Editor’s note: When this post was first published, the columns in the second table were mislabeled; the table has been corrected. (August 19, 9:30 a.m.)

Building upon our earlier Liberty Street Economics post, we continue to analyze the heterogeneity of COVID-19 incidence. We previously found that majority-minority areas, low-income areas, and areas with higher population density were more affected by COVID-19. The objective of this post is to understand any differences in COVID-19 incidence by areas of financial vulnerability. Are areas that are more financially distressed affected by COVID-19 to a greater extent than other areas? If so, this would not only further adversely affect the financial well-being of the individuals in these areas, but also the local economy. This post is the first in a three-part series looking at heterogeneity in the credit market as it pertains to COVID-19 incidence and CARES Act debt relief.

We use county-level data, on numbers of cases and deaths, compiled by the New York Times (NYT) and the New York City Department of Health (Department of Health) for our analysis. The New York Times compiles a daily series of confirmed cases and deaths for almost every county in the United States. Its data set aggregates New York City, which consists of five counties, into a single entity. To get a breakdown of deaths and cases by New York City’s boroughs, we use data from the Department of Health.

Because race and income data for affected individuals are not available in all states, we match our county-level COVID-19 data with county-level data on race, median household income, urban status, and population density from the 2014-18 five-year American Community Survey (ACS). We define percent minority as the percentage of people in a county that is Hispanic or non-Hispanic Black. We define majority-minority counties as those in which at least half the population is Hispanic or non-Hispanic Black. We split counties into equal-population quartiles of median household income; we refer to the counties that fall in the bottom quartile as “low-income” counties.

For measures of financial health, we use the New York Fed’s Consumer Credit Panel (CCP), a nationally representative sample of Equifax credit report data. Our data set for this analysis includes roughly 1 percent of the nation’s adults with credit records in anonymized form. We see their payments, balances, and delinquencies for various types of debt, including 1) auto loans, 2) mortgages, 3) credit cards, and 4) student loans. For each county and for each of these four types of loans, we compute delinquency measures that constitute the share of borrowers who are 90+ days past due on that type of loan. In addition, we create an overall delinquency measure that captures the share of borrowers in a county who are 90+ days past due on any type of loan. For each of these five delinquency measures (overall, auto, mortgage, credit card, student loan) we define high-delinquency (High DQ) counties as those in the (population-weighted) top quartile of that delinquency rate (High DQ, High Auto DQ, High Mortgage DQ, High CC DQ, High SL DQ). All analysis uses data from the fourth quarter of 2019.

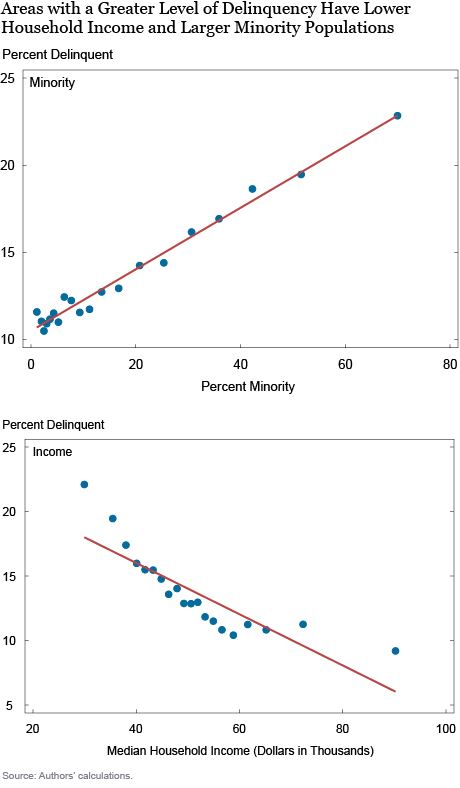

The chart below presents bin-scatter plots representing the descriptive relationship between overall delinquency and neighborhood characteristics: percent minority and median household income. We find that areas with a greater level of delinquency are also those that have lower household income and larger minority populations.

Next we investigate whether high delinquency counties faced different case and death rates due to COVID-19. We find that as of mid-July, high-delinquency counties had a mean of 4.3 cases/1,000, while other counties had 2.8 cases/1,000. Death rates have been higher as well: 16/100,000 in high-delinquency counties and 10/100,000 elsewhere. To investigate whether this relationship continues to hold within communities that are relatively homogeneous in terms of income, race, urban status, and population density—factors that have been found to correlate with COVID-19 incidence—we conduct a multivariate regression analysis.

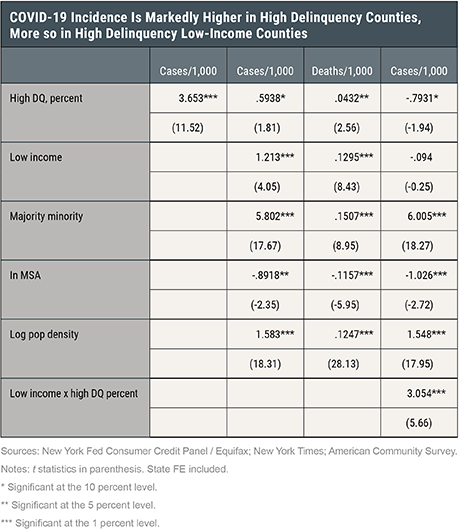

We start by regressing case rate on a dummy for high delinquency. All regressions in this post control for fixed characteristics of states, observable and unobservable. We find in column 1 of the table below that more financially vulnerable counties have had more severe COVID-19 spreads. Specifically, High DQ counties have had 3.65 more cases/1,000 than others (column 1). Given the high correlation between delinquency and household income and minority status (in the chart above), it is likely that some of this association between high delinquency and COVID-19 incidence is explained by higher minority and low-income populations in these counties.

To investigate to what extent this relationship between delinquency and case rates is accounted for by inherent characteristics of these counties (low income, majority minority status, urban status, population density), we control for these variables in column 2. We can explain some of the relationship between High DQ and case rate by the demographic factors (column 2), but even after including these variables, we find that High DQ counties still have 0.59 more cases/1,000 than counties that are not High DQ. High-delinquency counties also have more deaths after controlling for the same factors (column 3): four more per 100,000 than other counties. This analysis suggests that even if we look within low income or majority-minority or dense areas, places with higher delinquency also suffered higher COVID-19 incidence.

Next, we examine whether High DQ counties that are also low income faced a higher incidence of cases. In column 4 of the table below, we observe that high-delinquency counties that are also low-income have had a worse spread of COVID-19 than High DQ counties that are not low income—almost three more cases/1,000. In fact, increased virus spread in High DQ counties appears to be concentrated exclusively in those that are also low-income.

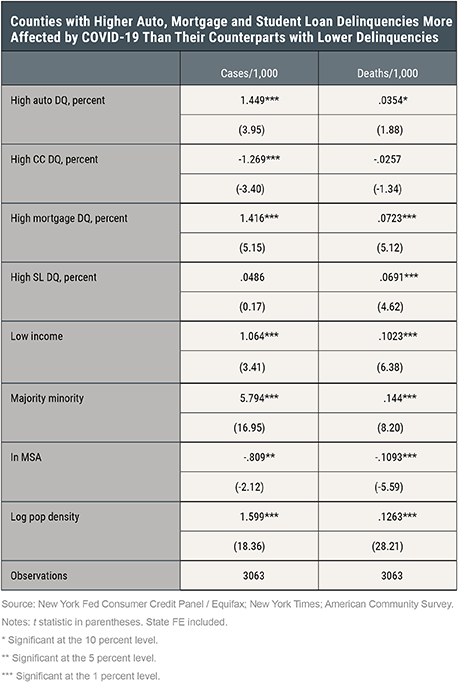

Next, in the table below, we examine relationships between delinquency in specific kinds of debt and COVID-19 spread. We find that counties that have high mortgage delinquency (High mortgage DQ) have higher COVID-19 incidence as captured by both case and death rates. Counties that have high student loan delinquency (High SL DQ) also have higher death rates. Counties with high auto loan delinquency (High Auto DQ) have higher case rates than those that do not have high auto loan delinquency. The High Auto DQ counties also have higher death rates, but this estimate is not statistically different from zero at conventional levels. It is worth noting that although High Mortgage DQ and High SL DQ areas were relatively adversely affected by COVID-19 incidence, and this is expected to further increase financial distress in these areas, the borrowers in these areas will potentially receive some relief from the CARES Act mortgage and student debt forbearance provisions which to some extent will ameliorate their increased financial distress. In contrast, the CARES Act does not include provisions for auto loan payment relief although these borrowers may be able to obtain some relief on a case-by-case basis by contacting the lenders. However, this relief is considerably more uncertain than CARES Act relief for student loans and mortgages. Consequently, the higher incidence of COVID-19 in High Auto DQ areas (relative to those that do not have high auto loan delinquency) may lead to larger subsequent increases in financial hardships in these areas.

What have we learned? We have seen that there is a strong relationship between COVID-19 cases and pre-COVID delinquency rates at the county level and this correlation cannot be easily explained by some known sources of heterogeneity in COVID-19, such as income, minority status, and population density. This suggests that the harms from COVID-19—the loss of life and health, the decline in employment, the destruction of businesses and the surge in medical expenses—will fall on counties particularly ill-suited to bearing them. The much higher per-capita case counts in places with high delinquency rates and low income portend a disproportionate financial impact on those who can least afford it. Why do we observe this relationship? While the precise mechanisms are beyond the scope of this work, volatility of income may be associated with both financial stress and higher risk of COVID-19, potentially because of greater reliance on essential work in such communities and corresponding difficulty of social distancing. Further research is needed to understand these factors.

<img class=”asset asset-image at-xid-6a01348793456c970c026be407bc9a200d img-responsive” style=”width: 45px; margin: 0px 5px 5px 0px;” alt=”Rajashri Chakrabarti<” title=”Rajashri Chakrabarti

Rajashri Chakrabarti is a senior economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

William Nober was a former a senior research analyst in the Bank’s Research and Statistics Group.

Maxim Pinkovskiy is a senior economist in the Bank’s Research and Statistics Group.

How to cite this post:

Rajashri Chakrabarti, William Nober, and Maxim Pinkovskiy, “Are Financially Distressed Areas More Affected by COVID-19?,” Federal Reserve Bank of New York Liberty Street Economics, August 17, 2020, https://libertystreeteconomics.newyorkfed.org/2020/08/are-financially-distressed-areas-more-affected-by-covid-19.html.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics