John Campbell, Andreas Fuster, David O. Lucca, Stijn Van Nieuwerburgh, and James Vickery

Because mortgages make up the majority of household debt in most developed countries, mortgage design has important implications for macroeconomic policy and household welfare. As one example, most U.S. mortgages have fixed interest rates—if interest rates fall, existing borrowers need to refinance to lower their interest payments. In practice, households are often slow to refinance, or may not be able to do so. As a result, the transmission of U.S. monetary policy is dampened relative to countries like the United Kingdom where mortgage rates on most loans adjust automatically with short-term interest rates. In this post, we discuss some of the key takeaways from a recent conference where policymakers, academics, practitioners, and other experts convened to discuss mortgage design and consider possible mortgage market innovations.

The May 20-21 conference “Mortgage Contract Design: Implications for Households, Monetary Policy, and Financial Stability” was organized by the New York Fed in association with the Center for Real Estate Finance Research at the NYU Stern School of Business. The conference featured a lunch address by Atif Mian from Princeton University, and opening remarks by New York Fed Research Director Jamie McAndrews. The first day focused on academic research (see the papers and slides). Here, we turn to the issues raised on the second day of the conference in four policy-oriented panel discussions.

Which mortgages work best for households?

The first session focused on the household perspective on mortgage design. A key theme that emerged was that no product is inherently “best” for borrowers—each variant simply changes the risks that borrowers face. As discussed in Joao Cocco’s presentation, a nominal fixed-rate mortgage (FRM) without a prepayment option may seem safe, but actually exposes the borrower to inflation risk. That is, a fall in inflation will increase the real (inflation-adjusted) present value of the borrower’s mortgage payments. A prepayment option mitigates this risk; if inflation and nominal interest rates fall, the borrower can refinance. But this prepayment option does not come for free—the borrower has to pay a higher mortgage interest rate. As a result, a prepayable FRM will turn out to be an expensive contract if inflation remains stable. Although an adjustable rate mortgage (ARM) is much less exposed to inflation risk, ARM borrowers are exposed to short-term variability in their real mortgage payments if nominal interest rates move. This can be particularly problematic if the borrower has limited savings to buffer the effects of higher mortgage payments.

Participants had widely differing views about borrowers’ risks associated with ARMs, interest-only mortgages, and other nontraditional mortgages. For example, as noted by Susan Wachter, ARMs generally have higher average default rates than FRMs. However, is not clear whether this difference is caused by the mortgage design, or whether riskier borrowers are more likely to select an ARM. Paul Willen presented evidence consistent with the latter view by showing that although subprime ARMs had high default rates during the recent crisis, many ARM borrowers became delinquent before their interest rate ever reset.

Panelists also discussed whether ARMs and nontraditional mortgages are appropriate products for underserved populations. One concern is that some borrowers may not fully realize how much their mortgage rate could change over time. Consistent with this concern, research by Federal Reserve staff finds that ARM borrowers have historically underestimated the degree to which their interest rates could fluctuate.

What about supply?

The observed design of mortgage contracts also depends on what lenders are willing to offer. Mortgage supply depends crucially on how loans are funded. In this regard, the United States has a distinctive funding model that relies heavily on securitization and government credit guarantees. Banks and other mortgage originators aren’t natural holders of long-term fixed-rate mortgages, given their reliance on demand deposits and short-term wholesale funding. Securitization “solves” this mismatch by transferring the interest rate and prepayment risk of FRMs from lenders to capital markets. This is likely an important factor supporting the high share of FRMs in the United States. Denmark, the only other country with a comparable market share of long-term prepayable FRMs, features an interesting alternative funding model for these loans (a type of “covered bond”), which also transfers interest rate and prepayment risk to capital markets, as illustrated by panelist Jesper Berg.

Some elements of the U.S. funding model may generate systemic risk, a point emphasized by Nancy Wallace. In particular, nonbank mortgage lenders primarily rely on fragile short-term bridge funding during the period between origination and the sale of the loan to investors. This funding dried up during the 2007-08 subprime crisis, triggering the failure of a number of mortgage lenders. Continued reliance on short-term bridge funding makes a repeat of that episode possible.

What are the implications for macroeconomics and monetary policy?

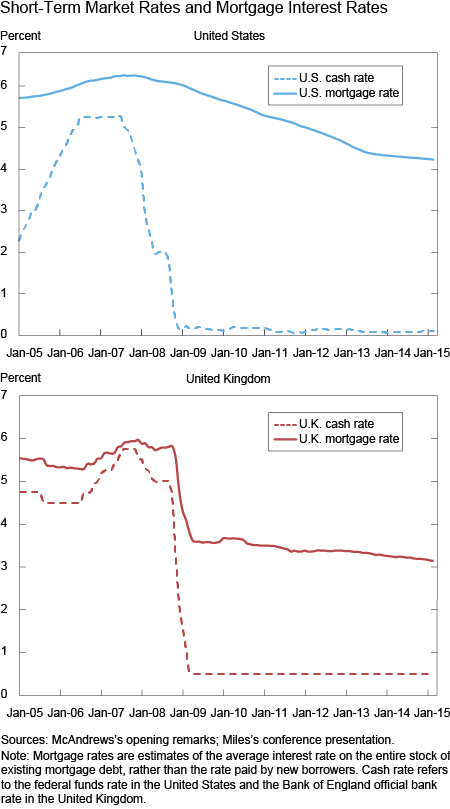

Current and former policymakers discussed how mortgage design matters for macroeconomic dynamics, monetary transmission, and financial stability. David Miles, member of the Monetary Policy Committee of the Bank of England, highlighted how the preponderance of ARMs in the United Kingdom makes the average interest rate paid by borrowers respond more directly to changes in the cash rate set by the central bank. This dynamic is illustrated in the chart below, which plots average mortgage rates on all existing mortgages in the United States and the United Kingdom over recent years. In both countries, short-term interest rates were cut dramatically during the 2008 financial crisis, and have remained near zero since then. In the United Kingdom, this led to a significant and almost immediate decline in interest rates on the stock of existing mortgage debt, albeit by less than the fall in the cash rate. In contrast, in the United States this pass-through to mortgage rates was much slower and less direct.

Two main factors account for these differences. First, most mortgages in the United States are thirty-year fixed rate, and long-term rates fell more slowly than short-term ones (even though a primary goal of unconventional monetary policy in recent years has been to lower these long-term rates, as emphasized by panelist William English). Second, FRM borrowers have to refinance to lower their interest payments, but during the financial crisis many were unable to do so because of falling home values and tightening lending standards. The faster drop in interest payments lowered mortgage defaults in the United Kingdom, which mitigated house price declines and bank losses. More generally, since borrowers tend to have a higher marginal propensity to consume than savers, lowering borrower mortgage payments stimulates aggregate demand. This means that monetary policy is more powerful in a system with ARMs (see McAndrews’s opening remarks for further discussion).

ARMs can pose financial stability concerns, however, by increasing borrowers’ vulnerability as rates increase. Lars Svensson, former deputy governor at the Swedish Riksbank, presented examples of how a financial stability authority can “stress test” households’ ability to repay in a rising interest rate environment.

What’s next in mortgage design?

In the final session, four panelists presented innovative mortgage design proposals. Andrew Kalotay proposed a “ratchet mortgage,” which is essentially an ARM with a rate that can only reset downward. This design insulates borrowers against higher interest rates, while still greasing the wheels of monetary policy during easing episodes. Under this design, mortgage rates would drop automatically when market interest rates fall, rather than relying on borrowers being willing and able to refinance.

Ed Pinto outlined a “wealth building home loan” that features shorter amortization—fifteen or twenty years—than most U.S. mortgages. This means borrowers build equity in their homes more quickly, and the design achieves this goal without requiring a much higher monthly payment. Several pilot programs using this approach are currently underway.

Howell Jackson discussed embedding call options in mortgage contracts that would allow an interested party (such as the government) to buy a mortgage from the holder under specific circumstances (for instance, during a financial crisis) at a predetermined price. This type of provision could mitigate legal and other frictions that may prevent efficient actions at time of crisis.

Finally, Andrew Caplin focused on shared-equity finance, in which a third party (such as a private equity firm) provides some of the equity for a home purchase, and in turn shares the risk (or gain) when house prices change. Shared equity would improve up-front housing affordability for the borrower without increasing household leverage. It could also reduce borrowers’ exposure to home-price risk, and may be useful as a workout tool in times of distress. Despite these potential benefits, and the fact that these ideas have been around for a while, shared-equity mortgages have not gained much traction. In that sense, they provide a useful case study that highlights the difficulty of mortgage innovation despite considerable potential benefits.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

John Campbell is the Morton L. and Carole S. Olshan Professor of Economics at Harvard University.

Andreas Fuster is a senior economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Andreas Fuster is a senior economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

David O. Lucca is a research officer in the Federal Reserve Bank of New York’s Research and Statistics Group.

David O. Lucca is a research officer in the Federal Reserve Bank of New York’s Research and Statistics Group.

Stijn Van Nieuwerburgh is a professor of finance and director of the Center for Real Estate Finance Research at the NYU Stern School of Business.

James Vickery is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

James Vickery is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Any discussion of mortgage reform benefits from mentioning the largest distortion in the mortgage market is the deductibility of interest expense, which 85% of economists agree should be eliminated. http://www.igmchicago.org/igm-economic-experts-panel/poll-results?SurveyID=SV_1AFdlMiaQywGktu