When inflation is high, companies may raise prices to keep up. However, market watchers and journalists have wondered if corporations have taken advantage of high inflation to increase corporate profits. We look at this question through the lens of public companies, finding that in general, increased prices in an industry are often associated with increasing corporate profits. However the current relationship between inflation and profit growth is not unusual in the historical context.

Mapping Inflation to Public Company Profits

We make use of the producer price index (PPI) published at the three-digit North America Industry Classification System (NAICS) level and compare inflation at the industry level to the aggregate profits of public companies in the same industries. We do this for 36 industries, ranging from Oil and Gas Extraction (NAICS 211) to Telecommunications (NAICS 517). We do not cover all the industries as we limit the analysis to industries with more than 15 public companies, so that the results are not overly impacted by any single company.

| NAICS Industry Codes | |

|---|---|

| 211 Oil and gas extraction | 337 Furniture and related product mfg. |

| 212 Mining, except oil and gas | 339 Miscellaneous manufacturing |

| 213 Support activities for mining | 423 Merchant wholesalers, durable goods |

| 221 Utilities | 424 Merchant wholesalers, nondurable goods |

| 311 Food manufacturing | 441 Motor vehicle and parts dealers |

| 312 Beverage and tobacco product mfg. | 448 Clothing and clothing accessories stores |

| 315 Apparel manufacturing | 452 General merchandise stores |

| 321 Wood product manufacturing | 454 Nonstore retailers |

| 322 Paper manufacturing | 481 Air transportation |

| 324 Petroleum and coal products mfg. | 483 Water transportation |

| 325 Chemical manufacturing | 484 Truck transportation |

| 326 Plastics and rubber products mfg. | 488 Support activities for transportation |

| 331 Primary metal manufacturing | 511 Publishing industries, except internet |

| 332 Fabricated metal product mfg. | 515 Broadcasting, except internet |

| 333 Machinery manufacturing | 517 Telecommunications |

| 334 Computer and electronic product mfg. | 523 Securities, commodity contracts, investments |

| 335 Electrical equip. and appliance mfg. | 524 Insurance carriers and related activities |

| 336 Transportation equipment mfg. | 721 Accommodation |

There are many factors that affect sales and profits, and figuring out who benefits from high inflation is a challenging question. Researchers have also considered these factors in analysis of aggregate data, although it has been hard to conclusively isolate the extent to which higher inflation comes from increasing profits. This is because net sales reflect both the price, the amount, and the mix of goods, meaning that the sales or profit increases could be due to higher prices, but also to more goods sold or changes in the mix of goods.

To understand the relationship between inflation and profits, we would ideally be able to break down the number of units sold (not to mention the quality of the units sold and the profit margin per unit). Although this is hard to do with available public data, a simple measure of profitability is gross margin. Gross margin is the difference between net sales and the direct cost of goods sold (COGS) normalized by net sales. It captures the difference between the cost of inputs and the revenues to the company. Normalizing by sales to look at gross margin in percentages, rather than gross profit in dollars, mitigates concerns about misattributing growth in dollars of gross profit that arise from selling more goods.

Gross Profits Increased More for Industries with More Inflation

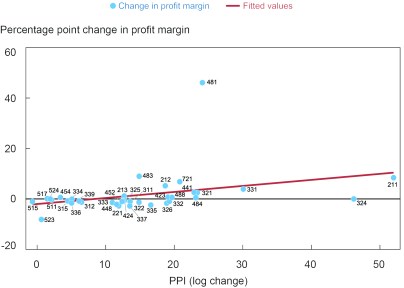

The chart below plots the change in gross margin and inflation for the first quarter of 2022 compared to the first quarter of 2021. The slope is 0.24, suggesting that on average for every one percent increase in prices, corporate gross margins increased by 24 basis points.

Change in Gross Profit Margin and PPI

Note: Numbers = 3-digit NAICS industry codes.

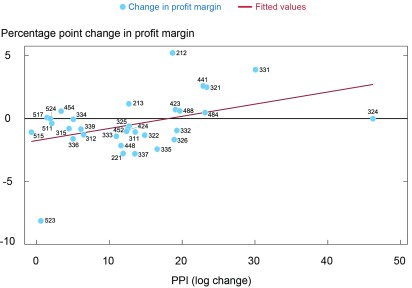

Some of the industries with the greatest changes in profit margins include oil and gas, and industries such as air transportation which are heavily affected by COVID-related changes in demand. To assuage concerns that these industries are distorting the observed pattern, we drop them from the graph and find that the upward slope remains. It appears that industries with higher inflation are indeed earning higher profits.

Change in Gross Profit Margin and PPI, Excluding Oil & Gas and COVID Impacted Industries

Note: Numbers = 3-digit NAICS industry codes.

Is This Time Different?

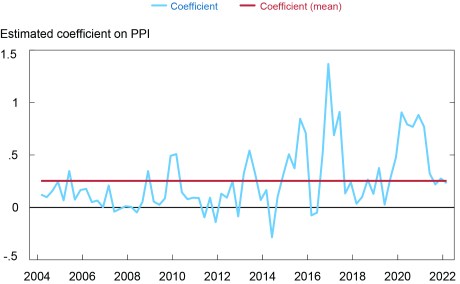

Have changes in market power increased corporations’ ability to raise prices? We examine the relationship between profit margins and inflation over the past two decades (for which we have inflation data for most of the industries) as well as over the past four decades (for which we have inflation data for a smaller set of industries). We regress inflation on changes in gross margins based on quarterly data, including fixed effects for changes in margins over time and for industries on average.

Looking only at how the most recent period compares to the historical data, the relationship between inflation and gross profits seems sharply higher in 2021 and the first quarter of 2022. We estimate a positive, statistically significant coefficient on an interaction between inflation and the 2021-22 observations and find that the slope is approximately 0.36 during this period, as compared to 0.29 between 2004 and 2020. However, further examination reveals that the relationship between profits and inflation is nonlinear—that is, when estimating the relationship separately for different quartiles of inflation, we see that the relationship between inflation and profits changes with the level of inflation. The steepest slope is estimated when inflation is high, but not too high (between 37 basis points and 4.3 percent, representing the 25th and 75th percentiles of inflation).

This is illustrated in the chart below that estimates the slope of the relationship between gross profit and PPI across industries for each quarter since 2004 using the full sample, controlling for time and industry fixed effects. In the period following the onset of the pandemic, the slope was particularly steep, although it has returned close to the historical average more recently. Over the full sample, the slope has been greater than 0 in almost every quarter with an average of 0.25, attesting to a consistent positive correlation between industry level inflation and changes in gross margins.

The Relationship between PPI and Gross Margin over Time

While we only have inflation numbers for a more limited number of industries, the results are very similar when estimated on a longer time series going back to 1986. The recent relationship between inflation and profits seems similar to that realized in the past when inflation was very high, as it is today.

This nonlinear relation between outcomes and inflation appears across several dimensions in addition to profits and was originally noted in work by researchers at the New York Fed (Amiti, Heise, and Karahan). This is consistent with theories of strategic complementarities in pricing, whereby the knowledge that competitors are changing prices emboldens companies to change their own prices. Our analysis is agnostic to the reason that companies are changing prices—we look only at inflation in the company’s own industry, not at changes in the price of inputs.

Inflation May Not Be That Great for Corporate Profits

The relationship between changes in corporate profits and inflation is positive even when inflation is unusually high. This only means that those industries with higher inflation are able to increase profits more than industries with lower inflation, not that profits are increasing. Looking back to the initial graph of the changes in profits in 2022, the change in gross profits in most industries (22 of 36) is negative. Profits are falling overall, and it’s just that companies in higher inflation industries have profits that are falling less quickly. In addition, gross margin misses many key components of profit, most notably sales, general and administrative costs (SG&A). To the extent that these other costs are changing, the overall net profitability of companies may also be changing. Finally, changes in gross margin are negatively serially correlated, meaning that decreases in profits are often followed by increases in profits. This means that profit increases may not be followed by more profit increases.

Mathias Andler is a research analyst in Macrofinance Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Anna Kovner is the director of Financial Stability Policy Research in the Bank’s Research and Statistics Group.

How to cite this post:

Mathias Andler and Anna Kovner, “Do Corporate Profits Increase When Inflation Increases?,” Federal Reserve Bank of New York Liberty Street Economics, July 13, 2022, https://libertystreeteconomics.newyorkfed.org/2022/07/do-corporate-profits-increase-when-inflation-increases/

BibTeX: View |

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Mark: We agree that it could also be interesting to look at other measures of profit such as EBITDA or operating profit. These, however, may be more likely to reflect other changes such as the mix of goods sold, which is why we focus in this post on gross margins.

Hi, Great article. I would suggest using operating profit since griss profit isn’t what corporations or the street consider “profit”. EBITDA would be a better fit for an inflation review. Gross margins don’t determine profit.