Samuel Antill, David Hou, and Asani Sarkar

This post is the fifth in a series of thirteen Liberty Street Economics posts on Large and Complex Banks. For more on this topic, see this special issue of the Economic Policy Review.

Building upon previous posts in this series that discussed individual banks, we examine the historical growth of the entire financial sector, relative to the rest of the economy. This sector’s historically large share of the economy today (see chart below) and its role in disrupting the functioning of the real economy during the recent financial crisis have led to questions about the social value of costly financial services. While new regulations such as the Dodd-Frank Act impose restrictions on financial activities and increase their costs, especially those of large firms, our paper suggests that there may be limits to what regulation can achieve. In particular, we show that financial growth has occurred in the more opaque and harder to regulate sectors: private firms, shadow banks, and small nonbank financial firms. Moreover, we find that the stock market values these opaque areas of finance more, suggesting that they may expand even faster in the future.

Rise of Finance and Shadow Banks

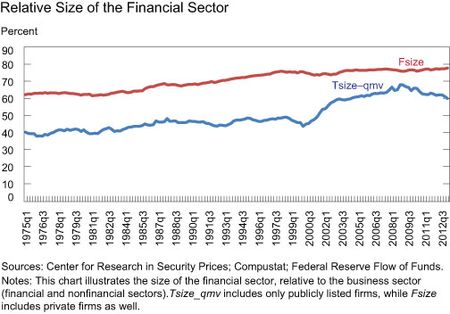

We measure the relative size of the financial sector by the value of its assets (the market value of equity plus the book value of debt), relative to the value of assets in the business sector (that is, the financial and nonfinancial sectors). This measure, Tsize–qmv (in the chart below), includes only publicly listed firms, and is estimated at the firm level. A second measure, Fsize (also in the chart below), is the total liabilities (generated by all transactions, not just those of publicly listed firms) of the financial sector, relative to the total liabilities of the business sector, and is estimated at the sectoral level.

By either measure, the financial sector has been a growing part of the economy. It has mostly increased in relative size over the past four decades, interrupted in a major way only by the recent financial crisis (see chart below). On average, the financial sector has accounted for about 50 percent of the asset values of publicly listed firms, but roughly 70 percent of total business sector liabilities. Hence, one reason to worry about the size of this sector is its high representation among private firms that have virtually no transparency.

The Relative Size of Shadow Banking

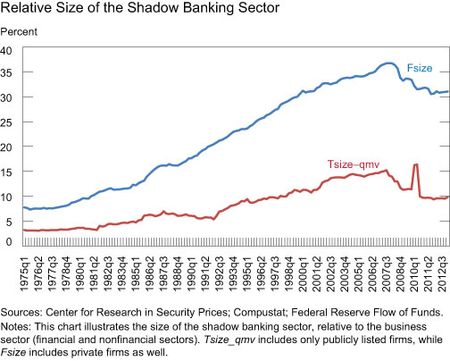

The shadow banking sector comprises specialized financial institutions (such as asset management and securities firms) that perform credit intermediation services similar to traditional banks or depository credit institutions (DCIs), but without the explicit central bank liquidity support or public sector credit guarantees received by DCIs. Pozsar, Adrian, Ashcraft, and Boesky argue that shadow banks contributed to the crisis through their excessive expansion of credit backed by illiquid assets. Consistent with their argument, we find that this sector has grown rapidly from about 8 percent of total business sector liabilities in 1975 to about 36 percent just before the crisis in 2007 (see chart below). For publicly listed firms, asset values increased from 4 percent to 15 percent during the corresponding period. Thus, similar to the financial sector in general, shadow banks make up a larger share of the liabilities of private firms than of publicly listed firms.

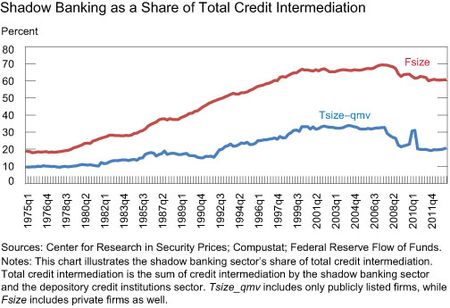

How big are shadow banks relative to the more heavily supervised DCIs? Shadow banking’s share of total credit intermediation (by shadow banks and DCIs) tripled in the period from 1975 to just before the crisis in 2007 (see chart below). Indeed, DCI actually shrunk in relative size while shadow banking expanded, fueled mainly by credit intermediation in the securities sector (for example, by investment banks) and asset management (for example, by exchange traded funds). Relatedly, portfolio management (also a part of asset management, but not involved in credit intermediation) has also grown explosively, as noted by Greenwood and Scharfstein. These authors discuss the poor performance and high fees of active managers, while the Office of Financial Research discusses the vulnerabilities of the asset management sector.

Large and Small Firms

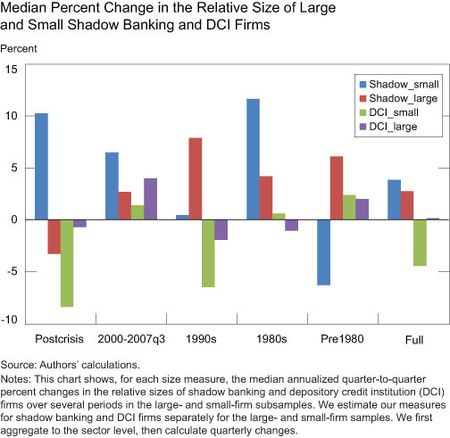

There have been long-standing concerns about too-big-to-fail financial firms whose failure imposes negative externalities on the rest of the economy. We find that large financial firms are a bigger share of all large firms (defined as the top 10 percent of all firms) than small financial firms are of all small firms (defined as the bottom 90 percent of all firms). Although the growth rates of large and small financial firms are similar, small shadow banks have grown faster than large shadow banks, while the reverse is true for DCIs (see chart below). Thus, the shadow banking sector has grown through the emergence of new firms, whereas DCIs have grown through consolidation among existing firms (especially since 1994).

Effect of the Recent Financial Crisis

The recent financial crisis reversed the steady growth of the financial sector in the economy. Shadow banking firms fared particularly poorly in the crisis, as their share in the economy shrank more than 6 percentage points from the pre-crisis peak to the crisis trough quarters. In comparison, financial firms in general shrank about 2 percentage points and large DCIs actually grew in size, especially during periods of government support such as when the FDIC debt guarantee program was in effect.

Stock Market Valuation of Different Financial Sectors

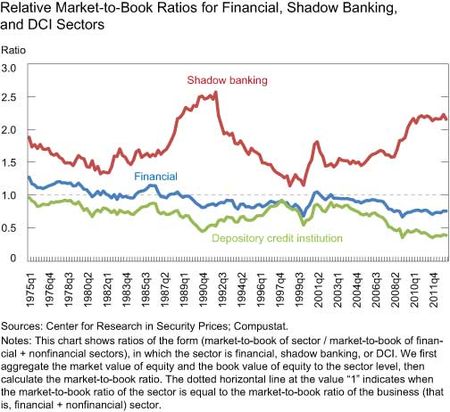

The financial sector and shadow banks have grown over time, but is the growth expected to continue? Since stock prices incorporate market expectations of future growth, we estimate the ratio of the market value of equity to the book value of equity (market-to-book) of the financial sector, which indicates the market value of $1 of book equity. This ratio is divided by the market-to-book ratio of the busine

ss sector in order to obtain the relative valuation of the financial sector.

Financial firms have had a lower valuation relative to business sector firms since the late 1980s, except for a brief period in 2000, and their relative valuation has been steadily declining since around 2003 (see chart below). Within the financial sector, however, shadow banking had a higher valuation than the business sector for the entire sample, and their relative valuation has been increasing since around 2003. The reverse is true for DCIs. These results suggest that the market expects shadow banks to grow faster than DCIs and/or to generate a more stable stream of earnings in the future.

Conclusion

Although the policy response to the growth and vulnerabilities of the financial sector has been to enhance supervision and regulation of large firms and visible financial sectors, our paper documents that, historically, growth has occurred mainly in areas outside the current regulatory ambit. If financial transactions migrate out of regulated sectors, as expected by some, then this trend is likely to persist. We need to improve our knowledge of these opaque financial sectors in order to understand what risks (if any) they pose to the economy.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Samuel Antill is a senior research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

David Hou is a risk analytics associate in the Bank’s Financial Institution Supervision Group.

Asani Sarkar is an assistant vice president in the Bank’s Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Thanks for your comments. With regard to your first comment, in our shadow banking sector, we include asset management firms involved in credit intermediation (e.g., open-end investment funds) but exclude those that are not (e.g., investment advice, portfolio management). Table B.1 in our paper(http://www.newyorkfed.org/research/epr/2014/1412anti.pdf) reports the industries making up shadow banking. However, it seems unlikely that valuations of asset management firms are driving our results because, in our sample, they contribute less than 4% of shadow banking sector assets on average (see Table 4 in our paper http://www.newyorkfed.org/research/epr/2014/1412anti.pdf). Regarding your second comment, please note that the valuation trends (referred to in your quote) are evident since 1975 and are not specific to the recent financial crisis period.

With regard to the following statement: “Within the financial sector, however, shadow banking had a higher valuation than the business sector for the entire sample, and their relative valuation has been increasing since around 2003. The reverse is true for DCIs. These results suggest that the market expects shadow banks to grow faster than DCIs and/or to generate a more stable stream of earnings in the future.” I think you may be missing several factors in your assessment of the valuation of SBIs vs DCIs. Firstly, are you incorporating valuations of fund management companies in your universe. Non asset owning fund managers are fee businesses which would command very different valuations. Further, the book values of DCIs currently include enormous legacy assets on the portfolio side which the market has great difficulty in valuing and assumes are being carried at levels that are vulnerable, if not actually overstated. These legacy assets stem from the bubble and will clear eventually, as which time you can expect valuations to improve. (of course, on the other hand, even a modest recession might seriously adversely impact bank balance sheets in the interim, with respect to such vulnerable legacy assets on the portfolio side of DCIs).

Shadow banking is not “bad.” Non-bank financial institutions represent the PRIVATE SECTOR. The TBTF banks + GSEs are a government protected PUBLIC monopoly. The last vestige of Glass Steagall is the BANK HOLDING COMPANY ACT which protects the TBTF FIs and their mediocrity. Of course the TBTF banks take on more risk because they are inherently unprofitable. Negative risk-adjusted returns. We need to repeal the bank holding company act and allow non-banks to break up the TBTF banks. Let Google, WalMart, fix the problem.