Andreas Fuster and David O. Lucca

As of mid-December, the average thirty-year fixed-rate mortgage was near its historic low of about 3.3 percent, or half its level in August 2007 when financial turmoil began. However, yield declines in the mortgage-backed-securities (MBS) market, where bundles of mortgage loans are sold to investors, have been even more dramatic. In fact, all else equal, had these declines passed through to loan rates one-for-one, the average mortgage rate would now be around 2.6 percent. In this post, we summarize some of the findings from a workshop held at the New York Fed in early December aimed at better understanding the drivers behind the increased wedge between mortgage loan and MBS rates.

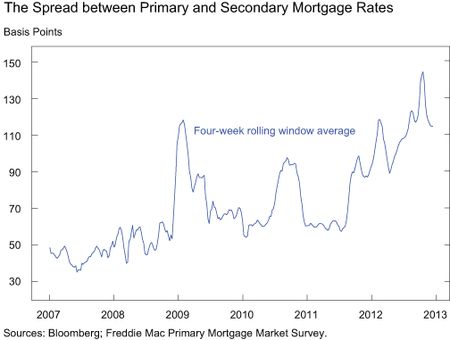

The chart below shows the recent evolution of the gap between the two rates (the “primary-secondary spread”) as measured by the difference between a representative yield on newly issued agency MBS (the “current coupon,” or secondary rate) and the average thirty-year fixed loan rate (the “primary rate”) from the Freddie Mac Primary Mortgage Market Survey. The spread has increased 70 basis points, on net, from around 45 basis points in 2007 to about 115 today, implying that declines in the primary rate have been smaller than those in the secondary rate. So, why is the primary rate at 3.3 percent and not at 2.6 percent today?

As we noted in a white paper prepared as background material for the workshop, a number of factors may be at play. First, the primary-secondary spread is only an imperfect proxy for the degree of “pass-through” between the MBS market and the primary market. For one thing, we can’t observe the MBS yield directly, but instead must compute it under a number of assumptions that are particularly sensitive to misspecification in the current environment. Also, the spread doesn’t take into account the guarantee fees on loans charged by Fannie Mae or Freddie Mac (the agencies or “GSEs”), which have increased from 20 to 25 basis points before 2008 to about 50 basis points today.

Rising Cost or Rising Profit?

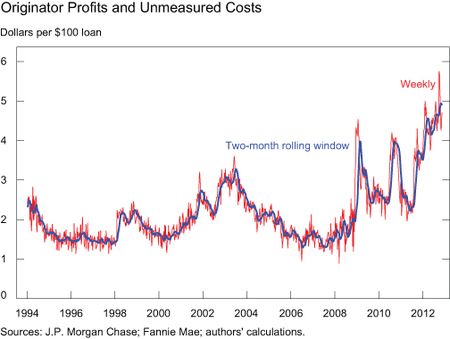

A clearer picture of the link between MBS and primary markets comes from an alternative measure that we call “Originator Profits and Unmeasured Costs,” or OPUCs. The OPUC measure captures the loan originator’s average revenue from selling a mortgage in the agency MBS market (after accounting for the guarantee fee) as well as the revenues from servicing the loan and from points paid upfront by the borrower. As the name implies, OPUCs represent either lender costs (other than the guarantee fee), lender profits, or a combination of the two.

Recent movements in OPUCs, shown in the chart below, are similar to those in the primary-secondary spread. OPUCs have increased significantly, from below $2 (per $100 loan) in the 2005-08 period to a record high of about $5, suggesting that even after accounting for the higher guarantee fees, something unusual may be occurring in mortgage markets today.

Much of the discussion at the workshop, like the analysis in the paper, revolved around the question of why OPUCs have grown so substantially. First, OPUCs could be unusually high in order to compensate originators for increased put-back risk (the risk of having to repurchase some delinquent loans from the GSEs), possible increases in pipeline hedging costs, or other loan production expenses. They could also be overstated due to a decline in the value of mortgage servicing rights. While it’s hard to measure each of these components, we tentatively concluded in the paper that these costs don’t seem to have changed sufficiently to offset the increase in OPUCs, suggesting that profits in mortgage origination have likely increased. Workshop participants overall agreed with this analysis, but also countered that while each cost increase was small on its own, their sum was a sizable amount, offsetting part of the OPUC rise. In addition, some panelists pointed to more time-intensive underwriting procedures as contributing to higher origination costs. Overall, the discussion didn’t refute the alternative explanation of higher profit levels. So what would drive such an increase in the profitability of mortgage origination?

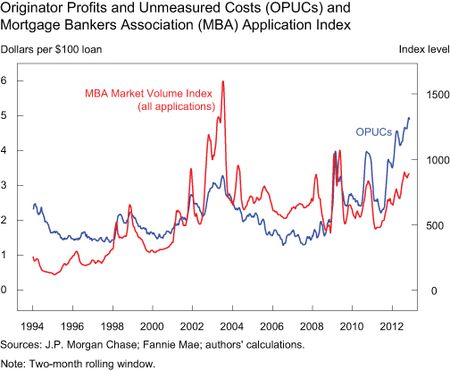

In the paper, we discuss how lenders’ pricing power appears to have increased over the past couple of years, especially on refinancing loans. For example, we document how rates on refinancing loans, in particular those under the Home Affordable Refinance Program (HARP), have been higher than those on purchase loans, for which the market appears to be more competitive. We also note, however, that originators’ capacity constraints are likely the key driver behind the currently elevated profit levels. The chart below plots the OPUC measure against the mortgage application volume index from the Mortgage Bankers Association. OPUCs tend to increase whenever application volume rises rapidly. As discussed at the workshop, a likely interpretation of this relationship is that in such times, lenders can’t handle all the demand they would get if they lowered rates further, and thus they keep their offered rates high.

In principle, when profits are high, one would expect existing firms to expand capacity or new competitors to enter the market. But workshop participants pointed out that these channels may be impaired today because of the decline in third-party originations by mortgage brokers or correspondent lenders, uncertainty about how long the high origination volumes will last, lack of clarity about future regulations, more general fear of future liability risk, or difficulty hiring qualified underwriters. As a result, profit levels and the primary-secondary spread could stay higher than normal.

What’s Next?

Given the discussion thus far, will mortgage rates eventually hit 2.6 percent if MBS prices stay at current levels? This is unlikely, we think, in part due to the increase in guarantee fees, which alone accounts for 25 to 30 basis points of the rise in the primary-secondary spread. Whether or not average mortgage rates could fall more modestly to, say, 3 percent depends crucially on the de

gree to which the capacity constraints in the mortgage origination industry could be alleviated and the lenders’ apparent pricing power reduced. With these issues in mind, some policy changes may be worth further consideration. For example, extending representation and warranty reliefs to different servicers for streamline refinancing programs (such as HARP) may help increase competition for these loans. More generally, making more agency loans eligible for such programs would likely lower underwriting burdens and loosen the industry’s capacity constraints without increasing the GSEs’ credit risk exposure (as the loans are already guaranteed by these institutions). Relaxing the GSE minimum net worth requirements and volume caps for loan sellers and servicers could also positively affect capacity and entry in the industry. While each of these proposals requires further study, we see these topics as staying at the forefront of the policy discussion. The pass-through from financial market conditions to consumer rates has always been of interest to central banks, but as noted at the workshop by New York Fed President William Dudley in his opening remarks and by Boston Fed President Eric Rosengren in his keynote speech, it’s of even greater interest today as large-scale purchases of agency MBS—aimed in part at lowering mortgage rates—have become a key monetary policy instrument.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Andreas Fuster is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

David O. Lucca is an economist in the Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Thank you for your comments. To David K., an approximate aggregate OPUC calculation can be obtained by multiplying gross MBS issuance and OPUC per loan. However, as noted in the post, one needs to subtract costs (other than GSE guarantee fees) to parse out profits. To Steve Thomas, this would be an interesting exercise, but not all required information is publicly available (in particular, lender-specific info on points paid by or to the borrower). To Dan, changes in LO compensation may have contributed to what is happening in the market (by changing the attractiveness of third-party originations), but at least in the aggregate series from Freddie Mac’s PMMS, there hasn’t been much of a change in the number of points paid by borrowers over the past few years. As for your second point, it’s not the coupon of an MBS that matters, but rather the risk-adjusted yield on the bond. To Chris Mayer, we try to look at the potential impact of regulation on the valuation of servicing rights, and find a non-zero but limited impact. However, there are certainly other potential channels due to regulation that we leave out, and it may indeed be true that those channels contribute to limited entry or exit from the business, thus limiting capacity and sustaining profits. All else equal, less regulatory uncertainty would of course always be beneficial in mortgage and other markets. However, it may also be the case that the reduction in capacity by some incumbent lenders is driven more by past losses in mortgage lending and a desire to get out of that line of business rather than the current conditions and profitability per se. To Lt, notwithstanding the widening in the primary-secondary spread, mortgage rates are at historic lows, and LSAPs have eased financial conditions beyond mortgage markets. Please see President Dudley’s speech that we cite in the post for more detail. Finally to Monitor Bank Rates, we use the average rate, rather than the lowest advertised rate, as a proxy of the typical rate that a consumer is offered.

The spread between the two markets is greater that it has been in years past but if you look at the lowest advertised rates instead of the average rates published by Freddie Mac the spread narrows considerably. You can find fixed 30 year mortgage rates today advertised as low as 2.875 percent, a lot lower than the average rate of 2.34 percent in this week’s PMMS and a lot closer to the 2.60 percent rate.

So the bottom line is that Fed efforts to lower rates are – at least in part – illusory, and the Fed is helping economic growth only indirectly as a function of helping banks. The Fed pads bank profits, and if banks feel generous they may deign to share some of that with borrowers? It’s good to be a banker. Financials (XLF) are the second best performing sector since March 13, 2009 (+173%). Trailing consumer discretionary (XLY +199%) but well ahead of the other sectors (industrials XLI +152%).

Having attended this conference, Andreas and David have done a great job summarizing the comments and ideas. Their paper is excellent. However, I should express a belief that regulation and higher costs and risks play a bigger role in explaining the growth of this spread than is commonly perceived. One key observation: capacity is constrained not just because lenders are not investing more in capacity, but some large lenders are actually shrinking their mortgage origination capacity. Reducing capacity is inconsistent with higher risk adjusted profits. At least some lenders are choosing to reduce capacity despite seemingly higher profit margins. Regulators could do more to be sure there is greater certainty about putback risk, for example. A candid conversation with lenders who are voluntarily shrinking capacity might generate additional observations. As well, neither the GSEs nor FHFA has credibly explained why they continue to leave barriers in place to competitive refis…instead these parties seem to argue that there aren’t barriers to different servicer refis despite the evidence to the contrary in this paper.

If you could find one honest, candid Jr. VP at any major bank, he or she could give you a breakdown of their profit margin on a mortgage, including much more detail than the analytic guesses outlined in the white paper. They know where their profits come from and how much they are. The big question not answered is: Why is market competition not working? Why doesn’t a new Countrywide pop up that would cut profit margins (OPUC if you prefer)to less exploitive levels? Not enough underwriters? Half the population is an unemployed former mortgage underwriter.

One reason for the higher mortgage interest rates after 2008 is the Dodd-Frank Act. The costs of licensing and compliance resulting from this legislation are significant. The fines/lender recapture/retribution policies put into place by Dodd-Frank also make the mortgage industry riskier for lenders/originators. In addition, the Dodd-Frank Act changed the way mortgage loan officers are allowed to be compensated. Pre 2008, loan officers would charge the consumer upfront points. Dodd-Frank calls this “borrower paid” compensation, and technically it is illegal for the LO to get paid on such a transaction. Also it was common to charge 1 point upfront and one point in yield spread via a higher rate. That practice is no longer allowed per Dodd-Frank. Therefore, all of the broker/originator compensation is worked into the rate which results in higher rates for consumers across the board. Obviously when the lender sells these above market rate loans on the secondary market there are greater profits than prior to Dodd-Frank. I would consult the Dept of Housing and Urban Development and compare how many upfront points consumers were paying pre-Dodd-Frank and compare that to industry numbers today. On another note, would there be interest from investors for a 30yr note at 2.6% when you can buy a bond that is guaranteed at a higher yield?

It would be most interesting to measure and report on the primary-secondary market spread, or OPUC level, by lender name or by originator size. THis would allow potentially for the FRB NY to direct its MBS purchase toward lenders most willing (or able) to pass on the subsidy to borrowers instead of rewarding all originators, including those who retain the subsidy for themselves as excess profit.

It would be interesting to see an estimate for the total gain to lenders over, say, the 2010-2012 period from these higher-than-expected mortgage rates. And whose role would it be to force or encourage more pass-through?