Did the Dodd-Frank Act end ‘‘too-big-to-fail’’ (TBTF)? In this series of two posts, we look at this question through the lens of rating agencies and financial markets. Today we begin by discussing rating agencies’ views on this topic.

The belief that very large banks may be too big to let fail appears to date back to the demise of Continental Illinois Bank in 1984. Continental, then the seventh largest bank in the United States by deposits, experienced deposit runs following news of significant loan losses. Concerns that Continental’s failure might topple other banks led regulators to take the unprecedented step of protecting even uninsured investors, including large depositors, bond holders, and the shareholders of Continental’s holding company.

In the financial crisis beginning in late 2007, the U.S. government provided liquidity and capital support to some of the largest U.S. financial institutions out of concern that a potential failure would threaten the entire financial system. A problem with such support is that it engenders expectations of future support that could motivate further increases in size to preserve or gain too-big-to-fail status. Moreover, when market participants expect institutions to receive support, they underprice their risk which invites excessive risk-taking (moral hazard) and pressures competing firms to do likewise.

To address TBTF, the Dodd-Frank Act requires the Federal Reserve to impose enhanced prudential standards for the largest bank holding companies, and introduces new resolution mechanisms to deal with large financial institutions in distress. Large, systemically important financial institutions must now submit to the Fed and the Federal Deposit Insurance Corporation (FDIC) resolution plans (“living wills”) that detail their plan for rapid and orderly resolution under the U.S. Bankruptcy Code in the event of failure. In addition, Title II of the Dodd-Frank Act authorizes the FDIC to wind down financial companies whose resolution under ordinary bankruptcy law might destabilize the financial system. The FDIC has developed a “single point of entry” (SPOE) strategy (discussed below) for implementing its Orderly Liquidation Authority (OLA) for resolving large financial companies.

A natural question to ask at this stage is whether the Dodd-Frank Act is succeeding in reducing TBTF perceptions. Are rating agencies convinced that support for very large banks is a thing of the past? Below we look at this question using the views of three rating agencies: Moody’s, Standard & Poor’s (S&P), and Fitch Ratings.

What Do Raters Think?

Rating agencies have different ways of indicating the likelihood that, in their opinion, an institution will receive government support. Fitch publishes a support rating floor (SRF) that reflects its view about the likelihood of government support for a bank or its holding company. Related measures can be derived for Moody’s and S&P using a measure known as uplift, defined as the difference between an institution’s all-in rating, which reflects intrinsic financial strength and external support, and its intrinsic strength rating. Uplift is perhaps a noisier measure of government support since it also incorporates possible support from parent companies.

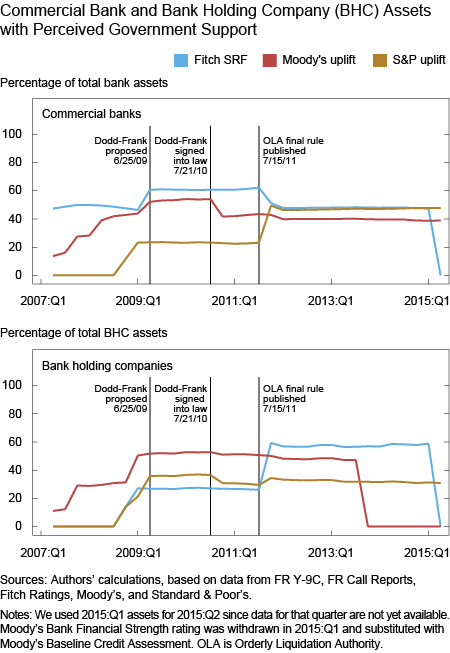

As a first look, the top panel in the chart below plots the ratio of commercial banks’ assets that the agencies expect to receive support (“supported” banks’ assets) to total banking system assets. Until Fitch withdrew its perception of support for the commercial banks of the eight U.S. global systemically important financial institutions (G-SIBS) on May 19 of this year, that ratio remained relatively stable at about 50 percent for each of the rating agencies. This constancy seems to be at odds with the disappearance of TBTF.

Also notable is how perceived support for bank holding companies has evolved under Dodd-Frank. Under Title II and the SPOE resolution strategy, the FDIC will be appointed receiver of the top-tier parent of the failing bank holding company (BHC). The Act also prohibits the use of taxpayer funds to preserve a company that has been put into receivership, which theoretically eliminates the possibility of bailouts of the holding company. As the bottom panel in the chart below shows, in S&P’s view, the proportion of bank holding companies’ assets that it perceives as supported has remained constant over the last six years. However, both Moody’s and Fitch have removed their expectations of government support to bank holding companies (Moody’s announcement, Fitch announcement), in line with Dodd-Frank ending TBTF for parent bank holding companies.

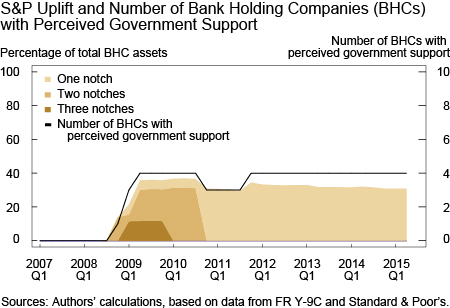

Is it possible that, while S&P still expects support for some BHCs, the perceived strength of support has decreased and is now negligible? A look at the chart below reveals a mixed picture. According to S&P, the strength of government support has weakened (as indicated by progressively lighter shading for the uplift measure). However, as the black line suggests, the number of BHCs that could receive support has remained unchanged. In S&P’s view, four large U.S. BHCs (representing 31 percent of the total BHC assets) still retain one notch of uplift relative to their main commercial bank, two notches down from the height of the crisis.

Circling back to our original question of whether the Dodd-Frank Act has solved too-big-to-fail in the United States, the answer seems to be yes, according to Fitch; maybe, according to Moody’s; and not yet, according to S&P. While Fitch has removed its expectation of government support to U.S. commercial banks and bank holding companies, Moody’s still expects support for commercial banks, and S&P for commercial banks and bank holding companies. However, S&P has indicated that it expects to revise its ratings of four U.S. G-SIBS this year to reflect the reduced likelihood of government support for these institutions. Of course, this analysis only reflects the rating agencies’ views. In our next post, we look at this question from the point of view of financial markets.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Gara Afonso is a research officer in the Federal Reserve Bank of New York’s Research and Statistics Group.

João A.C. Santos is a vice president in the Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics