View |

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics