A 2017 Liberty Street Economics post described the balance sheet effects of the Federal Open Market Committee’s decision to cease reinvestments of maturing securities—that is, the mechanics of the Federal Reserve’s balance sheet “runoff.” At the time, the overnight reverse repo (ON RRP) facility was fairly small (less than $200 billion for most of July 2017) and was not mentioned in the post for the sake of simplicity. Today, by contrast, take-up at the ON RRP facility is much larger (over $1.5 trillion for most of 2022). In this post, we update the earlier analysis and describe how the presence of the ON RRP facility affects the mechanics of the balance sheet runoff.

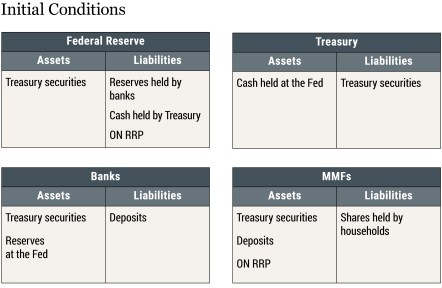

Simplified Balance Sheets

In the exhibit below, we describe simplified balance sheets for the Fed, the Treasury, banks, and money market funds (MMFs). We only show the balance sheet items that are essential for understanding the mechanics related to the Fed’s actions. In a follow-up post, we consider the role of levered nonbank financial institutions and households.

- On the Fed’s balance sheet, the asset side contains Treasury securities; on the liability side, there are reserves held by banks, cash balances held by the Treasury in its “checking account” at the Fed (the Treasury General Account, or TGA), and ON RRP balances held by MMFs.

- On the Treasury’s balance sheet, the asset side contains balances in the TGA; on the liability side, there are Treasury securities.

- On banks’ balance sheet, the asset side contains Treasury securities and reserves held at the Fed; on the liability side, there are deposits held by MMFs (for example, transaction deposits as well as overnight and term deposits placed in wholesale funding markets).

- On MMFs’ balance sheet, the asset side contains Treasury securities, deposits at banks, and investments in the ON RRP facility; on the liability side, there are MMF shares held by households. In contrast to banks and the Treasury, MMFs cannot hold balances in a Fed account; however, MMFs have access to the ON RRP facility (MMFs with ON RRP access accounted for approximately 80 percent of MMF assets under management at the end of 2021).

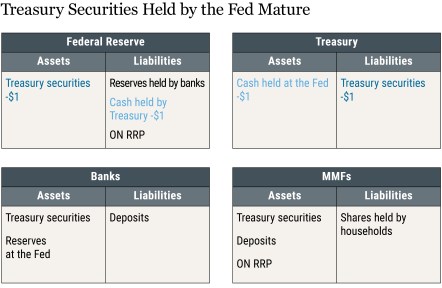

We start by showing what happens when Treasury securities held by the Fed mature, the Fed doesn’t reinvest the proceeds of the maturing securities, and the Treasury does not issue new securities. In this case, depicted in the next exhibit, the Treasury pays the Fed with cash from the TGA as the securities mature. The Fed holds fewer assets (its holdings of Treasury securities decrease) and has fewer liabilities (cash held by the Treasury at the Fed decreases), so the size of its balance sheet decreases.

For the remainder of the post, we assume that when $1 worth of Treasury securities held by the Fed matures, the Treasury issues $1 worth of new securities, so the size of the Treasury’s balance sheet remains unchanged. To make things simple, we assume that new securities are issued at the same time as old securities mature.

Banks Purchase Newly Issued Securities

We now consider what happens when newly issued Treasury securities are purchased by banks (see exhibit below).

Two transactions occur simultaneously:

- As in the previous exhibit, the Treasury repays the Fed for the maturing securities, which reduces the TGA balance and the Treasury securities held by the Fed by the same amount. In all subsequent exhibits in this post, the sequence of transactions includes this step of the Treasury repaying the Fed. In the interest of simplicity, we won’t mention this step again.

- Banks purchase the new securities issued by the Treasury, with banks transferring balances to the Treasury in exchange for the securities. As banks transfer money to the Treasury, the TGA balance goes back to its original level.

At the end of this process, the size of the Fed’s balance sheet has decreased with a reduction of Treasury securities on the asset side and reserves on the liability side; the Treasury’s balance sheet is unchanged; and the size of banks’ balance sheet is the same but the composition of assets is different (higher holdings of Treasury securities and lower reserves).

MMFs Purchase Newly Issued Securities

We next consider what happens when newly issued Treasury securities are purchased by MMFs. MMFs can fund their purchases by withdrawing deposits at banks, reducing their investments in the ON RRP facility, or a combination of the two. The next exhibit shows what happens if MMFs use both deposits and ON RRP investments to purchase Treasury securities.

Several transactions occur simultaneously:

- MMFs buy new securities from the Treasury, which holds the proceeds at the Fed, returning the TGA balance to its level before the Treasury securities held by the Fed matured.

- MMFs’ deposits at banks decrease as MMFs use them to purchase a portion of the Treasury securities. Banks facilitate the purchase, transferring reserve balances to the TGA while debiting the accounts that MMFs have at the banks.

- MMFs reduce their investments in the ON RRP facility to fund the purchase of the remainder of the Treasury securities. ON RRP balances decline and the TGA balance increases by an equal amount.

Banks’ balance sheet shrinks, with lower deposits on the liability side, and lower reserves on the asset side. The size of MMFs’ balance sheet is unchanged, but its composition on the asset side has changed: the increase in Treasury securities holdings is offset by a decrease in deposits held at banks and investments in the ON RRP facility.

Since MMFs can only buy newly issued Treasury securities if they are Treasury bills or floating rate notes, only when these securities are issued in large amounts will MMFs be able to absorb a large fraction of the Fed’s balance sheet reduction. Moreover, the extent to which MMFs are willing to buy Treasury securities depends on how the rates on these securities compare to the rates paid on alternative assets such as bank deposits and ON RRP investments. Finally, since a large fraction of the MMF industry—namely government funds—cannot invest in bank deposits, it is likely that a large proportion of purchases of Treasury securities by MMFs would be financed through reduced investments in the ON RRP facility.

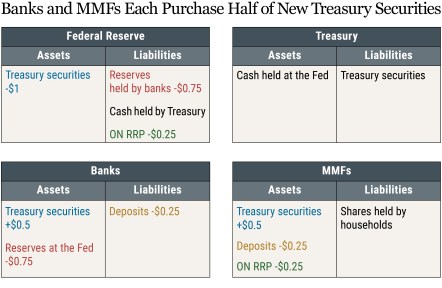

Banks and MMFs Purchase Newly Issued Securities

Finally, we illustrate the case where some of the new Treasury securities are purchased by banks and some by MMFs. The next exhibit shows what happens when banks and MMFs each purchase half of the new issuance, and MMFs purchase the securities by drawing down a combination of deposits at banks and investments in the ON RRP facility. The description of the transactions corresponding to the exhibit is similar to the ones described above and left as an exercise for the reader.

Conclusions

In this post, we updated an earlier post illustrating the balance sheet mechanics of a runoff in the Fed’s holdings of Treasury securities to illustrate the effect of the ON RRP facility. In all cases, the Fed’s balance sheet decreases as the Fed doesn’t reinvest the proceeds of its maturing Treasury securities. On the liability side of the Fed’s balance sheet, the decrease may stem from either a reduction of reserves held by banks or a reduction in ON RRP take-up or a combination of both. Similar mechanics occur when agency mortgage-backed securities mature and banks purchase the newly issued securities, as was noted in this Liberty Street Economics post. As the exhibits in this post show, the runoff of the Fed’s security holdings has potential implications for the balance sheets of a range of financial market participants.

Marco Cipriani is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

James Clouse is a deputy director in the Division of Monetary Affairs at the Board of Governors of the Federal Reserve System.

Lorie Logan is an executive vice president in the Federal Reserve Bank of New York’s Markets Group.

Antoine Martin is a senior vice president in the Bank’s Research and Statistics Group.

Will Riordan is an assistant vice president in the Bank’s Markets Group.

How to cite this post:

Marco Cipriani, James Clouse, Lorie Logan, Antoine Martin, and Will Riordan, “The Fed’s Balance Sheet Runoff and the ON RRP Facility,” Federal Reserve Bank of New York Liberty Street Economics, April 11, 2022, https://libertystreeteconomics.newyorkfed.org/2022/04/the-feds-balance-sheet-runoff-and-the-on-rrp-facility/.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Excellent work, guys! This blog deserves more attention.

This is SO HELPFUL! Thank you very much for publishing this and going through the accounting steps.

Thank you for the illustration Mr. Cipriani.