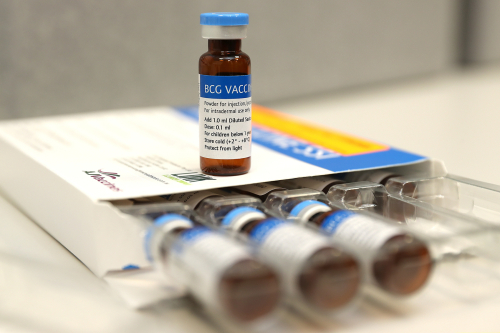

Does the BCG Vaccine Protect Against Coronavirus? Applying an Economist’s Toolkit to a Medical Question

As COVID-19 has spread across the globe, there is an intense search for treatments and vaccines, with numerous trials running in multiple countries. Several observers and prominent news outlets have noticed that countries still administering an old vaccine against tuberculosis—the Bacillus Camille-Guerin (BCG) vaccine—have had fewer coronavirus cases and fewer deaths per capita in the early stages of the outbreak. But is that correlation really strong evidence that the BCG vaccine provides some defense against COVID-19? In this post, we look at the incidence of coronavirus cases along the former border between East and West Germany, using econometric techniques to investigate whether historical differences in vaccination policies account for the lower level of infection in the former East.

The Money Market Mutual Fund Liquidity Facility

To prevent outflows from prime and muni funds from turning into an industry-wide run after the COVID-19 outbreak, the Federal Reserve established Money Market Mutual Fund Liquidity Facility. This post looks at the Fed’s intervention, its goals, and the direct and indirect market effects.

Amid the COVID‑19 Outbreak, Consumers Temper Spending Outlook

The New York Fed’s Center for Microeconomic Data released results today from its April 2020 SCE Household Spending Survey, which provides information on consumers’ experiences and expectations regarding household spending. These data have been collected every four months since December 2014 as part of our Survey of Consumer Expectations (SCE). Given the ongoing COVID-19 outbreak, the April survey, which was fielded between April 2 and 30, unsurprisingly shows a number of sharp changes in consumers’ spending behavior and outlook, which we review in this post.

Translating Weekly Jobless Claims into Monthly Net Job Losses

News headlines highlighting the loss of 26 million jobs (so far) underscore the massive shock that has hit the U.S. economy and the dislocation, hardship, and stress it has caused for so many American workers. But how accurately does this number actually capture the number of net job losses? In this post, we look at some of the statistical anomalies and quirks in the weekly claims series and offer a guide to interpreting these numbers. What we find is that the relationship between jobless claims and payroll employment for the month can vary substantially, depending on the nature, timing, and persistence of the disaster.

W(h)ither U.S. Crude Oil Production?

Treasury Market Liquidity during the COVID‑19 Crisis

A key objective of recent Federal Reserve policy actions is to address the deterioration in financial market functioning. The U.S. Treasury securities market, in particular, has been the subject of Fed and market participants’ concerns, and the venue for some of the Fed’s initiatives. In this post, we evaluate a basic metric of market functioning for Treasury securities—market liquidity—through the first month of the Fed’s extraordinary actions. Our particular focus is on how liquidity in March 2020 compares to that observed over the past fifteen years, a period that includes the 2007-09 financial crisis.

How Widespread Is the Impact of the COVID‑19 Outbreak on Consumer Expectations?

In a recent blog post, we showed that consumer expectations worsened sharply through March, as the COVID-19 epidemic spread and affected a growing part of the U.S. population. In this post, we document how much of this deterioration can be directly attributed to the coronavirus outbreak. We then explore how the effect of the outbreak has varied over time and across demographic groups.

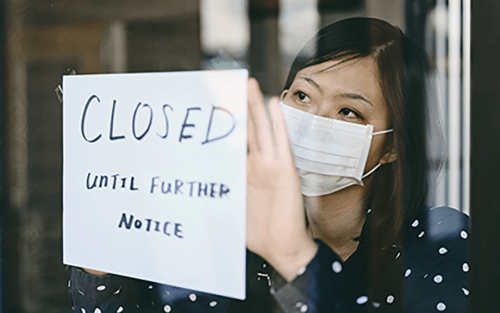

New York Fed Surveys: Business Activity in the Region Sees Historic Plunge in April

Indicators of regional business activity plunged to historic lows in early April, as efforts to slow the spread of the coronavirus kept many people at home and shut down large parts of the regional economy, according to the Federal Reserve Bank of New York’s two business surveys. The headline index for both surveys plummeted to nearly -80, well below any historical precedent including the depths of the Great Recession. About 60 percent of service firms and more than half of manufacturers reported at least a partial shutdown of their operations thus far. Layoffs were widespread, with half of all businesses surveyed reporting lower employment levels in early April.

The COVID‑19 Pandemic and the Fed’s Response

Helping State and Local Governments Stay Liquid

On April 9, the Federal Reserve announced up to $2.3 trillion in new support for the economy in response to the coronavirus pandemic. Among the initiatives is the Municipal Liquidity Facility (MLF), intended to support state and local governments. The details of the facility are described in the term sheet. The state and local sector is a unique but very important part of the economy. This post lays out some of the economics of the sector and the needs that the facility intends to satisfy.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics