Marco Cipriani, Antoine Martin, and Bruno Parigi

Since the financial crisis of 2007-09—and, in particular, the run on prime money market funds (MMFs) in September 2008—policymakers have been concerned that the funds’ fragility may render banks themselves more susceptible to risk. For instance, in a recent article and speech arguing in favor of MMF reform, New York Fed President Bill Dudley stated that MMF fragility may contribute to financial market systemic risk. The idea that the susceptibility of MMFs to runs may make the financial system more unstable seems intuitive, but is it correct? In this post, we show that the idea isn’t only intuitively appealing, it’s also sound from an economic theory standpoint: MMF fragility is indeed a concern for the stability of the banking system and a contributing factor to financial market systemic risk.

The Economic Function of MMFs

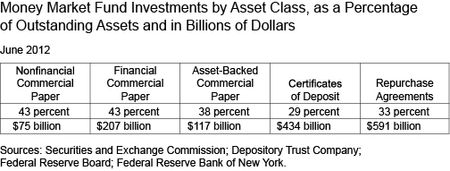

Traditionally, banks have financed their investments in loans and long-term securities by collecting demand deposits from both households and corporations. In recent decades, however, U.S. banks have also increasingly relied on funding from other financial intermediaries, such as MMFs. As we discuss in an earlier post, MMFs collect money from large institutional and retail investors in order to provide short-term funding to the financial sector and to banks in particular. In the United States, they’re a significant player in the short-term funding market. The funds managed approximately $2.5 trillion in assets at the end of 2012. As the table below shows, MMFs held 43 percent of financial commercial paper, 29 percent of certificates of deposit, and 33 percent of repo agreements.

In the United States, deposits are insured up to $250,000; so bank deposits by institutional and wholesale investors are often not fully insured. As a result, these investors need to limit their exposure to a single banking institution and diversify their portfolio of deposits. One way for investors to limit their bank exposure is by depositing their funds directly in several banks. We show how this can be achieved in the exhibit below: The arrows denote the investments into a bank as well as the cost to the investor to find and monitor those banks in which he invests. We can call this banking structure diversification through direct finance.

Intermediation through MMFs allows investors to achieve the same diversification gains as they do through direct finance, while at the same time saving on monitoring and search costs. In the next exhibit, we show a financial economy similar to that of the one above, although intermediated through MMFs. Investors deposit their money in an MMF, which in turn invests it in several banks. Intermediation through the MMF allows investors to reduce their exposure to the bankruptcy of a single banking institution. Since MMFs deposit their funds in banks on behalf of several clients, they save the search and monitoring costs that each investor would otherwise have to pay on his own.

Informed Investors and the Fragility of MMF-Intermediated Finance

Before a bank run, at least some of a bank’s assets usually become impaired. Of course, as assets become impaired, investors learn about it over time. They become “informed.” In a direct-finance banking system, investors would withdraw their funds from their bank as they learn about its trouble. As a result, unless all investors learn about the trouble at the same time, the bank loses its investor base somewhat gradually.

In contrast, in an economy intermediated through MMFs, investors who are aware that an MMF is investing in troubled banks will withdraw their funds from the MMF itself. This is indeed what happened to U.S. MMFs in 2011, as investors redeemed their MMF shares out of concern for the funds’ investment in European banks. Remember that MMFs collect investments from a large number of investors, and invest their funds in banks and other financial institutions. As informed MMF investors redeem their shares, MMFs become aware that some of their own investments—for instance, short-term funding to a bank—are in trouble. Because of this, they may withdraw their funds en masse from a bank, precipitating a run that wouldn’t have happened otherwise. Since MMFs collect funds from investors, the MMFs will learn from their redemptions when investors are informed. Accordingly, even a piece of bad news that only few investors have access to may lead to large withdrawals of funds from the banking system. In other words, MMFs act as an amplification mechanism. Whereas under the traditional banking model the slow withdrawal of funds from a bank may be manageable, the rapid drying up of funds from MMFs and other wholesale funds providers may be fatal to a bank. The bank may be forced to sell its assets at “fire-sale” prices, thereby worsening both its own balance sheet and that of other financial institutions. As a result, MMF intermediation may contribute to the fragility of the financial system by making it more prone to runs and contagion.

The Way Forward

We make this argument more formally in a recent staff report. We show that MMF intermediation allows investors to limit their exposure to a single bank and reap the gains from diversification. However, a banking system intermediated through MMFs is more unstable than one in which investors interact directly with banks. The mechanism through which instability arises is the information that MMF investors have on bank assets, which is learned by MMFs and leads them to withdraw en masse from a bank.

Our results underpin the idea that an MMF-intermediated financial system can be particularly fragile. This fragility has been the main driver of the recent industry regulatory efforts by the Securities and Exchange Commission. In recent decades, banks have relied more and more on financial intermediaries, such as money markets funds, to finance their investments. However, our findings suggest that this trend, while providing investors with valuable diversification, may increase the instability of the banking system.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Marco Cipriani is a senior economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Antoine Martin is a vice president in the Research and Statistics Group.

Bruno Parigi is a professor of economics at the University of Padua.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

I think you make a thoughtful case for the risk of fire-sale in regards to MMFs and their intermediation of Direct Finance between investors and banks. I know disintermediation is a long-term goal of the FSB and the Fed ala Shadow Banking Reform. However, I think the risk of fire-sales can be reduced, not by disintermediating the MMFs, but by expanding their intermediation beyond the banks to other, non-traditional repo counterparty sectors (similar to the Fed’s own Reverse Repo Facility and Direct Repo), such as pension funds, credit unions, corporations, asset managers, hedge funds, mREITs, Insurance Companies, and Supra-Nationals. This would potentially a) achieve reduced concentration risk of MMFs to banks, b) achieve greater diversification of counterparty sectors and different risk tolerances for intermediated investors, c) tap into ‘stickier’ money, unlike the ‘hot’ money of banks who might be more inclined to liquidate quicker, d) achieve higher yields for MMFs and investors, e) achieve higher haircut protection, also reducing the risk of liquidation. The knock-on benefit for teh system is that it would also reduce Shadow Banking, having repo transacted between traditional cash provider MMFs and end-user collateral providers.