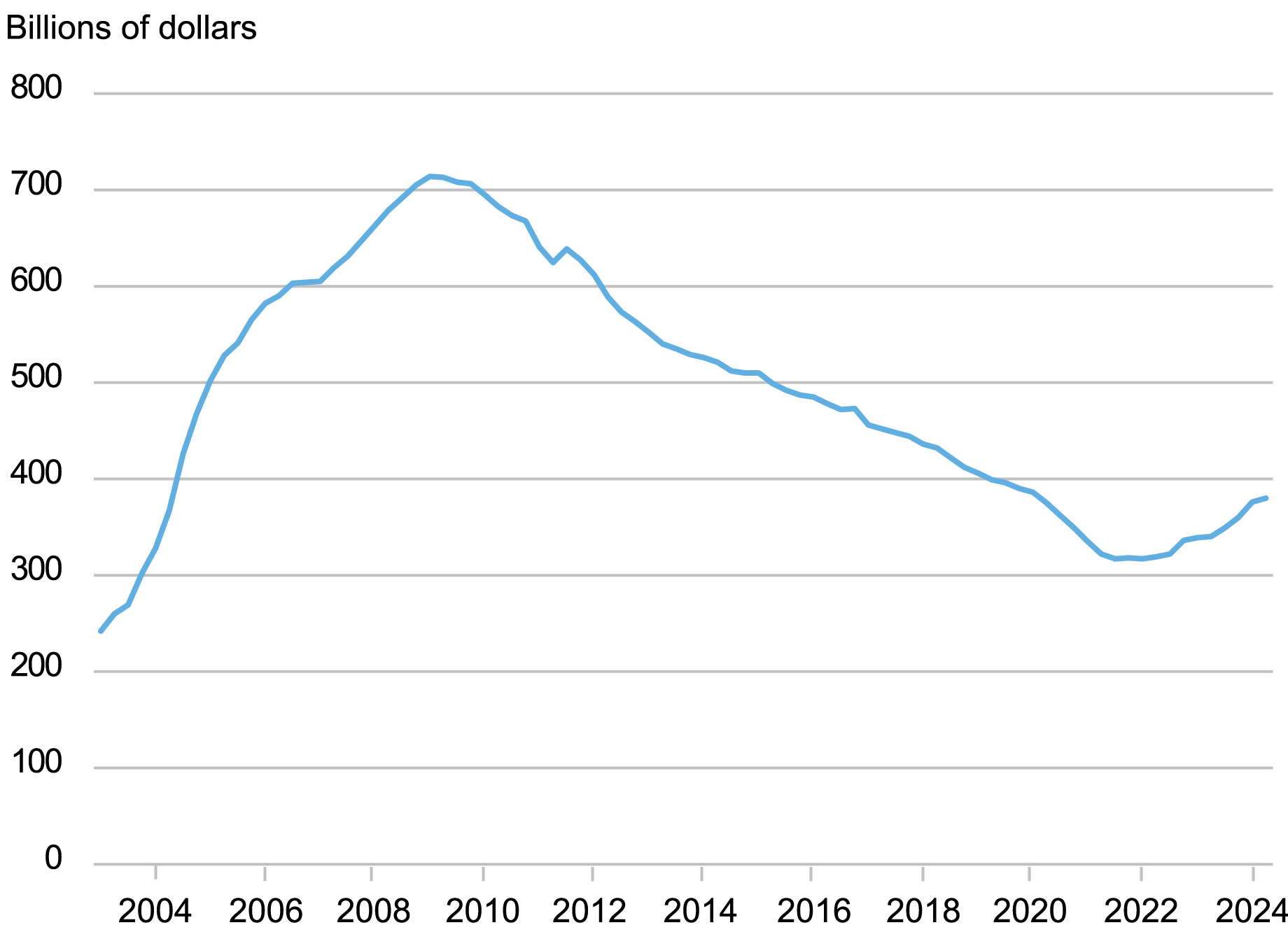

Mortgage balances, the largest component of U.S. household debt, grew by only $77 billion (0.6 percent) in the second quarter of 2024, according to the latest Quarterly Report on Household Debt and Credit from the New York Fed’s Center for Microeconomic Data. This modest increase reflects a substantial slowdown in mortgage origination; only $374 billion was originated during the second quarter, compared to an average of about $1 trillion per quarter between 2021 and 2022. Meanwhile, after nearly thirteen years of decline, balances on home equity lines of credit (HELOC) have begun to rebound, gaining 20 percent since bottoming out at the end of 2021. In this post, we consider the factors behind this upswing, finding that HELOCs have likely become an attractive alternative to cash-out refinancings amid higher interest rates.

Note: This analysis and the Quarterly Report are based on the New York Fed’s Consumer Credit Panel, which is comprised of credit report data from Equifax.

HELOC Balances Have Risen 20 Percent since 2021

Source: New York Fed Consumer Credit Panel / Equifax.

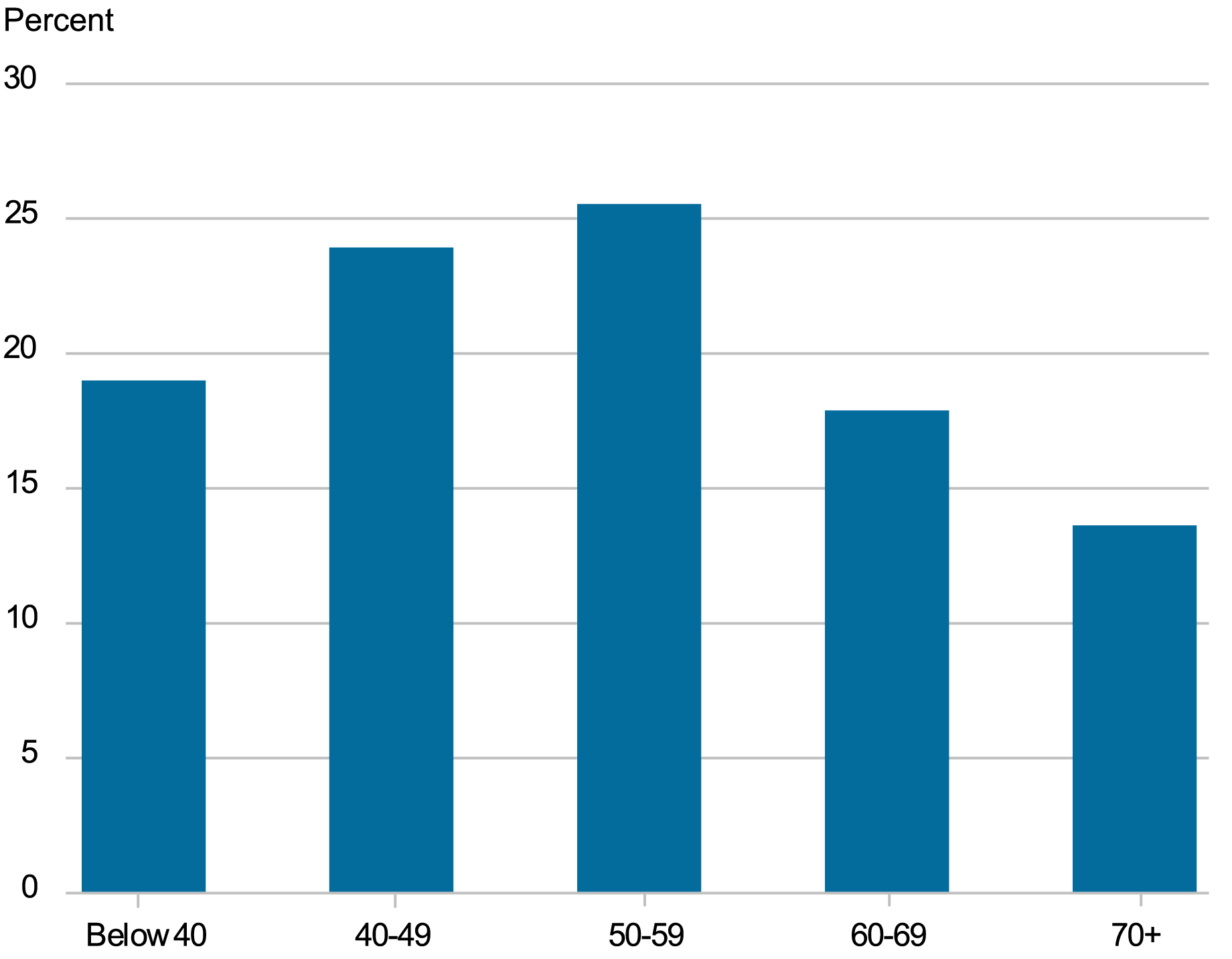

Approximately 1.3 million HELOCs were originated in 2023, and then 0.5 million through the second quarter of 2024. HELOCs are typically originated to homeowners with significant home equity and, therefore, the average HELOC borrower is older than the average mortgage borrower. Of these 1.8 million HELOCs, about 57 percent went to borrowers aged 50 and older, with about 24 percent going to borrowers in their 40s and 19 percent going to younger borrowers.

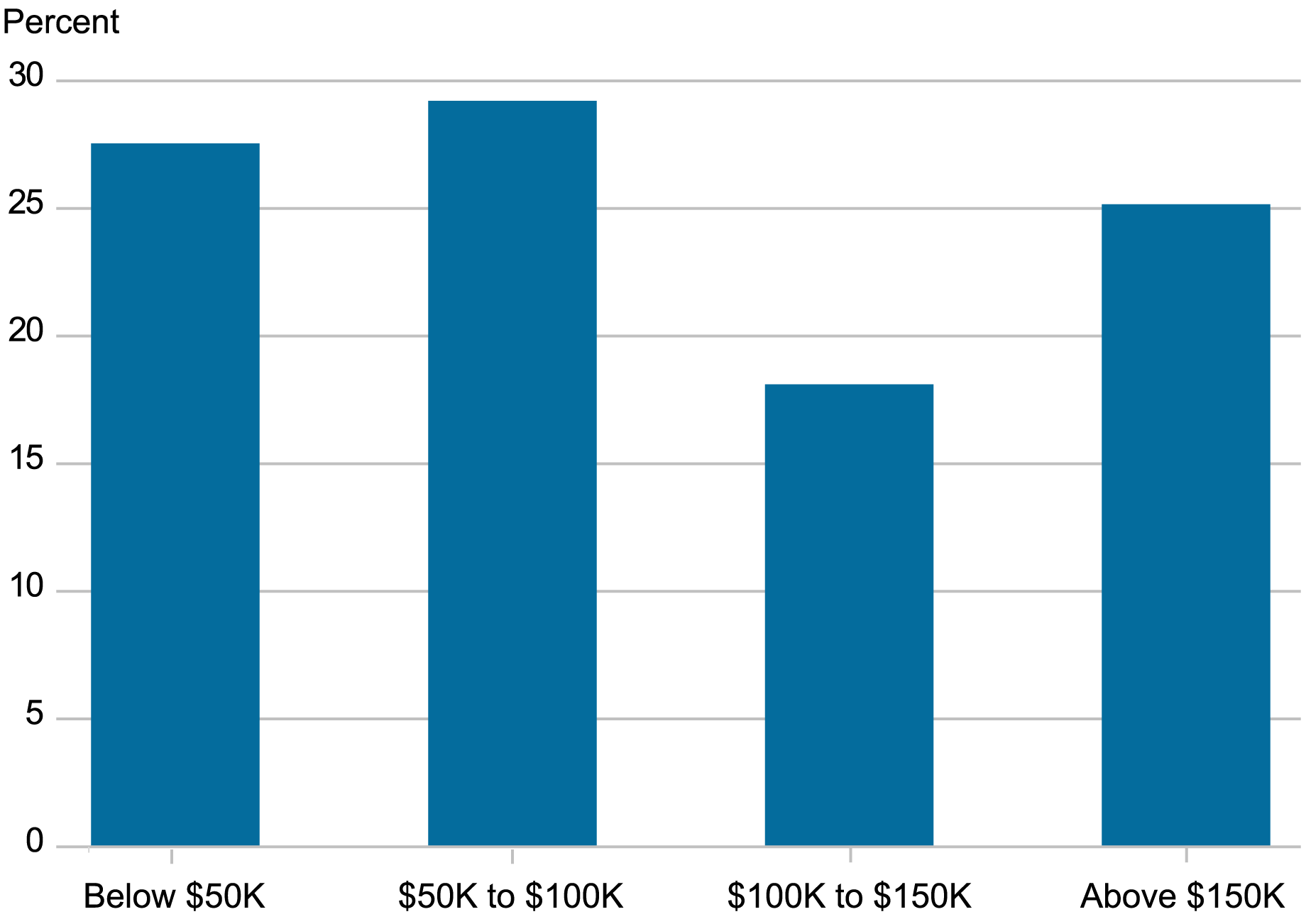

Since HELOCs are secured by owners’ equity in their homes, HELOC credit limits are generally a function of a home’s value, such that the combined total of the first mortgage and HELOC limit are capped at a certain percentage of the home value, typically 80 percent. About 28 percent of the 1.8 million HELOCs originated in 2023-24 had limits below $50,000, with about 29 percent in the $50,000–$100,000 range and about 18 percent in the $100,000–$150,000 range; the remaining 25 percent had credit limits above $150,000. As the value of home equity varies greatly, some HELOCs have very high limits: about 1 percent of HELOCs originated over this time had limits higher than $650,000.

HELOC Originations by Age Group, 2023:Q1-2024:Q2

Source: New York Fed Consumer Credit Panel / Equifax, authors’ calculations.

HELOC Originations by Credit Limit, 2023:Q1-2024:Q2

Sources: New York Fed Consumer Credit Panel / Equifax, authors’ calculations.

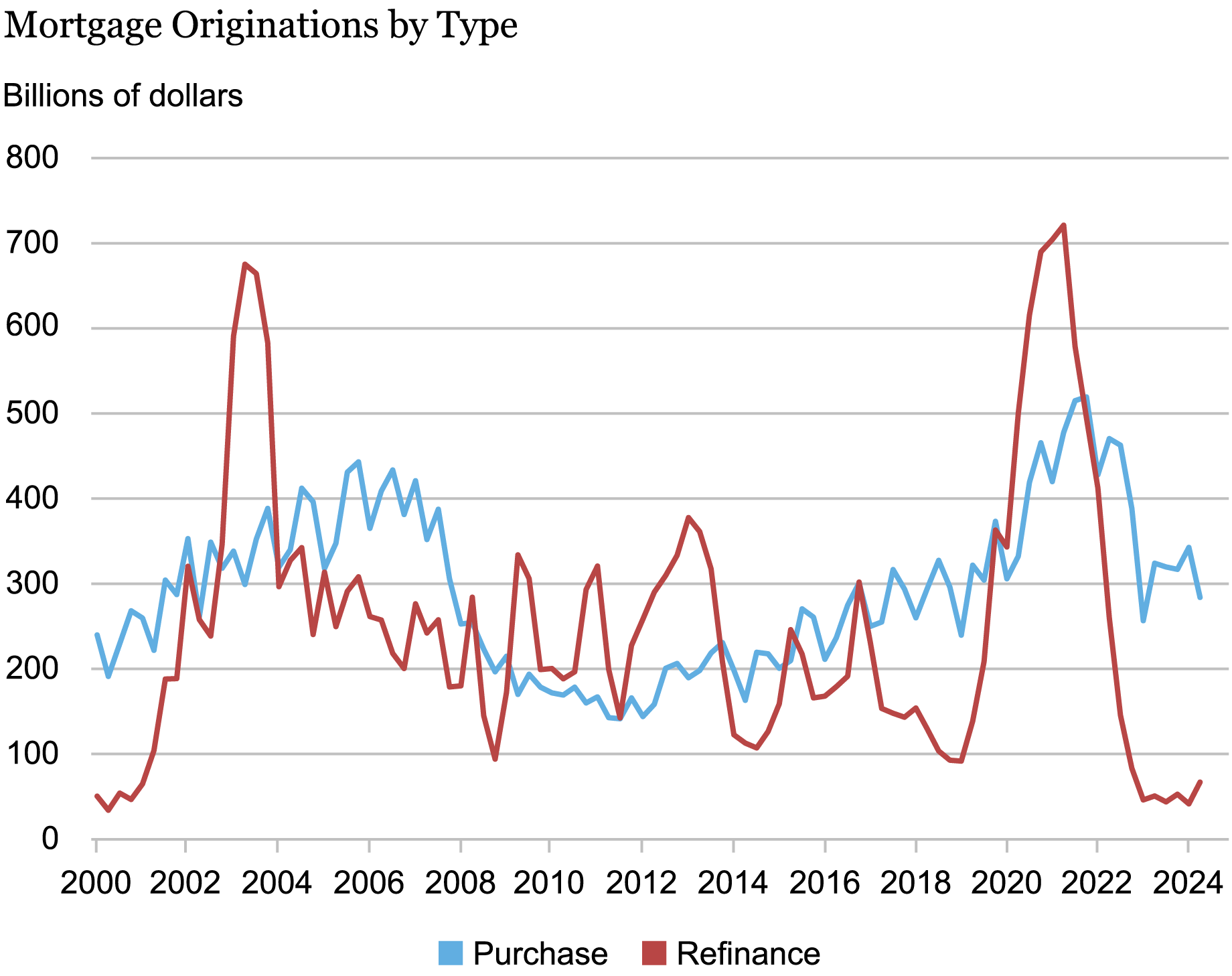

Why do we see a rebound in HELOC originations when interest rates are higher? Since the cost of borrowing through a HELOC has risen as interest rates have increased, shouldn’t demand go down? Well, in this case it depends on the cost of the closest alternative to a HELOC, namely a cash-out refinancing of a first mortgage. Between 2020 and 2022, historically low rates on mortgages induced many borrowers to refinance. In the chart below, we present mortgage originations, broken into purchase and refinance categories. Refinance originations, shown in red, experienced a bit of a boom during this period of unusually low mortgage rates, rising as high as $700 billion per quarter in 2021; that pace has dropped below $100 billion since 2023 amid rising interest rates.

Mortgage Refinances Are Near Record Lows

Source: New York Fed Consumer Credit Panel / Equifax, authors’ calculations.

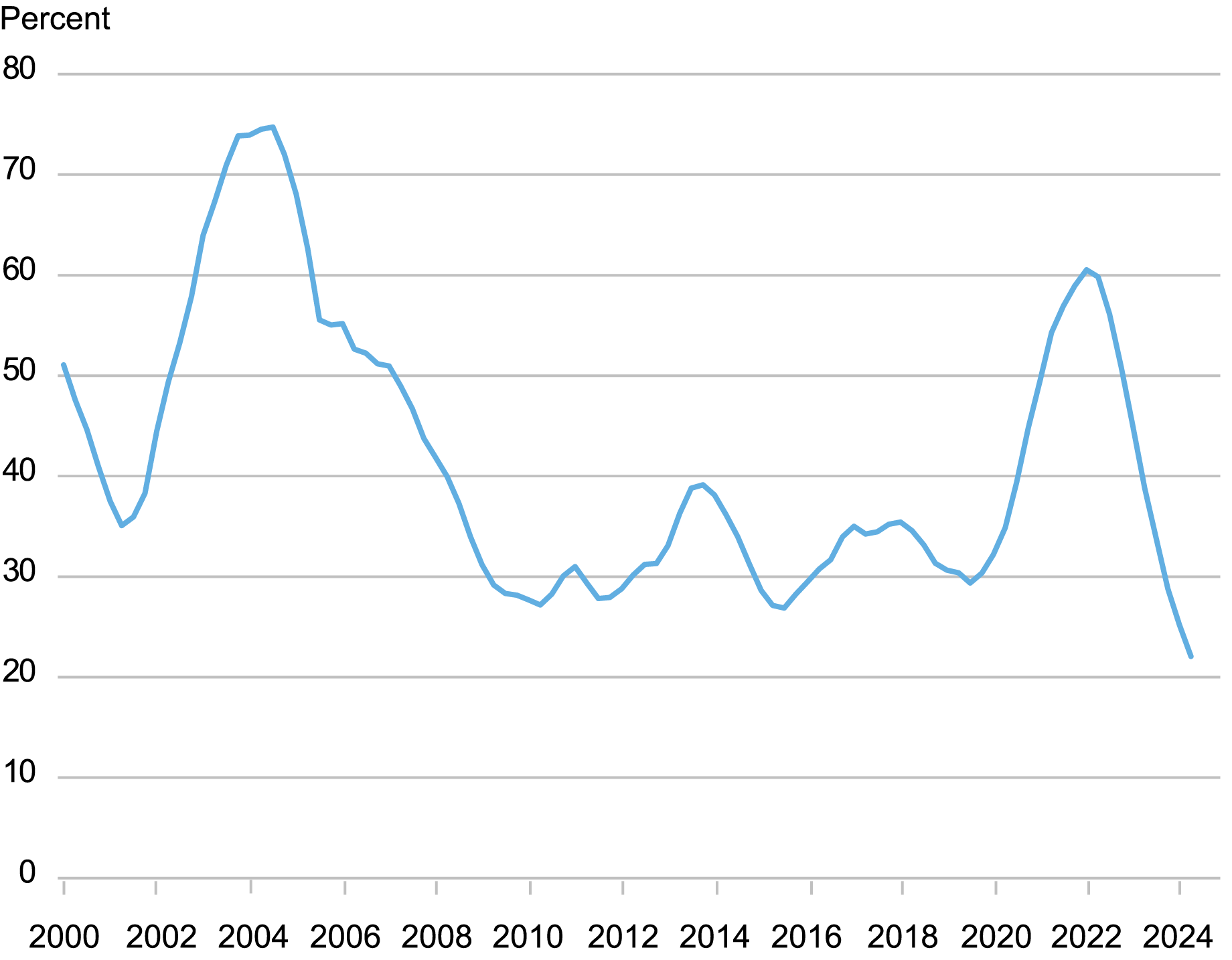

By the second quarter of 2022, more than 60 percent of outstanding mortgage balances had been originated during the previous two-year window—the highest such share since 2005, as shown in the chart below. And as of the second quarter of 2024, the stock of outstanding mortgages was older, by this definition, than observed in the twenty-four prior years. Homeowners are now hanging on to their pandemic-era mortgages (and, for some, their pandemic homes).

Share of Outstanding Mortgage Balance Originated in Past Two Years

Source: New York Fed Consumer Credit Panel / Equifax, authors’ calculations.

When mortgage rates began rising, many of these borrowers who had taken advantage of low interest rates were locked in at rates significantly below the prevailing rates on new mortgages. In fact, by the end of 2023, nearly 70 percent of mortgages outstanding in the United States were set to 3 percentage points lower than the prevailing rate at that time. This effect provided benefits to borrowers in the form of lower monthly mortgage payments and interest expenses; however, it also disincentivized mortgage refinances by borrowers who wanted to extract equity from their homes. A cash-out refinancing would extract equity, but at a significantly higher interest cost than their existing mortgage carries. But with owners’ equity in real estate near a record high, HELOCs provide homeowners with an alternative way to extract that housing wealth—and enable them to retain their lower-rate first mortgage. Given record levels of home equity and the undesirability of cash-out refinancing, one may actually wonder why we are not seeing a larger surge in HELOC originations.

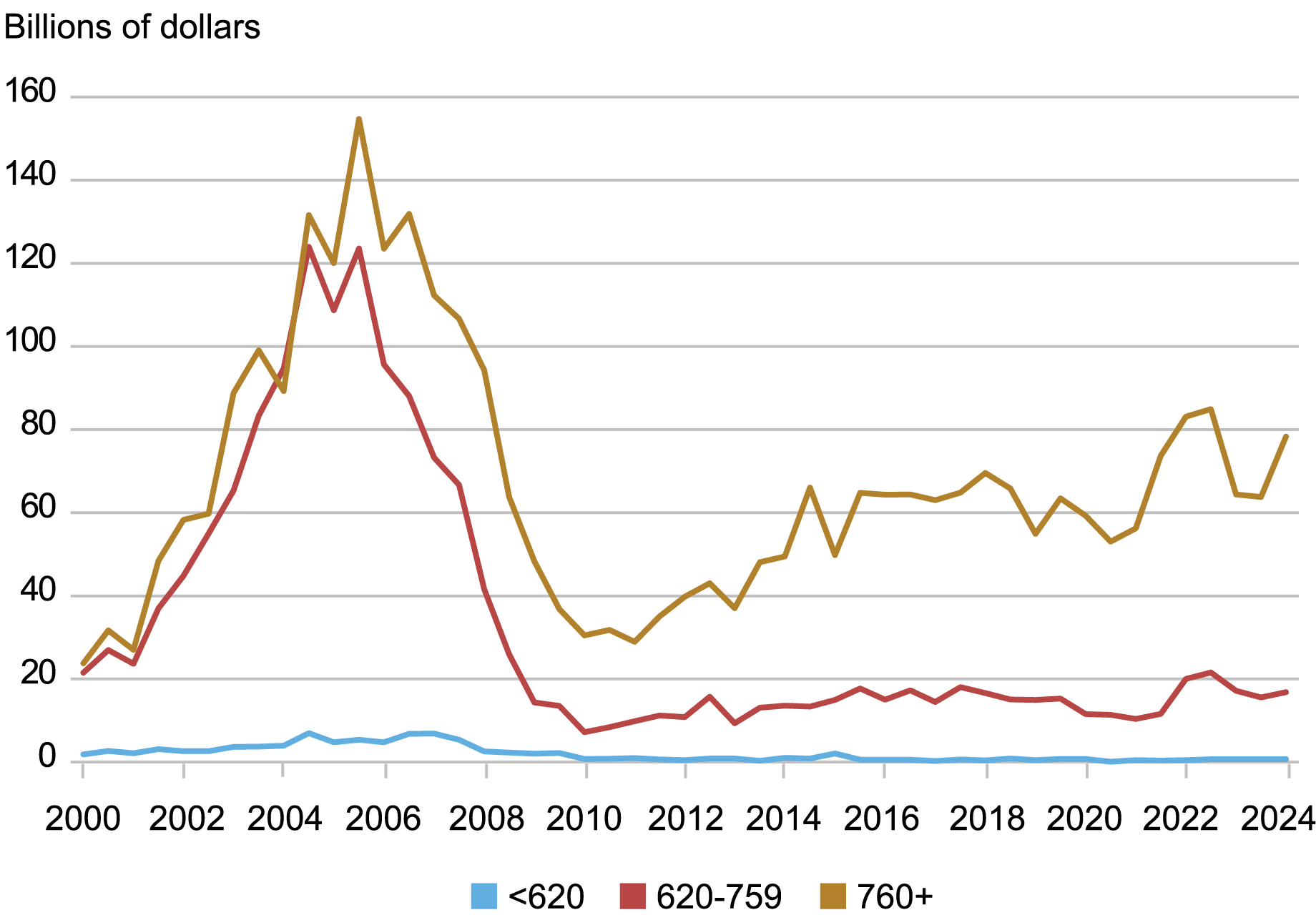

Importantly, underwriting on HELOCs is now much tighter than it was during the housing boom of the early 2000s. HELOCs soared in popularity between 2000 and 2008—and they grew in prevalence across a broader spectrum of credit scores. Since 2010, however, HELOC originations have been overwhelmingly skewed toward high-score borrowers, with only a small share of newly open credit lines going to borrowers with credit scores below 760.

Aggregate Credit Limits of Newly Opened HELOC Lines

By Credit Score at Origination

Source: New York Fed Consumer Credit Panel / Equifax, authors’ calculations.

Will the upswing in HELOC borrowing continue? The answer is not clear to us. On the one hand, existing homeowners are disincentivized to cash-out refinance if they are locked into a mortgage at a rate lower than the prevailing rate, since that would leave them with a higher mortgage interest rate. Additionally, if home prices remain high and the amortization of first mortgages increases available home equity, there could be higher demand for HELOCs. On the other hand, the decline in HELOC use since 2010 was a very strong secular trend, and the increase in HELOCs might prove to be a short-term deviation.

Andrew F. Haughwout is director of Household and Public Policy Research in the Federal Reserve Bank of New York’s Research and Statistics Group.

Donghoon Lee is an economic research advisor in Consumer Behavior Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Daniel Mangrum is a research economist in Household and Public Policy Research in the Federal Reserve Bank of New York’s Research and Statistics Group.

Joelle Scally is a regional economic advisor in the Federal Reserve Bank of New York’s Research and Statistics Group.

Wilbert van der Klaauw is an economic research advisor on Household and Public Policy Research in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Andrew Haughwout, Donghoon Lee, Daniel Mangrum, Joelle W. Scally, and Wilbert van der Klaauw, “Mortgage Lock‑In Spurs Recent HELOC Demand,” Federal Reserve Bank of New York Liberty Street Economics, August 6, 2024, https://libertystreeteconomics.newyorkfed.org/2024/08/mortgage-lock-in-spurs-recent-heloc-demand/

BibTeX: View |

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics