In the wake of the global financial crisis, the Federal Reserve dramatically increased the size of its balance sheet—from about $900 billion at the end of 2007 to about $4.5 trillion today. At its September 2017 meeting, the Federal Open Market Committee (FOMC) announced that—effective October 2017—it would initiate the balance sheet normalization program described in the June 2017 addendum to the FOMC’s Policy Normalization Principles and Plans.

This post summarizes analysis conducted in our recent working paper that seeks to understand the fiscal implications of the Federal Reserve’s balance sheet normalization program. Of course, monetary policy always has fiscal implications since it influences interest rates paid on government debt. But changes in the Federal Reserve’s balance sheet have additional fiscal consequences related to the central bank’s net income that is remitted to the U.S. Treasury. While the level and volatility of remittances do not prevent the FOMC from conducting monetary policy in conformity with its mandate and are thus not the focus of monetary policy decisions, they can potentially be associated with political-economy concerns (see, for example, Dudley).

In the paper, we assess the fiscal implications of different longer-run sizes of the balance sheet. We conduct simulations that leverage two models maintained by the Federal Reserve Board: the System Open Market Account (SOMA) model that generates detailed projections of the evolution of the balance sheet and associated net income; and the public version of the FRB/US model, a large-scale macroeconomic model, which we use to generate future paths for interest rates as well as government revenues, expenditures, and debt.

We explore how different longer-run sizes of the Federal Reserve’s balance sheet affect the average size and variability of remittances and the likelihood of net losses. We consider four scenarios tied to longer-run levels of reserve balances: $100 billion (which is intended to represent a return to a pre-crisis “scarce-reserves” balance sheet), $2.3 trillion (which roughly corresponds to the current level of reserves), and two levels in-between, namely $500 billion and $1 trillion. The $2.3 trillion longer-run reserve balance scenario means that reserves would remain at their currently elevated level. This implies, in turn, that the balance sheet would immediately start growing at a pace mostly in line with the expansion in key liabilities such as the value of Federal Reserve notes and capital paid-in. It is important to stress that this scenario is neither consistent with the current FOMC’s balance sheet normalization program nor an indication of any potential future Federal Reserve policy. We present this counterfactual, illustrative scenario only to understand the fiscal implications that could arise with reserve balances close to current levels. The other scenarios, which feature a gradual reduction in securities holdings through the medium term, are in line with the FOMC’s balance sheet normalization program. All other assumptions needed are based on publicly available information (such as the June 2017 addendum to the FOMC’s Policy Normalization Principles and Plans and the June 2017 Summary of Economic Projections forecast). Given these assumptions, for each scenario, we run stochastic simulations of the FRB/US model and compute summary statistics for Federal Reserve net income and remittances to the Treasury. Specifically, for each of our four scenarios, we generate paths for interest rates and other financial and macroeconomic variables using the March 2017 public version of FRB/US. Then, for each path, we derive the implications for remittances and other variables of interest.

A key feature of our approach is that it allows us to consider the effects of changing the longer-run size of the balance sheet on interest rates, asset prices, economic activity, and inflation. For instance, in the context of the model, larger holdings of longer-term securities by the central bank put downward pressure on longer-term interest rates and stimulate the economy. In response, short-term interest rates increase (in accordance with the monetary policy rule in FRB/US). These changes in short- and longer-term interest rates have important feedback effects on remittances.

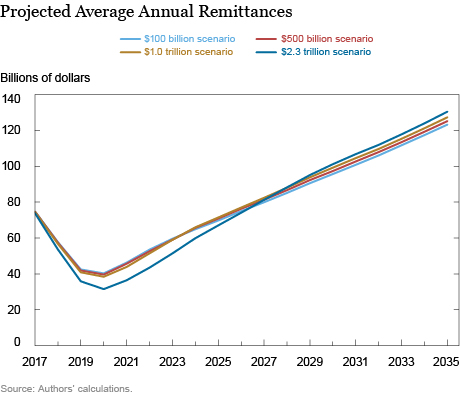

We start by looking at the evolution of average remittances from the Federal Reserve to the Treasury. The chart below displays, for each of the four scenarios, the average annual remittances (across the simulations) for the next twenty years. In each case, average remittances decline over the next four or five years and increase thereafter. This initial decrease is largely driven by an increase in interest expense paid on reserves, which rises sharply since short-term interest rates are projected to increase at a faster pace than the decline in the level of reserve balances. The larger the balance sheet the larger the increase in expenses. In addition, under the largest balance sheet scenario, interest expense is further boosted owing to the more accommodative financial conditions, which lead to higher inflation and short-term interest rates. By contrast, interest income is less responsive to the current level of interest rates through the medium term because it mostly reflects fixed-coupon interest produced by long-term legacy assets. Of course, interest income will initially decline in scenarios in which securities mature and roll off the portfolio. After normalization of the size of the balance sheet, income starts to move up, as the Federal Reserve resumes purchases of securities at higher prevailing market yields, mostly to keep up with currency demand. All in all, remittances decline more in the short run under the $2.3 billion of reserves scenario through the medium term. In the longer-run, remittances are increasing, and more so for scenarios with a larger balance sheet size, since expected future term premiums are, on average, positive.

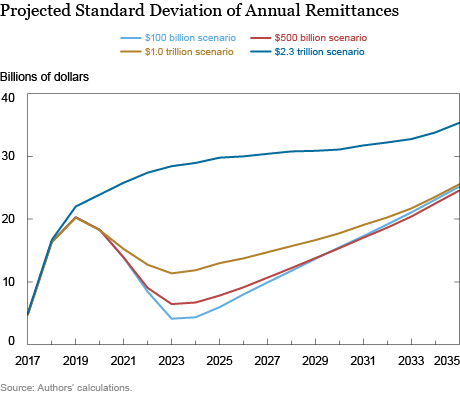

The next chart shows the standard deviation (across simulations) of annual remittances for each of the four scenarios. The volatility of remittances increases for all scenarios for the first few years because, as the modal path for the interest rate on excess reserves (IOER) moves away from the effective lower bound, there is more scope for volatility in IOER and thus for volatility in interest expense. For the scenarios featuring declines in securities holdings over the next few years (that is, the three smaller reserve-balances scenarios), the volatility of remittances falls as the size of the balance sheet shrinks. On the contrary, volatility does not fall for the large balance sheet scenario because reserve balances never decrease. Eventually, volatility increases for all scenarios as the balance sheet grows in line with Federal Reserve notes.

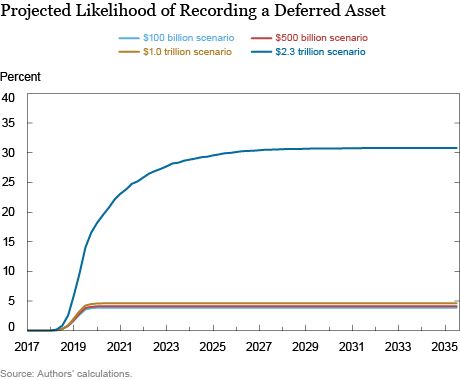

In the event that the Federal Reserve’s earnings net of expenses are negative, no remittances occur and a deferred asset is booked as a negative liability on its balance sheet. We use our stochastic simulations to compute the likelihood of recording a deferred asset. The analysis shows that it is only when short-term interest rates are driven to exceptionally high levels—which occurs very rarely in our simulations—that interest expense on reserve balances more than offsets interest income from the Federal Reserve’s securities holdings. The next chart plots the share of simulations for each scenario featuring a deferred asset in any quarter prior to and including that quarter. Overall, for the scenarios which exhibit a reduction in the securities portfolio of the Federal Reserve, the probability of recording a deferred asset is low. In fact, only in the scenario in which longer-run reserve balances remain at $2.3 trillion is the likelihood of booking a deferred asset significant, at about 30 percent. This likelihood falls under 5 percent with longer-run reserve balances below $1 trillion.

Our analysis shows that the FOMC’s balance sheet normalization program should lead to a reduction in both the volatility of remittances and the likelihood of the Federal Reserve recording a deferred asset. We stress that remittances are an outcome of the proper conduct of monetary policy and that the FOMC’s actions are designed to achieve its dual mandate of maximum employment and price stability. However, these simulations are informative for understanding the possible evolution of remittances based on different longer-run size of the Federal Reserve’s balance sheet. As noted in previous research (Carpenter et al. and Rosengren), the fiscal implications of balance sheet policies go well beyond the effects on remittances. More generally, when short-term interest rates are constrained by the effective lower bound, unconventional policy measures such as large-scale asset purchases can provide necessary stimulus to the economy (as shown in Engen, Laubach, and Reifschneider), allowing the Federal Reserve to meet its dual mandate.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Michele Cavallo is chief in the Federal Reserve Board of Governors’ Division of Monetary Affairs, heading the money market analysis section.

Marco Del Negro is a vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

W. Scott Frame is a financial economist and senior advisor in the Research Department of the Federal Reserve Bank of Atlanta.

Jamie Grasing, a former research assistant at the Federal Reserve Board, is a graduate student at the University of Maryland.

Benjamin A. Malin is a senior economist in the Research Division of the Federal Reserve Bank of Minneapolis.

Carlo Rosa worked on this analysis when employed as a senior economist in the Federal Reserve Bank of New York’s Markets Group, and is currently working for a financial institution.

We thank Jane Ihrig and Larry Mize for helpful comments and Khalela Francis, Margaret Sauer, and James Trevino for excellent research assistance.

How to cite this blog post:

Michele Cavallo, Marco Del Negro, W. Scott Frame, Jamie Grasing, Benjamin A. Malin, and Carlo Rosa, “Fiscal Implications of the Federal Reserve’s Balance Sheet Normalization,” Federal Reserve Bank of New York Liberty Street Economics (blog), January 9, 2018, http://libertystreeteconomics.newyorkfed.org/2018/01/fiscal-implications-of-the-federal-reserves-balance-sheet-normalization.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics