Thomas M. Eisenbach and Tanju Yorulmazer

In a previous Liberty Street Economics post, we introduced a framework for thinking about the risks banks face. In particular, we distinguished between asset return risk and funding risk that can interact and cause a bank to fail. In our framework, a bank can fail for two reasons:

- Low asset returns: Fundamental insolvency due to erosion of equity by low asset returns that don’t cover a bank’s debt burden.

- Loss of funding: Costly liquidation of assets that erode equity.

In this post, we use the framework to study how several factors and policy instruments affect a bank’s risk of failure. We look at how changes in the liquidity of banks’ assets affect failure risk, we analyze what happens if the bank has more capital (or lower leverage), and we show how similar the implications are if the bank held more cash instead of risky assets and if the bank had more long-term instead of short-term debt. In addition, we provide an interactive chart where you can experiment yourself with how changing these bank characteristics affects bank solvency.

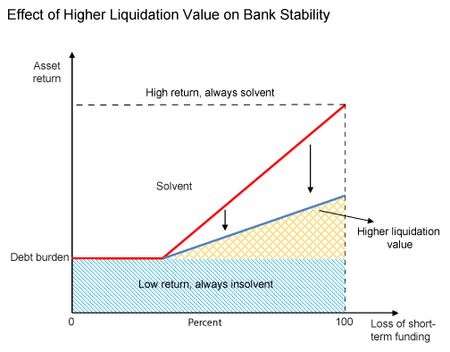

We first consider the effect of the liquidation value of the bank’s risky assets. A higher liquidation value means that if the bank has to sell assets, it’s able to do so at a smaller discount to the assets’ fundamental value. The effect of a higher liquidation value (lower “fire-sale” discount) is illustrated in the chart below. In particular, there are two effects to note:

- The region of fundamental insolvency (blue shaded area) is unaffected. In this region, the fundamental value of the risky assets turns out to be so low that the bank is insolvent even if all short-term creditors roll over their debt.

- The red line separating the solvency from the insolvency regions becomes flatter, shrinking the region over which the bank is “solvent but illiquid.” With a higher liquidation value, the bank can raise more cash to pay for withdrawals. Hence, the bank is able to survive funding shocks and/or asset return shocks that would have caused insolvency for a lower liquidation value.

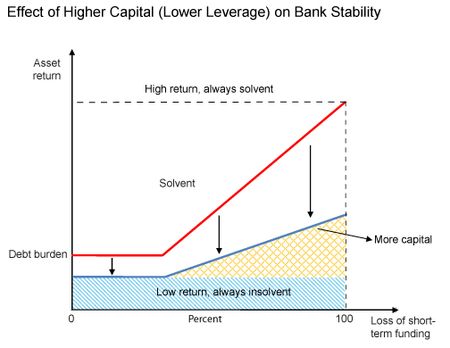

Next, we consider how lower leverage (higher capital), keeping the maturity structure of the bank’s liabilities fixed, affects insolvency risk. Lower leverage means that the assets the bank holds are funded by more equity and less debt. While equity can act as a cushion against losses, debt has to be repaid no matter what and can therefore cause a bank to fail.

In contrast to the liquidation value, we see in the next chart that the leverage ratio affects both a bank’s risk of fundamental insolvency as well as its risk of being “solvent but illiquid.” The reason is that more equity unambiguously increases the bank’s loss-absorption capacity. With less total debt to repay, the bank will survive for some low asset returns that would have caused insolvency with higher leverage. In addition, since the bank has less short-term debt, there are relatively more assets available to sell and satisfy withdrawals. Therefore, the bank is less vulnerable to illiquidity.

Regulation, such as through higher capital requirements or constraints on leverage ratios, would have this kind of stabilizing effect.

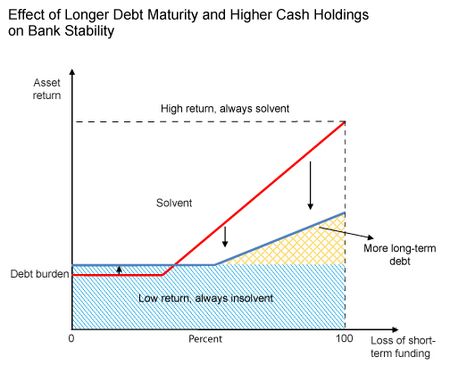

Finally, we turn to two related issues. As we discussed, the two factors that make banks vulnerable to runs are 1) that a large part of their debt is short term and can be withdrawn quickly and 2) that a large part of their assets is long term and can only be sold at a discount. Some direct ways to address these factors would be for a bank to finance itself with more long-term instead of short-term debt and/or hold more of its assets in cash instead of risky assets.

As it turns out, these two measures have the same effects in our framework, as illustrated in the chart below.

- First, as we would expect, the region where the bank fails because of illiquidity shrinks. With less of its debt short term, the bank can lose less of its funding on any day. Similarly, with more of its assets in cash, a given level of withdrawals is less destructive since it doesn’t cause as much costly liquidation of the risky assets.

- Second and somewhat surprisingly, the region where the bank is fundamentally insolvent increases. This is because the debt burden effectively increases since borrowing long term is typically more expensive than borrowing short term. This means that while less short-term debt reduces the risk of a run, the bank has to repay more in total and will therefore be insolvent slightly more often. Similarly for higher cash holdings, the return on cash is typically lower than the expected return on risky assets. So while holding more cash provides safety against short-term withdrawals, it reduces a bank’s long-term return and increases the risk of insolvency.

In our discussion so far, we’ve only studied the effects of changing one bank characteristic at a time. We invite you to use our interactive chart to experiment yourself with changes in one or more of the characteristics and see the effects on the four regions of bank solvency.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Thomas M. Eisenbach is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Thomas M. Eisenbach is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Tanju Yorulmazer is a research officer in the Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics