China lends to the rest of the world because it saves much more than it needs to fund its high level of physical investment spending. For years, the public sector accounted for this lending through the Chinese central bank’s purchase of foreign assets, but this changed in 2015. The country still had substantial net financial outflows, but unlike in previous years, more private money was pouring out of China than was flowing in. This shift in private sector behavior forced the central bank to sell foreign assets so that the sum of net private and public outflows would equal the saving surplus at prevailing exchange rates. Explanations for this turnaround by private investors include lower returns on domestic investment spending and a less optimistic outlook for China’s currency.

Inferring Data Using National Income Identities

China’s income exceeds its spending, which is equivalent to saying its saving exceeds its physical investment spending, that is, all money spent replacing or adding to the capital stock. As an accounting matter, a country’s income is allocated to either consumption or saving while spending goes to either consumption or investment spending. These two identities mean that a nation’s saving equals its investment spending when income equals spending. Opening up to trade allows a country to have its income exceed its spending when its exports exceed its imports, and this difference exactly equals the difference between saving and investment spending. The insight here is that the gaps between spending and income, between saving and investment spending, and between exports and imports all equal a nation’s lending to (or borrowing from) the rest of the world.

These identities are useful in backing out data that are hard to calculate directly. For instance, most countries, including China, do not calculate their gross saving (personal, business, and government). The International Monetary Fund (IMF) circumvents this data limitation by calculating saving indirectly as the sum of investment spending and the current account balance. Essentially, it rearranges the identity presented in the previous paragraph: the trade balance (measured by the current account) equals the gap between saving and investment spending—that is, CA = S – I.

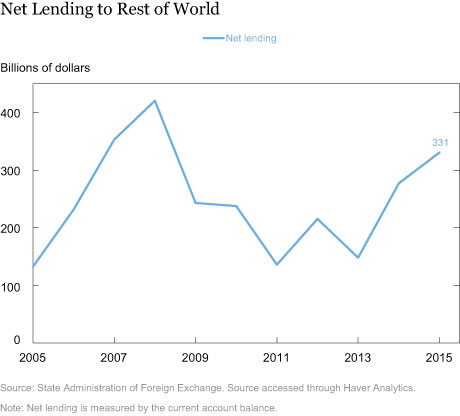

Measuring cross-border financial flows is also difficult. The financial account in the balance of payments is supposed to do this, but those numbers often differ substantially from the current account when they should be of the exact same magnitude, ignoring the trivial capital account. It is easier to measure imports and exports than financial flows, which makes the current account balance a better measure of net financial flows. The relative reliability of the two balances was important last year when China reported net financial outflows from both public (the central bank) and private investors at $143 billion, while the current account implied that net financial outflows totaled $331 billion. So, we do not know the whole story about gross financial flows into and out of China in 2015, but we do have a good sense of the net value of these flows from the current account balance.

China’s High Saving and Investment Spending

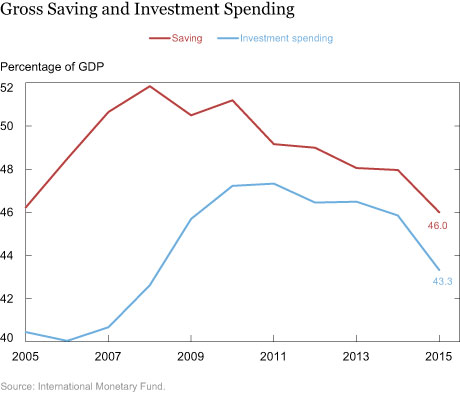

The chart below, which plots gross saving and investment spending as a share of GDP, shows that China’s saving rate is so high that the country can finance a very high level of investment spending and still have a substantial saving surplus that must flow abroad. Note that the saving surplus narrowed during the global downturn (2008-09) as the government pushed investment spending to unusually high levels of around 47 percent of GDP, relative to the average of 38 percent over the previous twenty years, to make up for weak export growth.

The high investment spending illustrates the current challenges facing China. Such spending will, at some point, yield diminishing returns. In fact, IMF data suggest that investment spending as a share of GDP fell in 2014 and 2015, consistent with declining returns on this spending. The country’s macroeconomic challenge is that additional reductions in investment spending as a share of GDP will be a drag on the economy, requiring higher consumption and/or exports to maintain growth.

Moving China’s Saving Surplus Abroad

The chart below shows that China’s saving in excess of investment spending, in dollar terms, rose to $331 billion in 2015 after averaging around $250 billion per year over the past decade. In the past, these financial outflows were in the form of purchases of foreign assets by China’s central bank, because private investors were more interested in investing in China. Explanations for private investors’ interest in domestic assets include high rates of return in China, capital controls that make it difficult to move funds out of the country, and expectations that the currency would tend to appreciate over time given the country’s rapid growth. Indeed, it was often the case that more private money was flowing into than out of China as foreign investors bought Chinese assets. As a result, the central bank had to channel out the domestic saving surplus and recycle back private inflows.

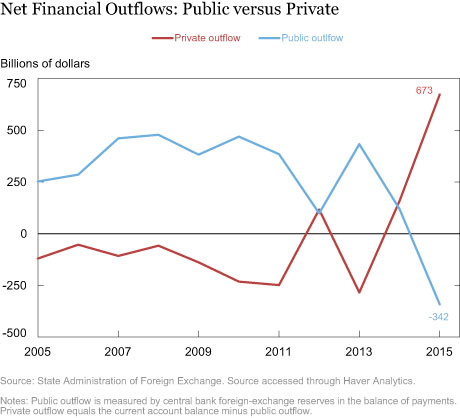

The chart below shows the dramatic change in the composition of financial outflows last year. It uses data on China’s current account balance and its central bank foreign exchange reserves to back out the net flows of private money, since public plus private net financial flows equal the current account balance. This calculation shows that private investor outflows to purchase foreign assets (or reduce foreign liabilities) were $673 billion more than private investor inflows to purchase Chinese assets at prevailing exchange rates. China’s central bank ended up selling $342 billion in foreign assets so that the sum of net private and public financial flows would match the country’s $331 billion surplus saving.

Possible explanations for this shift in investment preferences include signs of a lower rate of return on domestic investment spending and a decrease in confidence that China’s currency would only strengthen over time.

For the rest of the world, China is still a major buyer of global assets. What changed last year is the risk appetite of those investing abroad, with private investors replacing the central bank as the buyer of these assets.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Thomas Klitgaard is a vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Harry Wheeler is a senior research analyst in the Group.

How to cite this blog post:

Thomas Klitgaard and Harry Wheeler, “The Turnaround in Private and Public Financial Outflows from China,” Federal Reserve Bank of New York Liberty Street Economics (blog), May 9, 2016, http://libertystreeteconomics.newyorkfed.org/2016/05/the-turnaround-in-private-and-public-financial-outflows-from-china.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics