A recommended charge on settlement fails for agency debt and agency mortgage-backed securities (MBS) took effect on February 1, 2012. This follows the successful introduction of a charge on settlement fails for U.S. Treasury securities in 2009. With a fails charge, a seller of securities that doesn’t deliver on time must pay a charge to the buyer. The practice is meant to ensure that sellers have adequate incentive to deliver securities without undue delay and thereby reduce the level of settlement fails. In this post, I discuss how and why the fails charge was implemented.

Settlement Fails before the Fails Charge

Historically, market practice was to allow a failing seller to deliver after the original contracted settlement date at an unchanged invoice price. As the buyer didn’t pay the seller until delivery of the securities, the seller lost (and the buyer gained) the time value of the transaction proceeds over the fail interval. The prospect of losing the time value of money on the transaction proceeds provided incentive for the seller to deliver on the settlement date or as soon as possible thereafter.

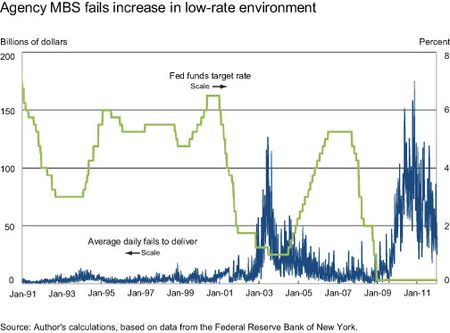

While the historical practice worked well in normal interest rate environments, it proved inadequate in low-rate environments. As explained in this white paper, there’s limited incentive to borrow securities to avoid failing in a low-rate environment because the cost of failing, as measured by the time value of money, is commensurately low. As shown in the chart below, agency MBS settlement fails surged in 2003-04 as the target fed funds rate was lowered to 1 percent. They again increased sharply after the rate was lowered to its current 0-25 basis point range in December 2008.

Costs of Fails

Settlement fails matter to both the counterparties of a trade and to market participants more generally. To the counterparties, fails can increase operational costs and counterparty credit risk, absorb scarce capital through regulatory charges, and hurt customer relations. More generally, persistent settlement fails at a high level can cause participants to withdraw from the market, adversely affecting market liquidity and stability. The Treasury Market Practices Group (TMPG) cited these costs in its announcement proposing fails charge recommendations.[1]

Fails Charge Recommendations

The fails charge recommendations are modeled on the TMPG’s earlier fails charge recommendation for Treasury securities, but reflect the particular characteristics of the agency debt and agency MBS markets. As with the Treasury fails charge, the agency debt and agency MBS fails charges only kick in when short-term interest rates are low, so as to provide a solution narrowly tailored to the problem. As explained in this TMPG announcement, the charge for agency debt securities, like that for Treasury securities, ranges between 0 and 3 percent (it’s 3 percent per year in the current environment, but would be zero if the fed funds rate was at or above 3 percent). The charge for agency MBS ranges between 0 and 2 percent, as the TMPG explains in this announcement. The charge for agency debt securities, like that for Treasury securities, applies to fails outstanding a day or more, whereas the agency MBS charge only applies to fails outstanding three days or more. In both cases, charges of small dollar amounts are waived to minimize operational costs.

Will the Fails Charge Be Effective?

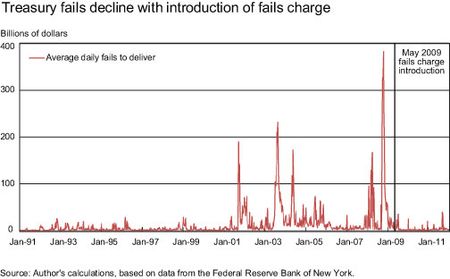

Will the fails charge reduce settlement fails? There are several reasons to think so. First, the increased cost of failing resulting from the charge provides a greater incentive for market participants to avoid fails in low-rate environments. Second, evidence from the May 2009 adoption of a fails charge for Treasury securities suggests that the charge in that market has been successful at reducing fails, as shown in the chart below. Lastly, the TMPG has said that it will closely monitor fails under the new regime, and that it may raise the level of the charge if its initial recommendation proves inadequate at reducing fails.

Disclaimer

The views expressed in this post are those of the author and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

I agree with Michael Fleming’s analysis. Both the existence of the fail penalty and experience with a similar penalty for treasuries suggest that this rule will be successful at reducing MBS repo failures in a low rate environment. This should, in turn, improve market efficiency and stability. Failures generate negative network (knock-on) externalities. Thank you Michael.

The option of failure is it the same as the Japanese model?