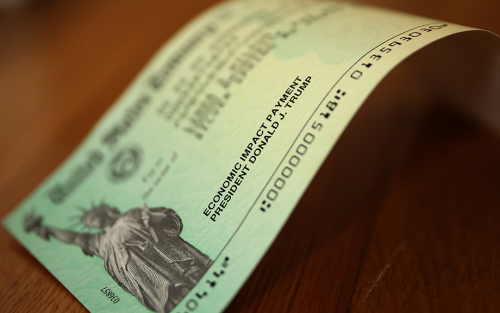

Consumers Increasingly Expect Additional Government Support amid COVID‑19 Pandemic

The New York Fed’s Center for Microeconomic Data released results today from its April 2020 SCE Public Policy Survey, which provides information on consumers’ expectations regarding future changes to a wide range of fiscal and social insurance policies and the potential impact of these changes on their households. These data have been collected every four months since October 2015 as part of our Survey of Consumer Expectations (SCE). Given the ongoing COVID-19 pandemic, households face significant uncertainty about their personal situations and the general economic environment when forming plans and making decisions. Tracking individuals’ subjective beliefs about future government policy changes is important for understanding and predicting their behavior in terms of spending and labor supply, which will be crucial in forecasting the economic recovery in the months ahead.

Amid the COVID‑19 Outbreak, Consumers Temper Spending Outlook

The New York Fed’s Center for Microeconomic Data released results today from its April 2020 SCE Household Spending Survey, which provides information on consumers’ experiences and expectations regarding household spending. These data have been collected every four months since December 2014 as part of our Survey of Consumer Expectations (SCE). Given the ongoing COVID-19 outbreak, the April survey, which was fielded between April 2 and 30, unsurprisingly shows a number of sharp changes in consumers’ spending behavior and outlook, which we review in this post.

Just Released: Transitions to Unemployment Tick Up in Latest SCE Labor Market Survey

The Federal Reserve Bank of New York’s July 2019 SCE Labor Market Survey shows a year-over-year rise in employer-to-employer transitions as well as an increase in transitions into unemployment. Satisfaction with promotion opportunities and wage compensation were largely unchanged, while satisfaction with non-wage benefits retreated. Regarding expectations, the average expected wage offer (conditional on receiving one) and the average reservation wage—the lowest wage at which respondents would be willing to accept a new job—both increased. Expectations regarding job transitions were largely stable.

Expecting the Unexpected: Job Losses and Household Spending

Unemployment risk constitutes one of the most significant sources of uncertainty facing workers in the United States. A large body of work has carefully documented that job loss may have long-term effects on one’s career, depressing earnings by as much as 20 percent after fifteen to twenty years. Given the severity of a job loss for earnings, an important question is how much such an event affects one’s standard of living during a spell of unemployment. This blog post explores how unemployment and expectations of job loss interact to affect household spending.

Just Released: Are Employer‑to‑Employer Transitions Yielding Wage Growth? It Depends on the Worker’s Level of Education

The rate of employer-to-employer transitions and the average wage of full-time offers rose compared with a year ago, according to the Federal Reserve Bank of New York’s July 2018 SCE Labor Market Survey. Workers’ satisfaction with their promotion opportunities improved since July 2017, while their satisfaction with wage compensation retreated slightly. Regarding expectations, the average expected wage offer (conditional on receiving one) and the reservation wage—the lowest wage at which respondents would be willing to accept a new job—both increased. The expected likelihood of moving into unemployment over the next four months showed a small uptick, which was most pronounced for female respondents.

Just Released: Is Housing a Good Investment? Where You Stand Depends on Where You Sit

Home price growth expectations remained stable relative to last year, according to the Federal Reserve Bank of New York’s 2018 SCE Housing Survey. Respondents expect mortgage rates to rise over the next year, and perhaps as a result, the share of owners who expect to refinance their mortgages over the next year declined slightly. In addition, homeowners view themselves as more likely to make investments in their homes, and renters’ perceived access to mortgage credit has tightened somewhat. Although the majority of households continue to view housing as a good financial investment, there are some persistent and large differences across regions in the pervasiveness of this view, as this post will discuss.

Just Released: Great Recession’s Impact Lingers in Hardest‑Hit Regions

The New York Fed’s Center for Microeconomic Data today released our Quarterly Report on Household Debt and Credit for the fourth quarter of 2017. Along with this report, we have posted an update of state-level data on balances and delinquencies for 2017. Overall aggregate debt balances increased again, with growth in all types of balances except for home equity lines of credit. In our post on the first quarter of 2017 we reported that overall balances had surpassed their peak set in the third quarter of 2008—the result of a slow but steady climb from several years of sharp deleveraging during the Great Recession.

Political Polarization in Consumer Expectations

Following the 2016 presidential election, as noted on this blog and many other outlets, Americans’ political and economic outlook changed dramatically depending on partisan affiliation. Immediately after the election, Republicans became substantially more optimistic relative to Democrats. In this blog post, we revisit the issue of polarization over the past twelve months using data from the New York Fed’s Survey of Consumer Expectations (SCE)—also the focus of a detailed technical overview in the latest edition of the Bank’s journal, the Economic Policy Review. The overview walks readers through the design and implementation of the survey, as well as the computation of the various statistics released by the SCE team every month.

Just Released: Introducing the SCE Labor Market Survey

The New York Fed has just released new data on individuals’ experiences and expectations in the labor market. These data have been collected every four months since March 2014 as part of the Survey of Consumer Expectations (SCE). In this post we introduce the SCE Labor Market Survey and highlight some of its features.

How Do People Revise Their Inflation Expectations?

The New York Fed started releasing results from its Survey of Consumer Expectations (SCE) three years ago in June 2013. The SCE is a monthly, nationally representative, internet-based survey of a rotating panel of about 1,300 household heads. Its goal, as described in a series of Liberty Street Economics posts, is to collect timely and high-quality information on consumer expectations about a broad range of topics, covering both macroeconomic variables and the household’s own situation. In this post, we look at what drives changes in consumer inflation expectations. Do people respond to changes in recent realized inflation, and to expected and realized changes in prices of salient individual commodities—like gasoline? Understanding what drives inflation expectations is important for the conduct of monetary policy, since it improves a central bank’s ability to assess its own credibility and to evaluate the impact of its policy decisions and communication strategy.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics