U.S. import tariffs increased to historically high rates in recent months, raising the costs of many imported inputs businesses use. Businesses subject to these higher costs have been faced with difficult and complex decisions about whether to absorb the tariffs through lower profits, raise their prices to recover the higher costs, or some combination of both. These decisions are influenced by the degree of competition in the marketplace, potential customer reactions, and the ability to maintain profit margins, among other factors. Our May survey of businesses in the New York–Northern New Jersey region asked firms about the tariffs they faced, recent changes in the cost of imported goods, and whether they were passing on tariff-induced cost increases to their customers. Results indicate most businesses passed on at least some of the higher tariffs to their customers, with nearly a third of manufacturers and about 45 percent of service firms fully passing along all tariff-induced cost increases by raising their prices.

Have Businesses Passed Through the Tariffs?

Many businesses in the region have been exposed to higher tariffs. Indeed, about 90 percent of manufacturers and about three-quarters of service firms in our surveys import some goods, with the average imported input share among all firms at around 30 percent. Our survey was in the field between May 2 and May 9, before tariff hikes on goods from China were reduced from 145 percent to 30 percent, and before any of the court decisions around tariffs at the end of May. At the time of our survey, manufacturers estimated that the average tariff rate they paid across all imported goods across all countries was 35 percent (a roughly 25 percentage point increase from six months ago) and service firms reported an estimated average tariff rate of 26 percent (a 17 percentage point increase from six months ago), in line with other estimates of the average effective tariff rate facing U.S. firms at that time. As a result of the higher tariffs, manufacturers indicated that the cost of their tariffed goods had increased by an average of about 20 percent over the past six months, while service firms reported a roughly 15 percent average cost increase. While these figures are quite close to the increases in the firms’ average tariff rates, firms’ costs of tariffed goods may not have increased by as much as the tariffs in part because importers may have switched towards suppliers in other countries or in the United States; foreign suppliers may also have lowered their prices to help offset the tariffs.

As shown in the chart below, about three-quarters of businesses facing tariff-induced cost increases in both the manufacturing and service sectors passed along at least some of these higher costs to their customers by raising prices. Almost a third of manufacturers and about 45 percent of service firms reported fully passing along all tariff-related cost increases, while 45 percent of manufacturers and a third of service firms said they passed along some but not all of the cost increase. At the other end of the spectrum, roughly a quarter of both types of firms said they absorbed all tariff-related cost increases and were not raising their prices. This pattern is consistent with other research using business surveys showing that in response to a hypothetical 5 percent cost increase, about a quarter of firms would fully pass through this cost increase into higher prices, while another quarter of firms would not change prices at all.

Most Businesses Passed Through Some or All of the Tariffs

Share of businesses

Note: Figures are based on businesses that reported an increase in the cost of their imported goods owing to tariffs over the past six months.

We also asked firms that raised their prices due to tariffs how quickly they did so, as shown in the chart below. Price increases happened rapidly: over half of both manufacturers and service firms said they raised prices within a month of experiencing tariff-related cost increases—many within a day or week. Another quarter indicated they had raised prices (or planned to do so) within one to three months of such cost increases, while few were waiting longer than three months.

Tariff-Induced Price Increases Happened Quickly

Share of businesses

Note: Figures are based on businesses that reported an increase in the cost of their imported goods owing to tariffs over the past six months.

How Have Higher Tariffs Affected Businesses?

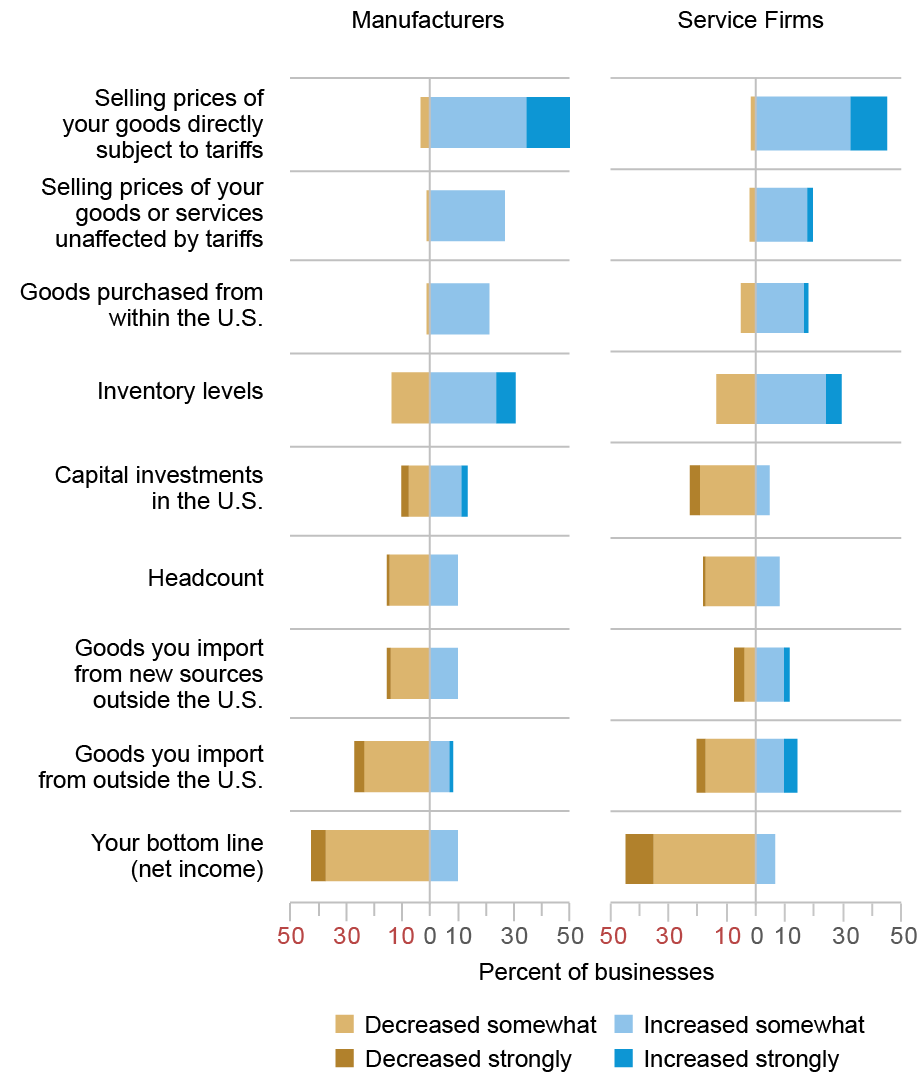

We asked businesses that imported goods how they were adjusting their operations in response to higher tariffs. For each potential margin of adjustment, the chart below shows how businesses responded over the past six months, and if they saw any change to their bottom lines. The share of businesses reporting an increase or decrease in each adjustment margin is shown in blue and gold, respectively. Higher tariffs have affected businesses in a number of different ways.

Businesses Have Adjusted to Higher Tariffs in Many Ways

Note: Figures are based on businesses that reported using imported goods as inputs.

Consistent with textbook economics, tariffs generally resulted in higher prices to customers. Indeed, roughly half of businesses reported raising prices of goods directly subject to tariffs. Interestingly, a significant share of businesses also reported raising the selling prices of their goods and services unaffected by tariffs. Many businesses indicated they increased prices to cover other rising costs such as wages and insurance, though it is possible that in some cases, businesses were taking advantage of an escalating pricing environment to increase prices. For example, something similar happened in 2018-19 as firms increased their prices on dryers when tariffs rose on washing machines from China, even though dryers were not subject to tariffs.

Higher tariffs also affected where businesses sourced their inputs as well as inventory levels. As might be expected, a significant share of businesses reported an increase in goods purchased from within the United States, and a similar share reported a decline in goods they imported. Just under a third of both manufacturers and service firms reported increasing their inventory levels, in part to get ahead of rising tariffs and to build some inventory buffer against potential supply shortages. On the flip side, about 15 percent of businesses reported declining inventories, likely drawn down to meet demand as some customers moved purchases forward to build their own inventories and get ahead of any tariff-related price increases or supply shortages.

There were some signs that the sharp and rapid increase in tariffs affected employment levels and capital investments. Adjustments to headcounts were fairly modest but slightly tilted toward a small reduction among both manufacturers and service firms. On balance, manufacturers reported little net change in capital spending in the United States due to rising tariffs, with 13 percent of manufacturers increasing investment compared to 10 percent decreasing investment. Capital spending fell noticeably in the service sector with nearly a quarter of service firms decreasing investment compared to just 5 percent increasing investment. All in all, almost half of businesses reported a decrease in their bottom lines, though a small share saw a boost as some businesses have been protected by tariffs—particularly those that produce items domestically that compete with tariffed goods from abroad.

Businesses Are Highly Uncertain about Tariffs

While our survey suggests that three-quarters of firms that saw tariff-induced cost increases were passing on at least some of these cost increases to their customers, businesses found it difficult to determine exactly what tariffs they were paying. While input cost increases were common, how much of the increase was from tariffs was not always transparent when businesses purchased imported goods. Thus, some of what we estimate as tariff pass-through may include other forms of cost increases.

Looking ahead, businesses expressed considerable uncertainty about the future path of tariffs. Indeed, in early May, about half of service firms expected tariffs to move higher in the next six months and about a third expected tariffs to decline. Among manufacturers, about a third expected tariffs to increase over the next six months, while more than half expected them to decline. Many businesses expressed difficulty making decisions and determining the appropriate pricing strategies under such heightened uncertainty.

Jaison R. Abel is head of Microeconomics in the Federal Reserve Bank of New York’s Research and Statistics Group.

Richard Deitz is an economic policy advisor in the Federal Reserve Bank of New York’s Research and Statistics Group.

Sebastian Heise is a research economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Ben Hyman is a research economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Nick Montalbano is a data analytics specialist in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Jaison R. Abel, Richard Deitz, Sebastian Heise, Ben Hyman, and Nick Montalbano, “Are Businesses Absorbing the Tariffs or Passing Them On to Their Customers?,” Federal Reserve Bank of New York Liberty Street Economics, June 4, 2025, https://libertystreeteconomics.newyorkfed.org/2025/06/are-businesses-absorbing-the-tariffs-or-passing-them-on-to-their-customers/.

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics