The rate of employer-to-employer transitions and the average wage of full-time offers rose compared with a year ago, according to the Federal Reserve Bank of New York’s July 2018 SCE Labor Market Survey. Workers’ satisfaction with their promotion opportunities improved since July 2017, while their satisfaction with wage compensation retreated slightly. Regarding expectations, the average expected wage offer (conditional on receiving one) and the reservation wage—the lowest wage at which respondents would be willing to accept a new job—both increased. The expected likelihood of moving into unemployment over the next four months showed a small uptick, which was most pronounced for female respondents.

The SCE Labor Market Survey, which has been fielded every four months since March 2014 as part of the broader Survey of Consumer Expectations (SCE), provides information on consumers’ experiences and expectations regarding the labor market. The data, together with a companion set of interactive charts showing a subset of the data that we collect, are published every four months by the New York Fed’s Center for Microeconomic Data. As with other components of the SCE, we report statistics not only for the overall sample, but also by various demographic categories, namely age, gender, education, and household income. The underlying micro (individual-level) data for the full survey are made available with an 18-month lag.

The remainder of this post provides more detail on one major finding from the latest survey data collected from July 2017 to July 2018. Additional results are available in the press release.

Job Transitions

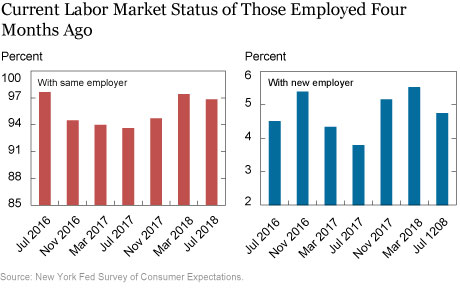

Labor market transition rates (such as job-to-job or employed-to-unemployed transition rates) are some of the most important metrics that summarize the dynamics of the labor market. The chart below reports the current labor market status of those who were employed four months ago. We see that the proportion of those who are still employed has increased from 93.6 percent in July 2017 to 96.8 percent in July 2018. In addition, the rate of transitioning to a different employer rose from 3.8 percent in July 2017 to 4.7 percent in July 2018. Although respondents who were employed four months ago show a higher rate of transitioning to a new employer compared to a year ago, we observe some interesting differences across education groups.

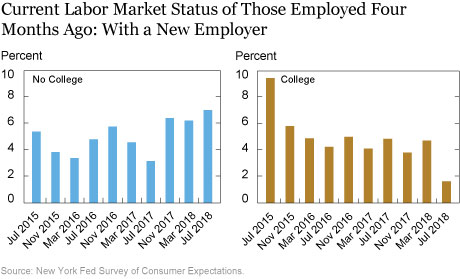

The chart below illustrates how the rate of transitioning to a new employer, among respondents who were employed four months ago, has been diverging since July 2017 between those with and without a college degree. The rate of transitioning to a new employer for respondents who do not have a college degree reached 7 percent in July 2018. In fact, this is the highest level this series has recorded since its start in July 2014. On the contrary, the rate of transitioning to a new employer has been on a downward trend for college graduates since July 2015, and it reached a series low of 1.6 percent in July 2018.

Earnings

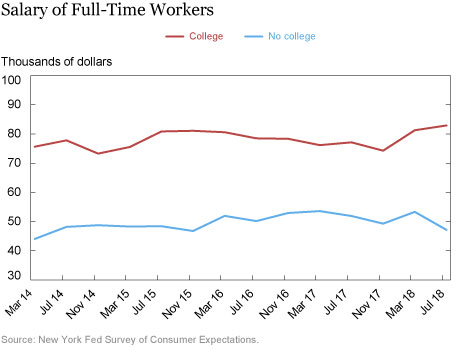

Economists care about job-to-job transitions primarily because such changes are key to understanding the evolution of wage growth. Job switching, or employer-to-employer reallocations, is shown to be a sufficient statistic for average wages; positively correlated with real and nominal wage growth; and a good predictor for both wage growth and wage inflation. In the overall sample, we observe that the average salary of full-time workers essentially remained constant in July 2018, compared to a year ago. The chart below shows the average salary of full-time workers with and without a college degree, separately. We observe that even though the job-to-job transitions of the respondents without a college degree have been on the rise since July 2017; the average full-time salary for this group declined slightly from July 2017 to July 2018, by approximately $4,700.

On the other hand, the average full-time salary of the workers with a college degree increased by $5,800 from July 2017 to July 2018. The results indicate that the positive relationship between job-to-job transitions and average wages does not hold for the period after July 2017. We observe a negative relation between job-to-job transitions and average wages in this period, for the respondents without a college degree.

Reconciling the Trends in Transitions and Earnings

The fact that college graduates are experiencing a rise in average full-time salary in tandem with a declining rate of transitioning to a new employer may be reconciled with employers’ retention policies. In other words, the trends we see are suggestive evidence of more aggressive wage responses by employers in order to retain their employees. In fact, we observe an increase in the percentage of respondents with a college degree who are satisfied with their wage compensation, a rise of 6 percentage points, from July 2017 to July 2018. We also see a slight uptick in this group’s satisfaction with nonwage benefits during the same time period.

Workers typically switch jobs for offers with higher wages, better nonwage amenities, or better wage prospects in the long term due to the new employer having a higher productivity (or a combination of these). Since we don’t observe an increase in the average full-time salary of the respondents without a college degree, we next examine whether they have access to better nonwage amenities. When we look at these respondents’ satisfaction with nonwage benefits, we see that the percentage who are satisfied with their nonwage benefits remained constant in July 2018, compared to July 2017. On the other hand, we observe a significant 11.5 percentage point rise in the proportion of respondents without a college degree who are satisfied with the career progression opportunities at their current jobs. This result is suggestive of the “option-value effect,” or in other words, that workers might be willing to take a wage cut to move from low to high productivity firms that will be able to offer larger wage increases in the long term.

Conclusion

Results of the July 2018 SCE Labor Market Survey point out a rise in employer-to-employer transitions and essentially no change in the average annual salary for full-time workers, compared with a year ago. However, in this post we show that these results and the interpretation of these findings differ considerably based on the education level of the respondents. For more details, visit the SCE Labor Market Survey home page.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Gizem Kosar is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Gizem Kosar is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Kyle Smith is a senior research analyst in the Bank’s Research and Statistics Group

Kyle Smith is a senior research analyst in the Bank’s Research and Statistics Group

How to cite this blog post:

Gizem Kosar and Kyle Smith, “Just Released: Are Employer-to-Employer Transitions Yielding Wage Growth? It Depends on the Worker’s Level of Education,” Federal Reserve Bank of New York Liberty Street Economics (blog), September 28, 2018, http://libertystreeteconomics.newyorkfed.org/2018/09/just-released-are-employer-to-employer-transitions-yielding-wage-growth-it-depends-on-the-workers.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics