Vasco Cúrdia and Andrea Ferrero

With the federal funds rate at the zero lower bound, the Fed’s large-scale purchase of Treasury securities provides an alternative tool to boost the economy. In November 2010, the Federal Open Market Committee (FOMC) announced a second round of large-scale asset purchases (LSAP2) with the goal of accelerating the recovery. In this post, we analyze the impact of LSAP2 on the two variables that fall under the Fed’s dual mandate: inflation and unemployment. Our point estimates suggest that the effects will be moderate and delayed, although there is considerable uncertainty attached to these estimates.

For this analysis, we estimate a small-scale Vector Auto-Regression (VAR) model (one that summarizes the historical relationship between variables) that includes two lags of the unemployment rate, core PCE inflation, the real value of the Commodity Research Bureau index, the effective federal funds rate, and the ten-year Treasury yield. The data are at the quarterly frequency, covering the period 1976:Q1–2007:Q2. We use a standard recursive structure—with the variables ordered in the manner described above—to provide an economic interpretation to the shocks in the model. Our ordering implies that the federal funds rate responds contemporaneously to all variables except the ten-year Treasury yield. Conversely, the ten-year Treasury yield is in principle allowed to respond contemporaneously to all variables.

To test the reliability of our VAR, we estimate the responses of inflation and unemployment to an unexpected temporary reduction in the federal funds rate. The monetary easing increases inflation and reduces unemployment. Consistent with the existing VAR literature, the effects of the monetary easing on macroeconomic variables are small and delayed.

To understand the potential effects of the second round of the LSAP, a more relevant exercise is to study the response of inflation and unemployment to an unexpected temporary reduction in long-term rates. Because LSAPs have a very short history, the months preceding the FOMC decision witnessed very active discussions about the effects of LSAPs on long-term Treasury yields. Typical estimates predict a 3-to-15-basis-point reduction in the ten-year Treasury yield per $100 billion of asset purchases (see, for example, the estimates in Hamilton and Wu; Gagnon, Raskin, Remache, and Sack; D’Amico and King). These studies primarily exploit the information in recent events, such as the first round of LSAP. Alon and Swanson, however, obtain comparable estimates for the most significant previous asset purchase program, the so-called “Operation Twist” of 1961-64.

Based on these estimates, the announced purchase of $600 billion of longer-term Treasury securities would be expected to translate into an 18-to-90-basis-point reduction in the ten-year Treasury yield. Using the mid-point of the above range of estimates as a guide, we assume the effect of LSAP2 is a 50-basis-point reduction in the ten-year Treasury yield and then focus on its potential effects on macroeconomic variables. Our results suggest that following a 50-basis-point shock to the ten-year Treasury yield, the maximum reduction of unemployment is 0.14 percentage points after seven quarters, while the maximum increase in inflation is 0.18 percentage points after sixteen quarters. Based on the model estimates, the impact on unemployment is equivalent to a 175-basis-point reduction in the federal funds rate (a factor of 3.5=175/50). The relative strength of changes to the long-term rate vis-à-vis the federal funds rate is also common to previous studies (see Rudebusch).

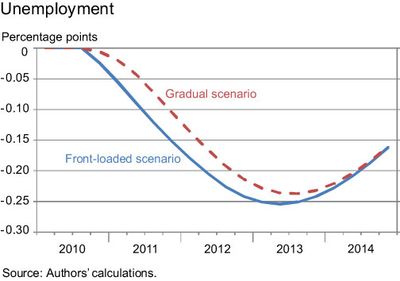

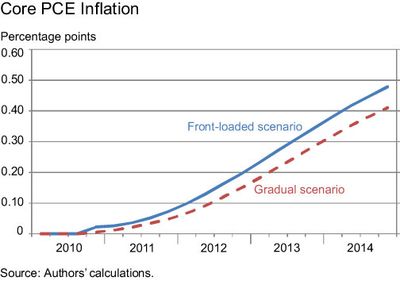

LSAP2 is more complicated, however, than a simple temporary increase to the Fed’s asset holdings because the planned purchases extend over time in roughly equal monthly amounts through the end of the second quarter of 2011. Some commentators (see, for instance, these two recent articles in the New York Times and the Atlantic) argue that the LSAP2 effects on macroeconomic variables have been small. But how small? To fully evaluate the potential effects of LSAP2, we construct two scenarios that differ in how long-term rates evolve during the first year of the program. In both cases, we assume that the ten-year Treasury yield drops 50 basis points. The difference is that in the first scenario (front-loaded), the full drop occurs immediately, while in the second scenario (gradual), the decrease takes place over the course of the first year of the program. In both scenarios, LSAP2 lasts for two years, after which long-term rates gradually recover to their normal level. We present our results as deviations from the New York Fed’s forecast in the absence of LSAP2.

In the front-loaded scenario, the maximum decrease in unemployment is 0.25 percentage points in 2013:Q1 (top chart), and the maximum increase in inflation is 0.48 percentage points in 2014:Q4 (bottom chart). The gradual scenario features similar effects, although slightly smaller quantitatively (0.05 percentage points).

Our results for unemployment are slightly larger than the estimates by Roubini Global Economics (maximum reduction of 0.1 percentage points in 2011), but smaller than Macroeconomic Advisers’ simulations using their large-scale macroeconomic model (maximum reduction of 0.5 percentage points in 2012:Q4). Conversely, our estimates for the impact on inflation are larger than both Macroeconomic Advisers (maximum increase less than 0.1 percentage points in 2012:Q4) and Roubini Global Economics (maximum increase of 0.3 percentage points in 2011).

A recent San Francisco Fed working paper assumes that the second round of LSAP likely induced a 20-basis-point decrease in the ten-year Treasury yield. As a consequence, the unemployment rate falls by about 0.3 percentage points by the middle of 2012, and core PCE inflation increases by about 0.2 percentage points by the end of 2011, relative to a scenario without LSAP2. These effects are in line with our analysis, despite a smaller change in the ten-year Treasury yield.

Some market observers have also entertained the possibility that the second round of the LSAP could have a substantial impact via a depreciation of the dollar. This channel is dif

ficult to quantify because the argument relates more to the pressure that the LSAP could place on countries that are currently pegging their exchange rates to the dollar than the actual effects on the market price of the dollar (see, for instance, Dumas on China). Nevertheless, we try to evaluate the relevance of this effect by including the nominal trade-weighted broad dollar index as an additional variable in our VAR model.

As expected, a reduction of nominal interest rates (whether short-term or long-term) generates a depreciation of the nominal exchange rate. However, when we repeat our simulations of the effects of the LSAP, we find no notable difference relative to the baseline experiment (for example, the maximum impact on unemployment would be only 0.02 percentage points stronger in the front-loaded scenario). We interpret this evidence as indicating that a depreciation of the dollar is not likely to be a strong channel influencing unemployment and inflation in the United States under current circumstances.

In summary, our simple VAR analysis suggests that the second round of LSAP as currently conceived is likely to have a moderate and delayed impact on macroeconomic variables such as unemployment and inflation, with substantial uncertainty (not reported here) around the point estimates.

Clearly, our results are not insensitive to the underlying assumptions. First, the VAR is a purely backward-looking statistical model. Therefore, our estimates ignore potential expectation effects on future inflation and economic activity arising from LSAP2. Second, the VAR is subject to the well-known criticism that the statistical relationships captured in the estimation could in principle change in response to the transition from an environment of interest-rate setting to asset purchase programs. Third, our results are somewhat sensitive to using different subsamples, mostly due to the change in volatility of macroeconomic time-series after the mid-1980s. Unfortunately, we are not in a position to ascertain how these caveats may affect our results.

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics