The modern financial system is complex, with funding flowing not just from the financial sector to the real sector but within the financial sector through an intricate network of financial claims. While much of our work focuses on understanding the end result of these flows—credit provided to the real sector—we explore in this post how accounting for interlinkages across the financial sector changes our perception of who finances credit to the real sector.

Direct Lending to the Real Sector

We begin by examining how the composition of direct lenders to the real sector in the U.S. has evolved over time. To do so, we rely on the novel issuer-to-holder (“From-Who-to-Whom”) data from the enhanced financial accounts of the U.S. We define the real sector as the sum of the household and nonfinancial business sectors, and credit as the sum of all types of debt securities and loans (including mortgages). We consider broad categories of financial institutions: monetary financial institutions (or banks), insurance companies, mutual funds, pension funds, government-sponsored enterprises (GSEs), the central bank, and other financial institutions (OFIs).

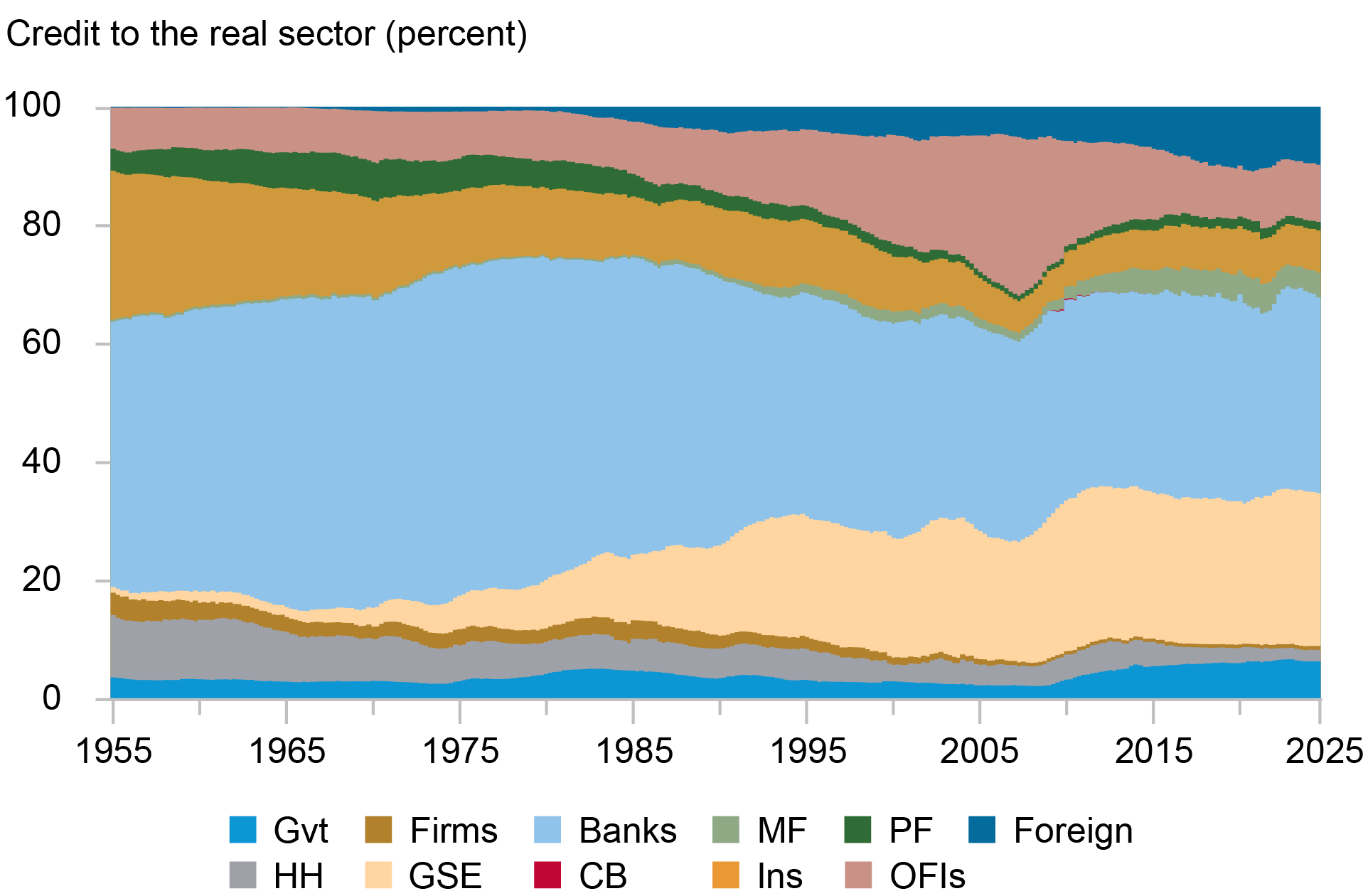

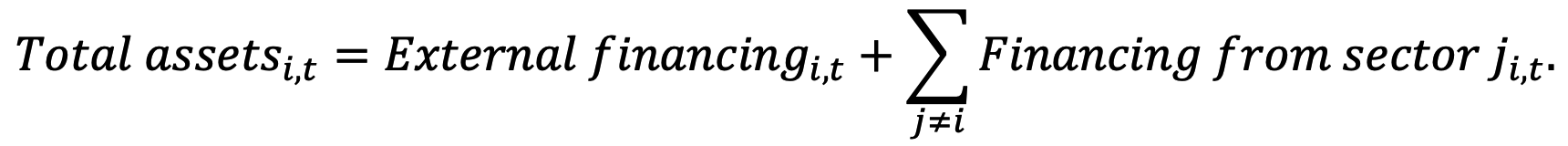

The chart below plots the shares of lending to the real sector, highlighting the well-documented decline in the role of banks as direct lenders to the real sector (from 45 percent in Q1:1955 to 33 percent in Q2:2024). In the lead-up to the global financial crisis (GFC), this decline in the bank share was offset by three sectors: GSEs, OFIs, and the foreign sector. However, while the role of OFIs has since reverted to historical levels, contributions from the GSEs and the foreign sector have continued to increase.

Importance of Banks as a Lender to the Real Sector Has Declined over Time

Notes: The chart shows credit to the real sector by lender sector, in percentages. “Gvt” refers to the government sector, “Firms” to nonfinancial business, “Banks” to monetary financial institutions, “MF” to mutual funds, “PF” to pension funds, “Foreign” to the rest of the world, “HH” to households (and nonprofit institutions serving households), “GSE” to government-sponsored enterprises, “CB” to the central bank, “Ins” to insurance companies, and “OFIs” to other financial institutions.

Tracing the Network of Financial Interconnectedness

In our previous post, we argued that who finances real credit has consequences for subsequent real outcomes. In that context, properly capturing the ultimate lenders to the real sector is paramount. In other words, we need to move beyond measuring only direct lending to the real sector and, instead, consider the role of the network of interlinkages between different parts of the financial sector in channeling funding entering the financial system into real credit.

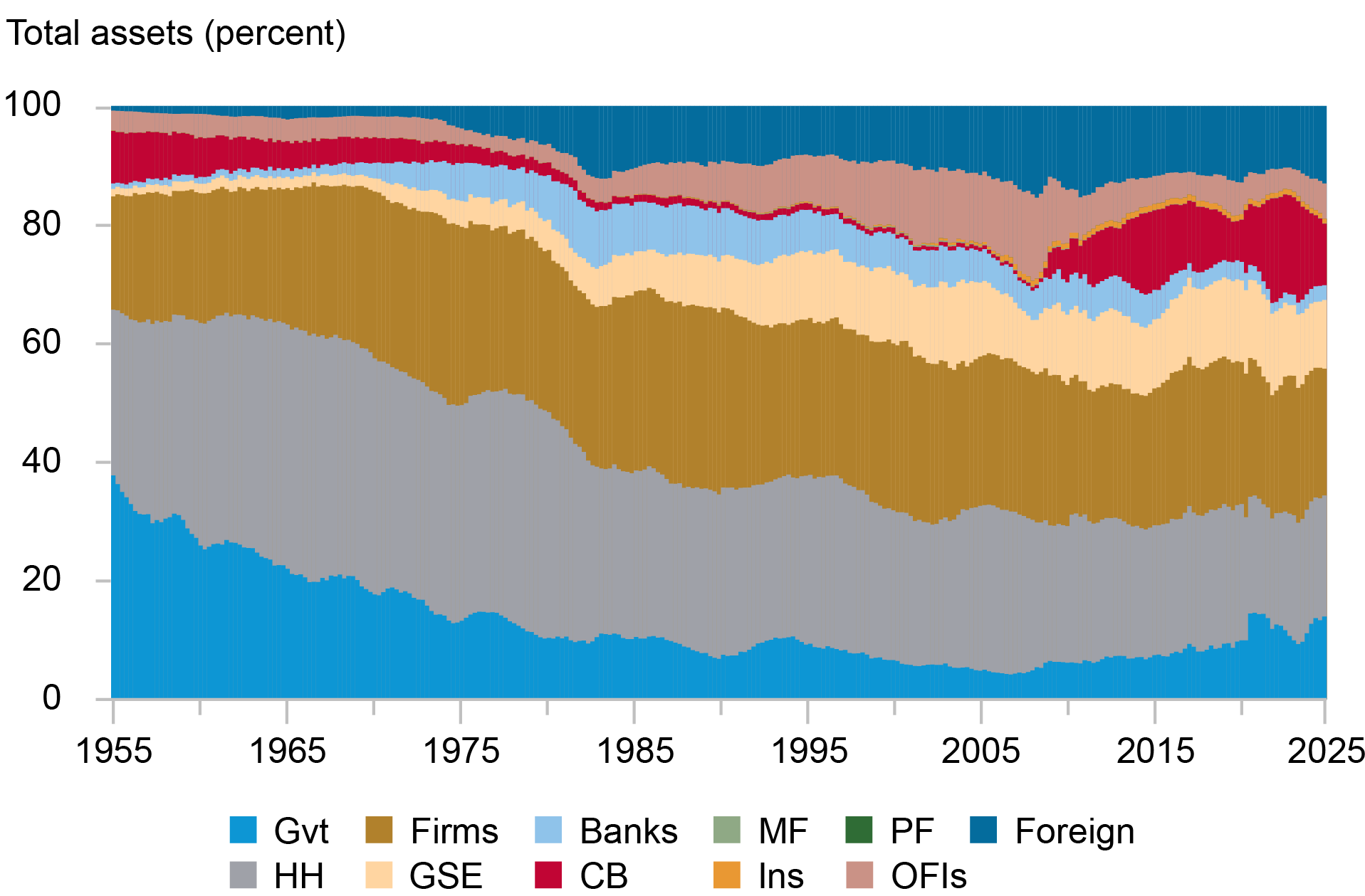

To illustrate the concept of financial sector interlinkages, the next chart decomposes total assets of the banking sector in the U.S. into financial claims issued by other financial sectors, as well as the foreign sector, government, and the real sectors.

Banks Hold Claims on Other Financial Sectors

Notes: The chart shows claims issued by each sector and held by banks as a share of total bank assets, in percentages. “Gvt” refers to the government sector, “Firms” to nonfinancial business, “Banks” to monetary financial institutions, “MF” to mutual funds, “PF” to pension funds, “Foreign” to the rest of the world, “HH” to households (and nonprofit institutions serving households), “GSE” to government-sponsored enterprises, “CB” to the central bank, “Ins” to insurance companies, and “OFIs” to other financial institutions.

While the first chart in this post shows that banks are a declining direct source of credit to the real sector of the economy (households and nonfinancial firms), the chart above shows that financial instruments issued by the real sector are a declining fraction of bank total assets. Instead, a greater portion of bank balance sheets is allocated to claims issued by the GSEs and foreign entities. Furthermore, the expansion in OFIs as a source of credit to the real sector in the run-up to the GFC and its subsequent decline is also mirrored in the share of bank assets allocated to OFI claims. Instead, a substantial fraction of bank assets after the GFC are allocated to central bank reserves (claims on the central bank).

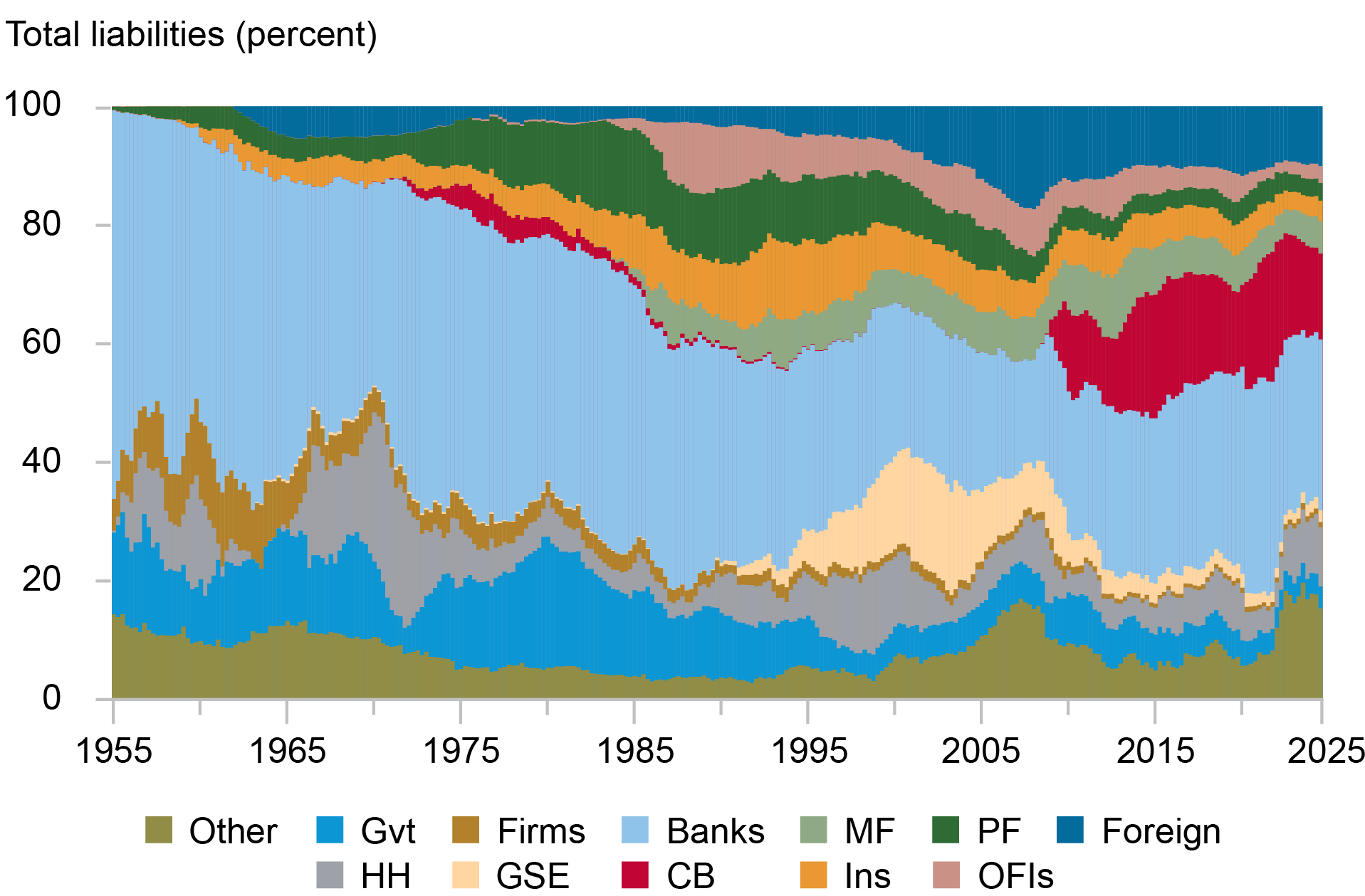

The composition of financial sector liabilities—that is, which sectors hold claims issued by a given part of the financial sector—provides a complementary view to that provided by the composition of assets. The next chart illustrates this idea using the liabilities of the GSEs.

GSEs Are Largely Financed by Other Financial Sectors

Notes: The chart shows holdings of government-sponsored enterprise (GSE) liabilities by each sector as a share of total GSE liabilities, in percentages. “Gvt” refers to the government sector, “Firms” to nonfinancial business, “Banks” to monetary financial institutions, “MF” to mutual funds, “PF” to pension funds, “Foreign” to the rest of the world, “HH” to households (and nonprofit institutions serving households), “GSE” to government-sponsored enterprises, “CB” to the central bank, “Ins” to insurance companies, and “OFIs” to other financial institutions.

The chart shows that the importance of banks as a source of financing for GSEs declined steadily in the run-up to the GFC, with nonbank financial institutions and especially the foreign sector expanding their financing of GSEs. The share of GSE financing provided by banks has recovered since its nadir at the start of the GFC but still represents a much smaller fraction than it did at the start of the sample.

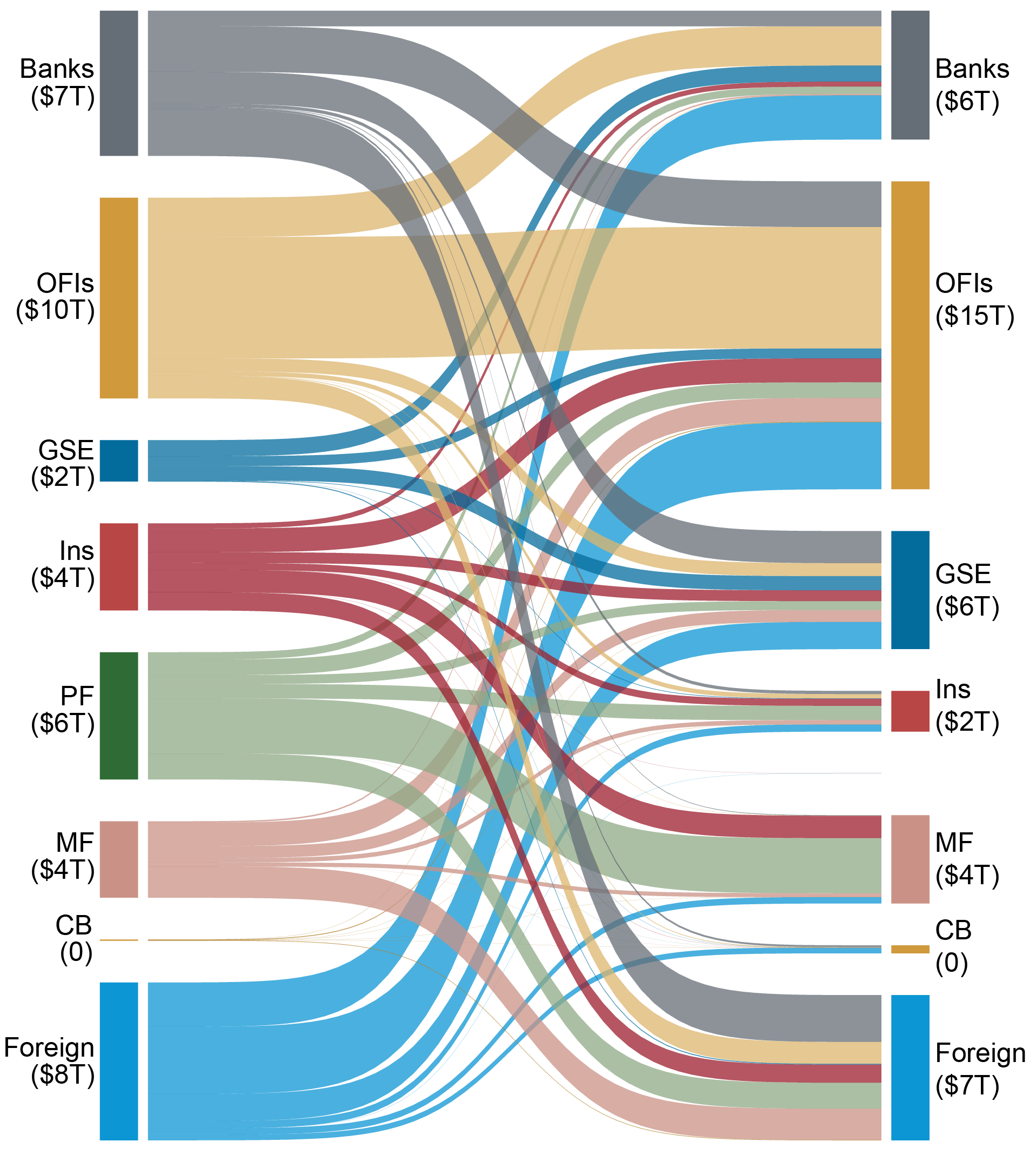

More generally, claims issued by one part of the financial sector and held by a different part of the financial sector create a network of interlinkages within the financial system. The next chart visualizes this network of interlinkages as of Q1:2007, with the sectors that are providers of financing on the left and the sectors that are receiving financing on the right. The chart shows that, on the eve of the GFC, the biggest user of financing was the OFI sector, with a substantial portion of financing provided by the foreign sector.

Complex Financial Sector Interlinkages in Q1:2007

Notes: The chart shows the network of financial sectors’ claims on each other, in trillions. “Banks” refers to monetary financial institutions, “MF” to mutual funds, “PF” to pension funds, “Foreign” to the rest of the world, “GSE” to government-sponsored enterprises, “CB” to the central bank, “Ins” to insurance companies, and “OFIs” to other financial institutions.

In contrast, OFIs were substantially smaller in Q2:2024 (not shown). While the foreign sector was still a large source of financing for OFIs, it also invested a comparable amount in mutual funds and the banking sector. Comparing interlinkages between Q1:2007 and Q2:2024 shows that the complexity of funds flowing within the financial sector has only increased over time.

Accounting for Indirect Lending

While the discussion above highlights the interlinkages within the financial sector, it does not address the question of who the ultimate lender to the real sector is. We now use the information on financial sector interlinkages in each quarter to attribute real credit to the ultimate lender, rather than to the direct lender as we did in the first chart of this post.

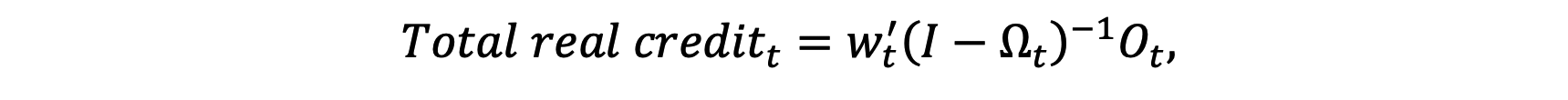

More specifically, since total assets must equal total liabilities for each sector, we decompose each sector’s assets into those financed by other financial sectors—reflecting the financial sector interlinkages we discussed above—and those financed through other sources:

While we abstract here from the details of the network representation, if we express the financing that one sector provides to another as a fraction of total assets of the lender sector, the mathematical expression capturing these interlinkages is

In matrix form, we thus have

The real credit ultimately financed by the foreign sources Ot can thus be written as

where wi,t is the share of each sector’s assets allocated to providing real credit.

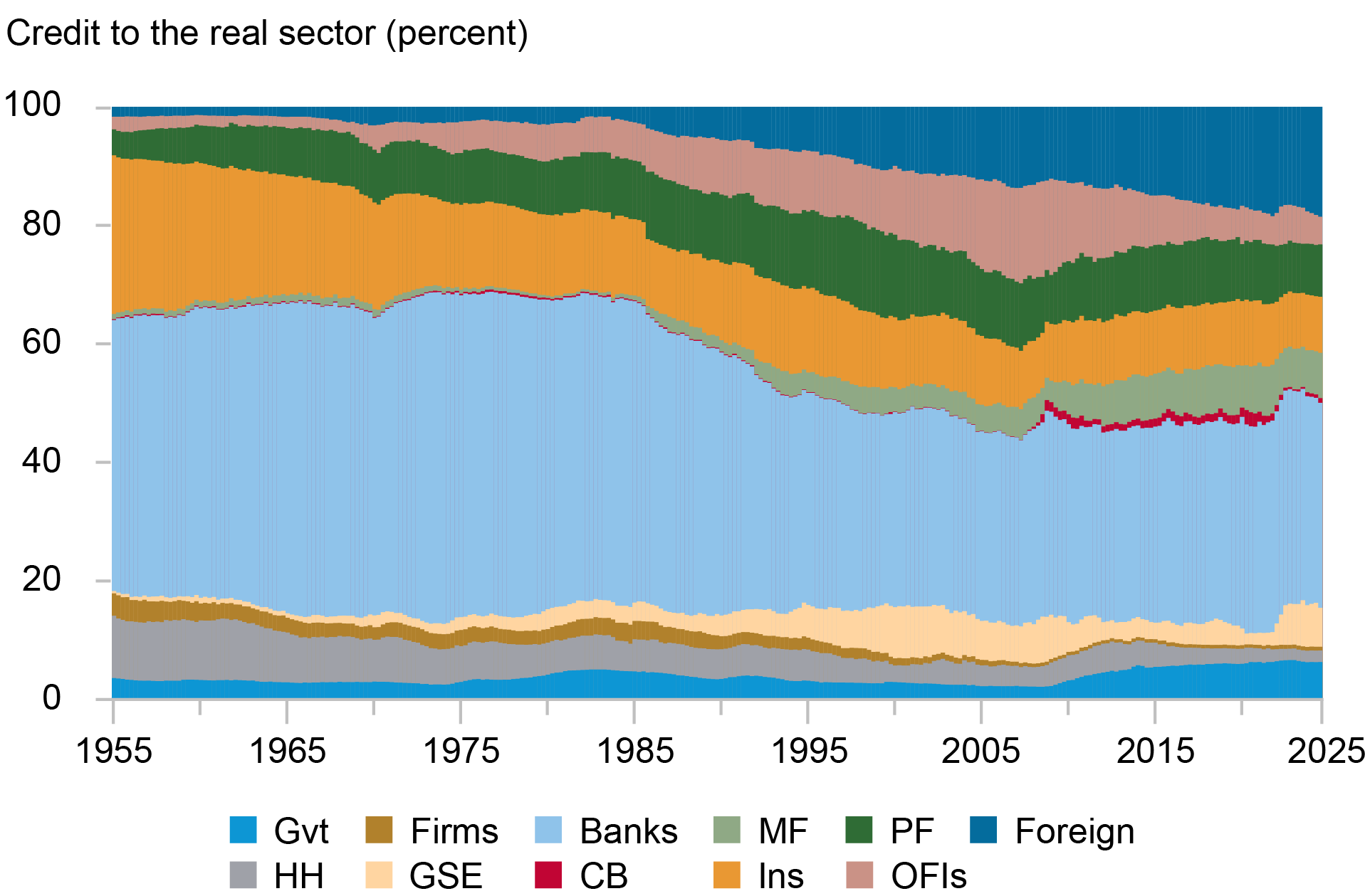

The next chart plots the composition of lenders to the real sector once we account for financial sector interlinkages using the above procedure.

Adjusted Lending to the Real Sector by Insurance Companies, Mutual Funds, Pension Funds, and the Foreign Sector Is Substantially Higher Than Their Direct Lending

Notes: The chart shows the share of real sector direct borrowing and adjusted borrowing by financial sector, in percentages. “Gvt” refers to the government sector, “Firms” to nonfinancial business, “Banks” to monetary financial institutions, “MF” to mutual funds, “PF” to pension funds, “Foreign” to the rest of the world, “HH” to households (and nonprofit institutions serving households), “GSE” to government-sponsored enterprises, “CB” to the central bank, “Ins” to insurance companies, and “OFIs” to other financial institutions.

Comparing this chart to the direct lending chart discussed previously, we see striking differences between direct lending and adjusted real sector lending. While GSEs are a major source of direct real sector lending (over 25 percent as of Q2:2024), they only account for around 7 percent of the adjusted real sector lending. As we saw in the network charts above, GSEs are primarily financed by other financial sectors, so that a relatively small fraction of GSEs’ lending to the real sector is financed outside of the financial sector. Similarly, the adjusted share of credit provided by OFIs is only half of the direct lending share (5 percent and 10 percent, respectively). In contrast, the adjusted share of real credit is higher than the direct share for the foreign sector, pension funds, mutual funds, and insurance companies. That is, these sectors are providing financing to sectors that lend directly to the real economy.

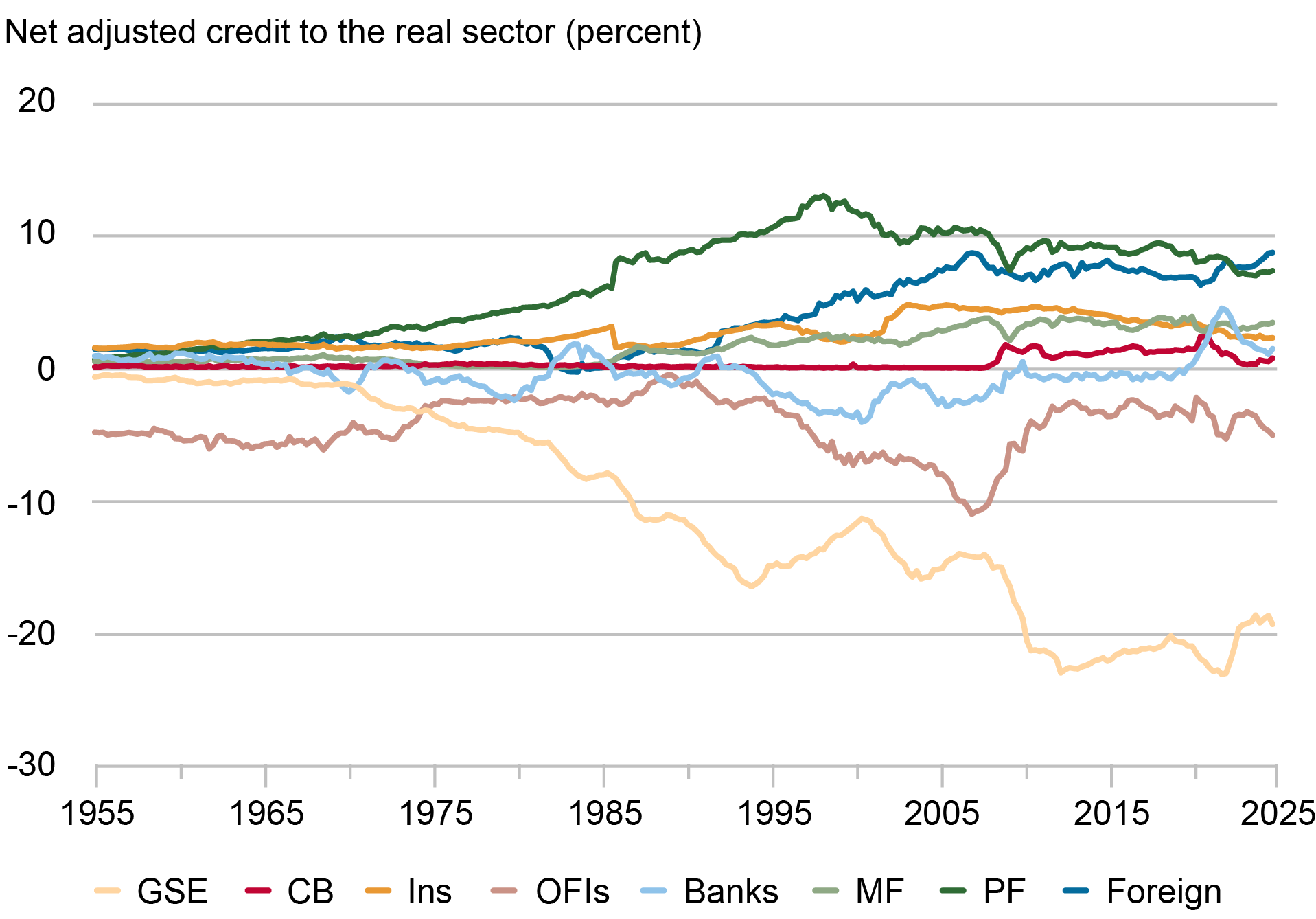

The chart below plots the difference between the adjusted and the direct credit shares for each financial sector, with values below zero indicating that the adjusted share is smaller than the direct share. We see that while the difference between adjusted and direct shares for GSEs stabilized at around -20 percent after the GFC, the importance of the foreign sector as a source of credit to the real sector has continued to grow.

Adjusted Lending to the Real Sector by GSEs and OFIs Is Substantially Lower Than Their Direct Lending

Notes: The chart shows net adjusted credit to the real sector by financial sector, in percentages. “Banks” refers to monetary financial institutions, “MF” to mutual funds, “PF” to pension funds, “Foreign” to the rest of the world, “GSE” to government-sponsored enterprises, “CB” to the central bank, “Ins” to insurance companies, and “OFIs” to other financial institutions.

Wrapping Up

The financial sector in the U.S. economy is deeply interconnected. Incorporating information about this network of financial claims leads to a substantial reallocation of the accounting of lending to the real sector. While the financial stability implications of direct lending may be different from those of lending intermediated through other parts of the financial system, our results highlight a different picture of exposures to risks originating in the real sector.

Nina Boyarchenko is a financial research advisor in the Federal Reserve Bank of New York’s Research and Statistics Group.

Hyuntae Choi is a research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Leonardo Elias is a financial research economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Nina Boyarchenko, Hyuntae Choi, and Leonardo Elias, “Who Finances Real Sector Lenders?,” Federal Reserve Bank of New York Liberty Street Economics, May 12, 2025, https://libertystreeteconomics.newyorkfed.org/2025/05/who-finances-real-sector-lenders/

BibTeX: View |

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics